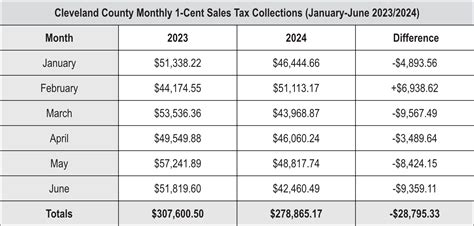

Cleveland Sales Tax

Cleveland, the vibrant city nestled along the shores of Lake Erie, is a bustling hub known for its rich history, cultural diversity, and thriving economy. As with many cities in the United States, understanding the intricacies of its sales tax system is essential for both residents and businesses. The sales tax in Cleveland plays a crucial role in the city's fiscal framework, contributing to its development and the overall well-being of its citizens.

The Cleveland Sales Tax: A Comprehensive Overview

The sales tax in Cleveland is a consumption tax imposed on the purchase of goods and services within the city limits. It is a critical revenue source for the city government, enabling the provision of essential services and infrastructure projects. This tax structure is carefully designed to ensure fairness and efficiency, reflecting the unique needs and characteristics of the Cleveland community.

Cleveland's sales tax system operates within the broader framework of Ohio's tax laws. Ohio, like many states, has a base sales tax rate set at the state level, which is then subject to additional taxes and surcharges at the local level. This local sales tax is often referred to as the "municipal tax" or "city sales tax."

In Cleveland, the sales tax consists of several components, each with its own rate. The primary tax is the city's general sales tax, which is applied to most retail transactions. Additionally, Cleveland imposes a separate tax on food sales, often referred to as the "food tax" or "food and beverage tax." This food tax is designed to capture revenue from a broad range of food items, from grocery store purchases to restaurant meals.

The city of Cleveland also collects a transit tax, which is dedicated specifically to funding public transportation infrastructure and services. This tax is a crucial component of the city's efforts to maintain and enhance its public transit network, ensuring efficient and accessible mobility for residents and visitors alike.

Tax Rates and Exemptions: Understanding the Details

The sales tax rates in Cleveland are subject to periodic adjustments to meet the evolving needs of the city. As of the latest available information, the city’s general sales tax rate stands at 7.25%, which is applied to most tangible personal property and selected services. This rate is uniform across the city, ensuring fairness and simplicity for both businesses and consumers.

However, it's important to note that not all items are subject to this general sales tax. Certain goods and services are exempt, reflecting the unique nature of the items or the specific needs of the community. For instance, many grocery items are exempt from the general sales tax, ensuring that essential food purchases remain affordable for Cleveland's residents.

In addition to the general sales tax, Cleveland's food tax is levied at a rate of 1.5%. This tax is applied to the sale of food and beverages for immediate consumption. While this tax adds to the overall cost of dining out or purchasing prepared meals, it is crucial for supporting the city's food service industry and ensuring the availability of diverse culinary options.

| Tax Type | Rate | Description |

|---|---|---|

| General Sales Tax | 7.25% | Applies to most tangible personal property and selected services |

| Food Tax | 1.5% | Tax on food and beverage sales for immediate consumption |

| Transit Tax | Varies | Dedicated to funding public transportation infrastructure and services |

Compliance and Administration: Ensuring Fairness and Efficiency

The administration and enforcement of Cleveland’s sales tax system are overseen by the city’s tax department, in collaboration with state tax authorities. This collaborative effort ensures that the tax collection process is fair, efficient, and in line with the legal framework set by Ohio’s tax laws.

Businesses operating within Cleveland are responsible for collecting and remitting the appropriate sales taxes on behalf of the city. This process involves careful record-keeping and accurate reporting to ensure compliance with the law. Non-compliance can result in penalties and legal consequences, underscoring the importance of staying informed and up-to-date with tax regulations.

For individuals and businesses alike, understanding the nuances of Cleveland's sales tax system is essential for making informed financial decisions. Whether it's planning a budget, pricing goods and services, or simply being aware of the tax implications of various purchases, knowledge is power. It enables consumers and businesses to navigate the city's tax landscape with confidence and contribute to the vibrant economic ecosystem of Cleveland.

The Impact of Sales Tax on the Local Economy

The sales tax in Cleveland has a significant impact on the local economy, influencing consumer behavior, business operations, and the overall fiscal health of the city. Here’s a closer look at some of the key ways in which the sales tax affects the city’s economic landscape.

For businesses, the sales tax is a critical consideration in their pricing strategies. It influences the cost of goods and services, impacting the competitiveness of local businesses in the market. Businesses must carefully calculate the sales tax into their pricing to ensure they remain attractive to consumers while maintaining profitability. This dynamic can shape the business landscape, encouraging innovation and efficiency to stay ahead in a competitive market.

