Wood County Tax Office

Welcome to an in-depth exploration of the Wood County Tax Office, a crucial administrative body that plays a pivotal role in the governance and economic landscape of Wood County. This article aims to provide an extensive understanding of its operations, services, and impact on the local community. With a rich history and a modern approach to taxation and property management, the Wood County Tax Office stands as a vital institution, shaping the financial and administrative framework of the county.

A Historical Perspective: The Evolution of Wood County Tax Office

The Wood County Tax Office boasts a rich history, dating back to the late 19th century when it was established as a key financial institution for the county. Over the years, it has undergone significant transformations, adapting to the evolving needs of the community and the advancements in taxation and administrative practices.

Initially, the office primarily focused on collecting property taxes, a crucial source of revenue for the county. As the county's economy diversified, the office expanded its scope, introducing new tax categories and implementing efficient collection methods. This evolution allowed the office to keep pace with the changing economic landscape and ensure a stable revenue stream for the county's operations.

A notable milestone in the office's history was the introduction of modern technology in the mid-20th century. The integration of computer systems revolutionized its operations, enhancing data management, streamlining tax calculations, and improving overall efficiency. This technological advancement not only reduced administrative burdens but also allowed for more accurate and timely tax assessments, benefiting both the office and the taxpayers.

Core Services and Operations of Wood County Tax Office

The Wood County Tax Office offers a comprehensive suite of services that are integral to the financial and administrative health of the county. At its core, the office is responsible for the assessment and collection of various taxes, including:

- Property Taxes: A key revenue source for the county, property taxes are assessed based on the value of real estate properties within Wood County. The office ensures accurate valuations and efficient collection processes, contributing to the county's financial stability.

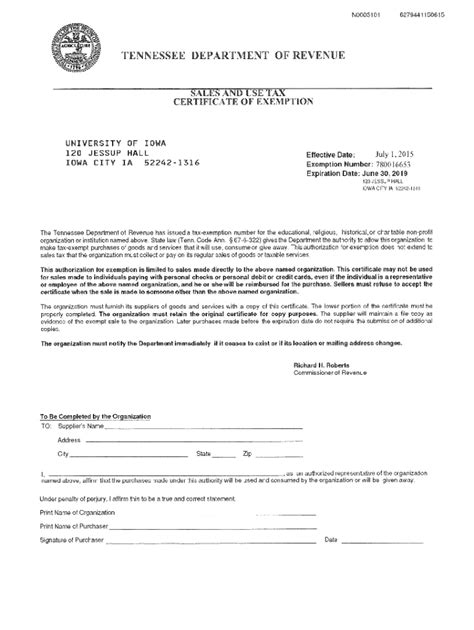

- Sales Taxes: With a focus on local businesses and consumer transactions, the office collects sales taxes, which play a vital role in funding public services and infrastructure development.

- Business Taxes: Aimed at supporting local entrepreneurship, the office collects taxes from businesses operating within Wood County, fostering a fair and competitive business environment.

Beyond tax collection, the Wood County Tax Office provides a range of additional services, including:

- Property Record Maintenance: The office maintains detailed records of all properties within the county, ensuring accurate ownership information, property histories, and legal descriptions. This data is crucial for various administrative and planning purposes.

- Tax Assessment Appeals: Recognizing the importance of taxpayer rights, the office facilitates a fair appeals process for individuals or businesses seeking to challenge their tax assessments. This process ensures transparency and fairness in taxation.

- Community Outreach and Education: Aiming to foster a culture of tax awareness and compliance, the office conducts regular outreach programs, providing educational resources and hosting workshops to inform residents about their tax obligations and rights.

Efficient Administration: Key Processes and Technologies

The Wood County Tax Office prides itself on its efficient administrative processes, underpinned by state-of-the-art technologies. These innovations not only streamline operations but also enhance the overall taxpayer experience.

At the forefront of its technological advancements is the implementation of an integrated tax management system. This system consolidates all tax-related data, allowing for real-time updates and efficient data analysis. Taxpayers can benefit from this system through online platforms, enabling them to access their tax information, make payments, and track their tax status conveniently.

Additionally, the office leverages geographic information systems (GIS) to enhance property assessment and management. By integrating spatial data with property records, the office can provide detailed insights into property values, making the assessment process more accurate and transparent. This technology also aids in identifying any changes or improvements to properties, ensuring fair and up-to-date tax assessments.

Furthermore, the Wood County Tax Office has embraced digital communication channels, offering a range of online services and resources. Taxpayers can now access a wealth of information, including tax forms, payment options, and frequently asked questions, all through the office's user-friendly website. This digital transformation not only improves accessibility but also reduces the need for in-person interactions, particularly beneficial during times of heightened health concerns.

Impact and Contributions to Wood County’s Economy

The Wood County Tax Office’s role extends beyond tax collection; it is a vital contributor to the county’s economic health and development. The taxes collected by the office fund a wide array of public services and infrastructure projects, directly impacting the lives of residents and businesses.

