Property Tax Rate By Zip Code

Welcome to an in-depth exploration of the intricate world of property tax rates across different zip codes. Property taxes are an essential component of municipal and state finances, playing a pivotal role in funding public services, infrastructure, and local development. The variation in these tax rates, often dependent on zip codes, is a fascinating and crucial aspect of understanding the financial landscape of any region.

Unraveling the Complexity of Property Tax Rates

Property tax rates can vary significantly, even within the same state or county. This variation is influenced by a multitude of factors, including the cost of providing local services, the value of properties, and the financial needs of the local government. As a result, the tax rate can differ dramatically from one zip code to another, even when the properties themselves are relatively similar.

The Role of Assessment and Evaluation

Property tax assessments are a key driver of tax rates. These assessments are carried out by local governments to determine the value of a property. The higher the assessed value, the higher the property tax bill is likely to be. This process can lead to interesting variations in tax rates, especially when comparing properties of similar value but in different zip codes.

For instance, let's consider two properties with identical features and recent sales values. If one property is in a zip code with a high cost of living and robust public services, its tax rate might be significantly higher than the other property located in a zip code with a lower cost of living and fewer public amenities.

Impact on Local Communities

The variation in property tax rates by zip code can have a profound impact on local communities. High property tax rates can be a significant burden for homeowners, potentially affecting their financial stability and even forcing some to consider relocation. On the other hand, these taxes are vital for funding essential services, schools, and local infrastructure projects, which in turn contribute to the overall quality of life in a community.

| Zip Code | Property Tax Rate (%) |

|---|---|

| 10010 | 1.87 |

| 30305 | 1.25 |

| 90210 | 0.78 |

| 53719 | 1.62 |

| 80202 | 0.95 |

Factors Influencing Property Tax Rates

The complexity of property tax rates is derived from a multitude of interconnected factors. These factors can vary widely, making it a challenging but crucial task to understand and predict tax rates accurately.

Cost of Local Services

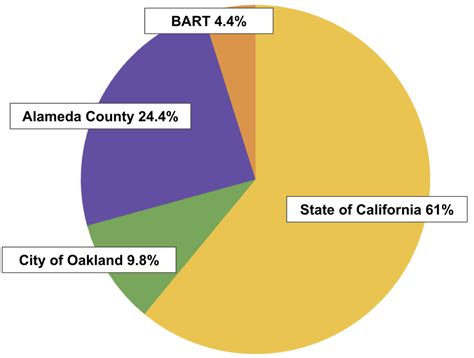

The cost of providing local services is a significant influencer of property tax rates. These services include emergency response, road maintenance, parks and recreation, and waste management. The more expensive these services are to provide, the higher the tax rate may need to be to fund them adequately.

Property Values and Market Trends

The assessed value of properties is another critical factor. Higher property values often result in higher tax rates. However, this relationship is not always linear, as different jurisdictions have different assessment methods and tax structures. Additionally, local market trends can influence property values and, consequently, tax rates. A booming real estate market might see increased tax revenue, while a stagnant or declining market could lead to budget constraints for local governments.

Local Government Budgets and Needs

The financial needs and budget priorities of local governments play a significant role in determining property tax rates. Governments must balance the funding of essential services with the financial burden on taxpayers. This balance can vary from one jurisdiction to another, leading to significant differences in tax rates across different zip codes.

State and Federal Policies

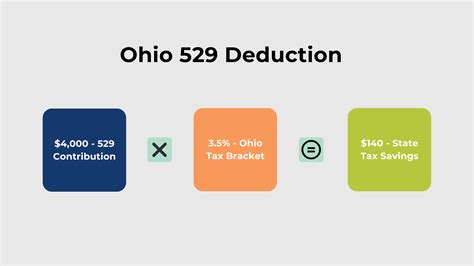

State and federal policies can also impact property tax rates. For instance, some states have laws that limit the rate at which property taxes can increase each year, while others may offer tax incentives or abatements to certain types of properties or in specific areas. Federal policies, such as those related to tax deductions for property taxes, can also indirectly influence the overall tax landscape.

