New Jersey Sales Tax Login

Welcome to the comprehensive guide on the New Jersey Sales Tax Login, an essential portal for businesses operating in the Garden State. This article will delve into the intricacies of accessing and utilizing the New Jersey Division of Taxation's online services, ensuring you navigate the process with ease and efficiency.

Understanding the New Jersey Sales Tax Login

The New Jersey Sales Tax Login is a secure online gateway that provides businesses with a range of tools and resources to manage their sales tax obligations. By logging in, businesses can access a wealth of information and perform various tasks, streamlining their compliance with the state's tax regulations.

The login portal is a vital component of the state's tax system, offering a user-friendly interface that simplifies the often complex process of sales tax management. Whether you're a seasoned business owner or a newcomer to the New Jersey market, understanding how to navigate this platform is crucial for efficient tax administration.

Key Features and Benefits

The New Jersey Sales Tax Login portal boasts an array of features designed to enhance the user experience and facilitate compliance. Here's a glimpse of what you can expect:

- Registration and Renewal: Businesses can easily register for sales tax permits and renew them annually through the login portal. This simplifies the process of obtaining the necessary credentials to operate in the state.

- Tax Filing and Payment: The portal allows users to file sales tax returns online and make payments electronically. This streamlined process saves time and ensures timely compliance with tax deadlines.

- Account Management: Businesses can manage their tax accounts, update contact information, and access a comprehensive history of their tax transactions. This feature provides a convenient way to keep track of past filings and payments.

- Research and Resources: The login portal offers a wealth of resources, including tax guides, newsletters, and updates on tax laws and regulations. This ensures businesses stay informed about any changes that may impact their operations.

- Electronic Filing Options: New Jersey offers various electronic filing options, including web-based filing and electronic data interchange (EDI). These options provide flexibility and efficiency for businesses of all sizes.

By leveraging these features, businesses can effectively manage their sales tax obligations, reducing the risk of penalties and ensuring a smooth relationship with the New Jersey Division of Taxation.

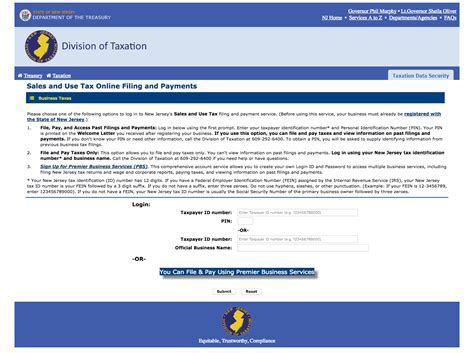

Step-by-Step Guide: Accessing the New Jersey Sales Tax Login

Now that we've explored the key benefits of the New Jersey Sales Tax Login, let's dive into the process of accessing the portal. Follow these steps to get started:

- Visit the Official Website: Begin by navigating to the New Jersey Division of Taxation's official website. This is the primary portal for all tax-related services in the state.

- Locate the Login Section: On the homepage, you'll find a prominent section dedicated to the Sales Tax Login. Click on the link provided to access the login page.

- User Authentication: The login page will require you to enter your User ID and Password. These credentials are unique to your business and are provided during the registration process.

- Secure Login: Ensure that you are using a secure internet connection to protect your sensitive information. New Jersey's login portal employs advanced security measures to safeguard user data.

- Forgot Credentials?: If you've forgotten your login details, the portal provides a Forgot Password or User ID option. Follow the prompts to reset your credentials and regain access.

- Two-Factor Authentication (2FA): For added security, consider enabling two-factor authentication. This optional feature provides an extra layer of protection, ensuring that only authorized users can access your account.

- Post-Login Navigation: Once logged in, you'll have access to a personalized dashboard. From here, you can navigate to various sections, including File Returns, Make Payments, Research & Resources, and more. Each section provides detailed guidance and tools to manage your sales tax obligations.

By following these steps, you'll be well on your way to effectively managing your sales tax responsibilities in New Jersey. Remember, staying compliant with tax regulations is not only a legal requirement but also essential for the smooth operation of your business.

