Nc Tax Deadline

The North Carolina tax deadline is an important date for residents and businesses alike, as it marks the final day to file and pay various taxes to the state. Understanding the specifics of this deadline and its implications is crucial for ensuring compliance with the law and avoiding penalties. In this comprehensive article, we will delve into the details of the NC tax deadline, providing a thorough analysis of its components, offering insights from industry experts, and answering common questions that arise around this critical date.

Understanding the NC Tax Deadline

The North Carolina tax deadline refers to the specific date by which individuals and entities must file their tax returns and make payments to the North Carolina Department of Revenue. While the term often evokes thoughts of a single, annual deadline, the reality is more complex. NC tax deadlines can vary depending on the type of tax, the taxpayer's status, and other specific circumstances.

The primary tax deadlines in North Carolina are for individual income taxes and business taxes. For individual taxpayers, the traditional tax filing deadline aligns with the federal deadline, which is typically April 15th of each year. However, it's important to note that this date can be subject to change, often due to weekends or holidays falling on the designated day. In such cases, the deadline is usually extended to the next business day.

Business entities in North Carolina face a slightly different scenario. The tax deadline for corporations, partnerships, and other business structures is typically March 15th. This earlier deadline allows the NC Department of Revenue to process business tax returns before the influx of individual returns. However, similar to individual tax deadlines, these dates can be adjusted for weekends and holidays.

Extensions and Special Circumstances

It's not uncommon for taxpayers to require more time to complete their tax returns accurately. In such cases, North Carolina offers a mechanism for taxpayers to request an extension. By filing Form D-41, taxpayers can secure a six-month extension, pushing the deadline to October 15th for individuals and September 15th for businesses. However, it's crucial to note that an extension of time to file does not extend the time to pay any taxes due.

