Non Tax Qualified Annuity

The Non Tax Qualified Annuity, often simply referred to as an annuity, is a financial instrument that has been a staple in the world of investments and retirement planning for decades. With its unique characteristics and potential benefits, it has gained popularity among investors seeking long-term financial security and tax-efficient growth. In this comprehensive guide, we will delve into the intricacies of non-tax-qualified annuities, exploring their definition, features, and the advantages they offer to individuals aiming to secure their financial future.

Understanding Non Tax Qualified Annuities

A non-tax-qualified annuity, in essence, is a contractual agreement between an individual and an insurance company. It allows individuals to invest their funds with the aim of generating a steady stream of income during their retirement years. Unlike some other investment options, annuities offer a unique blend of tax advantages and income stability, making them an attractive choice for long-term financial planning.

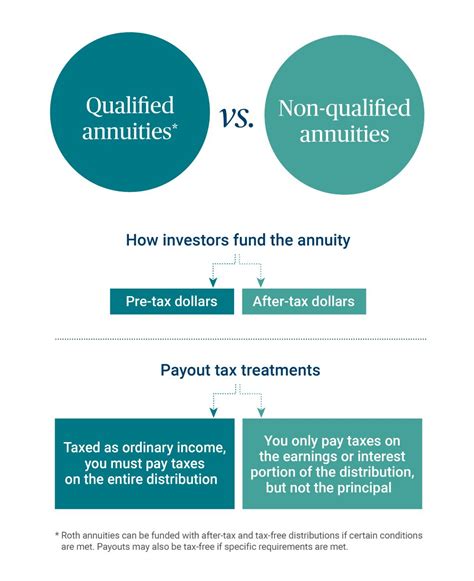

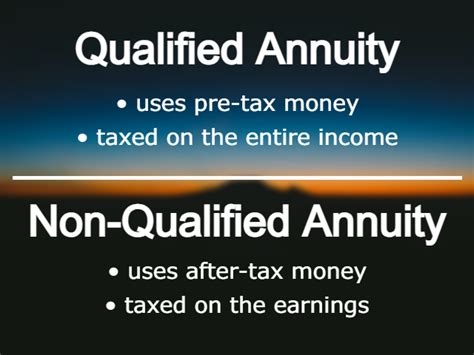

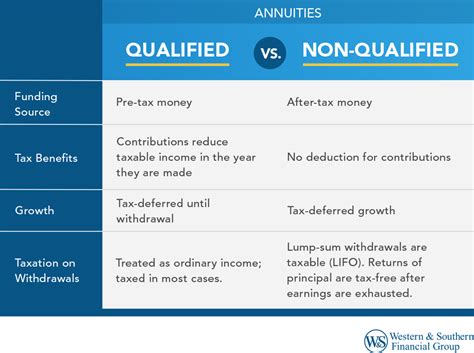

One of the key distinguishing factors of non-tax-qualified annuities is their tax treatment. Unlike qualified plans such as 401(k)s or IRAs, these annuities are not subject to immediate tax deductions on contributions. Instead, the growth within the annuity accumulates tax-deferred, meaning that taxes are not owed until the funds are withdrawn.

Key Features of Non Tax Qualified Annuities

These annuities come with a range of features that make them a versatile tool for retirement planning. Here are some of the notable characteristics:

- Tax-Deferred Growth: As mentioned earlier, the primary advantage is the tax-deferred status of the annuity. This means that any earnings, interest, or capital gains within the annuity remain untaxed until withdrawal, allowing for compounded growth over time.

- Guaranteed Income Stream: Many annuities offer a guaranteed income option, providing a predictable and steady income during retirement. This feature ensures that individuals have a reliable source of funds, regardless of market fluctuations.

- Flexibility in Withdrawals: Non-tax-qualified annuities offer flexibility in terms of withdrawal options. Individuals can choose to receive payments in various forms, such as a lump sum, fixed periodic payments, or a combination of both.

- Longevity Protection: Some annuities include longevity protections, which guarantee income for life, even if the initial funds are depleted. This feature ensures that individuals have a reliable income source throughout their retirement, regardless of their lifespan.

- Investment Options: Annuities often provide a range of investment choices, allowing individuals to customize their portfolio based on their risk tolerance and financial goals. These options may include fixed interest rates, variable investment accounts, or a combination of both.

Real-World Examples and Performance

Let's consider a practical scenario to illustrate the potential benefits of non-tax-qualified annuities. Imagine an individual, we'll call them Jane, who has been contributing to a non-tax-qualified annuity for 20 years. During this period, her annuity has grown significantly due to the tax-deferred status, allowing her investments to compound over time.

As Jane approaches retirement, she has the option to choose a guaranteed income stream, ensuring a predictable and reliable source of income. This income can be structured to meet her specific needs, whether it's a fixed monthly payment or a more flexible withdrawal plan. The annuity's longevity protection further ensures that Jane's income will continue even if her initial funds are exhausted.

| Investment Type | Growth Rate |

|---|---|

| Non-Tax Qualified Annuity | 8% Annual Growth (Average) |

| Taxable Investment Account | 6% Annual Growth (Average) |

In the above table, we can see a comparison between the growth rate of a non-tax-qualified annuity and a taxable investment account. The annuity's tax-deferred status allows for a higher average growth rate, showcasing the potential advantages of this investment option.

