Sales Tax In Tennessee

Sales tax is an essential component of the tax system in Tennessee, playing a significant role in the state's revenue generation and impacting various aspects of daily life for its residents. Understanding the intricacies of sales tax in Tennessee is crucial for both businesses and individuals alike. This comprehensive guide will delve into the specifics of Tennessee's sales tax, covering its history, rates, exemptions, and its impact on the state's economy and businesses.

A Historical Perspective: The Evolution of Sales Tax in Tennessee

Tennessee’s journey with sales tax began in the early 20th century, mirroring the national trend of states adopting this form of taxation. The Sales Tax Act of 1947 marked a pivotal moment, introducing a general sales tax of 2% on retail sales, services, and leases of tangible personal property. Over the decades, the state has witnessed a gradual increase in the sales tax rate, reflecting the changing economic landscape and the need for sustainable revenue sources.

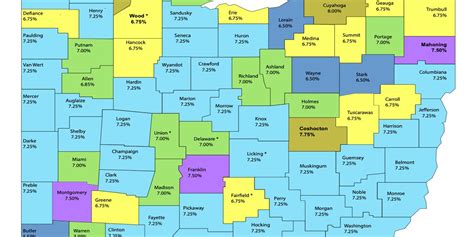

One notable evolution was the introduction of local option sales taxes, allowing counties and municipalities to levy additional taxes on top of the state's sales tax. This decentralized approach has resulted in varying sales tax rates across Tennessee, with some localities opting for higher rates to fund specific projects or services.

The Current Landscape: Tennessee’s Sales Tax Rates and Exemptions

As of [current year], Tennessee’s statewide sales and use tax rate stands at 7%, applicable to most retail sales, leases, and rentals of tangible personal property. However, this is not the only tax levied in the state. As mentioned earlier, local governments have the authority to impose their own sales taxes, leading to a diverse range of tax rates across the state.

Tennessee's sales tax structure is unique in that it applies to most goods and services, with few exemptions. Some notable exemptions include:

- Prescription medications

- Grocery items (excluding prepared foods)

- Most agricultural products

- Residential electricity and natural gas

- Certain manufacturing machinery and equipment

It's worth noting that these exemptions can vary depending on the locality, with some counties opting to tax certain exempt items to generate additional revenue.

The Impact of Local Option Sales Taxes

Local option sales taxes have had a profound impact on Tennessee’s tax landscape. These taxes, ranging from 0.25% to 2.75%, are typically used to fund specific projects or services, such as school improvements, fire department operations, or infrastructure development. While they provide a much-needed revenue stream for local governments, they can also lead to a complex and varied tax system, making compliance a challenge for businesses operating across multiple jurisdictions.

| County | Local Sales Tax Rate | Additional Notes |

|---|---|---|

| Davidson County | 2.25% | Includes a 0.5% transit tax for mass transit improvements. |

| Shelby County | 2.75% | One of the highest local sales tax rates in the state. |

| Hamilton County | 1.5% | Dedicated to funding county schools. |

| Knox County | 1% | A relatively lower local tax rate. |

Compliance and Collection: Navigating Tennessee’s Sales Tax System

For businesses operating in Tennessee, understanding and adhering to the state’s sales tax laws is imperative. The Tennessee Department of Revenue provides comprehensive guidelines and resources to assist businesses in registering, collecting, and remitting sales tax.

Registration and Licensing

Businesses are required to register with the state and obtain a Seller’s Permit or Sales and Use Tax License before engaging in taxable sales. This process ensures that businesses are officially recognized and can begin collecting and remitting sales tax.

Collection and Remittance

Sales tax is typically collected at the point of sale, with businesses acting as agents of the state. The collected tax is then remitted to the state on a periodic basis, often monthly or quarterly, depending on the business’s sales volume. The specific due dates and filing frequencies are outlined in the business’s registration process.

Recordkeeping and Audits

Proper recordkeeping is essential for sales tax compliance. Businesses must maintain records of all sales transactions, including the tax collected, to facilitate accurate reporting and potential audits. The Tennessee Department of Revenue conducts audits to ensure compliance, and businesses are required to cooperate and provide necessary documentation.

The Economic Impact: Sales Tax in Tennessee’s Revenue Landscape

Sales tax is a significant contributor to Tennessee’s revenue stream, providing a steady source of funds for various state and local government operations. In the fiscal year [current year], sales and use taxes accounted for [percentage]% of the state’s total revenue, a substantial portion that funds critical services such as education, healthcare, infrastructure, and public safety.

The impact of sales tax extends beyond state revenue. It also influences consumer behavior, business operations, and the overall economic climate of the state. For consumers, sales tax can impact purchasing decisions and overall spending habits. For businesses, especially those in retail and e-commerce, sales tax compliance and collection can be a complex and time-consuming process, requiring dedicated resources and attention.

A Case Study: The Impact of Sales Tax on Small Businesses

Consider the example of Main Street Books, a small independent bookstore located in downtown Nashville. With a local sales tax rate of 9.25% (state tax + local tax), the store faces the challenge of managing sales tax compliance while competing with online retailers that may not have the same tax obligations.

To stay competitive, Main Street Books has implemented a transparent pricing strategy, clearly displaying the sales tax on all items and promoting the benefits of shopping local. This strategy has not only helped the store comply with tax regulations but also fostered a sense of community and loyalty among its customers.

The Future of Sales Tax in Tennessee: Trends and Projections

Looking ahead, several trends and factors are likely to shape the future of sales tax in Tennessee. One key trend is the increasing reliance on sales tax as a revenue source, particularly with the state’s commitment to maintaining a low income tax rate. This trend is expected to continue, especially as the state seeks to fund critical services and infrastructure projects.

Additionally, the rise of e-commerce and online sales presents both challenges and opportunities for Tennessee's sales tax system. With more consumers opting for online purchases, the state will need to adapt its tax laws and enforcement strategies to ensure compliance in this evolving landscape. This may involve exploring new technologies and partnerships to enhance tax collection from online retailers.

Furthermore, the ongoing debate over state and local tax fairness is likely to influence future policy decisions. As Tennessee's sales tax system becomes more complex with varying local rates, ensuring a fair and equitable tax structure will be a key focus for policymakers and stakeholders.

How often do businesses need to remit sales tax in Tennessee?

+The frequency of sales tax remittance in Tennessee depends on the business’s sales volume. Businesses with high sales volumes (typically over $200,000 annually) are required to remit sales tax monthly. Those with lower sales volumes can remit quarterly. However, businesses can opt for monthly remittance regardless of sales volume.

Are there any special considerations for online retailers in Tennessee?

+Yes, online retailers operating in Tennessee or selling to Tennessee residents are subject to the state’s sales tax laws. This includes collecting and remitting sales tax on online sales. The state has specific guidelines and resources to assist online retailers in navigating these requirements.

What happens if a business fails to collect or remit sales tax in Tennessee?

+Failing to collect or remit sales tax in Tennessee can result in penalties and interest. The Tennessee Department of Revenue may conduct audits to ensure compliance, and businesses found in violation may face significant financial repercussions. It’s crucial for businesses to stay informed and compliant with sales tax laws to avoid such issues.