From a consumer perspective, the sales tax directly affects purchasing power and decision-making. Consumers may adjust their spending habits based on the tax rates, opting for tax-free items or seeking out deals and discounts to mitigate the impact of the tax. This behavior can influence the success of certain businesses and industries, driving consumer choices and shaping the local economy.

The sales tax also plays a crucial role in funding essential public services and infrastructure projects. The revenue generated from sales tax contributes to the city's budget, supporting areas such as education, public safety, healthcare, and community development. This funding is vital for maintaining a high quality of life for Cleveland's residents and fostering a positive business environment.

Furthermore, the sales tax can have implications for the local job market. Businesses may adjust their hiring practices or investment strategies based on the tax landscape, which can impact employment opportunities and economic growth. A well-managed sales tax system can encourage business growth and job creation, contributing to a thriving local economy.

In conclusion, the sales tax in Cleveland is a vital component of the city's fiscal framework, influencing various aspects of the local economy. From shaping business strategies and consumer behavior to funding essential services, the sales tax plays a crucial role in the city's development and prosperity. Understanding and navigating this tax system is key to ensuring the continued success and vibrancy of Cleveland's economic ecosystem.

Future Implications and Potential Changes

As Cleveland continues to evolve and adapt to changing economic and social landscapes, the sales tax system may also undergo transformations to meet emerging needs and challenges. Here are some potential future implications and possible changes to the sales tax in Cleveland.

Tax Reform and Modernization

Tax reform is a common topic of discussion in many cities and states, including Cleveland. As technology advances and the nature of commerce evolves, there may be calls for modernizing the sales tax system to better align with contemporary business models and consumer behaviors. This could involve exploring new methods of tax collection, such as online sales tax or point-of-sale tax collection, to ensure fairness and efficiency in an increasingly digital economy.

Additionally, tax reform may address issues of fairness and equity, ensuring that the tax burden is distributed equitably among different income levels and industries. This could involve adjustments to tax rates or the introduction of new tax categories to better reflect the changing economic landscape.

Economic Growth and Development

The sales tax plays a pivotal role in funding infrastructure projects and economic development initiatives. As Cleveland strives for economic growth and diversification, the revenue generated from sales tax becomes even more critical. The city may explore ways to leverage this revenue to attract new businesses, stimulate job creation, and enhance the overall business climate.

This could involve investing in strategic infrastructure projects, such as improving transportation networks or developing business-friendly districts, to create an environment conducive to business growth and investment. The sales tax revenue can be a powerful tool in driving economic development and shaping the future of the city.

Community Engagement and Transparency

Ensuring transparency and community engagement in tax matters is essential for building trust and fostering a sense of ownership among residents. As Cleveland looks to the future, it may prioritize initiatives that involve the community in decision-making processes related to tax policies. This could include public consultations, town hall meetings, or other forms of community engagement to gather feedback and ensure that tax policies reflect the needs and values of the people they serve.

By involving the community, the city can better understand the challenges and opportunities faced by its residents and businesses, leading to more effective and responsive tax policies. This approach can also enhance the overall trust and cooperation between the city government and its constituents, fostering a positive environment for economic growth and development.

Conclusion: Navigating Cleveland’s Sales Tax Landscape

Cleveland’s sales tax system is a dynamic and essential component of the city’s fiscal framework, influencing the lives and businesses of its residents. By understanding the nuances of this tax system, individuals and businesses can make informed decisions, contributing to the city’s economic vitality and overall well-being.

As Cleveland continues to evolve, the sales tax will play a pivotal role in shaping the city's future. From tax reform and modernization to economic growth and community engagement, the sales tax will remain a critical tool in the city's development strategy. By staying informed and engaged, Cleveland's residents and businesses can actively participate in shaping the city's tax landscape and, by extension, its future prosperity.

How often are sales tax rates updated in Cleveland?

+Sales tax rates in Cleveland are subject to periodic updates to reflect the changing needs of the city. While there is no set schedule for these updates, they are typically made when there is a need to adjust tax rates to align with economic conditions or to fund specific initiatives. It’s essential to stay informed through official sources to ensure you have the most current information.

Are there any items exempt from sales tax in Cleveland?

+Yes, certain items are exempt from sales tax in Cleveland. This includes most groceries and food items for home consumption, prescription drugs, and certain medical devices. Additionally, some services, such as legal and professional services, are exempt from sales tax. It’s important to consult the official tax guidelines for a comprehensive list of exempt items.

How does the sales tax impact small businesses in Cleveland?

+The sales tax can have a significant impact on small businesses in Cleveland. It influences their pricing strategies and profitability, as they must factor in the tax when setting prices. Additionally, small businesses may face challenges in collecting and remitting sales tax, requiring careful record-keeping and compliance with tax regulations. Supportive tax policies and initiatives can help alleviate these challenges and promote the growth of small businesses.