Ms State Sales Tax

Welcome to this comprehensive guide on understanding and navigating the complex world of sales tax in the great state of Mississippi. Sales tax is an essential aspect of doing business and is crucial for both entrepreneurs and consumers to grasp its intricacies. In this article, we will delve into the specifics of Mississippi's sales tax, exploring its rates, regulations, and unique characteristics. By the end, you'll have a thorough understanding of this critical tax and be equipped with the knowledge to navigate it successfully.

Unraveling Mississippi’s Sales Tax Structure

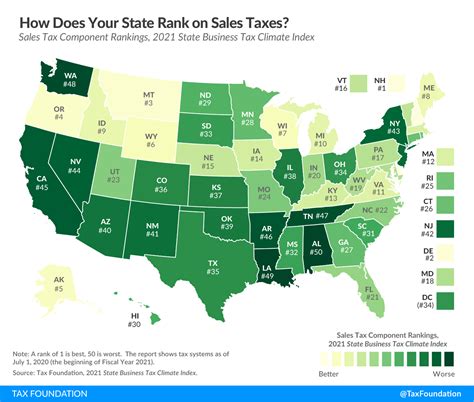

Sales tax in Mississippi is a fundamental component of the state’s revenue system, contributing significantly to its economic landscape. Understanding its structure is vital for businesses and consumers alike. Mississippi, like many other states, has a progressive sales tax system, which means the tax rate can vary based on the type of product or service being sold.

The state of Mississippi imposes a statewide sales tax rate of 7% on most goods and services. This base rate is consistent across the state, ensuring a level playing field for businesses and providing a stable revenue stream for the state government. However, it's important to note that local municipalities can levy additional sales taxes, resulting in varying total sales tax rates depending on the specific location within the state.

Local Sales Tax Variations

Mississippi’s local sales tax rates can add up to a significant portion of the overall tax burden. These rates are determined by individual counties and municipalities, and they can vary widely. For instance, in Jackson, the capital city of Mississippi, the total sales tax rate stands at 9.0%, comprising the state’s base rate and a 2% local tax. In contrast, Hattiesburg, another prominent city, has a total sales tax rate of 8%, with a 1% local tax on top of the state rate.

| City | State Rate | Local Rate | Total Rate |

|---|---|---|---|

| Jackson | 7% | 2% | 9.0% |

| Hattiesburg | 7% | 1% | 8% |

| Gulfport | 7% | 1% | 8% |

| Oxford | 7% | 1% | 8% |

| Southaven | 7% | 1% | 8% |

These variations in local sales tax rates can have a substantial impact on the prices consumers pay and the tax obligations of businesses. It's crucial for businesses operating in multiple locations to be aware of these differences and adjust their pricing and tax collection strategies accordingly.

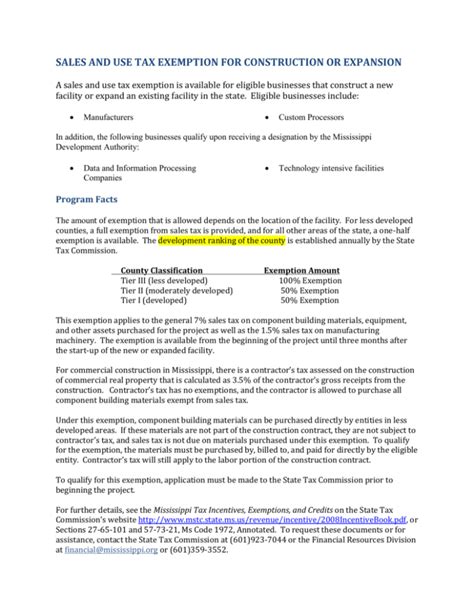

Sales Tax Exemptions and Special Cases

While Mississippi’s sales tax is relatively straightforward, there are certain exemptions and special cases that can complicate matters. Some products and services are exempt from sales tax, such as certain groceries, prescription drugs, and non-prepared foods. Additionally, non-profit organizations may be eligible for sales tax exemptions, depending on their specific activities and the nature of their transactions.

It's essential to understand these exemptions, as they can impact your tax obligations and the prices you set for your products or services. Failing to account for these exemptions could lead to overcharging customers or non-compliance with tax regulations.

Navigating Sales Tax Compliance in Mississippi

Compliance with sales tax regulations is a critical aspect of doing business in Mississippi. The state has stringent rules and guidelines to ensure proper tax collection and reporting. Here’s a closer look at some key aspects of sales tax compliance in the state.

Sales Tax Registration and Licensing

Any business selling taxable goods or services in Mississippi is required to obtain a sales tax permit from the Mississippi Department of Revenue. This permit authorizes you to collect and remit sales tax on behalf of the state. The application process typically involves providing basic business information, such as your business name, address, and taxpayer identification number.

It's crucial to obtain this permit before starting your business operations to avoid penalties and ensure compliance from the outset. The Department of Revenue provides clear guidelines and resources to facilitate the registration process, making it a straightforward task for new and established businesses alike.

Sales Tax Collection and Remittance

Once you’ve obtained your sales tax permit, the next step is to collect sales tax from your customers and remit it to the state on a regular basis. The frequency of your remittances depends on your business volume and sales tax collection. Most businesses are required to remit sales tax quarterly or monthly, but high-volume businesses may need to remit more frequently.

