Collector Of Taxes Hamden Ct

In the realm of local governance and administration, the role of a Collector of Taxes is an essential position that ensures the smooth functioning of a municipality. This role is responsible for the critical task of collecting taxes, which are the lifeblood of any community, enabling the provision of essential services and the development of infrastructure. This article delves into the specific case of the Collector of Taxes in Hamden, Connecticut, exploring their duties, the impact of their role on the community, and the broader context of tax collection within the state.

The Office of the Collector of Taxes in Hamden, CT

The Office of the Collector of Taxes in Hamden, CT, plays a pivotal role in the town’s administration, serving as the primary authority for managing and collecting various forms of taxation. This office is responsible for ensuring that all residents and businesses in Hamden fulfill their tax obligations, contributing to the town’s financial stability and growth.

Duties and Responsibilities

The Collector of Taxes in Hamden has a comprehensive set of duties that encompass the entire tax collection process. These duties include:

- Tax Assessment: The office is responsible for assessing the value of properties within the town. This process ensures that the taxes levied are fair and accurate, taking into account factors such as location, size, and market value.

- Billing and Collection: The primary responsibility is to send out tax bills to all taxpayers in Hamden. This includes both real estate taxes and personal property taxes. The office then collects these taxes, ensuring timely payments and offering various payment options for convenience.

- Tax Lien Sales: In cases where taxpayers fail to pay their taxes, the Collector’s office has the authority to place a tax lien on the property. This lien can then be sold at a public auction, with the proceeds going towards the outstanding tax debt.

- Record Keeping: Accurate record-keeping is crucial. The office maintains detailed records of all tax transactions, including payments, delinquencies, and lien sales. These records are essential for audit purposes and ensuring transparency in tax administration.

- Community Outreach: The Collector’s office often engages in community outreach programs to educate residents about tax obligations, payment options, and the importance of timely tax payments. This helps foster a sense of responsibility and understanding among taxpayers.

Impact on the Community

The role of the Collector of Taxes has a profound impact on the community of Hamden. Here are some key ways in which this office influences the town’s dynamics:

- Financial Stability: Timely and efficient tax collection ensures that the town has a stable and reliable source of revenue. This revenue is then used to fund essential services such as education, public safety, infrastructure development, and social programs.

- Equitable Tax System: The assessment process undertaken by the Collector’s office aims to create an equitable tax system. By ensuring that taxes are fairly assessed and collected, the office promotes a sense of fairness and trust in the tax system among residents.

- Community Development: The revenue generated through tax collection is a crucial driver of community development. It enables the town to invest in improvements such as road repairs, park renovations, and the expansion of public services, ultimately enhancing the quality of life for residents.

- Economic Growth: Efficient tax collection can attract businesses and investors to the town. A stable and reliable tax system, coupled with effective tax administration, creates an environment conducive to economic growth and development.

Connecticut’s Tax Collection System

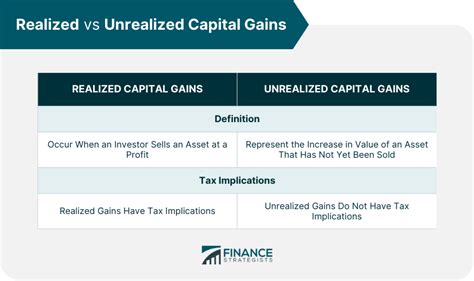

The role of the Collector of Taxes in Hamden is part of a broader tax collection system in the state of Connecticut. Connecticut’s tax system is designed to fund state and local government operations and services. The state levies various taxes, including income tax, sales and use tax, and corporate tax, while local municipalities, such as Hamden, collect property taxes.

Connecticut's tax system is known for its complexity, with various tax rates and exemptions depending on the type of tax and the jurisdiction. For instance, the state income tax has different rates for individuals, estates, and trusts, while the sales tax rate can vary depending on the type of goods or services being purchased.

| Tax Type | Tax Rate | Jurisdiction |

|---|---|---|

| State Income Tax | Varies (3.07% - 6.99%) | State-wide |

| Sales and Use Tax | 6.35% | State-wide |

| Property Tax | Varies (0.70% - 1.95%) | Local Municipality |

Future Outlook and Challenges

The role of the Collector of Taxes in Hamden, like many other municipalities, faces both opportunities and challenges in the future. With the advancement of technology, the office can explore digital tax collection systems, online payment portals, and data-driven assessment methods to enhance efficiency and transparency.

However, challenges such as tax delinquency, budget constraints, and changing economic conditions can impact the office's operations. Effective strategies, such as tax amnesty programs, community engagement initiatives, and continuous professional development for staff, can help mitigate these challenges and ensure the long-term sustainability of the tax collection system.

Conclusion

The Office of the Collector of Taxes in Hamden, CT, is an integral part of the town’s governance, playing a critical role in maintaining financial stability and supporting community development. Through their various duties and responsibilities, the Collector’s office ensures that Hamden’s tax system remains fair, efficient, and aligned with the town’s needs. As the town and the state of Connecticut continue to evolve, the role of the Collector of Taxes will adapt and innovate to meet the changing demands of tax administration.

What is the role of the Collector of Taxes in Hamden, CT?

+The Collector of Taxes in Hamden, CT, is responsible for assessing property values, sending out tax bills, collecting taxes, and managing tax lien sales. They ensure the town has a stable revenue source for essential services and community development.

How does the Collector’s office impact the community of Hamden?

+The Collector’s office ensures financial stability, promotes an equitable tax system, and drives community development by funding essential services and infrastructure projects.

What are some future challenges and opportunities for the Collector of Taxes in Hamden?

+Future challenges include tax delinquency and budget constraints, while opportunities lie in adopting digital tax collection systems and data-driven assessment methods to enhance efficiency and transparency.