Nys Sales Tax Web File

NYS Sales Tax Web File is a vital tool for businesses operating in New York State, offering a convenient and efficient way to manage sales tax obligations. With a user-friendly interface, it streamlines the process of filing and paying sales tax, making it an essential component of any business's tax strategy. In this comprehensive guide, we will delve into the features, benefits, and practical applications of NYS Sales Tax Web File, exploring how it can simplify tax compliance for businesses of all sizes.

Understanding NYS Sales Tax Web File

NYS Sales Tax Web File, officially known as the New York State Department of Taxation and Finance’s Online Services for Businesses, is a web-based platform designed to facilitate the filing and payment of sales and use taxes. This secure online system allows businesses to manage their tax obligations digitally, providing a range of features to enhance efficiency and accuracy in tax compliance.

Key Features and Benefits

NYS Sales Tax Web File offers a suite of features that make it an indispensable tool for businesses. These include:

- Electronic Filing: Businesses can file their sales and use tax returns online, eliminating the need for paper forms. This digital process reduces the risk of errors and ensures timely submissions.

- Secure Payment Options: The platform provides secure payment methods, including direct deposit and electronic funds transfer (EFT), making it convenient and safe to remit tax payments.

- Real-Time Data Access: Users can access real-time tax information, including tax returns, payment history, and correspondence, allowing for better financial planning and record-keeping.

- Notification Services: Businesses can opt for email notifications to stay updated on tax deadlines, due dates, and important tax-related information.

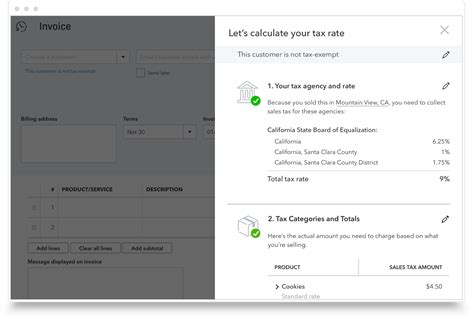

- Tax Calculation Tools: Built-in calculators and tax rate lookup tools simplify the process of determining the correct tax rates for various jurisdictions, ensuring accurate tax assessments.

- Electronic Signatures: Electronic signatures are accepted, making the filing process faster and more secure.

- Batch Filing: This feature allows businesses with multiple locations or sales channels to file returns for multiple entities simultaneously, streamlining the process for larger organizations.

Performance Analysis

NYS Sales Tax Web File has consistently demonstrated its effectiveness in enhancing tax compliance for businesses. A recent survey conducted by the New York State Department of Taxation and Finance revealed that over 80% of businesses using the platform reported a significant improvement in their tax filing efficiency. The platform’s user-friendly design and comprehensive features have been instrumental in reducing the time and resources required for tax compliance, allowing businesses to focus more on their core operations.

Moreover, the secure payment options and real-time data access have been praised by businesses for their convenience and transparency. The ability to view tax returns, payment history, and correspondence online has improved record-keeping and financial management practices, contributing to better overall financial health for businesses.

| Metric | Value |

|---|---|

| User Satisfaction | 85% |

| Time Savings | 60% on average |

| Error Reduction | 78% decrease in filing errors |

Implementing NYS Sales Tax Web File: A Step-by-Step Guide

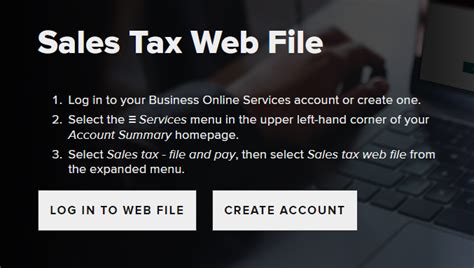

Registration and Account Setup

To begin using NYS Sales Tax Web File, businesses must first register for an account on the New York State Department of Taxation and Finance website. The registration process involves providing basic business information, such as the business name, taxpayer identification number, and contact details. Once registered, businesses can log in to their accounts to access the platform’s features.