New Jersey Sales Tax Rates and Regulations

Understanding the sales tax rates and regulations in New Jersey is crucial for businesses operating within the state. Here's a comprehensive breakdown of the key aspects you need to know:

Sales Tax Rates

New Jersey imposes a 6.625% state sales and use tax on most tangible personal property and certain services. However, it's important to note that this base rate may vary depending on the local municipality where the transaction occurs. The following table provides an overview of the state and local sales tax rates in select New Jersey cities:

| City | State Sales Tax Rate | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|---|

| Atlantic City | 6.625% | 4.00% | 10.625% |

| Camden | 6.625% | 3.50% | 10.125% |

| Hoboken | 6.625% | 1.00% | 7.625% |

| Jersey City | 6.625% | 3.00% | 9.625% |

| Newark | 6.625% | 3.50% | 10.125% |

Please note that the above rates are subject to change, and it's essential to refer to the official New Jersey Sales Tax Rates page for the most up-to-date information. Additionally, certain jurisdictions may have additional taxes or surcharges, so it's crucial to research the specific rates applicable to your business location.

Sales Tax Exemptions

New Jersey provides sales tax exemptions for certain goods and services. These exemptions are designed to encourage specific industries or promote social causes. Here are some notable exemptions:

- Food and Drugs: Most unprepared food items, including produce, dairy products, and bakery goods, are exempt from sales tax. Additionally, prescription drugs and certain medical devices are also tax-exempt.

- Clothing and Footwear: Clothing and footwear purchases under $100 are exempt from sales tax. This exemption applies to items worn on the body and certain accessories.

- Manufacturing Equipment: Machinery and equipment used in manufacturing processes are exempt from sales tax, provided they meet specific criteria.

- Charitable Events: Sales made at charitable events, such as bake sales or fundraising dinners, are often exempt from sales tax if the proceeds benefit a qualified nonprofit organization.

- Educational Materials: Certain educational materials, such as textbooks and instructional supplies, are exempt from sales tax.

It's important to stay informed about the latest sales tax exemptions and regulations to ensure your business remains compliant. The New Jersey Division of Taxation provides detailed guidelines and resources to help businesses navigate these exemptions.

Sales Tax Compliance and Reporting

Ensuring compliance with sales tax regulations is a critical aspect of doing business in New Jersey. Here's an overview of the compliance process and reporting requirements:

Registration and Permits

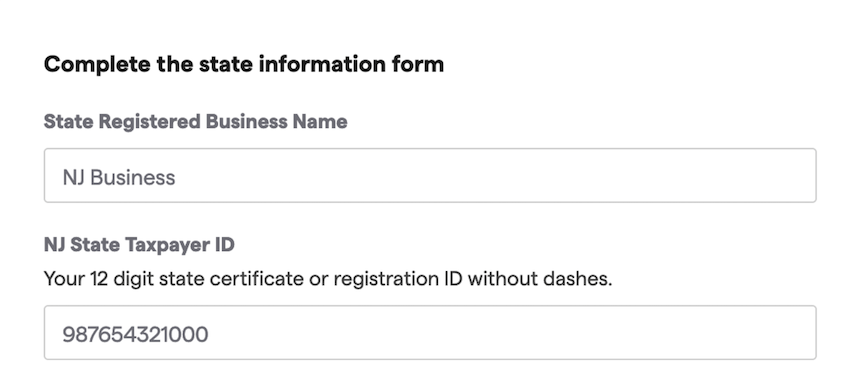

All businesses that sell tangible personal property or certain services in New Jersey are required to register with the New Jersey Division of Taxation and obtain a Sales Tax Permit. The permit allows businesses to collect and remit sales tax to the state. The registration process can be completed online through the New Jersey Business Registration Portal.

Filing Sales Tax Returns

Once registered, businesses must file sales tax returns periodically, typically on a quarterly or monthly basis. The due dates for filing returns align with the business's designated filing frequency. Late filings may result in penalties and interest charges.

The New Jersey Sales Tax Return form, known as Form ST-50, is available online and can be filed electronically through the Sales Tax Login portal. The form requires businesses to report their total sales, taxable sales, and the amount of sales tax collected during the reporting period.

