How Do I Amend State Taxes

Understanding the process of amending state taxes is crucial for individuals and businesses alike, especially when there are errors or changes to be made in your tax returns. This guide will walk you through the steps to amend state taxes, providing you with the necessary information to ensure compliance and accuracy.

The Importance of Amending State Taxes

Filing an amended tax return is essential to correct any mistakes, such as missing income sources, incorrect deductions, or errors in filing status. It's also necessary when there are changes in your personal or business circumstances that impact your tax liability. By amending your state taxes, you can avoid penalties, interest charges, and potential legal issues.

Amending taxes allows you to reconcile your financial records and ensure that you are in compliance with state tax laws. It is a responsible step that demonstrates your commitment to accurate reporting and transparency with the tax authorities.

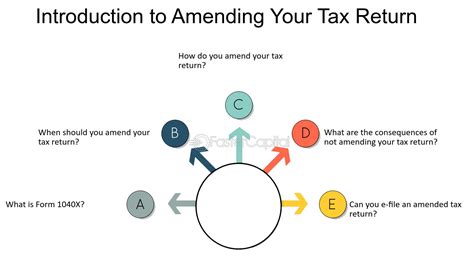

Step-by-Step Guide to Amending State Taxes

Here is a comprehensive guide to help you through the process of amending your state taxes:

Step 1: Identify the Errors or Changes

The first step is to carefully review your original tax return and identify the errors or changes that need to be addressed. Common reasons for amending state taxes include:

- Missed income sources (e.g., self-employment income, rental income)

- Incorrect deductions (e.g., overestimated charitable contributions)

- Changes in filing status (e.g., marriage, divorce)

- Unreported income or deductions

- Errors in tax credits or exemptions

Make a detailed list of all the errors and changes, ensuring you have all the necessary documentation to support your amendments.

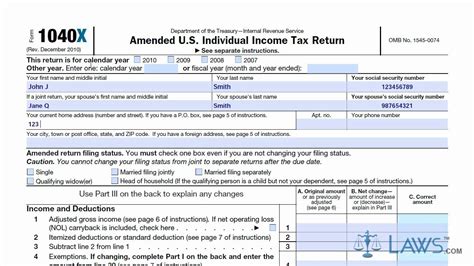

Step 2: Obtain the Correct Forms

Each state has its own set of tax forms and instructions for amending returns. Visit the official website of your state's tax agency to access the correct forms. Look for forms specifically designed for amending tax returns, such as the Form 1040X for federal amendments.

Ensure you download the most recent version of the forms and carefully read the instructions to understand the requirements and any specific guidelines for your state.

Step 3: Complete the Forms Accurately

When completing the amendment forms, pay close attention to the instructions and ensure you provide accurate and complete information. Here are some key points to consider:

- Clearly indicate the tax year you are amending.

- Calculate the adjustments to your income, deductions, credits, or exemptions.

- Attach any supporting documents, such as W-2 forms, 1099s, or receipts.

- Provide a detailed explanation of the changes made in the "Explanation of Changes" section.

- Double-check your calculations and ensure all fields are filled out correctly.

Step 4: Submit the Amendment

Once you have completed the forms and gathered all the necessary documentation, it's time to submit your amended tax return. Follow the instructions provided by your state's tax agency for submitting the forms.

Some states allow electronic filing of amended returns, while others require you to mail the physical forms. Ensure you meet the deadlines and follow any specific guidelines for submission.

Step 5: Await the Processing and Response

After submitting your amended return, you will need to wait for the state tax agency to process your request. The processing time can vary depending on the state and the complexity of your amendments.

Keep a record of your submission and any correspondence with the tax agency. You may receive a notice or letter from the state tax authority confirming the receipt of your amended return and providing further instructions or updates.

Step 6: Make Any Required Payments or Refunds

Based on your amendments, you may owe additional taxes or be eligible for a refund. Follow the instructions provided by the state tax agency to make any necessary payments or claim your refund.

If you owe additional taxes, consider setting aside funds to cover this liability. On the other hand, if you are due a refund, the state tax agency will provide information on how and when you can expect to receive it.

Common Questions and Scenarios

Can I Amend My State Taxes Online?

Online amendment options vary by state. Some states offer electronic filing for amended returns, while others require traditional paper filing. Check the official website of your state’s tax agency to determine the available methods.

What Happens if I Don’t Amend My State Taxes?

Failing to amend your state taxes when errors or changes are identified can lead to significant consequences. You may be subject to penalties, interest charges, and potential audits. Additionally, you risk underreporting your income or overstating deductions, which can result in legal issues and financial repercussions.

How Long Do I Have to Amend My State Taxes?

The statute of limitations for amending state taxes varies by state. Generally, you have a certain period, such as three to five years, to file an amended return. It’s essential to review the specific regulations and deadlines for your state to ensure you meet the requirements.

Can I Amend My State Taxes After an Audit?

Yes, you can amend your state taxes even after an audit. If you discover additional errors or changes during or after an audit, it’s important to file an amended return to correct them. This demonstrates your commitment to accuracy and can help resolve any outstanding issues with the tax authorities.

Conclusion

Amending state taxes is a crucial process that ensures compliance, accuracy, and transparency with the tax authorities. By following the steps outlined in this guide and staying informed about your state’s specific requirements, you can effectively navigate the amendment process and address any errors or changes in your tax returns.

Remember, accurate tax reporting is essential for maintaining a positive relationship with the state tax agency and avoiding potential legal and financial complications.

What happens if I make a mistake on my amended return?

+If you realize you made a mistake on your amended return, you can file another amended return to correct it. It’s important to carefully review your calculations and supporting documentation to minimize the chances of errors.

Can I amend my state taxes if I’ve already received a refund or paid the full amount due?

+Yes, you can amend your state taxes regardless of whether you received a refund or paid the full amount due. Amending is necessary to correct any errors or changes in your tax situation, even if you’ve already received a refund or settled your tax liability.

Are there any penalties for amending my state taxes late?

+Yes, there may be penalties for amending your state taxes late. States may impose late filing penalties and interest charges on the amount owed. It’s crucial to review the specific regulations and deadlines for your state to avoid these penalties.