Lakewood City Tax

Lakewood City, a vibrant and thriving urban center, has become a focal point for many residents and businesses seeking a blend of urban living and a strong sense of community. As the city continues to grow and develop, understanding its tax system and financial landscape is essential for both new and established residents. This comprehensive guide aims to shed light on the Lakewood City Tax system, offering a detailed overview of its structure, implications, and future prospects.

Unraveling the Lakewood City Tax System

The tax structure in Lakewood City is designed to support the city’s growth and development while maintaining a high quality of life for its residents. It encompasses a range of tax types, each playing a crucial role in funding various aspects of the city’s operations and services.

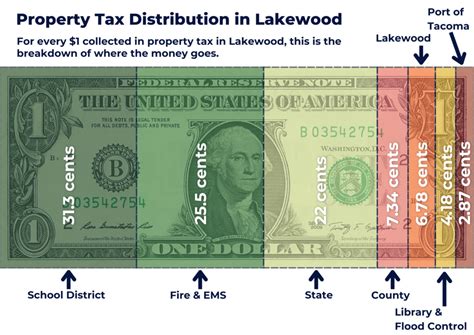

Property Taxes: The Backbone of Lakewood’s Finances

Property taxes form the cornerstone of Lakewood City’s tax revenue. These taxes are levied on both residential and commercial properties within the city limits. The assessment of property values is a critical aspect, as it directly influences the tax rates that property owners are subjected to.

The city employs a team of dedicated assessors who regularly evaluate properties to ensure fair and accurate assessments. This process takes into account factors such as location, size, improvements, and recent sales data to determine the market value of each property.

Property owners in Lakewood City can expect to receive a property tax bill annually. The bill outlines the assessed value of their property, the applicable tax rate, and the total amount due. It is important for property owners to carefully review these bills and understand the breakdown of taxes to ensure accuracy.

| Tax Category | Tax Rate |

|---|---|

| Residential Property Tax | 2.5% |

| Commercial Property Tax | 3.2% |

To provide relief to certain segments of the population, Lakewood City offers exemptions and discounts on property taxes. For instance, seniors aged 65 and above are eligible for a reduced tax rate on their primary residence. Additionally, veterans and individuals with disabilities may qualify for property tax exemptions, easing their financial burden.

Income Taxes: A Key Revenue Source

Lakewood City also imposes income taxes on its residents and businesses. This tax is levied on the earnings of individuals and entities operating within the city limits.

The income tax rate in Lakewood City is progressive, meaning that as income increases, so does the tax rate. This structure ensures that higher-income earners contribute a larger share of their earnings to the city's revenue. The tax rates are carefully calibrated to balance the need for revenue with the goal of maintaining a competitive business environment.

| Income Bracket | Tax Rate |

|---|---|

| Up to $50,000 | 2% |

| $50,001 - $100,000 | 3% |

| $100,001 and above | 4% |

For businesses, Lakewood City offers a range of incentives to encourage investment and job creation. Startups and small businesses, in particular, can benefit from reduced tax rates during their initial years of operation. This strategy not only boosts the local economy but also fosters a business-friendly environment, attracting new enterprises to the city.

Sales and Use Taxes: Supporting Local Businesses

Sales and use taxes are another vital component of Lakewood City’s tax system. These taxes are imposed on the sale of goods and services within the city, as well as on the use of certain products and services.

The sales tax rate in Lakewood City is currently set at 6.5%, which includes both the state and local components. This tax is collected by retailers at the point of sale and remitted to the city on a regular basis. The revenue generated from sales taxes is a significant contributor to the city's overall budget, funding various public services and infrastructure projects.

In addition to sales taxes, Lakewood City imposes a use tax on the purchase of goods and services from out-of-state vendors. This tax ensures that businesses and individuals who make such purchases contribute to the city's revenue, even if the sale does not occur within the city limits.

To promote local businesses and encourage economic growth, Lakewood City offers tax incentives for certain industries. For example, the city may waive or reduce sales taxes for businesses in the technology sector, providing a competitive advantage and attracting innovative startups to the area.

Special Assessments and Fees: Targeted Funding

Lakewood City utilizes special assessments and fees to fund specific projects and services that benefit the community.

Special assessments are levied on property owners to finance improvements or upgrades that directly benefit their properties. These could include street lighting, road repairs, or infrastructure enhancements. By tying the cost of these improvements to the properties that benefit from them, Lakewood City ensures a fair distribution of costs.

Fees, on the other hand, are charged for specific services or permits. For instance, a building permit fee is collected when homeowners or businesses undertake construction or renovation projects. These fees help cover the costs of plan reviews, inspections, and other related services provided by the city.

Lakewood City carefully evaluates the need for special assessments and fees, ensuring that they are reasonable and aligned with the benefits received by the community. This approach allows the city to fund essential projects and services without placing an undue burden on its residents.