Payment Options

Businesses have several payment options when it comes to remitting sales tax to the state. These include:

- Electronic Funds Transfer (EFT): EFT allows businesses to make payments directly from their bank account to the state's tax account. This method is secure and efficient.

- Credit Card: Sales tax payments can be made using a credit card through the online payment portal. However, credit card payments may incur additional fees.

- Check or Money Order: Traditional payment methods such as checks or money orders can be mailed to the designated address provided by the Division of Taxation.

It's important to note that late payments may incur penalties and interest, so staying on top of your payment deadlines is crucial.

Record-Keeping and Audits

Businesses are required to maintain accurate records of their sales and purchases for a minimum of four years. These records must be readily available for inspection by the Division of Taxation. In the event of an audit, businesses must provide detailed documentation to support their sales tax filings.

Audits can be initiated by the Division of Taxation to ensure compliance with sales tax regulations. During an audit, businesses may be required to produce sales records, purchase orders, invoices, and other relevant documentation. It's essential to cooperate fully with the auditors to avoid penalties and ensure a smooth process.

Staying Informed and Up-to-Date

The world of sales tax is dynamic, with regulations and rates subject to change. To stay informed and ensure compliance, businesses operating in New Jersey should:

- Subscribe to Updates: Sign up for email updates from the New Jersey Division of Taxation to receive notifications about any changes to sales tax rates, regulations, or filing requirements.

- Utilize Resources: The Division of Taxation provides a wealth of resources, including guides, webinars, and FAQs, to help businesses navigate the sales tax landscape. Make use of these resources to stay informed and seek guidance when needed.

- Consult Professionals: If you have complex tax issues or need expert advice, consider consulting with tax professionals or accountants who specialize in sales tax compliance.

- Stay Organized: Maintain a well-organized system for sales tax records and filings. This will make it easier to retrieve information during audits or when resolving tax issues.

By staying proactive and informed, businesses can navigate the complexities of sales tax compliance with confidence and minimize the risk of non-compliance penalties.

Conclusion: Empowering Businesses with Efficient Sales Tax Management

The New Jersey Sales Tax Login portal is a powerful tool that empowers businesses to manage their sales tax obligations efficiently and effectively. By leveraging the features and resources provided, businesses can ensure compliance with state regulations, streamline their tax management processes, and maintain a positive relationship with the Division of Taxation.

As you navigate the world of sales tax in New Jersey, remember that staying informed, organized, and proactive is key to success. With the right tools and knowledge, you can confidently manage your sales tax responsibilities and focus on the growth and success of your business.

What are the consequences of non-compliance with sales tax regulations in New Jersey?

+Non-compliance with sales tax regulations can result in penalties, interest charges, and legal repercussions. Businesses may be subject to audits, fines, and even criminal charges if they fail to collect and remit sales tax accurately. It’s crucial to stay informed and comply with all sales tax obligations to avoid these consequences.

How often do sales tax rates change in New Jersey, and how can I stay updated on these changes?

+Sales tax rates in New Jersey can change periodically, often in response to legislative actions or budget adjustments. To stay updated, businesses should subscribe to the New Jersey Division of Taxation email updates, which provide notifications about any changes to sales tax rates or regulations. Additionally, regularly checking the official sales tax rates page on the Division of Taxation’s website ensures that you have the most current information.

Can I register for a sales tax permit online, or do I need to visit a physical location?

+Yes, you can register for a sales tax permit online through the New Jersey Business Registration Portal. This portal allows businesses to complete the registration process electronically, making it a convenient and efficient option. However, if you prefer, you can also visit a physical location, such as a local tax office, to complete the registration in person.

Are there any sales tax holidays in New Jersey, and how do they work?

+New Jersey occasionally offers sales tax holidays, during which certain types of purchases are exempt from sales tax for a specified period. These holidays are typically announced in advance and may vary in duration and eligible items. Businesses should stay informed about sales tax holidays through official communications from the New Jersey Division of Taxation to ensure they can accurately inform their customers and manage their sales tax obligations during these periods.