Ocean County Nj Tax Records

In the heart of New Jersey's Ocean County, property ownership is a significant aspect of the local economy and community life. Residents and investors alike rely on accessible and transparent tax records to navigate the real estate landscape effectively. This article aims to provide an in-depth exploration of Ocean County's tax records, shedding light on the key factors, trends, and resources available to those interested in the area's property market.

Understanding Ocean County’s Tax Records: An Overview

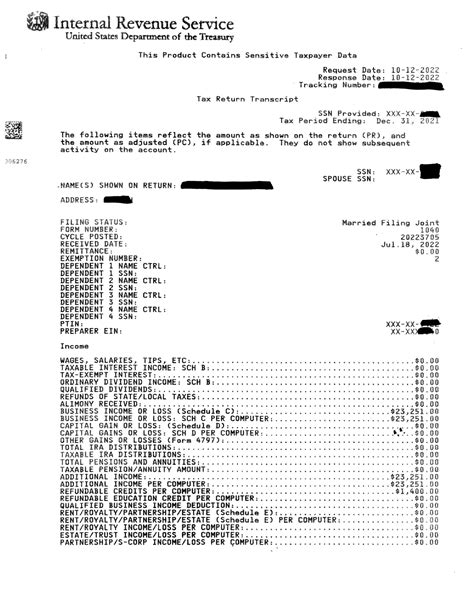

Ocean County’s tax records are a comprehensive database maintained by the county government, offering valuable insights into the local real estate market. These records encompass a wide range of information, including property assessments, tax rates, and payment histories. Understanding these records is essential for homeowners, prospective buyers, and investors seeking to make informed decisions about their properties or investments.

Property Assessments and Valuations

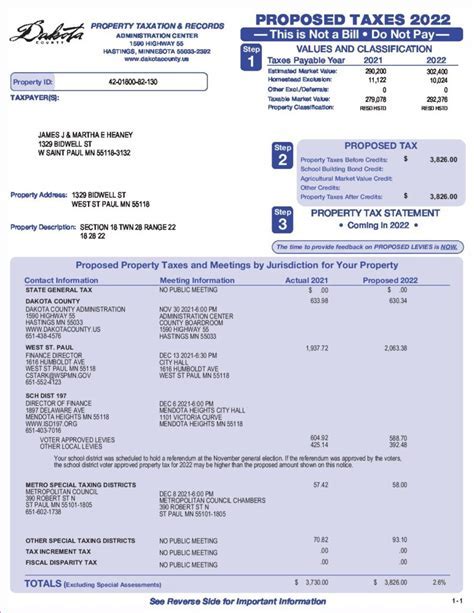

A cornerstone of Ocean County’s tax system is the annual property assessment process. Assessors evaluate each property within the county, determining its fair market value. This valuation is crucial as it forms the basis for calculating property taxes. The assessment considers factors such as the property’s location, size, condition, and recent sales data of comparable properties. Homeowners can access their individual assessments through the county’s online tax record portal, offering transparency and the ability to review and understand their property’s value.

The assessment process ensures that properties are taxed fairly and equitably. If a homeowner believes their assessment is inaccurate, they have the right to appeal, with clear guidelines and procedures outlined by the county.

| Property Type | Average Assessment Value (2023) |

|---|---|

| Single-Family Homes | $325,000 |

| Condominiums | $270,000 |

| Commercial Properties | $750,000 |

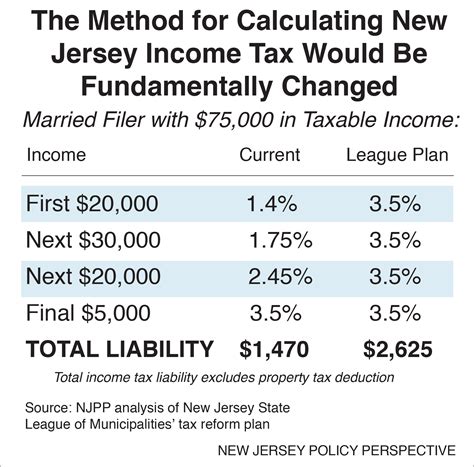

Tax Rates and Calculations

Ocean County’s tax rates are set annually by the county government and are applied uniformly across all properties. These rates are expressed as a percentage of the property’s assessed value. For instance, if the tax rate is set at 2.5%, a property valued at 300,000 would incur an annual tax of 7,500. The tax rate takes into account various factors, including the county’s budget, local infrastructure projects, and the cost of services provided to residents.

Tax rates can vary from year to year, so staying informed about the latest rates is essential for accurate tax planning. The county provides resources to help residents understand how their taxes are calculated and where their tax dollars are allocated.

