Nj Sales And Use Tax

In the world of commerce, taxes play a pivotal role, shaping the financial landscape for businesses and consumers alike. The state of New Jersey, with its diverse economy and vibrant business environment, has its own unique set of tax regulations. Among these, the New Jersey Sales and Use Tax stands out as a crucial aspect, impacting various transactions and operations within the state.

This article delves deep into the intricacies of the NJ Sales and Use Tax, offering an expert-level analysis that covers everything from its historical evolution to its practical implementation and future implications. By the end, readers will have a comprehensive understanding of this essential tax, its role in New Jersey's economy, and its significance for businesses and consumers within the state.

Unraveling the NJ Sales and Use Tax: A Comprehensive Overview

The New Jersey Sales and Use Tax is a consumption tax imposed by the state on the sale or use of tangible personal property and certain services. It is a critical revenue source for the state, contributing significantly to its overall tax income. The tax applies to a wide range of transactions, from retail sales to rentals and leases, making it a pervasive aspect of the state’s economic landscape.

The history of the NJ Sales and Use Tax dates back to the mid-20th century, with its inception aimed at stabilizing state revenues and promoting economic development. Over the years, the tax has undergone several amendments and updates, reflecting the evolving nature of the state's economy and the changing needs of its citizens.

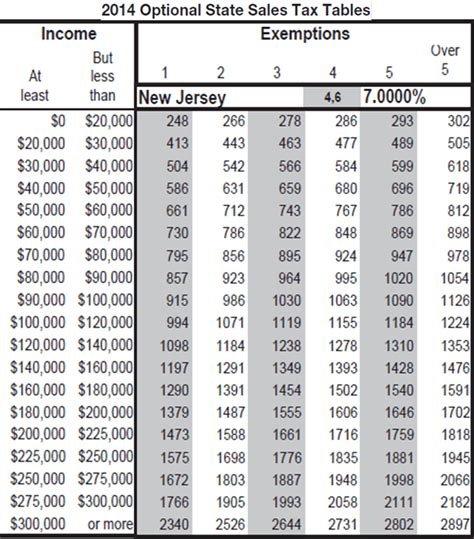

One of the key features of the NJ Sales and Use Tax is its rate structure. The state's sales tax rate is 6.625%, which includes both the state and local sales tax rates. However, this rate can vary across different counties and municipalities, with some areas imposing additional local taxes. This complexity in the rate structure often necessitates careful consideration and planning for businesses operating in multiple locations within the state.

The taxability of various goods and services under the NJ Sales and Use Tax is another critical aspect. While most tangible personal property and certain services are subject to the tax, there are numerous exemptions and special provisions that businesses and consumers should be aware of. These exemptions cover a wide range of items, from certain food products to educational materials and certain types of medical equipment.

Moreover, the NJ Sales and Use Tax also includes provisions for tax collection and remittance. Businesses engaged in taxable transactions are generally responsible for collecting the tax from customers and remitting it to the state. This process involves careful record-keeping, accurate tax calculation, and timely filing of tax returns. Failure to comply with these requirements can result in significant penalties and interest charges.

For consumers, the NJ Sales and Use Tax adds a direct financial burden to their purchases. However, it's important to note that the tax is not always a straightforward addition to the purchase price. The tax can be calculated differently for various types of transactions, and it may also be affected by other factors such as the customer's tax status, the location of the sale, and the specific goods or services involved.

In the context of business operations, the NJ Sales and Use Tax presents both challenges and opportunities. Businesses must navigate the complex tax landscape, ensuring compliance with the various regulations and provisions. This often requires dedicated resources and expertise in tax management. However, a well-managed approach to sales and use tax compliance can also lead to significant savings and a more efficient use of resources.

Looking ahead, the future of the NJ Sales and Use Tax is likely to be shaped by several factors. The ongoing digital transformation of the economy, the rise of e-commerce, and the increasing complexity of supply chains are all set to have an impact. These trends may lead to further amendments and updates to the tax regulations, ensuring they remain relevant and effective in the modern business environment.

Key Provisions of the NJ Sales and Use Tax

The NJ Sales and Use Tax is governed by a comprehensive set of regulations and provisions, which ensure its fair and effective implementation. These provisions cover a wide range of aspects, from the definition of taxable transactions to the procedures for tax collection and dispute resolution.

One of the critical provisions relates to the taxability of various goods and services. The state has established clear guidelines on what is subject to the tax and what is exempt. For instance, most tangible personal property, such as clothing, electronics, and vehicles, is generally taxable. However, there are numerous exemptions, including sales for resale, certain agricultural products, and some types of professional services.

The tax also applies to a wide range of services, including repairs, installations, and rentals. However, similar to tangible goods, certain services are exempt from the tax. These exemptions often relate to essential services, such as medical and educational services, and are aimed at ensuring access to these services for all citizens.

Another key provision relates to the registration and licensing of businesses for tax purposes. All businesses engaged in taxable transactions within the state are required to register with the New Jersey Division of Taxation and obtain a Sales and Use Tax Permit. This permit serves as a legal authorization for the business to collect and remit sales tax.

