Delaware State Income Tax

Welcome to an in-depth exploration of the Delaware State Income Tax, a critical component of the state's revenue system and a topic of interest for residents and businesses alike. In this comprehensive guide, we will delve into the intricacies of Delaware's income tax laws, rates, exemptions, and filing requirements, offering a clear understanding of this essential financial obligation.

Understanding Delaware’s State Income Tax Structure

Delaware, often referred to as “The First State,” boasts a unique tax landscape that significantly impacts its residents and businesses. While the state maintains a favorable business environment with a competitive corporate tax structure, the income tax system for individuals is a crucial aspect to navigate.

The Delaware State Income Tax is a progressive tax system, which means the tax rate increases as taxable income rises. This approach ensures fairness, as those with higher incomes contribute a larger portion of their earnings to the state's revenue.

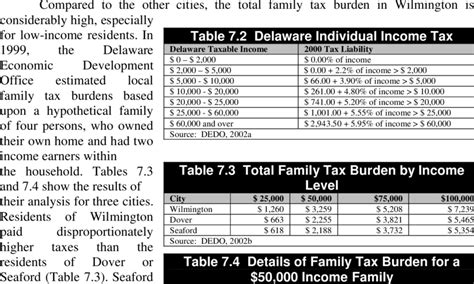

Tax Rates and Brackets

As of the latest tax year, Delaware operates with three income tax brackets, each with its own tax rate. These brackets are:

| Income Bracket | Tax Rate |

|---|---|

| Up to $2,000 | 2.2% |

| $2,001 - $6,000 | 3.9% |

| Above $6,000 | 6.6% |

These rates are subject to change, so it's essential for taxpayers to stay updated with the latest information from the Delaware Division of Revenue.

Exemptions and Deductions

Delaware offers several exemptions and deductions to help reduce the tax burden on individuals and families. Some of these include:

- Personal Exemption: Each taxpayer is entitled to a personal exemption, which reduces taxable income. This exemption is indexed for inflation and is adjusted annually.

- Standard Deduction: Delaware provides a standard deduction, which allows taxpayers to deduct a set amount from their taxable income. This deduction is beneficial for those who don't itemize their deductions.

- Itemized Deductions: Taxpayers have the option to itemize their deductions, which can include expenses like mortgage interest, charitable contributions, and medical costs.

It's important to note that the availability and applicability of these deductions depend on various factors, including income level and filing status.

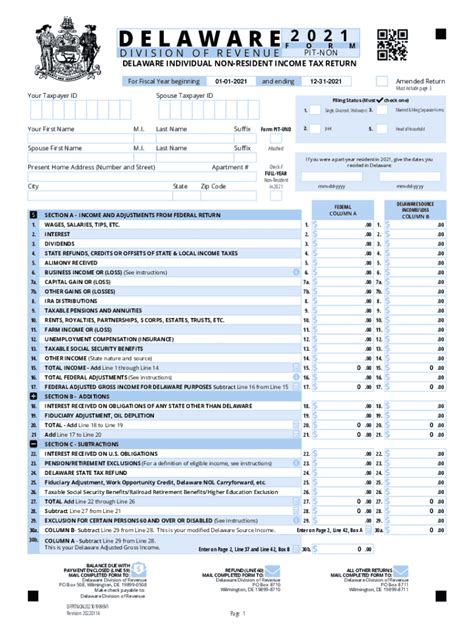

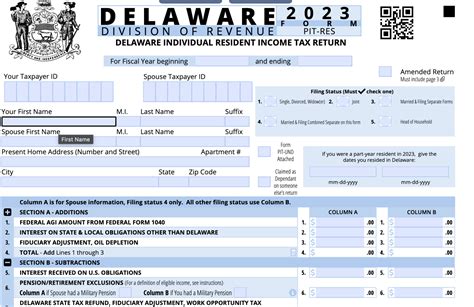

Filing Requirements and Deadlines

Navigating the filing process is a crucial aspect of managing one’s tax obligations. In Delaware, the income tax filing season typically aligns with the federal tax year, beginning on January 1st and ending on April 15th.

Who Needs to File

Delaware residents with income from any source, including wages, salaries, investments, and business profits, are generally required to file a state income tax return. Non-residents with Delaware-sourced income, such as income from a business or rental property in the state, may also have filing obligations.

Filing Methods

Delaware offers several convenient filing methods to accommodate various preferences and technological capabilities. Taxpayers can choose from:

- Online Filing: The Delaware Division of Revenue provides an online filing system, which is secure, efficient, and user-friendly. It allows taxpayers to file their returns electronically and receive their refunds quickly.

- Paper Filing: For those who prefer traditional methods, paper filing is an option. Taxpayers can download and print the necessary forms from the state's website and mail them to the appropriate address.

- Tax Preparation Software: Many popular tax preparation software programs offer Delaware-specific forms and calculations, making the filing process more accessible and accurate.

Payment Options

Delaware provides flexibility in payment methods to accommodate different financial situations. Taxpayers can choose from:

- Electronic Funds Transfer (EFT): This method allows for secure and direct payment from a taxpayer's bank account. It's a convenient option for those who prefer automatic payments.

- Credit or Debit Card: Taxpayers can use their credit or debit cards to pay their taxes online. However, it's important to note that there may be additional fees associated with this method.

