Illinois State Tax Return

The Illinois State Tax Return is an essential aspect of financial management for residents and businesses operating within the state. With a comprehensive understanding of the state's tax system, individuals and entities can navigate the process effectively and ensure compliance with the law. This article aims to provide an in-depth analysis of the Illinois State Tax Return, offering practical insights and guidance to help taxpayers efficiently complete their returns and maximize their tax benefits.

Understanding the Illinois State Tax System

Illinois, like many other states, imposes taxes on its residents and businesses to generate revenue for various public services and infrastructure development. The state’s tax system is intricate, comprising various tax types and rates that cater to different income levels, industries, and situations. This section aims to provide a comprehensive overview of the Illinois state tax landscape, shedding light on its structure, rates, and applicable regulations.

Tax Types and Rates

Illinois employs a progressive tax system for individual income tax, meaning that higher incomes are taxed at higher rates. As of the latest tax year, the state’s income tax rates range from 4.95% to 4.99% depending on income brackets. These rates are subject to change annually, so it’s essential to refer to the Illinois Department of Revenue’s official website for the most current information.

Apart from income tax, Illinois also imposes other taxes, including:

- Sales and Use Tax: A tax applied to the sale of tangible goods and certain services. The state’s base sales tax rate is 6.25%, but local municipalities may add their own taxes, resulting in varying total sales tax rates across the state.

- Property Tax: Levied on real estate properties, with rates varying by county and municipality. The average effective property tax rate in Illinois is 2.24%, one of the highest in the nation.

- Corporate Income Tax: Corporations operating in Illinois are subject to a 7% corporate income tax rate.

- Estate and Inheritance Tax: Estates valued over a certain threshold are subject to estate tax, while beneficiaries of estates may be subject to inheritance tax. These rates and thresholds are subject to change and should be verified with the Illinois Department of Revenue.

Taxable Entities and Exemptions

Understanding who is considered a taxable entity and what entities or transactions may be exempt from taxation is crucial. In Illinois, taxable entities include individuals, corporations, partnerships, limited liability companies (LLCs), trusts, and estates. However, certain entities, such as religious organizations, charitable institutions, and some educational facilities, may be exempt from specific taxes.

Additionally, some transactions and activities are exempt from sales tax. For instance, purchases made for resale, certain agricultural products, and select medical devices are typically exempt from sales tax. It’s important for taxpayers to review the official guidelines provided by the Illinois Department of Revenue to ensure compliance with these exemptions.

Tax Filing Deadlines and Extensions

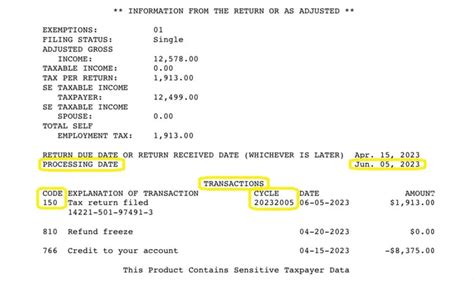

Illinois, like most states, has specific deadlines for filing tax returns. For individual income tax returns, the typical deadline is April 15th of each year. However, this deadline may be extended under certain circumstances. Taxpayers who anticipate not being able to file their returns by the deadline can request an extension by submitting Form IL-505. It’s important to note that while an extension provides more time to file the return, it does not extend the deadline for paying any taxes owed.

For businesses and corporations, the filing deadlines may vary depending on the type of entity and the tax being filed. For instance, the deadline for corporate income tax returns is typically March 15th for S corporations and April 15th for C corporations. It’s crucial for businesses to stay informed about their specific filing deadlines to avoid penalties and interest charges.

Preparing for Your Illinois State Tax Return

Preparing for your Illinois State Tax Return involves gathering the necessary documentation, understanding the applicable tax laws, and employing efficient strategies to ensure an accurate and timely submission. This section will guide you through the essential steps to navigate the process successfully.

Gathering Required Documentation

To prepare your Illinois State Tax Return, you’ll need a variety of documents to ensure an accurate filing. Here’s a comprehensive list of what you may need:

- W-2 Forms: If you’re an employee, you’ll receive a W-2 form from each of your employers. This form details your wages, salaries, and other compensation, as well as the taxes withheld from your pay.

- 1099 Forms: If you received any income from non-employment sources, such as freelance work, investments, or rental properties, you’ll receive 1099 forms detailing these earnings. Examples include 1099-MISC for miscellaneous income, 1099-INT for interest income, and 1099-DIV for dividend income.

- Social Security Statements: These statements, available from the Social Security Administration, provide details about your earnings history, estimated benefits, and other important information relevant to your tax return.

- Records of Deductions and Credits: Gather documentation for any deductions or credits you may be eligible for. This can include records of charitable contributions, medical expenses, education costs, and more.

