What Is A Tax Abatement

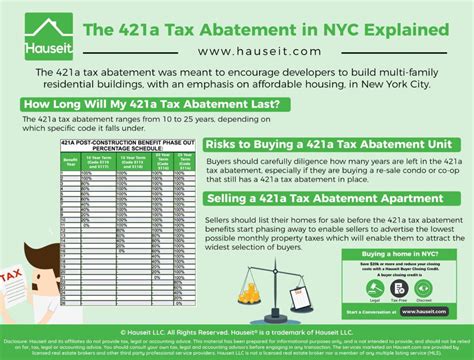

Tax abatement is a strategic financial tool employed by governments and local authorities to stimulate economic growth, attract businesses, and foster community development. It involves a temporary reduction or elimination of taxes, providing a significant incentive for businesses to invest, expand, or relocate to a particular area. This practice has become increasingly common in recent years as a means to drive economic vitality and create job opportunities.

The concept of tax abatement is not a one-size-fits-all approach; rather, it is tailored to the unique needs and goals of each jurisdiction. The specifics of tax abatement programs can vary widely, encompassing different types of taxes, such as property taxes, income taxes, or sales taxes, and applying to various industries or specific economic sectors.

Understanding the intricacies of tax abatement is crucial for businesses and investors seeking to maximize their financial strategies and navigate the complex landscape of economic development incentives. This article aims to provide an in-depth exploration of tax abatement, covering its definitions, types, applications, and potential implications.

The Fundamentals of Tax Abatement

At its core, tax abatement represents a deliberate reduction in tax obligations, offering a powerful incentive for businesses to invest and grow. This reduction can be partial or complete, and it typically applies to specific types of taxes and for a defined period.

The decision to implement tax abatement strategies is often driven by economic development objectives. Local governments and authorities recognize the potential for tax incentives to attract businesses, particularly in competitive markets. By offering tax breaks, these entities aim to create a more attractive business environment, fostering economic growth and community prosperity.

