Michigan State Tax Rate

When it comes to taxation, each state in the United States has its own set of rules and regulations. Michigan, the Great Lakes State, is no exception. Understanding Michigan's state tax rate is crucial for individuals and businesses alike to navigate their financial obligations effectively. In this comprehensive guide, we will delve into the intricacies of Michigan's tax landscape, providing you with a thorough understanding of its state tax rate, how it impacts residents and businesses, and the key factors to consider.

Unraveling Michigan's State Tax Rate

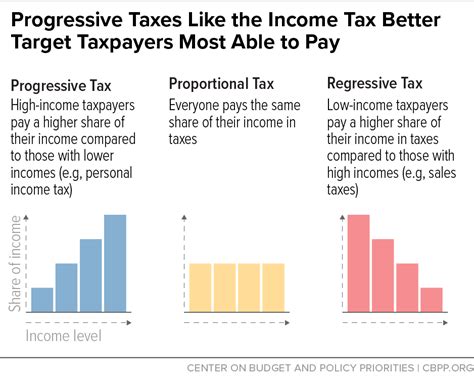

Michigan imposes a flat state income tax rate on its residents, meaning that regardless of income level, individuals are subject to the same tax percentage. As of my last update in January 2023, the Michigan state income tax rate stands at 4.25%. This rate applies to all taxable income earned within the state, including wages, salaries, dividends, and interest income.

It's important to note that Michigan's flat tax rate is distinct from its federal income tax system, which operates on a progressive scale, meaning higher income brackets are taxed at higher rates. The state's flat tax system simplifies the process for residents, offering a consistent rate regardless of income level.

In addition to the state income tax, Michigan also levies a sales and use tax on the purchase of goods and services within the state. The sales tax rate in Michigan is currently set at 6%, with additional local taxes varying across different jurisdictions. These local taxes, often referred to as "home rule taxes," can add up to an additional 2% or more, resulting in a total sales tax rate that varies across the state.

Taxable Income and Exemptions

Michigan's tax system includes provisions for taxable income and exemptions that can impact the amount of tax owed by individuals and businesses. For personal income tax, certain types of income are exempt from taxation, such as interest earned on municipal bonds and some types of retirement income. These exemptions can significantly reduce an individual's taxable income and, consequently, their tax liability.

Similarly, businesses operating in Michigan may be eligible for various tax incentives and exemptions, particularly if they engage in specific industries or meet certain criteria. These incentives can include tax credits, deductions, and exemptions for research and development activities, job creation, and investment in certain sectors.

| Tax Type | Rate |

|---|---|

| State Income Tax | 4.25% |

| Sales and Use Tax | 6% (Base Rate) |

| Local Sales Tax | Varies (Up to 2% additional) |

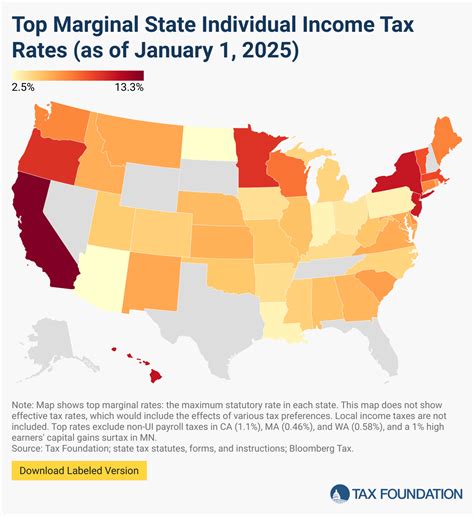

Comparative Analysis: Michigan vs. Other States

Michigan's state tax rate can be compared to that of other states to provide a broader perspective. When it comes to income tax, Michigan's flat rate of 4.25% is relatively moderate compared to some neighboring states. For instance, Illinois has a flat rate of 4.95%, while Indiana's income tax rates vary from 2.9% to 6.25% depending on income level. However, it's important to note that each state has its unique tax structure and additional taxes and exemptions that can impact the overall tax burden.

In terms of sales tax, Michigan's base rate of 6% is on par with many other states, although some states have lower or higher rates. Additionally, Michigan's local sales tax rates can vary significantly, with certain jurisdictions having rates as high as 8% or more when combined with the state sales tax.

Impact on Residents and Businesses

Michigan's state tax rate has a direct impact on the financial well-being of its residents and the economic climate for businesses. For individuals, the flat income tax rate provides a level of predictability and simplicity in tax planning. It ensures that regardless of income level, residents can anticipate their tax liability with relative ease. This transparency can encourage financial planning and budgeting, enabling residents to make informed decisions about their finances.

For businesses, Michigan's tax structure, including the flat income tax rate and various tax incentives, can be advantageous. The predictability of the tax rate provides a stable environment for businesses to operate and plan their financial strategies. Additionally, the state's tax incentives and exemptions can encourage business growth, investment, and job creation, making Michigan an attractive location for businesses looking to expand or relocate.

Tax Efficiency Strategies

Understanding Michigan's state tax rate and its nuances allows individuals and businesses to employ tax efficiency strategies. For individuals, this may involve taking advantage of tax-exempt investments or retirement accounts to reduce taxable income. Additionally, staying informed about any changes to the state's tax laws and taking advantage of deductions and credits can help minimize tax liability.

Businesses, on the other hand, can benefit from exploring the state's tax incentives and exemptions. This may involve researching and applying for tax credits for research and development activities, or leveraging incentives for job creation and investment in certain industries. By actively engaging with Michigan's tax system, businesses can optimize their financial strategies and potentially reduce their tax burden.

Future Implications and Considerations

Michigan's state tax rate is subject to potential changes and adjustments, influenced by various factors such as economic conditions, political decisions, and budgetary considerations. While the flat income tax rate of 4.25% has remained stable for some time, there is always the possibility of future amendments. Keeping a close eye on any proposed tax reforms or legislative changes is essential for individuals and businesses to stay informed and adapt their financial strategies accordingly.

Additionally, the ongoing evolution of Michigan's economy and its response to national and global trends can impact the state's tax landscape. As industries evolve and new sectors emerge, the state may introduce targeted tax incentives to encourage growth and innovation. Staying abreast of these developments can provide valuable insights for businesses looking to capitalize on emerging opportunities.

Frequently Asked Questions

What is Michigan’s state income tax rate as of 2023?

+As of my last update in January 2023, Michigan’s state income tax rate is 4.25%.

Are there any sales tax exemptions in Michigan?

+Yes, certain goods and services are exempt from sales tax in Michigan. These include most groceries, prescription drugs, and some medical devices. Additionally, certain items like clothing, footwear, and school supplies are exempt during designated tax-free shopping periods.

How does Michigan’s state tax rate compare to other states in the region?

+Michigan’s flat income tax rate of 4.25% is relatively moderate compared to some neighboring states. For instance, Illinois has a flat rate of 4.95%, while Indiana’s rates vary. However, sales tax rates can vary significantly across states, and local taxes add complexity.