Sales Tax On A Vehicle In Texas

Sales tax on vehicles is an important aspect of automotive purchasing in the state of Texas. Understanding how sales tax is applied, calculated, and potentially avoided can significantly impact the overall cost of buying a car. This comprehensive guide delves into the intricacies of sales tax on vehicles in Texas, providing an in-depth analysis of the regulations, exemptions, and strategies for minimizing your tax burden.

The Basics of Sales Tax on Vehicles in Texas

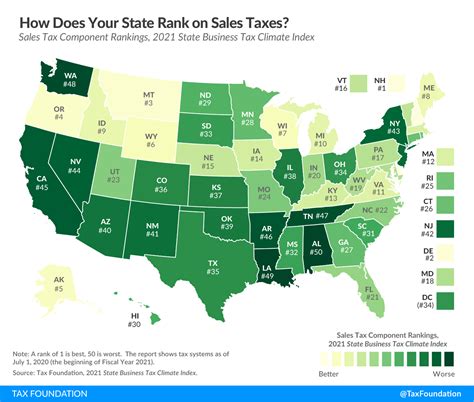

Texas is known for its unique approach to sales tax, especially when it comes to vehicles. Unlike some other states, Texas does not have a uniform sales tax rate for automotive purchases. Instead, the sales tax is determined by the county where the vehicle is purchased and registered.

The state sales tax rate in Texas is currently set at 6.25%, but this is just the base rate. On top of this, counties and municipalities can add their own local sales tax rates, which can vary significantly. For instance, in the bustling city of Houston, the total sales tax rate can be as high as 8.25%, while in more rural areas, it might be closer to the state base rate.

When purchasing a vehicle in Texas, you'll need to consider not just the vehicle's price but also the sales tax that will be added to the total cost. This can amount to a substantial sum, especially for higher-priced vehicles. For example, on a $50,000 car, the sales tax alone could be upwards of $4,000, depending on the county.

| County | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Harris County (Houston) | 2% | 8.25% |

| Dallas County | 2% | 8.25% |

| Bexar County (San Antonio) | 1.5% | 7.75% |

| Travis County (Austin) | 1.25% | 7.5% |

It's crucial for car buyers in Texas to be aware of these varying rates and plan their purchases accordingly. One strategy could be to research and compare prices and tax rates across different counties to find the most cost-effective option. However, it's important to note that this strategy might not always be feasible or practical, especially if you're set on buying from a specific dealership or have other logistical constraints.

How Sales Tax is Calculated on Vehicles

The calculation of sales tax on vehicles in Texas is straightforward: it’s applied to the total purchase price of the vehicle, including any optional features, extended warranties, and dealer-installed accessories. This means that the more expensive the vehicle and its add-ons, the higher the sales tax will be.

For instance, if you're purchasing a base model vehicle for $25,000 in a county with a 7% sales tax rate, the sales tax would be $1,750. However, if you add on optional features worth $5,000, the sales tax will be calculated on the total purchase price of $30,000, resulting in a tax of $2,100. This highlights the importance of considering the total cost of the vehicle, not just the base price, when budgeting for a car purchase in Texas.

Exemptions and Special Cases

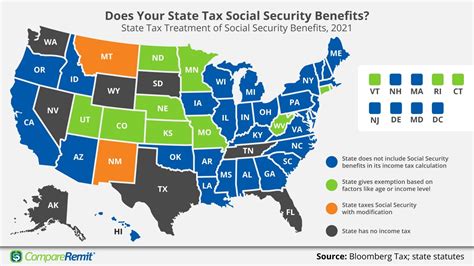

While sales tax on vehicle purchases is the norm in Texas, there are certain exemptions and special cases that can reduce or eliminate this tax burden. One such case is the exemption for certain types of vehicles, including some electric and hybrid vehicles. This is part of Texas’ efforts to promote environmentally friendly transportation options.

For example, the purchase of a qualified electric vehicle (EV) in Texas may be exempt from sales tax, saving buyers a significant amount of money. However, the specifics of this exemption can be complex and may depend on factors such as the EV's battery capacity, its manufacturer, and the date of purchase. It's essential to consult with a tax professional or refer to the official Texas Comptroller's website for the most up-to-date information on EV sales tax exemptions.

Strategies for Minimizing Sales Tax on Vehicle Purchases

Given the potentially high cost of sales tax on vehicle purchases in Texas, many buyers are keen to find ways to minimize this expense. While there are no guaranteed loopholes, there are several legitimate strategies that can help reduce the overall cost of buying a car in the state.

Negotiate the Price

One of the most effective ways to reduce the sales tax you pay on a vehicle is to negotiate a lower purchase price. The lower the price, the lower the sales tax will be. This is especially true for higher-priced vehicles, where even a small percentage reduction in the purchase price can result in significant savings on sales tax.

