Beware of Common Mistakes When Reading Luxury Car Tax News

In the gleaming world of luxury automobiles, the intersection of high-end vehicle ownership and evolving tax legislation creates a complex landscape for enthusiasts, investors, and legal advisors alike. Amid the allure of sleek lines, cutting-edge technology, and prestige branding, there lurks a series of nuanced tax regulations that, if misunderstood or overlooked, can lead to costly misunderstandings or inadvertent non-compliance. As markets fluctuate and government policies adapt, staying informed requires more than casual peripheral awareness—it demands a precise understanding of the intricacies involved in luxury car tax news. Recognizing common pitfalls and adopting best practices in interpreting this information ensures stakeholders navigate this terrain with confidence and strategic foresight.

Understanding the Landscape of Luxury Car Taxation

At its core, the taxation framework surrounding luxury vehicles varies significantly across jurisdictions, influenced by regional economic policies, environmental considerations, and fiscal priorities. A typical scenario involves progressive tax regimes designed to curb luxury consumption, promote sustainability, or generate revenue. These regimes often incorporate multiple layers of taxation, including import duties, excise taxes, annual registration fees based on vehicle value, and potential future taxes linked to emissions or technological features such as hybrid or electric models.

Recent shifts in legislative landscapes have seen governments introduce thresholds whereby vehicles exceeding a certain value are taxed at higher rates, sometimes surpassing 30% of the vehicle’s worth. Not only do these thresholds fluctuate annually, but local interpretations of tax codes also evolve, making it imperative for vehicle owners and financial professionals to follow official publications meticulously. Lapses in understanding, or reliance on outdated information, can result in underestimated tax obligations, penalties, or missed opportunities for strategic tax planning.

The Importance of Trustworthy and Up-to-Date Sources

When confronting the dense forest of official notices, legislative updates, and industry reports, the importance of leveraging credible, authoritative sources becomes evident. Government tax agencies publish detailed notices, often accompanied by technical annexes, that clarify thresholds, exemptions, and calculation methods. Private industry analyses, legal advisories, and comprehensive industry reports also synthesize these technicalities with real-world implications. Failing to cross-reference multiple sources can lead to misinterpretations, especially given the sometimes cryptic language or delayed publication cycles.

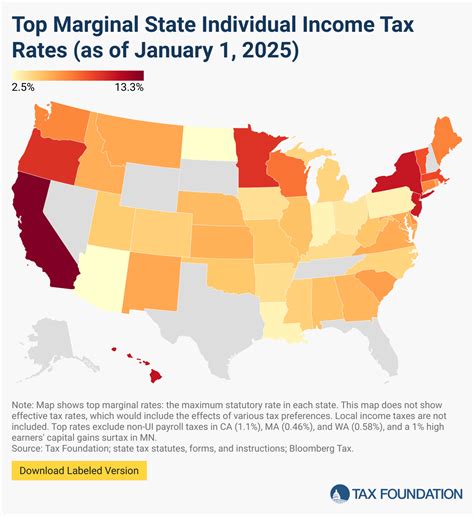

Moreover, it’s essential to monitor jurisdictional differences—what applies in California, for instance, might diverge considerably from European Union standards or Asian markets, adding layers of complexity. The correct approach involves continuous engagement with official updates and engagement with tax professionals certified in the relevant jurisdictions to prevent costly errors.

| Relevant Category | Substantive Data |

|---|---|

| Tax Thresholds | Vehicles valued above $50,000 incur additional luxury taxes in many US states; thresholds vary between $40,000 (e.g., Canada) to €60,000 (EU markets) |

| Tax Rates | Average luxury vehicle tax rate ranges from 10% to 30%, with some jurisdictions imposing progressive rates based on vehicle value or emissions output |

| Annual Registration Fees | In many regions, annual fees equate to 1-2% of the vehicle's value, with premium models commanding higher fees and potential discounts for electric or hybrid vehicles |

Common Mistakes When Reading Luxury Car Tax News

Despite the critical importance of staying informed, many enthusiasts and professionals fall prey to predictable missteps when interpreting luxury car tax news. These errors often stem from superficial engagement with complex regulatory language or from assumptions based on outdated information. Recognizing and avoiding these pitfalls can substantially mitigate legal risks and optimize tax efficiency.

