Property Tax Payment

Welcome to this comprehensive guide on the intricate process of property tax payment, a crucial aspect of homeownership and one that often sparks a range of questions and concerns among homeowners. From understanding the underlying principles to navigating the payment process, this article aims to provide you with an in-depth understanding of this essential financial obligation.

Understanding Property Tax

Property tax, a cornerstone of local government revenue, is an annual levy on the value of a property, whether it’s a residential home, commercial building, or land. It is a critical component of the financial landscape, providing funds for essential public services like education, infrastructure development, and emergency services.

The concept of property tax is rooted in the principle of taxation based on the value of property ownership. This value is typically assessed by local government authorities, taking into account factors such as the property's location, size, and market value. The assessed value is then multiplied by a tax rate, determined by the local government, to calculate the annual property tax liability.

Factors Influencing Property Tax

Several key factors influence the amount of property tax an individual or entity is required to pay. These include:

- Property Value: The higher the assessed value of the property, the higher the property tax.

- Location: Property taxes can vary significantly based on the municipality or county in which the property is located.

- Tax Rate: Determined by local authorities, this rate can fluctuate based on the needs and financial obligations of the local government.

- Property Type: Different types of properties, such as residential, commercial, or industrial, may have varying tax rates.

- Improvements and Renovations: Adding significant improvements to a property can increase its assessed value and, consequently, the property tax.

The Property Tax Payment Process

Navigating the property tax payment process is an essential skill for any homeowner. This section will guide you through each step, ensuring you understand your obligations and rights as a property owner.

Step 1: Property Tax Assessment

The first step in the property tax payment process is the assessment of your property’s value. This assessment is typically conducted by a professional assessor employed by the local government. The assessor will consider various factors, including:

- The property's physical characteristics, such as size, number of rooms, and any unique features.

- The property's location and the surrounding area's amenities and infrastructure.

- Recent sales of similar properties in the area (also known as "comparable sales").

- The property's condition and any recent improvements or renovations.

Once the assessment is complete, you will receive a property tax assessment notice, which details the assessed value of your property and the corresponding tax rate. This notice serves as the basis for calculating your property tax liability.

Step 2: Calculating Property Tax

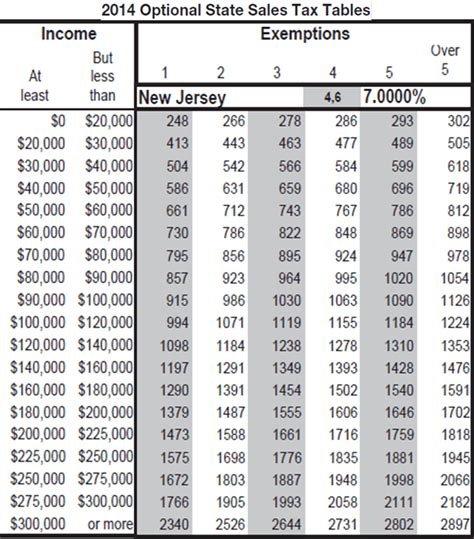

With the assessed value and tax rate determined, the next step is to calculate your property tax liability. This calculation is straightforward: Property Value x Tax Rate = Property Tax. For example, if your property is assessed at 500,000 and the tax rate is 2%, your property tax liability would be 10,000.

However, it's important to note that some jurisdictions may apply additional taxes or exemptions, which can impact the final amount. These could include:

- Homestead exemptions, which provide a tax reduction for primary residences.

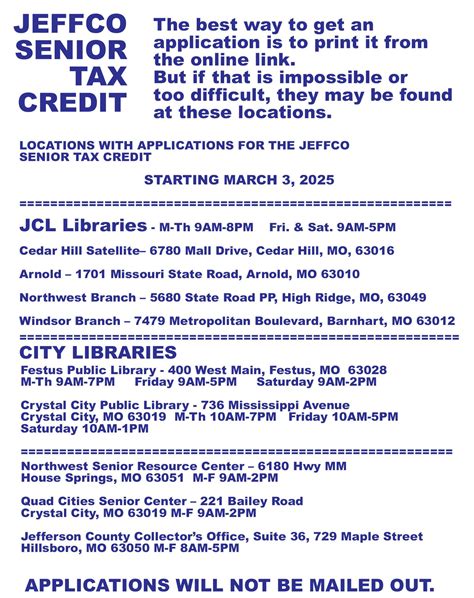

- Senior citizen or veteran discounts, offering reduced tax rates for eligible individuals.

- Special assessments for specific improvements or services, such as road maintenance or stormwater management.

Step 3: Payment Options and Due Dates

Once you understand your property tax liability, it’s time to consider your payment options and due dates. Most jurisdictions offer a variety of payment methods, including:

- Online Payments: A convenient and secure method, often with the option to set up automatic payments.

- Mail-in Payments: You can mail a check or money order to the designated tax office.

- In-Person Payments: Visit the local tax office or a designated payment center to make your payment.

- Electronic Funds Transfer (EFT): Set up an automatic transfer from your bank account to the tax office's account.

Due dates for property tax payments vary widely across jurisdictions. Some areas may have a single annual due date, while others may have multiple installments throughout the year. It's crucial to understand your specific due dates to avoid late fees and penalties.

