Connecticut Tax Calculator

Welcome to the comprehensive guide to the Connecticut Tax Calculator, a powerful tool designed to simplify the process of understanding and calculating taxes in the state of Connecticut. As a resident or business owner in Connecticut, it's essential to have a clear grasp of the state's tax system and its implications. This article aims to provide an in-depth analysis, offering insights, examples, and practical guidance to help you navigate the world of Connecticut taxes effectively.

Unraveling the Connecticut Tax Landscape

Connecticut, known for its vibrant economy and diverse industries, has a tax system that reflects its commitment to fiscal responsibility and community development. Understanding this system is crucial for individuals and businesses alike, as it impacts financial planning, budgeting, and overall economic growth.

State Income Tax: A Key Component

One of the primary taxes in Connecticut is the state income tax, which varies based on an individual’s or business’s income level and filing status. The state’s progressive tax structure means that higher incomes are taxed at a higher rate, promoting fairness and supporting essential public services.

For instance, consider a hypothetical scenario where an individual, let’s call them Jane, resides in Connecticut and earns an annual income of 75,000. Using the Connecticut Tax Calculator, we can estimate her state income tax liability. Based on the state's tax brackets, Jane's income falls within the 5.5% tax rate category, resulting in an estimated tax of approximately 4,125 for the year. This calculation takes into account various deductions and credits, ensuring an accurate representation of her tax obligation.

| Income Bracket | Tax Rate |

|---|---|

| $0 - $10,000 | 3.07% |

| $10,001 - $50,000 | 4.00% |

| $50,001 - $100,000 | 5.00% |

| $100,001 - $200,000 | 5.50% |

| Over $200,000 | 6.99% |

The table above showcases the progressive nature of Connecticut's income tax system, where higher incomes face a higher tax rate. This structure aims to ensure that those with greater financial means contribute proportionally more to the state's revenue.

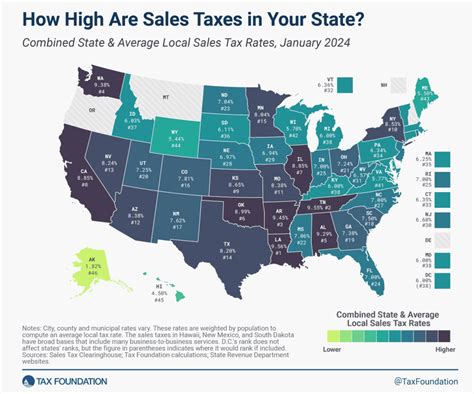

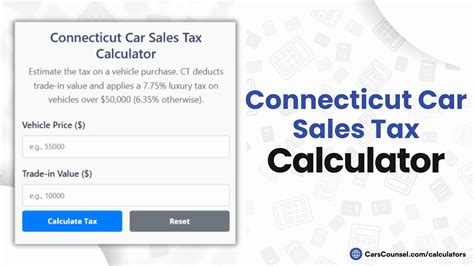

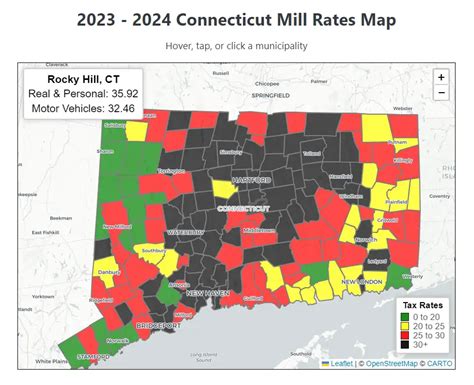

Sales and Use Tax: Impact on Consumers

Connecticut also imposes a sales and use tax on retail sales and certain services. This tax is collected by retailers and remitted to the state, with the primary purpose of generating revenue for essential public services and infrastructure projects.

Imagine you’re planning a major home renovation project in Connecticut. The materials and services required, such as lumber, plumbing supplies, and contractor fees, are subject to the state’s sales tax. By utilizing the Connecticut Tax Calculator, you can estimate the total tax liability for your project. For instance, if the total cost of materials and services is 20,000, the sales tax component would amount to approximately 1,300, assuming a standard sales tax rate of 6.35% in Connecticut.