For instance, negotiating a $2,000 discount on a $50,000 car would not only reduce the purchase price but also the sales tax. In a county with an 8% sales tax rate, this negotiation would save you $160 in sales tax alone.

Consider Lease Options

Leasing a vehicle can be an attractive option for those looking to avoid high sales tax rates. When you lease a vehicle, you’re essentially renting it for a set period, typically 2-3 years. You pay a monthly fee, which covers the depreciation of the vehicle over the lease term, plus interest and taxes. This means you’re not paying sales tax on the full purchase price of the vehicle, but rather on a smaller portion, often referred to as the “capitalized cost reduction.”

For example, if you lease a $50,000 vehicle with a $5,000 capitalized cost reduction, you're essentially only paying sales tax on the $5,000. This can result in substantial savings, especially in counties with high sales tax rates. However, it's important to note that leasing comes with its own set of considerations, including mileage limits and potential fees at the end of the lease term.

Buy from a County with a Lower Sales Tax Rate

As mentioned earlier, sales tax rates in Texas can vary significantly by county. If you have the flexibility to purchase your vehicle from a different county, you might be able to save money by choosing a county with a lower sales tax rate.

For instance, if you're considering a $40,000 vehicle and live in a county with an 8% sales tax rate, the tax alone would be $3,200. However, if you were to purchase the same vehicle in a county with a 6.25% sales tax rate, the tax would be reduced to $2,500, saving you $700. While this strategy might not always be feasible, it's certainly worth considering if you're in the market for a new vehicle.

The Future of Sales Tax on Vehicles in Texas

The landscape of sales tax on vehicles in Texas is not static. As the state’s economy and transportation needs evolve, so too might the sales tax regulations. While it’s impossible to predict the future with certainty, there are some trends and potential changes worth considering.

Potential Changes to Sales Tax Rates

The sales tax rates in Texas are set by the state and local governments, and they can be adjusted over time. While significant changes are not common, small adjustments or special assessments can occur. For instance, some counties might introduce temporary sales tax increases to fund specific projects or initiatives.

It's important for car buyers in Texas to stay informed about any potential changes to sales tax rates. This information is typically available on the Texas Comptroller's website and local government websites. By staying informed, you can better plan your vehicle purchase and potentially take advantage of any changes that might benefit you.

The Impact of Electric and Hybrid Vehicles

The increasing popularity of electric and hybrid vehicles (EVs and HEVs) is having a significant impact on the automotive industry, and this is reflected in Texas’ sales tax regulations. As mentioned earlier, there are currently exemptions for the sales tax on certain EVs, and these exemptions are likely to evolve as the state’s commitment to environmentally friendly transportation grows.

Looking ahead, we might see these exemptions expand to include more types of EVs and HEVs, or even to provide additional incentives, such as tax credits or rebates, for the purchase of these vehicles. This could make EVs and HEVs even more attractive options for Texas car buyers, both in terms of environmental benefits and potential cost savings.

The Rise of Online Vehicle Sales

With the advent of online vehicle sales platforms, the traditional model of car buying is evolving. Increasingly, consumers are turning to online marketplaces to research, compare, and even purchase vehicles. This shift could have implications for sales tax regulations in Texas.

Currently, when you purchase a vehicle online from an out-of-state dealer, you're typically responsible for paying the sales tax to your local tax authority. However, as online vehicle sales become more common, there may be pressure to adjust sales tax regulations to accommodate this new model. This could involve clarifying or simplifying the process for paying sales tax on out-of-state purchases, or even introducing new rules to govern these transactions.

Conclusion

Understanding the nuances of sales tax on vehicles in Texas is essential for any car buyer in the state. From the varying sales tax rates across counties to the potential exemptions for electric vehicles and the evolving landscape of online vehicle sales, there’s a lot to consider when it comes to minimizing your sales tax burden.

By staying informed about the latest regulations and strategies, and by leveraging the right tools and resources, you can make more informed decisions when purchasing a vehicle in Texas. Whether it's negotiating a better price, considering a lease, or buying from a county with a lower sales tax rate, there are options available to help you save money on sales tax.

Can I negotiate the sales tax on my vehicle purchase in Texas?

+No, you cannot negotiate the sales tax itself. However, you can negotiate the purchase price of the vehicle, which will directly impact the amount of sales tax you pay. The lower the purchase price, the lower the sales tax.

Are there any counties in Texas with no sales tax on vehicle purchases?

+No, every county in Texas has a sales tax rate, although some counties have a lower rate than others. The state sales tax rate is 6.25%, and local governments can add their own local sales tax rates on top of this.

What happens if I buy a car online from an out-of-state dealer in Texas?

+When you purchase a vehicle online from an out-of-state dealer, you’re typically responsible for paying the sales tax to your local tax authority. This means that even if you buy the car online, you’ll still need to pay sales tax based on the rate in the county where you’ll register the vehicle.