- Proof of Residency: If you’re a new resident to Illinois or have recently moved within the state, you may need to provide proof of residency to establish your tax liability.

- Previous Year’s Tax Returns: Having your previous year’s tax returns can be helpful for reference and to ensure consistency in your filings.

Understanding Tax Laws and Regulations

Illinois has a complex tax system with various laws and regulations that impact how you file your taxes. Understanding these rules is crucial to ensure compliance and maximize your tax benefits. Here are some key considerations:

- Income Tax Laws: Illinois has a progressive income tax system, meaning tax rates increase as your income rises. It’s important to understand which tax bracket you fall into and how this impacts your overall tax liability.

- Sales and Use Tax Regulations: Illinois imposes a sales tax on most goods and some services. However, certain items, such as groceries and prescription drugs, are exempt. Understanding these exemptions and the applicable tax rates is essential for accurate reporting.

- Property Tax Rules: Illinois’s property tax system is complex, with rates varying by county and municipality. It’s important to understand your local property tax rate and how it’s calculated to ensure you’re not overpaying.

- Corporate Tax Laws: Corporations operating in Illinois are subject to a corporate income tax rate of 7%. Understanding the rules and regulations surrounding corporate tax, including deductions and credits, is essential for businesses to minimize their tax liability.

- Estate and Inheritance Tax Laws: Illinois has estate and inheritance tax laws that can impact the transfer of wealth. Understanding these laws, including thresholds and applicable rates, is crucial for estate planning and ensuring compliance.

Strategies for Maximizing Tax Benefits

Maximizing your tax benefits involves careful planning and understanding of the various deductions, credits, and exemptions available to you. Here are some strategies to consider:

- Itemized Deductions: If your deductible expenses, such as medical costs, charitable donations, and state and local taxes, exceed the standard deduction, it may be beneficial to itemize your deductions. This can lower your taxable income and potentially reduce your tax liability.

- Education Credits and Deductions: Illinois offers various tax credits and deductions for education expenses, including the Illinois Education Expense Credit and the Illinois Tuition and Fee Deduction. These can significantly reduce your tax burden, especially if you or your dependents are pursuing higher education.

- Retirement Savings: Contributions to certain retirement plans, such as IRAs and 401(k)s, can be tax-deductible. Maximizing your retirement savings not only helps secure your future but also provides immediate tax benefits by reducing your taxable income.

- Energy-Efficient Home Improvements: Illinois offers tax credits for making energy-efficient upgrades to your home, such as installing solar panels or energy-efficient windows. These improvements not only reduce your carbon footprint but also provide tax benefits, making them a win-win for both the environment and your wallet.

- Small Business Incentives: Illinois provides various tax incentives for small businesses, including tax credits for job creation, research and development, and certain types of investments. Understanding these incentives and how to qualify can significantly reduce your business’s tax liability.

Filing Your Illinois State Tax Return

Now that you’ve prepared all the necessary documentation and have a solid understanding of the applicable tax laws, it’s time to dive into the actual process of filing your Illinois State Tax Return. This section will guide you through the step-by-step process, whether you choose to file electronically or by mail.

Electronic Filing (e-File)

Electronic filing, or e-filing, is the most efficient and convenient way to file your Illinois State Tax Return. The Illinois Department of Revenue offers a user-friendly online platform called MyTax Illinois, which allows taxpayers to file their returns securely and quickly. Here’s a step-by-step guide to e-filing your Illinois State Tax Return:

- Create an Account: If you haven’t already, create an account on the MyTax Illinois website. You’ll need to provide basic information, such as your name, address, and Social Security number.

- Gather Information: Ensure you have all the necessary documentation, including your W-2 forms, 1099s, and any other relevant tax documents. You’ll need this information to accurately complete your tax return.

- Select Your Tax Form: Illinois offers various tax forms, including the IL-1040 for individuals, the IL-1065 for partnerships, and the IL-1120 for corporations. Select the appropriate form based on your tax situation.

- Enter Your Information: Input your personal information, such as your name, address, and filing status. Then, proceed to enter your income, deductions, and credits. Be sure to refer to the instructions provided with your tax form to ensure accuracy.

- Review and Submit: Once you’ve entered all the necessary information, carefully review your tax return for any errors or omissions. Make sure all calculations are correct and that you’ve claimed all applicable deductions and credits. If everything looks good, submit your return electronically.

- Receive Confirmation: After submitting your tax return, you should receive a confirmation number. Keep this number for your records. It serves as proof that your return was successfully transmitted to the Illinois Department of Revenue.

- Pay Any Outstanding Taxes: If you owe taxes, you can pay them electronically through the MyTax Illinois platform using a credit or debit card, or by electronic funds transfer from your bank account. If you’re unable to pay the full amount, you may be eligible for a payment plan.