The Connecticut Tax Calculator: Your Financial Ally

The Connecticut Tax Calculator is an invaluable resource for residents and businesses alike, offering a user-friendly interface to estimate tax liabilities accurately. Whether you’re an individual filing your annual tax return or a business owner managing tax obligations, this calculator provides essential insights and simplifies the tax calculation process.

Key Features and Benefits

- Income Tax Estimation: The calculator takes into account your income, deductions, and tax credits to provide an accurate estimate of your state income tax liability.

- Sales Tax Calculator: Calculate the sales tax on various purchases, helping you budget effectively and understand the impact of sales tax on your expenses.

- Real-Time Updates: Stay informed about the latest tax rates and regulations with the calculator’s real-time data updates, ensuring you have the most current information.

- Customizable Scenarios: Input different income levels, deductions, or purchase amounts to explore various tax scenarios and make informed financial decisions.

A Practical Example: Business Tax Planning

Let’s consider a small business owner, David, who operates a thriving e-commerce platform in Connecticut. David’s business has grown significantly, and he’s planning for the upcoming fiscal year. By using the Connecticut Tax Calculator, he can estimate his business’s tax liability accurately. David’s business income is projected to be 500,000 for the year, with various deductions and expenses. The calculator helps him determine that his business will owe approximately 22,500 in state income tax, allowing him to allocate his finances strategically and plan for future growth.

Navigating Tax Complexity: Expert Insights

While the Connecticut Tax Calculator simplifies tax calculations, it’s important to note that tax laws can be complex. Consulting with tax professionals or utilizing reliable resources can provide further guidance and ensure compliance.

Understanding Tax Credits and Deductions

Connecticut offers various tax credits and deductions that can significantly impact your tax liability. These incentives are designed to support specific industries, promote economic growth, and provide relief to individuals and businesses.

For example, the state offers a Research and Development Tax Credit to encourage innovation. If your business qualifies for this credit, you can reduce your tax liability, potentially resulting in substantial savings. The Connecticut Tax Calculator can help you estimate the impact of such credits on your overall tax position.

Tax Planning Strategies

Effective tax planning is essential for both individuals and businesses. By strategically managing your finances and understanding tax regulations, you can optimize your tax position and potentially reduce your tax burden.

Consider the following strategies:

- Maximize Deductions: Explore all eligible deductions, such as business expenses, charitable contributions, and personal deductions, to minimize your taxable income.

- Utilize Tax-Advantaged Accounts: Take advantage of retirement accounts like 401(k)s or IRAs to reduce your taxable income and plan for your financial future.

- Review Tax Laws Regularly: Stay informed about changes in tax laws and regulations. This ensures you’re aware of any new incentives or requirements that may impact your tax obligations.

Conclusion: Empowering Connecticut’s Taxpayers

The Connecticut Tax Calculator serves as a powerful tool, empowering individuals and businesses to navigate the state’s tax landscape with confidence. By understanding the tax system and utilizing resources like this calculator, taxpayers can make informed decisions, optimize their financial strategies, and contribute to the state’s economic growth.

As you embark on your tax planning journey, remember that knowledge is power. Stay informed, seek professional advice when needed, and leverage tools like the Connecticut Tax Calculator to ensure a smooth and successful tax experience.

How often are the tax rates updated in the Connecticut Tax Calculator?

+The tax rates in the calculator are updated annually to reflect any changes made by the state. These updates ensure that the calculator provides accurate and up-to-date tax estimates.

Can the Connecticut Tax Calculator handle complex tax scenarios, such as multiple income streams or business structures?

+Yes, the calculator is designed to accommodate a wide range of tax scenarios. It can handle multiple income sources, business structures, and various deductions, making it versatile for both individuals and businesses.

Are there any limitations to the Connecticut Tax Calculator’s accuracy?

+While the calculator provides accurate estimates, it’s important to note that it’s a tool for estimation. For precise tax calculations and compliance, it’s recommended to consult with tax professionals or official tax authorities.