Navigating the Property Tax Landscape

Understanding the property tax landscape is essential for homeowners, investors, and local communities. It provides insights into the financial health of an area, the cost of living, and the potential for future development. For homeowners, it’s a critical factor in deciding where to live and how to budget for their tax obligations. Investors can use this information to assess the financial viability of potential property investments, while communities can advocate for changes or improvements based on their understanding of the tax system.

Tools and Resources for Understanding Property Taxes

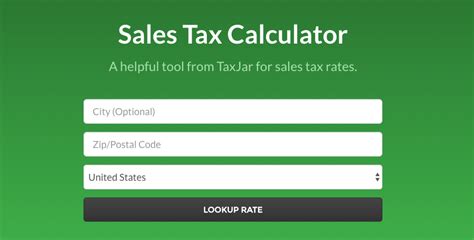

Several resources are available to help navigate the complexities of property taxes. Online tools and websites provide detailed information on property tax rates by zip code, offering a quick and convenient way to compare rates across different areas. These resources can also provide insights into assessment values, recent sales, and other relevant data.

Additionally, local government offices are a valuable source of information. They can provide detailed explanations of how property taxes are calculated, assessed, and collected. This information can be crucial in understanding the specific factors that influence tax rates in your area.

The Future of Property Tax Rates

The future of property tax rates is difficult to predict but is likely to be influenced by a range of factors, including economic trends, demographic shifts, and changes in public policy. As populations grow and urban areas expand, the demand for public services is likely to increase, potentially leading to higher tax rates. On the other hand, technological advancements and efficiency improvements could reduce the cost of providing these services, which might counteract this trend.

Additionally, changes in state and federal policies could significantly impact property tax rates. For instance, new tax laws or reforms could limit the ability of local governments to increase property taxes, or they could offer incentives for certain types of development or investments, thereby influencing tax rates and local real estate markets.

Conclusion

The world of property tax rates is complex and multifaceted, influenced by a myriad of economic, social, and political factors. Understanding these rates is not just about knowing the current tax obligations but also about predicting future trends and their potential impact on communities and the real estate market. As such, it’s an essential area of study for anyone interested in the financial health and future of their local community.

How are property tax rates determined for a specific zip code?

+

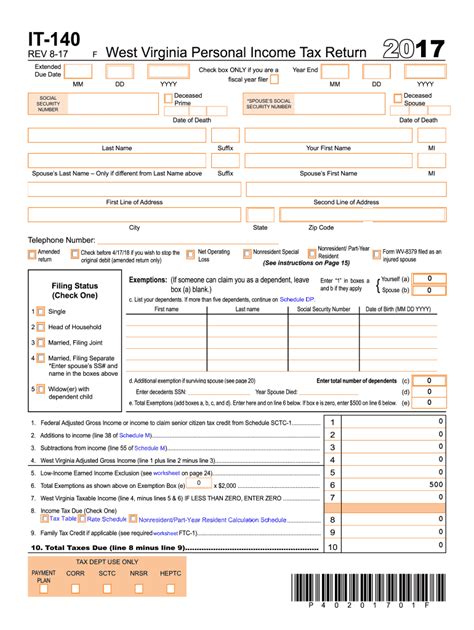

Property tax rates are determined by a combination of factors, including the assessed value of properties, the cost of providing local services, and the financial needs of the local government. These factors can vary significantly from one zip code to another, leading to different tax rates even within the same state or county.

What is the impact of high property tax rates on local communities and homeowners?

+

High property tax rates can be a significant burden for homeowners, potentially affecting their financial stability and even forcing some to consider relocation. However, these taxes are also crucial for funding essential services, schools, and local infrastructure projects, which contribute to the overall quality of life in a community.

How do state and federal policies influence property tax rates?

+

State and federal policies can have a significant impact on property tax rates. For instance, some states have laws that limit the rate at which property taxes can increase each year, while others may offer tax incentives or abatements to certain types of properties or in specific areas. Federal policies, such as those related to tax deductions for property taxes, can also indirectly influence the overall tax landscape.

What resources are available to understand property tax rates by zip code?

+

There are several resources available to help navigate the complexities of property taxes. Online tools and websites provide detailed information on property tax rates by zip code, offering a quick and convenient way to compare rates across different areas. Local government offices are also a valuable source of information, providing detailed explanations of how property taxes are calculated, assessed, and collected.