Key Components of Tax Abatement

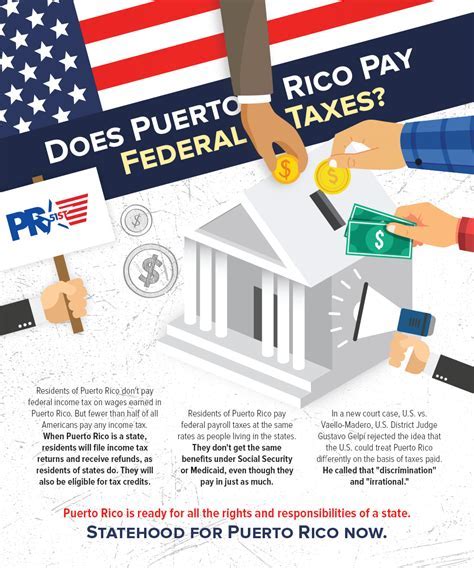

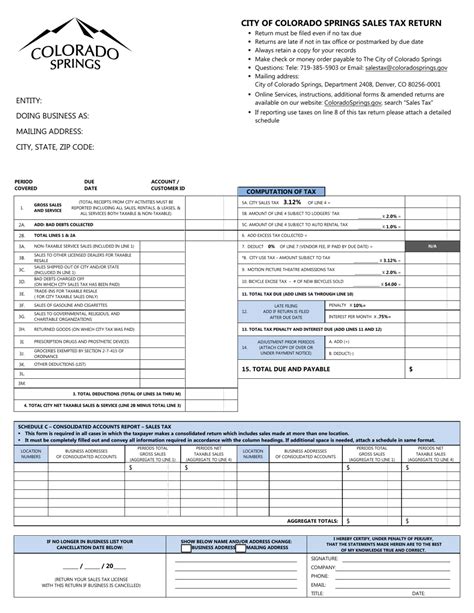

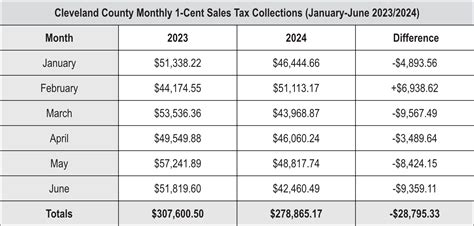

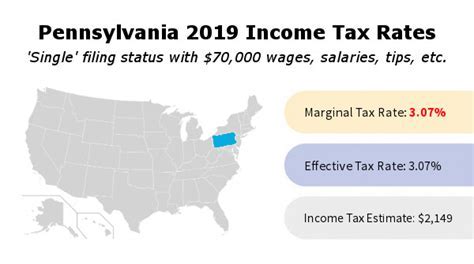

- Tax Type: Tax abatement can be applied to various types of taxes, including property taxes, income taxes, payroll taxes, or even specific fees and assessments. The choice of tax type depends on the objectives and resources of the jurisdiction.

- Target Audience: Tax abatement programs are often designed to cater to specific industries or sectors. For instance, a city might offer tax incentives to encourage the development of renewable energy projects or to attract technology startups.

- Duration: The length of a tax abatement period can vary, ranging from a few years to several decades. The duration is typically determined by the scale and impact of the project or investment being incentivized.

- Eligibility Criteria: Not all businesses or projects qualify for tax abatement. Jurisdictions often establish criteria, such as minimum investment amounts, job creation targets, or environmental sustainability standards, to ensure the abatement benefits are aligned with their development goals.

| Tax Type | Description |

|---|---|

| Property Tax Abatement | Reduces or eliminates property taxes for a defined period, often tied to development or investment projects. |

| Income Tax Abatement | Provides a reduction in income taxes, usually for new businesses or those creating a significant number of jobs. |

| Sales Tax Abatement | Waives sales taxes for specific industries or products, encouraging economic activity and consumer spending. |

Types of Tax Abatement Programs

Tax abatement programs come in various forms, each designed to address specific economic development needs and objectives. Here are some of the most common types:

Tax Increment Financing (TIF)

Tax Increment Financing is a popular method used by local governments to finance urban development projects. Under a TIF program, a designated area is identified for development, and the current tax revenue from that area is frozen. As the area develops and property values increase, the additional tax revenue generated is used to repay bonds issued to finance the initial development costs.

TIF programs are particularly effective in revitalizing declining urban areas, as they provide a dedicated funding source for infrastructure improvements, affordable housing initiatives, and other community development projects.

Enterprise Zones

Enterprise Zones, also known as Economic Development Areas, are geographically defined regions where businesses receive a range of tax incentives and regulatory reliefs. These zones are often established in economically distressed areas to stimulate business activity and create jobs.

Incentives within Enterprise Zones can include property tax abatements, reduced sales taxes, income tax credits, and streamlined permitting processes. By offering these incentives, governments aim to attract businesses and encourage economic growth in underdeveloped areas.

Tax Abatement for Specific Industries

Certain industries, such as renewable energy, film production, or advanced manufacturing, often receive targeted tax abatements. These incentives are designed to foster innovation, create high-value jobs, and establish a competitive edge in specific sectors.

For instance, states or provinces might offer tax credits or abatements to solar energy companies, encouraging the development of clean energy infrastructure. Similarly, film production tax incentives aim to attract film and television productions, stimulating local economies through increased spending on production services, equipment rental, and accommodations.

Job Creation Tax Credits

Job creation tax credits are a type of tax abatement program that incentivizes businesses to create new jobs. These credits are typically based on the number of full-time employees a business hires and retains for a defined period. The credits can be used to offset various types of taxes, such as income taxes or payroll taxes.

Job creation tax credits are particularly beneficial for businesses in labor-intensive industries, such as manufacturing or hospitality, as they provide a financial incentive to expand their workforce and create new employment opportunities.