Online Tax Record Access and Resources

Ocean County offers a user-friendly online platform for residents to access their tax records and related information. This platform, accessible via the county’s official website, allows homeowners to:

- View their property's assessment details, including the assessed value, property characteristics, and any applicable exemptions.

- Check tax bill amounts and due dates, ensuring timely payments to avoid penalties.

- Explore tax payment history, providing transparency and accountability.

- Access tax maps and zoning information, which is crucial for understanding a property's development potential and restrictions.

Additionally, the online platform provides a wealth of resources, including tax rate information, appeal procedures, and contact details for the county tax assessor's office. This centralized access to tax records and resources simplifies the process of managing property taxes for Ocean County residents.

Analyzing Ocean County’s Tax Landscape

Ocean County’s tax records offer a wealth of insights into the local real estate market and the broader economic climate. By analyzing these records, stakeholders can identify trends, assess the health of the property market, and make informed decisions.

Historical Tax Trends

A review of Ocean County’s tax records over the past decade reveals a generally stable tax landscape. While tax rates have fluctuated slightly, the overall trend has been one of modest increases, reflecting the county’s commitment to maintaining essential services and infrastructure. This stability provides a sense of predictability for homeowners and investors.

However, it's important to note that specific areas within the county may experience more significant changes due to local factors. For instance, coastal areas may see higher assessments and tax rates due to their desirability and the cost of maintaining beachfront infrastructure.

Impact of Economic Factors

Ocean County’s tax records are influenced by various economic factors, including:

- Real Estate Market Conditions: During periods of robust home sales and increasing property values, assessments may rise, leading to higher tax revenues for the county.

- Local Business Activity: Commercial properties contribute significantly to the tax base. A thriving business community can lead to increased tax revenues, benefiting the entire county.

- State and Federal Policies: Changes in state or federal tax laws can have a ripple effect on local tax structures and the resources available to counties like Ocean County.

Community Impact and Services

Ocean County’s tax revenues play a vital role in funding essential community services and infrastructure. These funds support:

- Education: From local schools to higher education institutions, tax dollars contribute to providing quality education for Ocean County's youth.

- Public Safety: Funding for police, fire, and emergency services ensures the safety and well-being of residents.

- Road Maintenance: Tax revenues help maintain and improve the county's road network, essential for commuters and businesses.

- Recreational Facilities: Parks, beaches, and recreational areas are funded in part by tax dollars, enhancing the quality of life for residents.

Future Implications and Opportunities

As Ocean County continues to evolve, its tax records will play a crucial role in shaping the future of the community. Here are some key considerations for the future:

Sustainable Development and Tax Policies

Ocean County’s tax policies can be leveraged to encourage sustainable development practices. By offering tax incentives for energy-efficient buildings or green initiatives, the county can promote environmental stewardship while potentially attracting eco-conscious residents and businesses.

Tax Incentives for Economic Growth

Strategic tax incentives can be a powerful tool for attracting new businesses and industries to Ocean County. By offering tax breaks or streamlined tax processes for specific sectors, the county can foster economic growth and job creation, benefiting the entire community.

Digital Transformation and Tax Services

The ongoing digital transformation in the tax industry presents opportunities for Ocean County to enhance its tax services. Implementing advanced technologies can streamline processes, improve data accuracy, and provide residents with more efficient and accessible tax record management.

Community Engagement and Transparency

Maintaining transparency and engaging with the community is essential for building trust and ensuring that tax policies align with residents’ needs and expectations. Regular town hall meetings, online forums, and accessible tax information can foster a sense of community involvement in the tax process.

Conclusion: Navigating Ocean County’s Tax Records

Ocean County’s tax records are a valuable resource for residents, investors, and stakeholders. By understanding the assessment process, tax rates, and the broader economic context, individuals can make informed decisions about property ownership and investment. The county’s commitment to transparency and accessible tax information empowers its community to actively participate in shaping the future of Ocean County.

How often are property assessments conducted in Ocean County?

+Property assessments in Ocean County are conducted annually to ensure that property values remain up-to-date and fair. This process allows the county to accurately calculate property taxes based on the current market value.

What are the typical tax rates in Ocean County for residential properties?

+Tax rates in Ocean County can vary based on the specific municipality. On average, residential properties in the county face tax rates ranging from 2% to 3% of the assessed value. It’s important to check with your local tax assessor for precise tax rate information.

How can I appeal my property assessment if I believe it is inaccurate?

+If you have concerns about your property assessment, you have the right to appeal. The process typically involves submitting an appeal application to the county tax assessor’s office, providing supporting evidence, and attending a hearing. It’s recommended to consult with a tax professional or the assessor’s office for guidance on the appeal process.