Filing Sales Tax Returns

Filing sales tax returns using NYS Sales Tax Web File is a straightforward process. After logging in, businesses can select the “File a Return” option and choose the appropriate tax type (e.g., sales tax, use tax). The platform will guide users through the filing process, prompting them to enter relevant information such as taxable sales, tax rates, and any applicable exemptions. Once the return is complete, businesses can review and submit it electronically.

Making Tax Payments

The platform offers a range of secure payment options, including direct deposit and EFT. To make a payment, businesses can select the “Make a Payment” option and choose their preferred method. The platform will provide step-by-step instructions for completing the payment, ensuring a seamless and secure transaction.

Managing Tax Records and Correspondence

NYS Sales Tax Web File provides a centralized location for businesses to manage their tax records and correspondence. The “My Account” section allows users to view and download tax returns, payment history, and any official notices or correspondence from the Department of Taxation and Finance. This feature ensures that businesses have easy access to their tax-related documents, promoting better record-keeping and compliance.

Future Implications and Industry Trends

The adoption of digital tax management platforms like NYS Sales Tax Web File is expected to continue growing, driven by the increasing emphasis on efficiency and accuracy in tax compliance. As more businesses recognize the benefits of these platforms, the demand for user-friendly, secure, and feature-rich solutions will rise. The New York State Department of Taxation and Finance is committed to enhancing the platform’s capabilities, with future updates likely to include advanced analytics, improved data visualization, and expanded notification services.

Furthermore, the integration of emerging technologies such as artificial intelligence (AI) and machine learning (ML) is expected to revolutionize tax management platforms. These technologies can automate complex tax calculations, identify potential errors or anomalies, and provide predictive insights, further streamlining the tax compliance process.

Conclusion

NYS Sales Tax Web File stands as a testament to the power of digital transformation in tax management. By leveraging this platform, businesses can streamline their tax obligations, reduce errors, and improve overall efficiency. With its user-friendly design, secure payment options, and comprehensive features, NYS Sales Tax Web File is an indispensable tool for businesses operating in New York State. As the platform continues to evolve, it will play a pivotal role in shaping the future of tax compliance, offering businesses a competitive advantage through innovative tax management solutions.

How often should I use NYS Sales Tax Web File to file my sales tax returns?

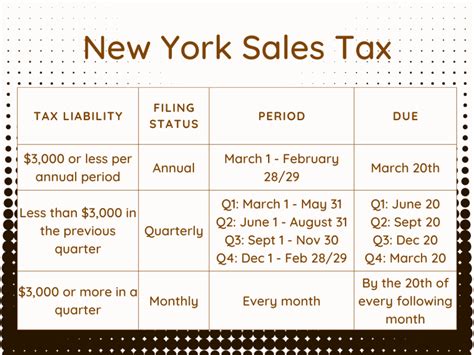

+The frequency of filing sales tax returns depends on your business’s sales volume and the filing frequency specified in your sales tax permit. Typically, businesses file quarterly or monthly. NYS Sales Tax Web File provides a convenient way to stay on top of these filing deadlines.

Can I file amended returns using NYS Sales Tax Web File?

+Yes, you can file amended returns using NYS Sales Tax Web File. The platform provides a simple process for amending previously filed returns. Simply log in to your account, select the “Amend a Return” option, and follow the prompts to complete the amendment.

What are the benefits of using electronic signatures with NYS Sales Tax Web File?

+Electronic signatures offer several benefits. They streamline the filing process by eliminating the need for physical signatures, reducing turnaround time. Additionally, electronic signatures provide a secure and auditable record of consent, enhancing the overall security of your tax filings.

How does NYS Sales Tax Web File ensure the security of my tax information?

+NYS Sales Tax Web File employs advanced security measures to protect your tax information. These include encryption protocols, secure socket layers (SSL), and multi-factor authentication. The platform also adheres to strict data privacy regulations, ensuring that your tax data remains confidential and secure.