The process of collecting and remitting sales tax involves several key steps:

- Calculating Sales Tax: Ensure you have the correct sales tax rate for your location. This may involve factoring in both the state and local rates.

- Adding Sales Tax to Invoices: Clearly indicate the sales tax amount on your invoices or sales receipts. This ensures transparency and helps your customers understand the breakdown of their purchases.

- Recording Sales Tax: Maintain accurate records of all sales tax collected. This is crucial for compliance and can simplify the remittance process.

- Remitting Sales Tax: Follow the guidelines provided by the Mississippi Department of Revenue to remit the collected sales tax. This typically involves filling out a sales tax return and making a payment by the due date.

Staying on top of your sales tax collection and remittance responsibilities is vital to maintaining a good standing with the state and avoiding penalties.

Sales Tax Filing and Payment

Filing your sales tax returns and making timely payments is a critical aspect of sales tax compliance. The Mississippi Department of Revenue provides clear guidelines and resources to facilitate this process. Typically, you’ll need to file your sales tax returns electronically using their secure online portal.

The frequency of your filings depends on your sales tax collection volume. Most businesses file quarterly, but those with high sales volumes may need to file monthly. It's crucial to stay on top of these deadlines to avoid late fees and penalties.

When filing your sales tax returns, you'll need to provide detailed information about your sales, including the total sales tax collected and the applicable tax rates. The Department of Revenue may also require additional information, such as the types of products or services sold and any applicable exemptions.

The Future of Sales Tax in Mississippi

As the world of commerce evolves, so too do the regulations and policies surrounding sales tax. In Mississippi, the future of sales tax is poised for several significant changes and developments. Staying informed about these potential shifts is crucial for businesses and consumers alike.

Potential Rate Changes

While the current sales tax rate in Mississippi remains at 7%, there have been ongoing discussions and proposals to modify this rate. Some legislators and stakeholders advocate for a higher sales tax rate to fund specific initiatives or offset budget deficits. Conversely, others propose a reduction in the sales tax rate to stimulate economic growth and make the state more attractive to businesses and consumers.

Staying updated on these discussions and potential rate changes is vital for businesses, as it can significantly impact their pricing strategies and tax obligations. Consumers, too, should be aware of these potential changes, as they can influence the prices they pay for goods and services.

Digital Sales Tax and E-Commerce

The rise of e-commerce and digital sales has presented new challenges and opportunities for sales tax regulation. Mississippi, like many other states, is grappling with the issue of taxing digital products and services, such as software, streaming services, and online downloads. Currently, the state is exploring ways to expand its sales tax base to include these digital transactions, ensuring a fair and equitable tax system for all businesses, whether brick-and-mortar or online.

For businesses operating in the digital space, staying abreast of these developments is crucial. It can impact their business models, pricing strategies, and tax compliance obligations. Consumers, too, should be aware of these potential changes, as they may influence the prices and availability of digital products and services.

Sales Tax Simplification and Reform

Mississippi, along with many other states, recognizes the complexity and challenges of the current sales tax system. As a result, there are ongoing efforts to simplify and reform sales tax regulations. These initiatives aim to make the system more transparent, efficient, and fair for all stakeholders, including businesses, consumers, and government entities.

Potential reforms include standardizing tax rates across the state, streamlining tax collection and filing processes, and clarifying the rules around exemptions and special cases. These reforms could significantly impact the way businesses operate and interact with the sales tax system, making it more streamlined and less burdensome.

Conclusion: Embracing a Culture of Compliance

Understanding and navigating Mississippi’s sales tax system is an essential part of doing business in the state. While it can seem complex, with the right knowledge and tools, it’s entirely manageable. By staying informed about the rates, regulations, and potential future changes, you can ensure your business remains compliant and thrives in this dynamic environment.

Remember, sales tax compliance is not just a legal obligation; it's also a responsibility to your customers, your business, and the state of Mississippi. By embracing a culture of compliance, you contribute to the state's economic growth and ensure a fair and transparent marketplace for all.

How often do I need to file sales tax returns in Mississippi?

+The frequency of your sales tax filings depends on your sales volume. Most businesses file quarterly, but those with high sales volumes may need to file monthly. It’s best to consult with the Mississippi Department of Revenue to determine your specific filing requirements.

Are there any online resources to help me calculate and manage sales tax in Mississippi?

+Yes, the Mississippi Department of Revenue provides an online sales tax calculator and other useful tools to help businesses manage their sales tax obligations. You can find these resources on their official website.

What happens if I don’t collect or remit sales tax correctly in Mississippi?

+Failing to collect or remit sales tax correctly can result in penalties and interest charges from the Mississippi Department of Revenue. In severe cases, it could lead to legal action. It’s crucial to stay compliant to avoid these consequences.

Are there any sales tax holidays in Mississippi?

+Yes, Mississippi occasionally offers sales tax holidays for specific products, such as school supplies or energy-efficient appliances. These holidays provide a temporary sales tax exemption for eligible items. Stay updated with the Department of Revenue for details on these events.