Implementing Tax Abatement: A Step-by-Step Guide

Implementing a successful tax abatement program requires careful planning and coordination. Here’s a step-by-step guide to help jurisdictions navigate the process:

Step 1: Define Objectives and Goals

Begin by clearly defining the economic development objectives you aim to achieve through tax abatement. This could include attracting new businesses, encouraging job creation, revitalizing specific areas, or supporting particular industries. Clearly defined goals will guide the design and implementation of the program.

Step 2: Assess Resources and Constraints

Evaluate the financial and administrative resources available to support the tax abatement program. Consider the potential impact on the jurisdiction’s overall tax revenue and ensure that the program is fiscally sustainable. Additionally, assess any legal or regulatory constraints that might affect the implementation process.

Step 3: Design the Program

Based on your defined objectives and resource assessment, design the tax abatement program. This involves deciding on the type of tax to be abated, the target audience (specific industries or businesses), the duration of the abatement, and any eligibility criteria. Ensure that the program aligns with the jurisdiction’s economic development strategy and has clear, measurable outcomes.

Step 4: Engage Stakeholders

Engage with key stakeholders, including local businesses, community leaders, and economic development organizations. Gather their input and feedback on the proposed tax abatement program. This engagement process can help refine the program’s design and ensure that it addresses the needs and concerns of the community.

Step 5: Secure Approval and Funding

Seek approval for the tax abatement program from the appropriate governing bodies, such as city councils or state legislatures. This may involve drafting and presenting legislation or regulations. Additionally, secure the necessary funding to administer the program, whether through existing budgets or by allocating specific funds for economic development initiatives.

Step 6: Implement and Monitor

Once approved, implement the tax abatement program and establish clear guidelines and application processes for businesses to access the incentives. Regularly monitor the program’s progress and impact, collecting data on job creation, investment levels, and other relevant metrics. Use this data to evaluate the program’s effectiveness and make any necessary adjustments.

Step 7: Evaluate and Refine

Conduct periodic evaluations of the tax abatement program to assess its success in achieving the defined objectives. Use the evaluation findings to refine and improve the program, ensuring that it remains effective and aligned with the jurisdiction’s evolving economic development needs.

Tax Abatement: Pros and Cons

While tax abatement programs offer numerous benefits, they also come with potential drawbacks. It’s essential to consider both sides to make informed decisions.

Pros of Tax Abatement

- Economic Growth: Tax abatement can stimulate economic activity, leading to increased investment, job creation, and business expansion.

- Community Development: These programs often target specific areas or industries, helping to revitalize communities and improve local infrastructure.

- Competitiveness: Tax incentives make a jurisdiction more attractive for businesses, especially when competing with other regions for investment.

- Job Creation: Tax abatements can be designed to incentivize businesses to hire more employees, reducing unemployment rates.

- Revenue Potential: While offering short-term tax breaks, tax abatement programs can lead to long-term tax revenue gains as businesses grow and prosper.

Cons of Tax Abatement

- Financial Impact: Tax abatements can reduce immediate tax revenue, potentially impacting the jurisdiction’s ability to fund essential services and infrastructure.

- Inequality: If not designed carefully, tax abatement programs might benefit certain industries or areas more than others, leading to economic inequality.

- Complexity: Administering tax abatement programs can be complex, requiring dedicated resources and expertise.

- Time-Bound Effectiveness: The benefits of tax abatements may diminish over time, especially if the incentives are not regularly reviewed and updated.

- Opportunity Cost: Implementing tax abatement programs may mean forgoing other potential economic development strategies that could have a broader impact.

The Future of Tax Abatement: Trends and Predictions

The landscape of tax abatement is constantly evolving, influenced by changing economic conditions, technological advancements, and shifting policy priorities. Here are some trends and predictions that are shaping the future of tax abatement programs:

1. Emphasis on Sustainable Development

There is a growing trend toward using tax abatement programs to support sustainable development initiatives. Governments are increasingly recognizing the importance of environmental stewardship and are incorporating green energy, waste reduction, and other sustainability goals into their tax incentive strategies.