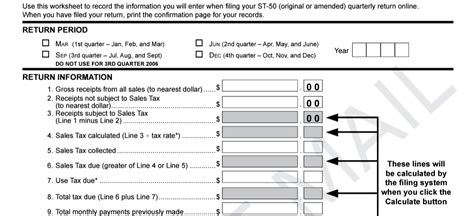

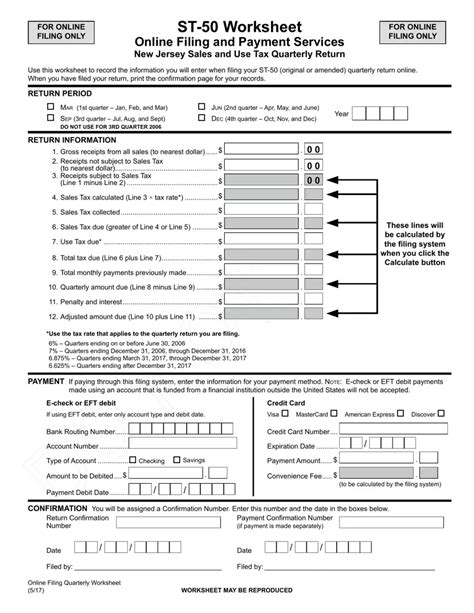

The NJ Sales and Use Tax also includes provisions for tax collection and remittance. Businesses are required to collect the tax at the point of sale and remit it to the state on a regular basis, typically quarterly or annually. The frequency of remittance depends on the business's tax liability and the amount of tax collected.

| Tax Collection Frequency | Business Type |

|---|---|

| Quarterly | Businesses with an annual tax liability of $25,000 or more |

| Annually | Businesses with an annual tax liability of less than $25,000 |

The NJ Sales and Use Tax also includes provisions for tax returns and reporting. Businesses are required to file tax returns, providing detailed information on their taxable transactions, tax collected, and tax remitted. These returns are typically due at the end of each reporting period, which corresponds to the frequency of tax remittance.

For businesses and consumers, understanding these key provisions is essential for ensuring compliance with the NJ Sales and Use Tax regulations. It helps businesses to effectively manage their tax obligations and consumers to understand their rights and responsibilities when it comes to tax payments.

Practical Implementation of the NJ Sales and Use Tax

The practical implementation of the NJ Sales and Use Tax involves a series of steps and processes that businesses must navigate to ensure compliance. This process begins with understanding the tax regulations and extends to tax registration, collection, remittance, and reporting.

Tax Registration

The first step in implementing the NJ Sales and Use Tax is tax registration. All businesses engaged in taxable transactions within the state must register with the New Jersey Division of Taxation. This process involves completing an application form, providing relevant business information, and obtaining a Sales and Use Tax Permit.

The application process typically requires businesses to provide details such as their legal name, business address, taxpayer identification number (TIN), and the nature of their business activities. The Division of Taxation reviews the application and, upon approval, issues a Sales and Use Tax Permit, which serves as a legal authorization for the business to collect and remit sales tax.

It's important to note that the registration process is not a one-time event. Businesses must ensure that their registration remains current and up-to-date, especially when there are changes in their business structure, ownership, or location. Failure to maintain a valid registration can result in penalties and interest charges.

Tax Collection

Once a business is registered, the next step is tax collection. The NJ Sales and Use Tax is generally collected at the point of sale, with businesses adding the tax to the purchase price of taxable goods or services. This process requires businesses to calculate the tax accurately, based on the applicable tax rate and the value of the transaction.

The tax collection process can be complex, especially for businesses with multiple locations or a diverse range of products and services. It often involves the use of specialized software or systems that can automatically calculate and track tax obligations. These systems ensure accuracy and efficiency in tax collection, reducing the risk of errors and non-compliance.

Tax Remittance

After collecting the tax, the next step is tax remittance. Businesses are required to remit the collected tax to the state on a regular basis, typically quarterly or annually. The frequency of remittance depends on the business’s tax liability and the amount of tax collected.

The remittance process involves filing a tax return, providing details on the tax collected, and remitting the tax amount to the state. This process typically requires businesses to access their online tax account, complete the tax return form, and submit it along with the tax payment. The state provides clear guidelines and instructions for the remittance process, ensuring a smooth and efficient transaction.

It's important for businesses to ensure timely remittance of the tax. Late payments can result in penalties and interest charges, which can significantly increase the overall tax burden. Businesses should also keep accurate records of their tax payments, as these records may be required for audit purposes.

Tax Reporting

In addition to tax remittance, businesses are also required to file tax returns, providing detailed information on their taxable transactions, tax collected, and tax remitted. These returns are typically due at the end of each reporting period, which corresponds to the frequency of tax remittance.

The tax reporting process involves completing a tax return form, which includes details such as the business's tax identification number, the period covered by the return, and the amount of tax collected and remitted. Businesses must ensure that the information provided in the return is accurate and complete, as any discrepancies can lead to audits and potential penalties.

The state provides clear guidelines and instructions for tax reporting, including the forms and schedules to be used. These guidelines ensure that businesses understand their reporting obligations and can complete the process accurately and efficiently.