Performance Analysis and Future Implications

The Lakewood City Tax system has proven to be a reliable and effective revenue generator, supporting the city’s growth and development over the years. A closer look at the city’s financial performance reveals several key insights.

Stable Revenue Streams

Lakewood City’s diverse tax structure has contributed to its financial stability. The combination of property, income, sales, and special assessment taxes provides a robust and resilient revenue base. This diversity minimizes the impact of economic downturns or fluctuations in any single tax category.

Over the past decade, Lakewood City has consistently seen a steady growth in tax revenue, with an average annual increase of approximately 5%. This growth can be attributed to a combination of factors, including population growth, rising property values, and a thriving local economy.

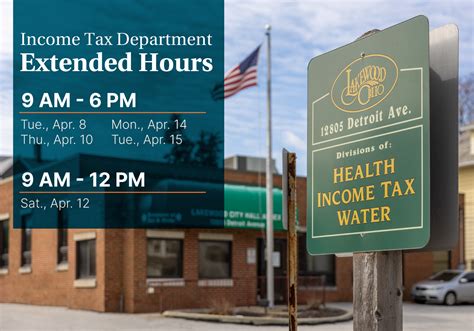

Efficient Tax Collection

The city’s tax collection processes are well-organized and efficient. The tax department employs a dedicated team of professionals who work closely with taxpayers to ensure compliance and address any concerns. The online tax payment system, introduced a few years ago, has further streamlined the process, making it convenient for residents and businesses to fulfill their tax obligations.

Lakewood City's commitment to transparency and taxpayer education has also played a significant role in maintaining high compliance rates. The city regularly hosts informational sessions and workshops to educate residents about their tax responsibilities and the benefits of timely payment.

Investing in the Community

The revenue generated through the Lakewood City Tax system is reinvested into the community in a variety of ways. A significant portion of the tax revenue is allocated to essential services such as education, public safety, and healthcare. These investments contribute to the overall well-being and quality of life for residents.

In addition, Lakewood City utilizes tax revenue to fund infrastructure projects, such as road improvements, park renovations, and the development of green spaces. These initiatives not only enhance the city's aesthetics but also boost economic activity and tourism.

The city's commitment to community development extends beyond infrastructure. Lakewood City actively supports local businesses through various initiatives, including business grants, startup incubators, and mentorship programs. These efforts foster a vibrant business environment, creating job opportunities and stimulating economic growth.

Future Prospects and Challenges

As Lakewood City continues to evolve and grow, its tax system will play a pivotal role in shaping its future. Several key factors will influence the city’s financial landscape in the years to come.

One of the primary challenges Lakewood City faces is keeping pace with the increasing demand for public services. As the population grows, the city must allocate resources to meet the needs of its residents, including expanded healthcare facilities, improved transportation infrastructure, and enhanced educational programs.

To address these challenges, Lakewood City is exploring innovative financing options, such as public-private partnerships and impact investing. These strategies can help leverage private sector expertise and resources to fund critical projects while minimizing the burden on taxpayers.

Additionally, the city is committed to staying competitive in the regional and national business landscape. This involves regularly reviewing and adjusting tax rates and incentives to attract and retain businesses, especially in high-growth sectors such as technology and sustainable energy.

Lakewood City's proactive approach to tax policy and community development positions it well for the future. By continuously evaluating its tax system and adapting to changing economic conditions, the city can ensure its long-term financial sustainability and continue to provide a high quality of life for its residents.

Frequently Asked Questions

How often do I need to pay my property taxes in Lakewood City?

+

Property taxes in Lakewood City are typically due twice a year, with payment deadlines falling in the spring and fall. It is essential to stay informed about these deadlines to avoid penalties and ensure timely payment.

Are there any tax incentives for energy-efficient upgrades in my home?

+

Absolutely! Lakewood City recognizes the importance of sustainability and offers tax credits for homeowners who invest in energy-efficient upgrades. These credits can significantly reduce your property tax burden and contribute to a greener community.

How can I stay updated on tax-related news and changes in Lakewood City?

+

The best way to stay informed is to subscribe to the city’s official newsletter and follow their social media channels. These platforms provide regular updates on tax-related matters, including any proposed changes, deadlines, and important announcements.

Can I appeal my property tax assessment if I believe it is inaccurate?

+

Yes, Lakewood City offers a fair and transparent appeals process for property owners who wish to challenge their tax assessment. You can initiate the process by submitting a formal request and providing supporting evidence to justify your claim.

Are there any tax breaks or discounts available for low-income residents?

+

Lakewood City is committed to supporting its low-income residents. The city offers a range of tax relief programs, including property tax deferrals and income tax credits. These initiatives help ensure that financial constraints do not prevent individuals from accessing essential services.