Filing by Mail

While electronic filing is the preferred method, some taxpayers may choose to file their Illinois State Tax Return by mail. Here’s a step-by-step guide to help you through the process:

- Gather Your Documents: Ensure you have all the necessary tax documents, including your W-2 forms, 1099s, and any other relevant paperwork. Organize your documents to make the filing process smoother.

- Download and Print the Tax Form: Visit the Illinois Department of Revenue’s website and download the appropriate tax form for your situation. This could be the IL-1040 for individuals, the IL-1065 for partnerships, or the IL-1120 for corporations. Print the form and any accompanying schedules or worksheets.

- Complete the Form: Fill out the tax form accurately and completely. Refer to the instructions provided with the form to ensure you’re entering the correct information in the right places. Double-check your calculations to avoid errors.

- Prepare Supporting Documents: If you’re claiming deductions, credits, or exemptions, you’ll need to attach supporting documentation to your tax return. This could include receipts, statements, or other relevant paperwork. Ensure that all supporting documents are clearly labeled and organized.

- Sign and Date Your Return: Sign and date your completed tax return. If you’re filing jointly with a spouse, both of you must sign the return.

- Prepare Payment (if applicable): If you owe taxes, include a check or money order made payable to the “Illinois Department of Revenue” for the full amount due. Write your Social Security number and the tax year on the payment.

- Mail Your Return: Use the pre-addressed envelope provided with your tax forms, or address your envelope to the Illinois Department of Revenue. Send your completed tax return and any supporting documents, along with your payment (if applicable), via certified mail with return receipt requested. This provides proof of mailing and receipt.

Common Mistakes and How to Avoid Them

Filing your Illinois State Tax Return can be a complex process, and it’s easy to make mistakes that could lead to penalties, interest charges, or even an audit. By being aware of common pitfalls and taking preventive measures, you can ensure a smoother filing experience. This section will highlight some of the most frequent errors and provide strategies to avoid them.

Failing to Report All Income

One of the most common mistakes taxpayers make is failing to report all their income. This can include forgetting to include certain types of income, such as investment gains, rental income, or even hobby earnings. Illinois has strict reporting requirements, and intentionally or unintentionally omitting income can result in significant penalties.

To avoid this mistake, it’s crucial to thoroughly review all your income sources and ensure they’re accurately reflected on your tax return. Gather all necessary documents, such as W-2s, 1099s, and statements from banks or investment firms, to verify your income amounts. If you have any doubts or questions about what should be included, consult a tax professional or refer to the Illinois Department of Revenue’s guidelines.

Overlooking Deductions and Credits

Another common error is overlooking deductions and credits that could significantly reduce your tax liability. Illinois offers various deductions and credits, including those for education expenses, energy-efficient home improvements, and small business incentives. By failing to claim these deductions and credits, you may be missing out on substantial tax savings.

To avoid this mistake, take the time to thoroughly research and understand the deductions and credits you may be eligible for. Consult the Illinois Department of Revenue’s website, which provides detailed information on available deductions and credits. Additionally, consider seeking advice from a tax professional who can guide you through the process and help you maximize your tax benefits.

Errors in Calculations

Mathematical errors are a common issue in tax returns, and they can lead to incorrect tax liabilities and potential penalties. These errors can occur when entering income amounts, calculating deductions, or computing the final tax due.

To minimize the risk of calculation errors, take your time and double-check all figures. Use a calculator or tax software to ensure accuracy, especially when dealing with complex calculations. If you’re using tax software, ensure it’s up-to-date and includes the latest tax laws and regulations. Additionally, consider having a trusted friend or family member review your calculations to provide a second pair of eyes.

Filing Late or Not Paying on Time

Filing your tax return late or not paying your taxes on time can result in significant penalties and interest charges. Illinois imposes penalties for late filing and late payment, which can add up quickly and increase your overall tax burden.

To avoid these penalties, make sure you’re aware of the filing deadlines and plan accordingly. If you anticipate not being able to file by the deadline, consider requesting an extension using Form IL-505. Remember, an extension only gives you more time to file your return; it doesn’t extend the deadline for paying any taxes owed.

If you’re unable to pay your taxes in full by the deadline, contact the Illinois Department of Revenue to discuss your options. They may be able to set up a payment plan or offer other alternatives to help you manage your tax liability.

Tax Tips and Strategies for Illinois Residents

Maximizing your tax benefits and minimizing your tax liability involves more than just accurately filing your Illinois State Tax Return. By implementing smart strategies and staying informed about tax laws and incentives, you can further optimize your financial situation. This section will provide valuable tips and insights to help you make the most of your tax situation.

Understanding Tax Credits and Deductions

Tax credits and deductions are powerful tools that can significantly reduce your tax liability. Understanding the differences between these two concepts and knowing which ones you’re eligible for is crucial to maximizing your tax benefits.

Tax credits directly reduce the amount of tax you owe, dollar-for-dollar. For example