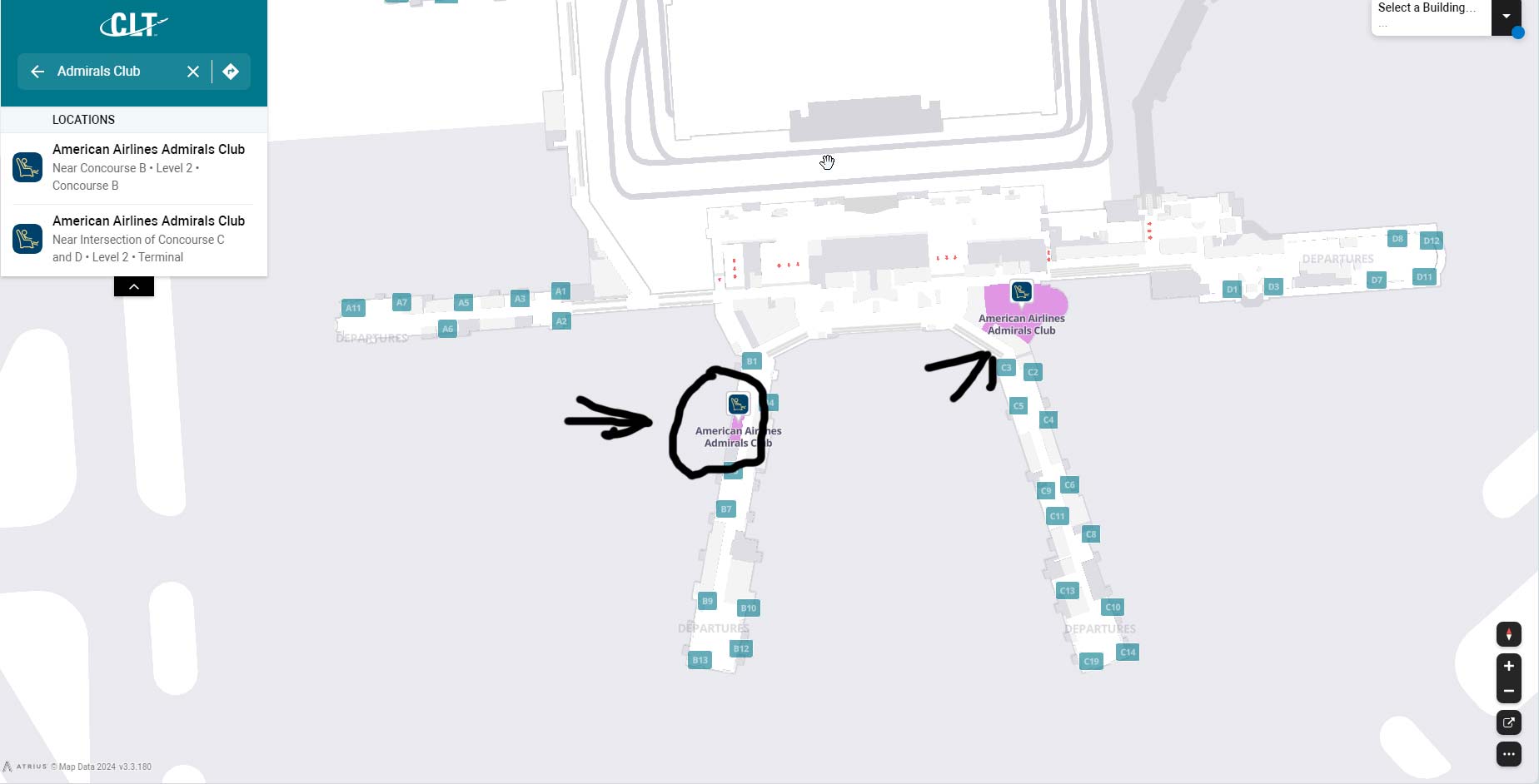

In exceptional circumstances, such as natural disasters or other emergencies, the NC Department of Revenue may announce special relief measures. These measures can include extended deadlines or other forms of tax relief. It's essential for taxpayers to stay informed about such announcements, as they can provide much-needed flexibility during challenging times.

Compliance and Penalties

Ensuring compliance with North Carolina's tax deadlines is not only a legal obligation but also a financial necessity. Failure to meet these deadlines can result in a range of penalties, including late filing fees, late payment penalties, and interest charges on unpaid taxes.

The late filing fee in NC is typically 5% of the tax due, with a minimum fee of $10. This fee can accumulate monthly, up to a maximum of 25% of the tax due. In addition to this fee, a late payment penalty of 0.5% per month, up to a maximum of 25%, can be imposed on unpaid taxes. Interest charges are also applied, calculated at a rate of 3% above the federal short-term rate, compounded daily.

To illustrate the potential impact of these penalties, consider the following example: If a taxpayer owes $10,000 in taxes and fails to file and pay by the deadline, they could face a late filing fee of $500 (5% of $10,000), a late payment penalty of $50 (0.5% of $10,000), and interest charges that accumulate daily. The financial burden of non-compliance can quickly become significant.

| Penalty Type | Description |

|---|---|

| Late Filing Fee | 5% of tax due, up to 25% (minimum $10) |

| Late Payment Penalty | 0.5% per month, up to 25% |

| Interest Charges | 3% above federal short-term rate, compounded daily |

Preparing for the NC Tax Deadline

To navigate the North Carolina tax deadline successfully, taxpayers should take proactive steps to ensure they are well-prepared. Here are some key considerations:

- Gather Necessary Documents: Start by collecting all relevant tax documents, such as W-2s, 1099s, and receipts for deductions. Having these documents organized and readily available can streamline the filing process.

- Understand Your Tax Situation: Take the time to understand your unique tax situation. This includes knowing which forms are applicable to you, whether you are eligible for any tax credits or deductions, and any specific rules that apply to your income or circumstances.

- Seek Professional Assistance: For complex tax situations or if you are unsure about the process, consider seeking the assistance of a tax professional. They can provide guidance, ensure accuracy, and help you maximize your tax benefits.

- Stay Informed: Keep up-to-date with any changes or updates to NC tax laws and regulations. The North Carolina Department of Revenue's website is a valuable resource for the latest information and forms.

- File Electronically: Whenever possible, opt for electronic filing. This method is not only faster and more efficient but also reduces the risk of errors and provides a record of your submission.

Tax Preparation Software

In today's digital age, tax preparation software has become an invaluable tool for many taxpayers. These software solutions can guide users through the tax filing process, offering step-by-step instructions and ensuring accuracy. They often include features such as data import, which can automatically populate forms with relevant information, saving time and effort.

When choosing tax preparation software, it's essential to select one that is compatible with your specific tax situation and offers the necessary forms and features. Some popular options include TurboTax, H&R Block, and TaxAct, each with its own set of strengths and pricing structures. Comparing these options and reading reviews can help you make an informed decision.

