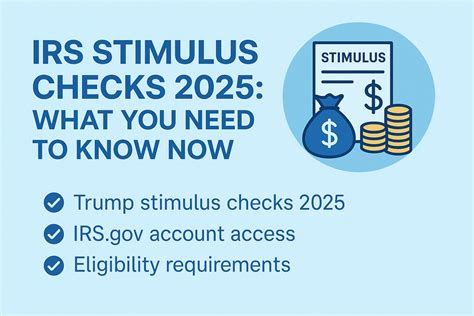

1750 Stimulus Check 2025: Definitive Guide To Eligibility And Timing

The 1750 Stimulus Check 2025 is a term you’ll see in policy discussions as lawmakers explore ways to provide quick relief to households facing higher living costs. This definitive guide explains eligibility and timing in clear terms, so you know what to watch for if the proposal advances and how it could affect your finances.

Key Points

- In most scenarios, eligibility hinges on income thresholds and filing status rather than universal entitlement.

- The timing of issuance depends on legislative action and distribution methods (tax system, direct deposits, or mailed checks).

- Automatic eligibility is possible for taxpayers already in the IRS system; some individuals may need to file a simplified return.

- Dependents, eligibility for mixed-status households, and non-filers add layers of complexity requiring accurate information.

- Always verify information with official government sources to avoid scams and misinformation.

What is the 1750 Stimulus Check 2025?

The 1750 Stimulus Check 2025 refers to a potential government relief payment designed to provide quick financial support. While policies vary, this guide explains how such a payment would be evaluated, who would qualify, and when it could be issued. The term is used for planning and comparison, not a guarantee.

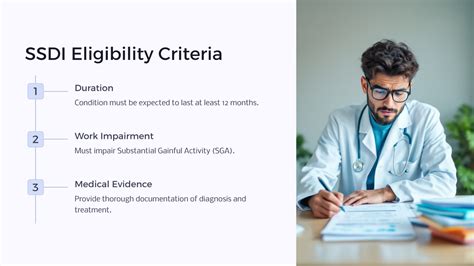

Eligibility Criteria

Income thresholds and filing status are common baselines for eligibility. Depending on the final law, residency, citizenship status, age, and presence of dependents may also influence eligibility. If you live in a household with fluctuating income or rely on tax-based distribution, you may fall into a different category. Always check the final rules when they are published.

Note: The details below illustrate how the program could work and are subject to change based on legislative action.

Timing, Amounts, and Application Window

Timing would hinge on congressional action, with payment amounts determined by final legislation. In a typical structure, eligible households could receive automatic payments for those already in the tax system, while others might need to file a simple form or non-filer return to establish eligibility. Distribution methods could include direct deposit, paper checks, or a combination depending on your preferred contact on file with the government.

How to Prepare and What to Do Next

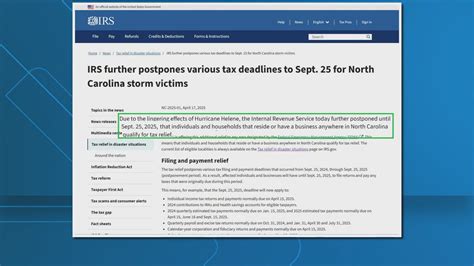

To be ready, gather your most recent tax documents, verify your mailing and direct deposit information, and confirm your residency and citizenship status. Monitor official channels from the Internal Revenue Service and the U.S. Department of the Treasury for updates, and be cautious of scams that promise guaranteed access or advise you to share passwords or Social Security numbers.

When could the 1750 Stimulus Check 2025 be issued?

+

Issuance depends on legislative action. If a bill is enacted, distribution could begin within weeks to a few months, with timing calibrated to the final rules and the chosen distribution method.

Who qualifies for the 1750 Stimulus Check 2025?

+

Qualification typically depends on income thresholds, filing status, residency or citizenship requirements, and whether you have dependents. Some recipients might be automatic based on IRS records, while others may need to file a simple form to establish eligibility.

Do I need to file a tax return to receive the payment?

+

In some scenarios, you would receive automatic eligibility if you are already in the IRS system. If you are not, you may need to file a simplified return or provide basic information to establish eligibility and ensure proper delivery.

How can I check the status of my payment?

+

Check official portals from the Internal Revenue Service and the Treasury for status updates. Use secure login, monitor sent notices, and watch for any guidance about required actions or verification steps.

What if I live outside the United States?

+

Typically, stimulus payments of this kind are limited to U.S. residents and citizens with valid tax records. If you reside abroad, review the final policy text, as eligibility may be restricted or require special provisions.