By understanding the practical implementation of the NJ Sales and Use Tax, businesses can ensure compliance with the state's tax regulations. This process, while complex, is essential for maintaining a healthy relationship with the state and avoiding potential legal and financial consequences.

Impact and Implications of the NJ Sales and Use Tax

The NJ Sales and Use Tax has a significant impact on various aspects of the state’s economy and society. It affects businesses, consumers, and the state’s overall financial landscape, shaping the way transactions are conducted and revenues are generated.

Impact on Businesses

For businesses operating within New Jersey, the NJ Sales and Use Tax presents both challenges and opportunities. On the one hand, it adds to their operational costs and administrative burden, as they must collect and remit the tax, maintain accurate records, and comply with various tax regulations.

However, a well-managed approach to sales and use tax compliance can also lead to significant savings and a more efficient use of resources. By understanding the tax regulations and implementing effective tax management strategies, businesses can minimize their tax burden and maximize their operational efficiency.

Moreover, the NJ Sales and Use Tax can also provide businesses with a competitive advantage. By effectively managing their tax obligations, businesses can ensure they are compliant with the law and avoid potential penalties and interest charges. This compliance can enhance their reputation and credibility, especially in the eyes of customers and partners who value ethical and responsible business practices.

Impact on Consumers

For consumers, the NJ Sales and Use Tax adds a direct financial burden to their purchases. The tax increases the cost of goods and services, impacting their purchasing power and spending decisions. However, it’s important to note that the tax is not always a straightforward addition to the purchase price.

The tax can be calculated differently for various types of transactions, and it may also be affected by other factors such as the customer's tax status, the location of the sale, and the specific goods or services involved. For instance, certain purchases, such as those made online or from out-of-state vendors, may not be subject to the NJ Sales and Use Tax, providing consumers with potential savings.

Moreover, the tax can also have an impact on consumer behavior. It may encourage consumers to make more informed purchasing decisions, considering not just the price of the goods or services but also the tax implications. This can lead to a more conscious and strategic approach to spending, which can have broader implications for the state's economy and society.

Impact on the State’s Economy

The NJ Sales and Use Tax is a critical revenue source for the state, contributing significantly to its overall tax income. The tax provides a stable and reliable source of funding for various state programs and initiatives, including education, healthcare, infrastructure development, and social services.

The tax also plays a crucial role in promoting economic development and stability. By generating revenue, the tax helps to fund various economic initiatives, such as business incentives, job creation programs, and infrastructure improvements. These initiatives can stimulate economic growth, attract new businesses, and create a more vibrant and competitive business environment within the state.

Moreover, the tax can also have a positive impact on the state's creditworthiness and financial stability. A strong and stable tax base, such as that provided by the NJ Sales and Use Tax, can enhance the state's credit rating, making it more attractive to investors and lenders. This, in turn, can lead to better access to capital and more favorable financing terms, further boosting the state's economic growth and development.

Future Implications

Looking ahead, the future of the NJ Sales and Use Tax is likely to be shaped by several factors. The ongoing digital transformation of the economy, the rise of e-commerce, and the increasing complexity of supply chains are all set to have an impact. These trends may lead to further amendments and updates to the tax regulations, ensuring they remain relevant and effective in the modern business environment.

For instance, the growth of e-commerce and online sales may require the state to reevaluate its tax policies and procedures. This could involve considering the taxation of online transactions, the collection of sales tax from out-of-state vendors, and the potential impact on brick-and-mortar businesses. These considerations are critical for ensuring a level playing field for all businesses and maintaining a fair and competitive market environment.

Furthermore, the increasing complexity of supply chains, driven by globalization and technological advancements, may also require updates to the tax regulations. This could involve addressing issues such as tax liability for cross-border transactions, the taxation of digital goods and services, and the impact of new business models on tax collection and compliance.

Overall, the NJ Sales and Use Tax is a dynamic and evolving aspect of the state's tax landscape. Its impact and implications are far-reaching, affecting businesses, consumers, and the state's economy as a whole. By understanding these implications and staying abreast of the latest developments, businesses and consumers can navigate the tax landscape effectively and contribute to the state's economic growth and prosperity.

FAQs

What is the NJ Sales and Use Tax rate?

+The NJ Sales and Use Tax rate is 6.625%, which includes both the state and local sales tax rates. However, this rate can vary across different counties and municipalities, with some areas imposing additional local taxes.

Who is responsible for collecting the NJ Sales and Use Tax?

+Businesses engaged in taxable transactions within New Jersey are generally responsible for collecting the NJ Sales and Use Tax from customers and remitting it to the state.

Are there any exemptions or special provisions under the NJ Sales and Use Tax?

+Yes, there are numerous exemptions and special provisions under the NJ Sales and Use Tax. These cover a wide range of items, from certain food products to educational materials and certain types of medical equipment.

How often do businesses need to remit the NJ Sales and Use Tax to the state?

+Businesses generally need to remit the NJ Sales and Use Tax to the state on a quarterly or annual basis, depending on their tax liability and the amount of tax collected. Businesses with an annual tax liability of 25,000 or more typically remit quarterly, while those with a liability of less than 25,000 remit annually.