Post-Deadline Actions

Once the NC tax deadline has passed, there are still several important actions taxpayers should take to ensure they remain in compliance and maximize their financial well-being.

- Review Your Return: Even after filing, it's crucial to review your tax return for accuracy. Mistakes can occur, and identifying and correcting them promptly can save you from potential audits or penalties.

- Keep Records: Retain all tax-related documents for at least three years. This includes your filed return, supporting documents, and any correspondence with the NC Department of Revenue. These records can be invaluable if you face an audit or need to substantiate deductions.

- Amend Returns: If you discover errors or changes to your tax situation after filing, you can amend your return. Form D-413 is used to amend individual income tax returns, while Form D-830 is for businesses. It's important to act promptly to correct any inaccuracies.

- Plan for the Next Year: Use the post-deadline period as an opportunity to plan for the upcoming tax year. Review your deductions, consider ways to optimize your financial strategies, and stay informed about any changes to tax laws that may impact you.

Future Implications and Trends

Looking ahead, the landscape of NC tax deadlines and compliance is likely to evolve, driven by technological advancements, changing economic conditions, and shifts in tax policies. Here are some key trends and future implications to consider:

Digital Transformation

The continued digital transformation of the tax landscape is expected to bring about increased efficiency and convenience for taxpayers. Online filing systems are likely to become even more robust, offering enhanced security and user-friendly interfaces. Additionally, the integration of artificial intelligence and machine learning technologies could revolutionize the way taxes are calculated and filed, reducing human error and streamlining the process.

Economic Impact

Economic conditions can significantly influence tax policies and compliance. In times of economic prosperity, tax revenues may increase, leading to potential changes in tax rates or the introduction of new tax incentives. Conversely, during economic downturns, taxpayers may face challenges in meeting their tax obligations, prompting the government to offer relief measures or adjust deadlines.

Tax Policy Changes

Tax policies are subject to change, often reflecting the priorities and goals of the governing administration. Future tax reforms could impact the structure of NC taxes, including changes to tax rates, deductions, or the introduction of new taxes. Staying informed about potential policy shifts is essential for taxpayers to adapt their financial strategies accordingly.

International Tax Considerations

In an increasingly globalized economy, international tax considerations are becoming more relevant for NC taxpayers. With businesses expanding across borders and individuals engaging in cross-border transactions, the complexity of tax obligations can increase. Staying abreast of international tax laws and their interplay with NC tax regulations will be crucial for taxpayers with global connections.

FAQs

What happens if I miss the NC tax deadline without requesting an extension?

+If you miss the tax deadline without requesting an extension, you may be subject to late filing fees, late payment penalties, and interest charges on unpaid taxes. It's crucial to file your return as soon as possible to minimize these penalties.

Can I file my NC taxes online, and is it secure?

+Yes, you can file your NC taxes online through the NC Department of Revenue's website. The online filing system is secure and offers a convenient way to submit your return. It's important to ensure you are using a trusted and official platform to protect your personal information.

Are there any tax breaks or incentives for NC taxpayers?

+Yes, North Carolina offers various tax credits and deductions to eligible taxpayers. These can include credits for education expenses, child care costs, and energy-efficient improvements, among others. It's advisable to consult a tax professional or the NC Department of Revenue's website for a comprehensive list of available incentives.

How can I stay updated on NC tax law changes and deadlines?

+To stay informed about NC tax law changes and deadlines, you can subscribe to the NC Department of Revenue's email updates, follow their social media accounts, and regularly visit their website. Additionally, consider signing up for alerts from reputable tax news sources or using tax software that provides updates on relevant tax law changes.

Is there a difference in tax deadlines for different types of businesses in NC?

+Yes, the tax deadlines for different types of businesses in North Carolina can vary. While the traditional deadline for most businesses is March 15th, there are exceptions for certain entities, such as S-corporations and trusts, which may have different filing due dates. It's essential to consult the specific regulations for your business type.

By staying informed and proactive, taxpayers can navigate the complexities of the NC tax deadline with confidence and ensure compliance with the law. Remember, the information provided here is a guide, and it’s always advisable to consult with tax professionals or the NC Department of Revenue for specific guidance tailored to your unique circumstances.