Mo Vehicle Sales Tax Calculator

Welcome to the ultimate guide on understanding and calculating Missouri's vehicle sales tax. In the state of Missouri, when you purchase a vehicle, whether new or used, you are required to pay a sales tax. This tax contributes to the state's revenue and infrastructure development. In this comprehensive article, we will delve into the intricacies of the Mo Vehicle Sales Tax Calculator, providing you with all the information you need to navigate this process with ease.

Understanding the Mo Vehicle Sales Tax

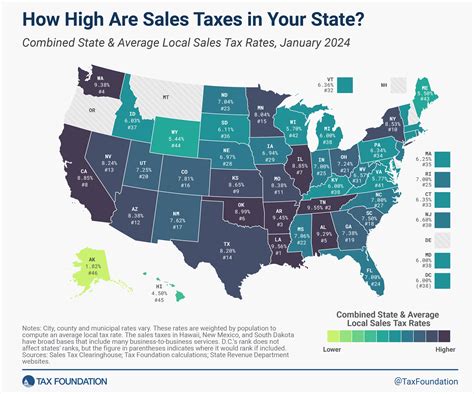

Missouri imposes a sales tax on the purchase of vehicles, which includes cars, trucks, motorcycles, and even recreational vehicles (RVs). The sales tax rate is determined by a combination of state and local taxes, which can vary across different regions within the state. Understanding the tax structure is crucial for calculating the exact amount you'll owe when buying a vehicle.

State Sales Tax

The state of Missouri has a uniform sales tax rate of 4.225% for vehicle purchases. This rate is applicable across the state and is a standard component of the sales tax calculation.

Local Sales Tax

In addition to the state sales tax, Missouri allows local governments to impose their own sales taxes. These local taxes can vary significantly from one city or county to another. It is essential to consider these local rates when calculating the total sales tax for your vehicle purchase.

For instance, let's consider the city of St. Louis, which has a local sales tax rate of 3.25%. When combined with the state sales tax, the total sales tax rate for vehicle purchases in St. Louis is 7.475%. On the other hand, in a rural county like Ozark, the local sales tax might be lower, resulting in a total sales tax rate of 5.725%.

| County/City | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| St. Louis | 3.25% | 7.475% |

| Ozark County | 1.5% | 5.725% |

| Jefferson City | 2.5% | 6.725% |

| Kansas City | 3.75% | 8.225% |

Calculating Vehicle Sales Tax with Mo Calculator

To simplify the process of calculating vehicle sales tax in Missouri, we've developed the Mo Vehicle Sales Tax Calculator. This calculator takes into account both the state and local sales tax rates to provide you with an accurate estimate of the sales tax you'll owe on your vehicle purchase.

Using the Mo Calculator

Our calculator is user-friendly and designed to guide you through the process step by step. Here's how you can use it:

- Enter the purchase price of your vehicle. This should be the total amount you are paying for the vehicle, including any additional fees and options.

- Select your county or city from the dropdown menu. Our calculator is equipped with a comprehensive database of local sales tax rates, ensuring accuracy.

- Click the "Calculate" button, and our calculator will instantly provide you with the estimated sales tax amount you'll need to pay.

For instance, let's say you're purchasing a used car in Kansas City for $20,000. By entering this information into our calculator and selecting Kansas City as your location, you'll find that the estimated sales tax amount is $1,645. This calculation takes into account the state sales tax rate of 4.225% and the local sales tax rate of 3.75% for Kansas City.