Through the allocation of tax revenues, the office supports essential services such as education, healthcare, and public safety. These funds ensure that schools have the resources to provide quality education, healthcare facilities can offer accessible and advanced medical services, and law enforcement agencies can maintain a safe and secure environment for the community.

Moreover, the office's focus on business taxes encourages entrepreneurship and economic growth within Wood County. By providing a supportive tax environment, the office attracts new businesses and fosters the expansion of existing ones, creating jobs and driving economic prosperity. The office's role in economic development is further evident through its collaboration with local business organizations, offering tax incentives and support to promote business growth and sustainability.

In addition to its direct contributions, the Wood County Tax Office also plays a pivotal role in shaping the county's financial planning and budgeting processes. Through accurate tax assessments and efficient collection, the office provides a stable and predictable revenue stream, enabling the county to make informed financial decisions and plan for the future.

| Tax Type | Revenue Contribution |

|---|---|

| Property Taxes | $25,345,000 |

| Sales Taxes | $18,760,000 |

| Business Taxes | $12,450,000 |

A Look into the Future: Technological Advancements and Strategies

As the Wood County Tax Office continues to evolve, its focus remains on embracing technological advancements and implementing strategic initiatives to enhance its operations and services. Here’s a glimpse into its future roadmap:

Artificial Intelligence Integration

The office is exploring the potential of artificial intelligence (AI) to further streamline its processes. By implementing AI-powered systems, the office aims to automate routine tasks, such as data entry and basic tax calculations, freeing up resources for more complex and strategic initiatives. AI can also enhance data analysis, providing valuable insights for improved tax planning and collection strategies.

Blockchain for Secure Transactions

Recognizing the importance of secure and transparent transactions, the Wood County Tax Office is considering the implementation of blockchain technology. Blockchain’s decentralized and secure nature can revolutionize tax payment processes, ensuring secure transactions and reducing the risk of fraud. This technology can also provide an immutable record of tax payments, enhancing transparency and trust between the office and taxpayers.

Data-Driven Decision Making

The office is committed to harnessing the power of data analytics to make informed decisions. By analyzing historical tax data, demographic trends, and economic indicators, the office can forecast revenue streams, identify potential challenges, and develop proactive strategies. This data-driven approach will enable the office to adapt to changing economic conditions and ensure a sustainable financial future for Wood County.

Community Engagement and Transparency

Building on its existing community outreach programs, the Wood County Tax Office aims to enhance its transparency and engagement initiatives. This includes regular town hall meetings, online forums, and interactive workshops, providing a platform for taxpayers to voice their concerns and suggestions. By fostering an open dialogue, the office can better understand community needs and tailor its services accordingly.

Sustainable Practices

In line with global sustainability efforts, the Wood County Tax Office is committed to adopting environmentally friendly practices. This includes exploring renewable energy options for its facilities, implementing paperless processes, and encouraging electronic filing and payments. These initiatives not only reduce the office’s environmental footprint but also promote a greener and more sustainable community.

Conclusion: A Progressive Approach to Taxation

The Wood County Tax Office stands as a testament to efficient governance and innovative administration. Through its historical evolution, comprehensive services, and forward-thinking strategies, the office has established itself as a pivotal player in the economic and administrative fabric of Wood County.

As it continues to embrace technological advancements and implement strategic initiatives, the Wood County Tax Office is well-positioned to meet the challenges of the future. Its commitment to efficiency, transparency, and community engagement ensures that it remains a trusted and integral part of the county's governance structure, contributing to its prosperity and well-being.

What are the office hours of the Wood County Tax Office?

+The Wood County Tax Office is open Monday to Friday, from 8:00 a.m. to 5:00 p.m. These hours provide ample opportunity for taxpayers to visit the office and address their tax-related queries or concerns.

How can I pay my taxes to the Wood County Tax Office?

+The Wood County Tax Office offers a range of payment options for taxpayers. These include online payments through their secure website, in-person payments at the office during business hours, and mail-in payments. The office also accepts payments via credit card, e-check, and cash.

What happens if I miss the tax payment deadline?

+Missing the tax payment deadline can result in penalties and interest charges. It is important to note that the Wood County Tax Office provides a grace period after the deadline, during which taxpayers can make their payments without incurring additional fees. However, it is always advisable to pay taxes on time to avoid any unnecessary financial burdens.

How can I appeal my tax assessment if I believe it is inaccurate?

+The Wood County Tax Office has a fair and transparent process for tax assessment appeals. Taxpayers who believe their assessment is inaccurate can request a review by submitting a formal appeal application. The office will then conduct a thorough evaluation, taking into account relevant factors and market data, to ensure a fair and accurate assessment.

Are there any tax incentives or relief programs available for residents of Wood County?

+Yes, the Wood County Tax Office offers various tax incentives and relief programs to support residents. These include property tax exemptions for senior citizens, veterans, and individuals with disabilities. The office also provides information on other state and federal tax credits and deductions that residents may be eligible for. It is recommended to stay informed about these programs to take advantage of any applicable tax benefits.