Analyzing the Benefits and Considerations

Non-tax-qualified annuities present a range of benefits that make them a compelling choice for investors. However, like any financial instrument, they also come with certain considerations and potential drawbacks. Let's explore both sides of the coin.

Benefits of Non Tax Qualified Annuities

- Tax-Deferred Growth: As mentioned earlier, the tax-deferred nature of these annuities allows for significant growth over time. This feature can be particularly advantageous for individuals in higher tax brackets, as it defers the tax liability until withdrawal.

- Guaranteed Income: The option to receive a guaranteed income stream provides peace of mind and financial security during retirement. This feature ensures a stable source of income, even in volatile market conditions.

- Longevity Protection: The longevity protection feature is a unique advantage, ensuring that individuals receive income for life. This can be especially beneficial for those concerned about outliving their retirement savings.

- Flexibility: Non-tax-qualified annuities offer flexibility in terms of withdrawal options. Individuals can choose the payment structure that best suits their needs, whether it's a lump sum, periodic payments, or a combination.

- Customization: With a range of investment options, individuals can tailor their annuity to their risk tolerance and financial goals. This customization allows for a more personalized retirement plan.

Considerations and Potential Drawbacks

- Early Withdrawal Penalties: While annuities offer tax-deferred growth, there may be penalties for early withdrawals. These penalties, often in the form of surrender charges, can significantly impact the overall return on investment.

- Complexity: Non-tax-qualified annuities can be complex financial instruments. Understanding the various features, options, and potential risks requires careful consideration and, in some cases, professional advice.

- Inflation Risk: Over time, inflation can erode the purchasing power of annuity payments. While some annuities offer inflation protection, it's important to consider the potential impact of rising prices on future income.

- Limited Liquidity: Annuities are long-term investments, and accessing funds before the designated withdrawal period may come with significant penalties. This limited liquidity can be a drawback for individuals with unexpected financial needs.

Comparative Analysis

When considering non-tax-qualified annuities, it's essential to compare them with other investment options. Here's a brief comparison with some common alternatives:

- Qualified Plans (401(k), IRA): While qualified plans offer immediate tax benefits, they may have contribution limits and stricter withdrawal rules. Non-tax-qualified annuities provide more flexibility and the potential for higher growth.

- Taxable Investment Accounts: Taxable accounts offer immediate access to funds and more liquidity, but they lack the tax-deferred growth advantage of annuities. Additionally, taxable accounts may be subject to higher taxes on earnings.

- Rental Properties: Investing in rental properties can provide a steady income stream, but it comes with the responsibilities of property ownership and management. Annuities, on the other hand, offer a more hands-off approach to generating income.

The Future of Non Tax Qualified Annuities

As the financial landscape continues to evolve, non-tax-qualified annuities are likely to play an even more significant role in retirement planning. With increasing life expectancies and the need for stable income during retirement, these annuities offer a compelling solution.

Furthermore, advancements in financial technology and the growing awareness of retirement planning among individuals are likely to drive the popularity of non-tax-qualified annuities. As more investors seek tax-efficient and stable income options, these annuities will remain a key component of comprehensive retirement strategies.

It's worth noting that the regulatory environment surrounding annuities may also evolve, potentially impacting their structure and features. Staying informed about any changes in the financial industry is essential for individuals considering non-tax-qualified annuities as part of their long-term financial plans.

How do non-tax-qualified annuities differ from tax-qualified plans like 401(k)s or IRAs?

+Non-tax-qualified annuities differ from tax-qualified plans in their tax treatment. While tax-qualified plans offer immediate tax benefits on contributions, non-tax-qualified annuities provide tax-deferred growth, allowing earnings to compound over time. Additionally, non-tax-qualified annuities offer more flexibility in terms of withdrawal options and may have higher contribution limits.

What are the potential risks associated with non-tax-qualified annuities?

+Potential risks include early withdrawal penalties, which can significantly impact the overall return on investment. Additionally, the complexity of these annuities may require careful consideration and professional advice. Inflation risk and limited liquidity are also factors to consider when investing in non-tax-qualified annuities.

Are there any age restrictions for investing in non-tax-qualified annuities?

+Age restrictions may vary depending on the annuity provider and the specific type of annuity. Generally, there are no strict age limits for investing in non-tax-qualified annuities. However, it’s essential to consider the long-term nature of these investments and ensure that the annuity aligns with your retirement goals and timeline.

How can I choose the right non-tax-qualified annuity for my retirement needs?

+Choosing the right annuity involves careful consideration of your financial goals, risk tolerance, and retirement timeline. It’s recommended to consult with a financial advisor who can guide you through the various options and help you select an annuity that aligns with your specific needs. Factors to consider include the annuity’s growth potential, withdrawal options, and any additional features such as longevity protection.