Florida Sales Tax

The Florida sales tax is a consumption tax levied on the sale of goods and some services within the state of Florida, United States. It is an essential component of the state's revenue system, contributing significantly to its overall budget. The Florida Department of Revenue (DOR) is responsible for administering and collecting this tax, ensuring compliance and providing clarity on applicable rates and regulations.

Understanding Florida Sales Tax

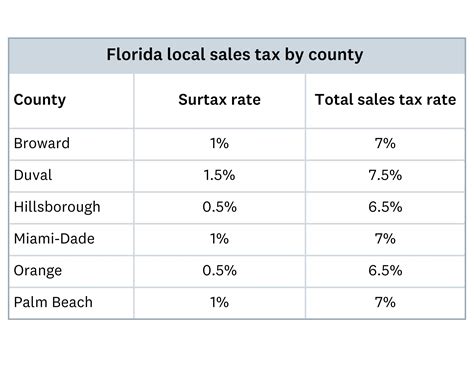

The Florida sales tax is a multi-faceted tax structure, comprising both state-level and local-level taxes. The state sales tax rate is 6%, one of the lower rates among US states. However, when combined with local sales taxes, the total sales tax rate can vary significantly across different counties and municipalities within Florida.

For instance, the city of Tampa has a combined sales tax rate of 7.5%, including the state sales tax and a local sales tax of 1.5%. Conversely, the city of Miami has a higher combined rate of 8%, with a local sales tax of 2% added to the state tax. These local sales taxes are used to fund specific community projects, infrastructure development, and other municipal initiatives.

In addition to the general sales tax, Florida also imposes a discretionary sales surtax in certain counties. This surtax is an additional percentage levied on top of the state and local sales taxes, and its rate can vary from 0% to 1.5%. The revenue generated from this surtax is typically used for county-specific projects, such as transportation improvements or environmental initiatives.

| Location | State Sales Tax | Local Sales Tax | Combined Rate |

|---|---|---|---|

| Tampa | 6% | 1.5% | 7.5% |

| Miami | 6% | 2% | 8% |

| Orlando | 6% | 1% | 7% |

Exemptions and Special Considerations

While the Florida sales tax applies to most tangible personal property and some services, there are several notable exemptions and special considerations to be aware of. These include:

- Groceries: Most unprepared food items are exempt from sales tax, including fresh produce, meats, dairy products, and bread. However, prepared foods and certain beverages like soft drinks and alcoholic beverages are taxable.

- Prescription Drugs: Sales of prescription drugs are exempt from sales tax, providing relief for individuals with medical needs.

- Educational Materials: Textbooks, educational software, and other materials directly related to education are generally exempt from sales tax.

- Certain Services: Services like legal, accounting, and certain types of repairs are exempt from sales tax.

- Tourist Development Tax: In addition to sales tax, a Tourist Development Tax (TDT) is levied on short-term rentals, such as hotel stays and vacation rentals, with rates varying between 1% and 6% depending on the county.

Compliance and Enforcement

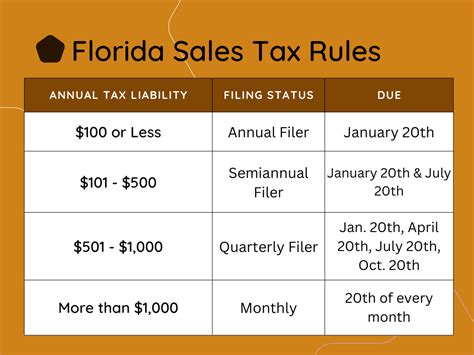

Ensuring compliance with the Florida sales tax is a critical responsibility for both businesses and consumers. The Florida DOR has comprehensive guidelines and resources available to help navigate the sales tax landscape. Businesses are required to register with the DOR, collect the appropriate sales tax on taxable goods and services, and remit these collections to the state on a regular basis.

The DOR conducts regular audits to ensure compliance. Non-compliance can result in penalties, interest charges, and potential legal consequences. It is important for businesses to maintain accurate records and understand their sales tax obligations to avoid these penalties.

Online Sales and Remote Sellers

With the rise of e-commerce, the collection of sales tax from online sales has become a critical issue. Florida, like many other states, requires remote sellers to collect and remit sales tax if they meet certain economic thresholds. These thresholds are based on the seller’s gross revenue or the number of transactions within the state.

To facilitate compliance, the Florida DOR provides resources and guidance for remote sellers, including information on Sales Tax Nexus, the point at which a business is considered to have a substantial enough connection with the state to be required to collect sales tax.

The Economic Impact of Florida Sales Tax

The Florida sales tax plays a crucial role in the state’s economy, generating significant revenue for state and local governments. This revenue is used to fund essential services, including education, healthcare, infrastructure development, and public safety. In 2022, the state collected over $10 billion in sales and use taxes, accounting for approximately 30% of the state’s general revenue fund.

The sales tax also influences consumer behavior. While the tax may discourage some purchases, it also encourages consumers to seek out tax-free alternatives or shop in areas with lower sales tax rates. This can impact business locations and strategies, particularly in border areas where consumers may cross state lines to take advantage of lower tax rates.

Furthermore, the sales tax system in Florida, with its varying local rates, can provide an economic development tool for local governments. By adjusting local sales tax rates, municipalities can attract businesses and stimulate economic growth in their areas.

The Future of Florida Sales Tax

As Florida’s economy continues to evolve, so too will its sales tax system. The rise of e-commerce and remote sellers presents ongoing challenges and opportunities for tax administration. The state will need to adapt its policies and technologies to ensure effective collection and compliance in this changing landscape.

Additionally, discussions around sales tax reform are ongoing. Some proposals suggest simplifying the tax system by standardizing rates across the state, while others advocate for a shift towards a broader-based tax system that could include services. These reforms aim to enhance fairness, efficiency, and competitiveness in the state's tax system.

What is the current Florida state sales tax rate?

+The current Florida state sales tax rate is 6%.

Are there any counties in Florida with a 0% sales tax rate?

+Yes, some counties in Florida have a 0% local sales tax rate, resulting in a combined state and local sales tax rate of 6%, which is the state sales tax rate.

How often does the Florida sales tax rate change?

+The Florida state sales tax rate has remained at 6% for several years. However, local sales tax rates can change more frequently, often with the approval of local voters or governing bodies.

Are there any plans to change the Florida sales tax system in the near future?

+There are ongoing discussions about sales tax reform in Florida, but no concrete plans have been announced yet. Any changes would likely involve extensive public consultation and legislative processes.