Hidalgo County Property Taxes

Welcome to an in-depth exploration of property taxes in Hidalgo County, a region nestled in the heart of Texas. Property taxes are a vital aspect of any community's financial landscape, impacting both residents and businesses alike. In this comprehensive guide, we'll delve into the intricacies of Hidalgo County's property tax system, shedding light on its workings, implications, and potential strategies for optimization.

Understanding Hidalgo County’s Property Tax Landscape

Hidalgo County, with its vibrant communities and diverse real estate market, presents a unique set of considerations when it comes to property taxes. The county’s tax system, much like elsewhere in Texas, is a complex interplay of various taxing entities, each with its own role and responsibilities. Understanding this landscape is key to navigating the process effectively.

Hidalgo County is home to a diverse range of properties, from sprawling ranches to bustling commercial hubs. The tax assessment process takes into account a multitude of factors, including property type, location, improvements, and market trends. This ensures that each property is valued fairly and contributes proportionally to the county's revenue stream.

The Role of Taxing Authorities

In Hidalgo County, property taxes are levied by several entities, each serving a distinct purpose. These include the county government itself, independent school districts, municipal governments, and special districts dedicated to specific services like water or fire protection. Each entity has its own tax rate, which is determined through a careful balance of budgetary needs and the desire to keep taxes manageable for residents.

For instance, the Hidalgo County government might prioritize funding for infrastructure projects, while an independent school district may focus on educational initiatives. These diverse needs result in a layered tax structure, where each entity's rate is combined to form the overall tax rate for a property.

| Taxing Entity | Tax Rate (per $100 valuation) |

|---|---|

| Hidalgo County | $0.4570 |

| McAllen Independent School District | $1.3900 |

| City of McAllen | $0.4295 |

| South Texas Water Authority | $0.0600 |

| Total Effective Tax Rate | $2.3365 |

As shown above, the total effective tax rate for a property in McAllen, one of Hidalgo County's largest cities, would be the sum of these individual rates. This rate can vary significantly depending on the location and the specific taxing entities present.

Assessment and Appraisal

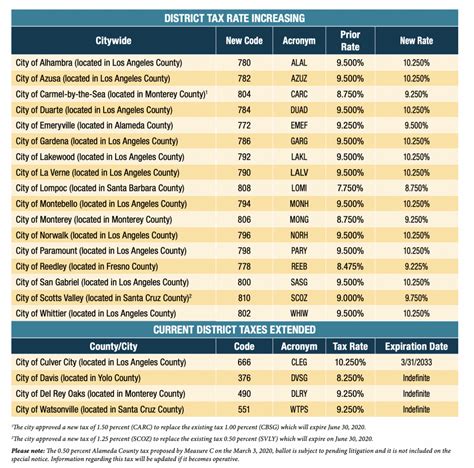

The process of determining a property’s taxable value is handled by the Hidalgo County Appraisal District (HCAD). HCAD employs certified appraisers who assess properties annually, taking into account recent sales, construction costs, and other market factors. This ensures that property values remain up-to-date and reflect the current real estate climate.

Homeowners have the right to appeal their property's assessed value if they believe it to be inaccurate. The protest process, managed by the Hidalgo County Appraisal Review Board (ARB), provides an opportunity for taxpayers to present evidence and argue for a lower valuation. This ensures a level of transparency and fairness in the system.

Strategies for Managing Property Taxes

Navigating the Hidalgo County property tax system can be complex, but there are strategies that homeowners and businesses can employ to optimize their tax obligations. Here are some key considerations:

Timely Payment and Discounts

Hidalgo County offers a discount for early payment of property taxes. Homeowners who pay their taxes in full by a certain deadline, typically in October, can receive a discount of 3.5%. This incentive encourages timely payment and can lead to significant savings over time.

Additionally, the county provides a variety of payment options, including online payment portals, which offer convenience and the ability to track payments. Understanding these deadlines and taking advantage of discounts can be a simple yet effective strategy for managing property taxes.

Homestead Exemptions

Hidalgo County, much like other Texas counties, offers a range of homestead exemptions. These exemptions reduce the taxable value of a property, providing savings to homeowners. The most common exemption is the General Homestead Exemption, which reduces the taxable value of a primary residence by $25,000.

There are also exemptions for senior citizens, disabled individuals, and veterans. These exemptions can provide significant relief to eligible homeowners, making property ownership more affordable. It's important for homeowners to understand the eligibility criteria and apply for these exemptions to take advantage of the savings they offer.

Property Tax Loans

For those who struggle to pay their property taxes in a single installment, property tax loans can be a viable option. These loans allow homeowners to spread the payment of their taxes over a longer period, often with more manageable monthly payments. While interest is charged on these loans, they can provide a solution for those facing financial hardship.

It's important to research reputable lenders and understand the terms and conditions of such loans. While they can provide short-term relief, they should be used judiciously to avoid accumulating unnecessary debt.

Stay Informed and Engage

Property taxes are a significant aspect of community funding, and as such, they are often a topic of public discussion and debate. Staying informed about tax rate proposals, budget plans, and community initiatives can empower residents to engage in the process. This could involve attending public meetings, voicing opinions, and understanding the budgetary needs of the county and its various entities.

Engaging with local government and expressing concerns or support for tax-related matters can influence policy decisions and ensure that tax rates are set fairly and responsibly.

Future Outlook and Considerations

As Hidalgo County continues to grow and evolve, its property tax landscape will undoubtedly be shaped by various factors. The county’s commitment to infrastructure development, education, and community services will continue to influence tax rates and budgetary decisions.

Additionally, the dynamic real estate market in Hidalgo County, influenced by factors such as population growth, economic trends, and development initiatives, will play a pivotal role in property valuations and tax revenues. Staying attuned to these market forces can help residents and businesses make informed decisions regarding their properties and tax obligations.

Conclusion

Hidalgo County’s property tax system, while complex, is a crucial component of the community’s financial health. By understanding the roles of various taxing entities, staying informed about assessment processes, and employing strategic tax management techniques, homeowners and businesses can navigate this landscape effectively. As the county continues to thrive, a proactive approach to property taxes will ensure a vibrant and sustainable future for all.

How often are property taxes assessed in Hidalgo County?

+Property taxes in Hidalgo County are assessed annually. The Hidalgo County Appraisal District conducts appraisals each year, taking into account various factors to determine a property’s taxable value.

Can I appeal my property’s assessed value?

+Yes, homeowners have the right to protest their property’s assessed value if they believe it is inaccurate. The protest process is managed by the Hidalgo County Appraisal Review Board (ARB), where taxpayers can present evidence and arguments for a lower valuation.

What are the deadlines for paying property taxes in Hidalgo County?

+The deadlines for paying property taxes vary slightly depending on the taxing entity. However, generally, the deadline for receiving a 3.5% discount for early payment is in October. After this deadline, taxes can be paid without the discount, but penalties may apply if not paid by a certain date.

Are there any homestead exemptions available in Hidalgo County?

+Yes, Hidalgo County offers several homestead exemptions. The most common is the General Homestead Exemption, which reduces the taxable value of a primary residence by $25,000. There are also exemptions for senior citizens, disabled individuals, and veterans.