Step 4: Receipts and Documentation

After making your property tax payment, ensure you receive a receipt or confirmation of payment. This documentation serves as proof of payment and can be crucial if any disputes or issues arise in the future. Keep these records safely, either in a physical file or digitally, for easy reference.

| Jurisdiction | Property Tax Rate | Average Annual Property Tax |

|---|---|---|

| New York City | 1.45% | $5,500 |

| Los Angeles County | 1.04% | $7,000 |

| Chicago | 1.86% | $4,200 |

| Houston | 2.16% | $3,800 |

| Phoenix | 1.13% | $2,600 |

Note: The above table provides a glimpse into the property tax landscape in various US cities. It's important to remember that these rates and averages can vary significantly based on location and property value.

Strategies for Managing Property Tax Payments

While property tax is a necessary expense, there are strategies you can employ to manage these payments effectively and potentially reduce your liability.

Appealing Your Property Assessment

If you believe your property’s assessed value is inaccurate, you have the right to appeal. This process typically involves providing evidence that the assessed value is too high, such as recent sales of similar properties in the area. It’s important to note that an appeal may result in a lower assessment, but it could also lead to a higher assessment if the evidence supports it.

Utilizing Tax Exemptions and Deductions

Many jurisdictions offer tax exemptions or deductions that can reduce your property tax liability. These may include homestead exemptions, senior citizen or veteran discounts, or deductions for energy-efficient improvements. Researching and understanding these options can help you take advantage of any available benefits.

Exploring Alternative Payment Plans

If you’re facing financial challenges, some jurisdictions offer alternative payment plans or payment deferral options. These plans may allow you to spread your property tax payments over a longer period, reducing the financial burden in any given month. However, it’s important to note that these plans often come with additional fees or interest.

Budgeting and Planning

Effective financial planning is key to managing property tax payments. By incorporating your annual property tax liability into your budget, you can ensure you have the necessary funds set aside. Consider setting up a dedicated savings account for property taxes to make payments more manageable.

The Impact of Property Tax on Homeownership

Property tax is an essential component of the homeownership experience, impacting not only your financial obligations but also the broader housing market and community development.

Property Tax and Home Values

Property tax is directly linked to the value of your home. As your home’s value increases, so does your property tax liability. This can be a double-edged sword: while a higher property value can be beneficial when selling your home, it also results in increased property taxes. Understanding this relationship is crucial for long-term financial planning.

Community Development and Services

Property taxes are a primary source of funding for local government services and community development projects. These funds contribute to the maintenance and improvement of schools, roads, parks, and other public amenities. By paying your property taxes, you’re not only fulfilling a financial obligation but also investing in the growth and well-being of your community.

Property Tax and Homeownership Affordability

For many individuals, property tax can be a significant expense, impacting the overall affordability of homeownership. It’s essential to consider property taxes when evaluating the cost of owning a home. While property taxes are a necessary expense, strategies such as those outlined above can help make homeownership more accessible and manageable.

The Future of Property Tax

As society and the housing market evolve, so too does the landscape of property tax. Here are some insights into the potential future of property tax and its impact on homeowners.

Technological Innovations

The integration of technology into the property tax process is already underway. Online platforms and apps are making it easier for homeowners to access assessment information, calculate taxes, and make payments. Additionally, advancements in data analytics and artificial intelligence could lead to more accurate and efficient assessment processes.

Policy Changes and Reforms

Property tax policies are often subject to political and economic influences. As such, changes in government or economic conditions can lead to reforms in the property tax system. These reforms could include adjustments to tax rates, the introduction of new exemptions or deductions, or changes in assessment methods.

The Impact of Economic Trends

Economic trends, such as inflation or shifts in the housing market, can significantly impact property tax. During periods of high inflation, for example, property values may increase rapidly, leading to higher property taxes. Conversely, a downturn in the housing market could result in lower property values and, consequently, reduced property taxes.

Community Engagement and Advocacy

Homeowners have a powerful voice in shaping the future of property tax. By staying informed and engaged with local government processes, homeowners can advocate for fair and equitable property tax policies. This engagement can lead to reforms that benefit homeowners and the community as a whole.

FAQ

What happens if I don’t pay my property taxes on time?

+

Late payment of property taxes can result in penalties, interest charges, and, in extreme cases, the loss of your property through a tax sale or foreclosure. It’s crucial to stay informed about your payment due dates and make timely payments to avoid these consequences.

Can I deduct my property taxes from my federal income tax return?

+

In many cases, yes. Property taxes are often deductible on federal income tax returns, providing a potential tax benefit to homeowners. However, the deductibility of property taxes can be subject to certain limitations and restrictions, so it’s important to consult with a tax professional for specific guidance.

How often do property tax assessments occur, and can I challenge them?

+

The frequency of property tax assessments can vary by jurisdiction. Some areas conduct assessments annually, while others may do so every few years. If you believe your property’s assessed value is incorrect, you have the right to appeal. The process typically involves providing evidence to support your claim and may require the assistance of a professional appraiser.

Are there any programs to assist low-income homeowners with property tax payments?

+

Yes, many jurisdictions offer programs to help low-income homeowners manage their property tax obligations. These programs may provide deferred payment options, tax exemptions, or even grants to assist with property tax payments. It’s worth researching and inquiring about these programs to see if you qualify.

Can I negotiate my property tax rate with the local government?

+

In general, property tax rates are set by local government bodies and are not negotiable on an individual basis. However, if you believe there has been an error in the calculation of your tax rate or if you have specific circumstances that could impact your tax liability, you may be able to appeal or request a review. It’s important to consult with local authorities or a tax professional for guidance on this process.