For instance, tax abatements might be offered to businesses that adopt energy-efficient practices, invest in renewable energy technologies, or develop sustainable supply chains. This trend is expected to continue, with more jurisdictions integrating environmental considerations into their economic development plans.

2. Focus on Small Businesses

Small businesses are the backbone of many local economies, and there is a rising recognition of their vital role in community development. As such, tax abatement programs are increasingly tailored to support small businesses, especially those in underserved or minority-owned sectors.

Programs might offer simplified application processes, reduced administrative burdens, and targeted tax incentives to encourage small business growth and entrepreneurship. This focus on small businesses is expected to persist, fostering greater economic diversity and resilience.

3. Digital Transformation and Remote Work

The digital transformation of the economy and the rise of remote work have opened up new opportunities for tax abatement programs. Jurisdictions are exploring ways to attract digital businesses, remote workers, and tech startups through targeted tax incentives.

For example, some regions offer tax abatements to companies that establish digital hubs or innovation centers, attracting tech talent and driving economic growth. As the digital economy continues to evolve, tax abatement programs are likely to adapt to support this transformation.

4. Data-Driven Decision Making

With the increasing availability of data and analytics, tax abatement programs are becoming more data-driven. Jurisdictions are leveraging data to identify areas for economic development, track the impact of tax incentives, and make informed decisions about program design and implementation.

Advanced analytics and machine learning can help identify patterns and trends, optimize tax abatement strategies, and measure the effectiveness of incentives in attracting businesses and creating jobs. This trend toward data-driven decision making is expected to enhance the efficiency and effectiveness of tax abatement programs.

5. Regional Collaboration

As the competition for investment and talent intensifies, jurisdictions are recognizing the benefits of collaborating regionally to create larger, more attractive economic development areas. Regional collaboration can pool resources, share best practices, and present a unified front to potential investors.

Tax abatement programs can be designed at the regional level, offering consistent incentives across multiple jurisdictions. This approach can help create more comprehensive and effective economic development strategies, especially in areas with overlapping economic interests.

Conclusion: Navigating the Tax Abatement Landscape

Tax abatement programs are powerful tools for economic development, offering jurisdictions a means to attract investment, stimulate growth, and create jobs. However, they require careful planning, strategic design, and ongoing evaluation to ensure they align with the community’s needs and goals.

By understanding the fundamentals, types, and implications of tax abatement, businesses and investors can make informed decisions about their financial strategies. Jurisdictions, too, can leverage this knowledge to design effective programs that drive economic vitality and community prosperity.

As the economic landscape continues to evolve, so too will tax abatement programs, adapting to new challenges and opportunities. By staying informed and responsive to these changes, both businesses and jurisdictions can maximize the benefits of tax abatement and navigate the complex world of economic development with confidence.

What is the difference between a tax abatement and a tax exemption?

+A tax abatement is a temporary reduction or elimination of taxes, often tied to specific development or investment projects. On the other hand, a tax exemption is a permanent exclusion from taxation, typically granted to certain entities or activities, such as charitable organizations or religious institutions.

How do tax abatement programs benefit local economies?

+Tax abatement programs can stimulate economic growth by attracting businesses, encouraging investment, and creating jobs. They help revitalize communities, improve infrastructure, and generate long-term tax revenue as businesses expand and prosper.

Are there any potential drawbacks to tax abatement programs?

+Yes, tax abatement programs can reduce immediate tax revenue, potentially impacting the jurisdiction’s ability to fund essential services. They may also lead to economic inequality if not designed carefully. Additionally, the administrative complexity and time-bound effectiveness of these programs can pose challenges.

How can jurisdictions ensure the success of tax abatement programs?

+Jurisdictions can maximize the success of tax abatement programs by carefully planning and designing them to align with their economic development goals. This involves defining clear objectives, assessing resources and constraints, engaging stakeholders, and regularly evaluating and refining the program based on data and feedback.