- Check or Money Order: Traditional payment methods are also available. Taxpayers can mail a check or money order along with their tax return to the designated address.

Delaware’s Income Tax Withholding and Estimated Payments

For those earning income from employment or self-employment, understanding Delaware’s income tax withholding and estimated payment requirements is essential.

Income Tax Withholding

Employers in Delaware are required to withhold state income tax from their employees’ wages. The amount withheld depends on the employee’s income, allowances, and tax rate. Employees can adjust their withholding allowances by completing a Delaware Withholding Allowance Certificate (Form W-4DE).

Self-employed individuals and those with other income sources, such as rental income or investment income, may need to make estimated tax payments to cover their Delaware income tax liability.

Estimated Tax Payments

Estimated tax payments are generally required if a taxpayer’s total Delaware income tax liability for the year, after accounting for withholdings, is expected to be $500 or more. These payments are typically due quarterly, with specific due dates set by the state.

To calculate estimated tax payments, taxpayers can use the Delaware Estimated Tax Worksheet, which takes into account the taxpayer's expected income, deductions, and credits for the year.

Delaware’s Taxpayer Assistance and Resources

The Delaware Division of Revenue understands that navigating the complex world of taxes can be challenging. To assist taxpayers, the division provides a wealth of resources and services, ensuring that individuals and businesses can meet their tax obligations with ease and confidence.

Online Resources

The official website of the Delaware Division of Revenue serves as a comprehensive hub for tax-related information. Here, taxpayers can find:

- Tax forms and instructions

- Tax rates and brackets

- Filing and payment guidelines

- Information on tax credits and deductions

- News and updates on tax-related matters

Taxpayer Assistance Programs

For those who require additional support, the Delaware Division of Revenue offers several assistance programs, including:

- Taxpayer Assistance Centers: These centers provide in-person assistance for taxpayers who need help with filing, payment, or other tax-related issues. Appointments can be scheduled online or by phone.

- Taxpayer Advocate Service: This service is designed to assist taxpayers who are experiencing economic hardship or who have complex tax issues. The advocate works to resolve issues and ensure taxpayers are treated fairly.

- Online Chat and Email Support: For quick inquiries, taxpayers can utilize the online chat feature or send an email to receive prompt assistance from tax professionals.

Taxpayer Education

To empower taxpayers with the knowledge they need to navigate the tax system, the Delaware Division of Revenue offers various educational resources, such as:

- Webinars and workshops on tax topics

- Tax guides and publications

- Video tutorials on common tax processes

- Social media updates with tax tips and reminders

Delaware’s Tax Credits and Incentives

Delaware recognizes the importance of incentivizing economic growth and supporting its residents and businesses. To achieve these goals, the state offers a range of tax credits and incentives, providing relief and promoting investment.

Tax Credits

Delaware provides various tax credits to eligible taxpayers, including:

- Earned Income Tax Credit (EITC): This credit benefits working individuals and families with low to moderate incomes, helping to offset the burden of state income taxes.

- Senior Citizen Tax Credit: Qualifying senior citizens can receive a credit against their income tax liability, providing much-needed relief for this demographic.

- Property Tax Credit: Delaware offers a credit for property taxes paid, which can significantly reduce the overall tax burden for homeowners.

Incentive Programs

In addition to tax credits, Delaware implements incentive programs to encourage economic development and job creation. These programs include:

- Delaware Strategic Fund: This fund provides financial assistance and incentives to businesses that are creating jobs, investing in research and development, or locating in designated areas of the state.

- Job Creation Tax Credit: Businesses that create a specified number of jobs within a certain timeframe may be eligible for a tax credit, further supporting economic growth.

- Research and Development Tax Credit: Delaware offers a credit for businesses engaged in research and development activities, promoting innovation and technological advancement.

Conclusion

The Delaware State Income Tax is a critical component of the state’s fiscal system, impacting residents and businesses alike. By understanding the tax rates, exemptions, filing requirements, and available resources, taxpayers can navigate this system with confidence and ensure compliance with state regulations.

Delaware's progressive tax structure, coupled with its comprehensive support system, ensures that taxpayers receive the assistance they need while contributing to the state's revenue and economic development. As Delaware continues to evolve and adapt its tax policies, staying informed and proactive in managing one's tax obligations remains essential.

What is the income tax rate in Delaware for the current year?

+

For the current tax year, Delaware operates with three income tax brackets: up to 2,000 (2.2%), 2,001 - 6,000 (3.9%), and above 6,000 (6.6%).

How do I know if I need to file a Delaware state income tax return?

+

Delaware residents with income from any source, including wages, salaries, investments, and business profits, are generally required to file a state income tax return. Non-residents with Delaware-sourced income may also have filing obligations.

What are the main differences between Delaware’s state income tax and federal income tax?

+

Delaware’s state income tax is separate from federal income tax and operates with its own set of rules, rates, and filing requirements. While both systems are progressive, the tax rates, brackets, and deductions can vary significantly.

Are there any tax benefits for seniors or veterans in Delaware?

+

Yes, Delaware offers specific tax credits for qualifying senior citizens and veterans, providing relief and support for these demographics.

What happens if I miss the Delaware state income tax filing deadline?

+

Missing the filing deadline may result in penalties and interest charges. It’s important to file as soon as possible to avoid these additional costs and maintain compliance.