Understanding the Sales Tax Breakdowns

When calculating sales tax, it's important to understand how the tax is applied to your vehicle purchase. Here's a breakdown of how sales tax is calculated:

State Sales Tax Calculation

The state sales tax is applied to the full purchase price of the vehicle. For a vehicle costing $20,000, the state sales tax calculation would be:

Purchase Price x State Sales Tax Rate = State Sales Tax

$20,000 x 0.04225 = $845

Local Sales Tax Calculation

The local sales tax is also applied to the full purchase price of the vehicle. For the same vehicle in Kansas City, the local sales tax calculation would be:

Purchase Price x Local Sales Tax Rate = Local Sales Tax

$20,000 x 0.0375 = $750

Total Sales Tax Calculation

The total sales tax is the sum of the state and local sales taxes. For our example, the total sales tax would be:

State Sales Tax + Local Sales Tax = Total Sales Tax

$845 + $750 = $1,595

This means that for a $20,000 vehicle purchase in Kansas City, the total sales tax amount would be $1,595.

Factors Affecting Sales Tax Calculations

While the Mo Vehicle Sales Tax Calculator provides accurate estimates, there are a few factors that can influence the final sales tax amount:

Trade-Ins and Rebates

If you're trading in your old vehicle or receiving rebates on your new purchase, these factors can impact the final sales tax calculation. In such cases, the sales tax is typically calculated based on the net purchase price after deductions.

Special Programs and Exemptions

Missouri offers certain tax exemptions and special programs for specific types of vehicles or buyers. For instance, there are tax exemptions for disabled individuals, military personnel, and certain types of alternative fuel vehicles. Understanding these programs can help you determine if you're eligible for any tax savings.

Tips for Saving on Sales Tax

While sales tax is a necessary expense when purchasing a vehicle, there are a few strategies you can employ to potentially save on your sales tax obligations:

Research Local Sales Tax Rates

As we've seen, local sales tax rates can vary significantly across Missouri. If you have the flexibility to choose where to purchase your vehicle, consider researching the local sales tax rates in different counties or cities. By selecting a location with a lower local sales tax rate, you can potentially save a considerable amount.

Consider Vehicle Pricing Strategies

When negotiating the price of your vehicle, keep in mind that sales tax is calculated based on the purchase price. By securing a lower purchase price, you can reduce the overall sales tax you'll owe. This strategy can be particularly effective when combined with trade-ins or rebates.

Explore Tax Exemptions

As mentioned earlier, Missouri offers various tax exemptions and special programs. Take the time to research and understand these programs. If you qualify for any exemptions, you can potentially reduce your sales tax burden significantly.

Frequently Asked Questions (FAQ)

Are there any online tools to calculate vehicle sales tax in Missouri?

+Yes, the Mo Vehicle Sales Tax Calculator is an online tool specifically designed to calculate sales tax for vehicle purchases in Missouri. It takes into account both state and local sales tax rates to provide accurate estimates.

How often do local sales tax rates change in Missouri?

+Local sales tax rates in Missouri can change periodically, typically as a result of local government decisions or ballot initiatives. It's important to verify the current local sales tax rate for your specific location to ensure accurate calculations.

Can I negotiate the sales tax amount when purchasing a vehicle in Missouri?

+Sales tax rates in Missouri are set by law and cannot be negotiated. However, you can negotiate the purchase price of the vehicle, which will indirectly impact the sales tax amount you owe.

Are there any alternatives to paying sales tax when buying a vehicle in Missouri?

+While sales tax is a mandatory expense when purchasing a vehicle in Missouri, there are certain tax exemptions and special programs that can reduce or eliminate your sales tax obligations. It's worth exploring these options to see if you qualify for any savings.

What happens if I fail to pay the sales tax on my vehicle purchase in Missouri?

+Failing to pay the sales tax on your vehicle purchase in Missouri can result in penalties and interest. It's important to ensure that you pay the correct sales tax amount to avoid any legal complications and financial consequences.

In conclusion, understanding and calculating Missouri’s vehicle sales tax is crucial when purchasing a vehicle. The Mo Vehicle Sales Tax Calculator simplifies this process by providing accurate estimates based on your purchase price and location. By familiarizing yourself with the state and local sales tax rates, you can make informed decisions and potentially save on your sales tax obligations. Remember to explore tax exemptions and negotiate pricing strategies to maximize your savings.