Over-reliance on Initial News Reports without Verifying Sources

One frequent mistake involves taking preliminary reports at face value without cross-verifying with official publications. News outlets, industry blogs, or social media summaries often provide an initial veneer of clarity but can omit crucial caveats or updates. For example, a news article may report that a new luxury tax threshold is set at a certain value, failing to note recent amendments, regional specifics, or legislative delays. In such cases, acting prematurely on incomplete data can result in underpayment or overpayment, both of which carry penalties or lost planning opportunities.

Ignoring the Effect of Regional and Jurisdictional Variations

Another common error is assuming a one-size-fits-all approach when understanding tax obligations. Billions of dollars’ worth of luxury vehicles circulate globally, and each market has distinct laws. For instance, European Union countries might use calculation bases linked tightly to CO₂ emissions, whereas American states might base taxation purely on vehicle value. Without comprehensive knowledge of the local legal frame, misinterpretations lead to miscalculations or legal exposure.

Failing to Track Legislative Changes and Policy Trends

Tax laws are dynamic; they respond to economic shifts, political priorities, and technological innovations. The misconception that tax thresholds and rates remain static over extended periods can produce disastrous results. This static thinking overlooks emerging policies like incentives for electric luxury vehicles, adjustments for inflation, or regional austerity measures targeting high-value assets. Staying current necessitates an active engagement with official channels and a network of industry experts.

Neglecting to Account for Hidden Costs and Fees

Because of the multi-layered structure of luxury car taxes, focusing solely on headline figures—like import duties or quoted tax percentages—can be misleading. Additional fees, such as administrative surcharges, registration costs, emissions-related levies, or luxury tax surcharges based on optional features, often inflate the total tax burden. A failure to incorporate these cost components into comprehensive calculations leads to underestimating total financial implications.

Strategies for Accurate Interpretation and Compliance

The pathway to mastering luxury car tax news begins with adopting systematic approaches rooted in evidence-based research and professional diligence. The following strategies help sharpen the accuracy of information intake and application:

Regularly Update Knowledge via Official Publications

Ensuring that interpretations are grounded in the latest official documentation, such as government tax bulletins, legislative amendments, and authoritative legal advisories, is fundamental. Subscriptions to official government portals, professional legal bulletins, or industry update services provide real-time alerts, thus preventing reliance on outdated data.

Leverage Expert Networks and Professional Guidance

In the intricate terrain of luxury vehicle taxation, consulting with certified tax professionals, legal advisors, and industry specialists reduces interpretative errors. Their expertise enables contextual understanding of technical language, jurisdictional nuances, and future legislative trajectories, equipping stakeholders to adapt proactively.

Implement Cross-Verification Protocols

Establishing a routine of cross-referencing data from multiple credible sources ensures consistency and reduces bias or misinterpretation. Comparing government publications, industry reports, and peer-reviewed analyses creates a robust informational framework adaptable to evolving legislative landscapes.

Develop Comprehensive Cost-Assessment Models

Implement financial modeling that incorporates all potential tax components, fees, and surcharges. Utilizing digital tools or spreadsheets with real-time data updates ensures holistic evaluation of the total ownership cost, enhancing compliance and strategic planning.

Key Points

- Stay current with official tax publications to avoid outdated interpretations that lead to compliance failures.

- Recognize jurisdictional variability to tailor strategies aligned with regional legal frameworks.

- Monitor legislative developments proactively to seize planning opportunities and mitigate risks.

- Account for all related costs and surcharges to accurately estimate total tax liabilities.

- Engage professional expertise for nuanced analysis and strategic advice in navigating complex tax codes.

How often do luxury car tax thresholds change?

+Tax thresholds for luxury vehicles are generally reviewed annually, with some jurisdictions implementing adjustments based on inflation, policy shifts, or economic conditions. Staying informed requires monitoring official government releases and industry reports vigilantly.

What are the best practices for staying updated on tax law changes?

+Subscribe to official government tax bulletins, engage with professional legal and tax advisory networks, and participate in industry seminars. These practices ensure timely access to accurate information and expert insights, reducing the risk of misinterpretation.

Can electric luxury vehicles help in reducing tax liabilities?

+Many jurisdictions introduce incentives for electric vehicles, including lower tax rates, exemptions, or credits. While these can mitigate tax burdens, it’s essential to verify specific regional policies, as incentives vary widely and are subject to frequent updates.