Land Taxes In Ohio

Land taxes in Ohio, a state in the Midwestern United States, are an essential component of the state's revenue system and play a crucial role in funding various public services and infrastructure. The Ohio Department of Taxation is responsible for administering property taxes, which include taxes on real estate, personal property, and public utilities. These taxes are a significant source of revenue for local governments, including counties, cities, townships, and school districts, allowing them to provide essential services such as education, public safety, and infrastructure maintenance.

The land tax system in Ohio is designed to ensure fairness and equity, taking into account the value of the property and the services provided to the property owners. The tax rate varies depending on the location and type of property, with different tax rates applied to residential, commercial, and agricultural properties. Additionally, Ohio offers several exemptions and deductions to reduce the tax burden on certain properties and individuals, promoting economic development and supporting vulnerable populations.

Understanding Land Taxes in Ohio: A Comprehensive Guide

Ohio's land tax system is a complex yet crucial aspect of the state's financial landscape. It is essential for property owners to have a thorough understanding of how land taxes are assessed, calculated, and applied to ensure compliance and make informed financial decisions. This comprehensive guide aims to demystify the land tax process in Ohio, providing a detailed overview of the key aspects, from tax assessment to payment.

Tax Assessment and Valuation

The first step in the land tax process is the assessment of the property's value. In Ohio, the county auditor is responsible for determining the taxable value of each property. This valuation is typically based on the property's market value, taking into account factors such as location, size, improvements, and recent sales of similar properties. The auditor's office conducts regular reappraisals to ensure that property values remain up-to-date and accurate.

Property owners have the right to appeal their assessed value if they believe it is incorrect. The appeals process involves submitting documentation and evidence to support a lower valuation. It is important for property owners to stay informed about their property's assessed value and understand the factors that influence it, as this directly impacts the amount of land tax they will owe.

Tax Rates and Calculation

Once the property's value has been determined, the applicable tax rate is applied to calculate the land tax due. Tax rates in Ohio can vary significantly depending on the location and type of property. Each county, city, township, and school district sets its own tax rates, which are expressed as millage rates. One mill is equivalent to one-tenth of a cent, or $0.001. The millage rate is multiplied by the property's taxable value to determine the tax amount.

For example, if a residential property has a taxable value of $200,000 and the applicable millage rate is 50 mills, the land tax calculation would be as follows: $200,000 x 0.050 = $10,000. This means the property owner would owe $10,000 in land taxes for that tax year.

| Property Type | Taxable Value | Millage Rate | Land Tax Due |

|---|---|---|---|

| Residential | $200,000 | 50 mills | $10,000 |

| Commercial | $350,000 | 60 mills | $21,000 |

| Agricultural | $150,000 | 40 mills | $6,000 |

It is worth noting that tax rates can change from year to year, and property owners should stay updated on any adjustments made by their local taxing authorities.

Tax Exemptions and Deductions

Ohio offers a range of tax exemptions and deductions to reduce the tax burden on certain properties and individuals. These exemptions and deductions are designed to promote specific public policy goals, such as encouraging homeownership, supporting veterans, and providing relief to low-income households.

One of the most common exemptions is the Homestead Exemption, which provides a reduction in the taxable value of a property for homeowners who use the property as their primary residence. This exemption helps make homeownership more affordable and encourages long-term residency. Other exemptions include those for senior citizens, disabled individuals, and veterans.

Deductions, on the other hand, reduce the taxable value of the property by a certain percentage or amount. For instance, the Agricultural Use Value deduction allows agricultural land to be taxed based on its agricultural value rather than its market value, benefiting farmers and promoting agricultural production. Understanding the available exemptions and deductions is essential for property owners to optimize their tax liability.

Tax Payment and Due Dates

Land taxes in Ohio are typically due twice a year, with payment deadlines falling around March 15th and September 15th. Property owners receive tax bills from their county treasurer, detailing the amount due, payment options, and any applicable penalties for late payments. It is crucial to note that failing to receive a tax bill does not relieve the property owner of their tax obligation.

Ohio offers various payment methods, including online payments, mail-in payments, and in-person payments at the county treasurer's office. Property owners can also opt for automatic payment plans or set up direct withdrawals from their bank accounts to ensure timely payments and avoid late fees.

For those facing financial difficulties, Ohio provides options for tax relief, such as the Tax Delinquency Amnesty Program, which offers a reduced penalty for late payments. Additionally, property owners can explore tax installment plans to manage their tax obligations over a more extended period.

The Impact of Land Taxes on Ohio's Economy and Communities

Land taxes in Ohio have a significant impact on the state's economy and the well-being of its communities. As a primary source of revenue for local governments, these taxes directly influence the provision of essential public services and the overall economic health of the state.

Funding Public Services and Infrastructure

Land taxes play a vital role in funding critical public services, including education, public safety, and infrastructure maintenance. The revenue generated from land taxes allows local governments to invest in schools, police and fire departments, emergency services, and the maintenance and improvement of roads, bridges, and other public facilities.

For example, a portion of the land taxes collected in Ohio is allocated to the Local Government Fund, which provides financial assistance to local governments, particularly those with limited tax bases. This fund helps ensure that all communities have access to adequate public services, regardless of their tax revenue.

Economic Development and Business Growth

Ohio's land tax system also has implications for economic development and business growth. The tax rates and incentives offered can influence business decisions regarding location and expansion. A favorable tax climate can attract new businesses and investments, leading to job creation and economic growth.

Ohio offers various tax incentives to promote business growth, such as the Job Creation Tax Credit, which provides tax credits to businesses that create new jobs in the state. Additionally, the state's Enterprise Zone Program provides tax benefits to businesses that locate or expand in designated economically distressed areas, encouraging economic development and revitalizing communities.

Equity and Social Justice

The land tax system in Ohio aims to promote fairness and equity. By considering the value of the property and the services provided to the property owner, the tax burden is distributed equitably among property owners. The availability of tax exemptions and deductions further ensures that vulnerable populations, such as low-income households and senior citizens, are not disproportionately burdened by land taxes.

Furthermore, Ohio's land tax system supports social justice initiatives by investing in education and community development. A significant portion of the land tax revenue is allocated to public education, ensuring that all children have access to quality education, regardless of their socioeconomic background. This investment in education has long-term benefits for the state's economy and society as a whole.

Navigating the Future: Trends and Challenges in Ohio's Land Tax System

Ohio's land tax system, like any other, is subject to ongoing changes and evolving challenges. As the state's economy and demographics shift, the tax landscape must adapt to meet the changing needs of its communities. Understanding these trends and challenges is crucial for policymakers, taxpayers, and stakeholders to make informed decisions and ensure the sustainability and effectiveness of the land tax system.

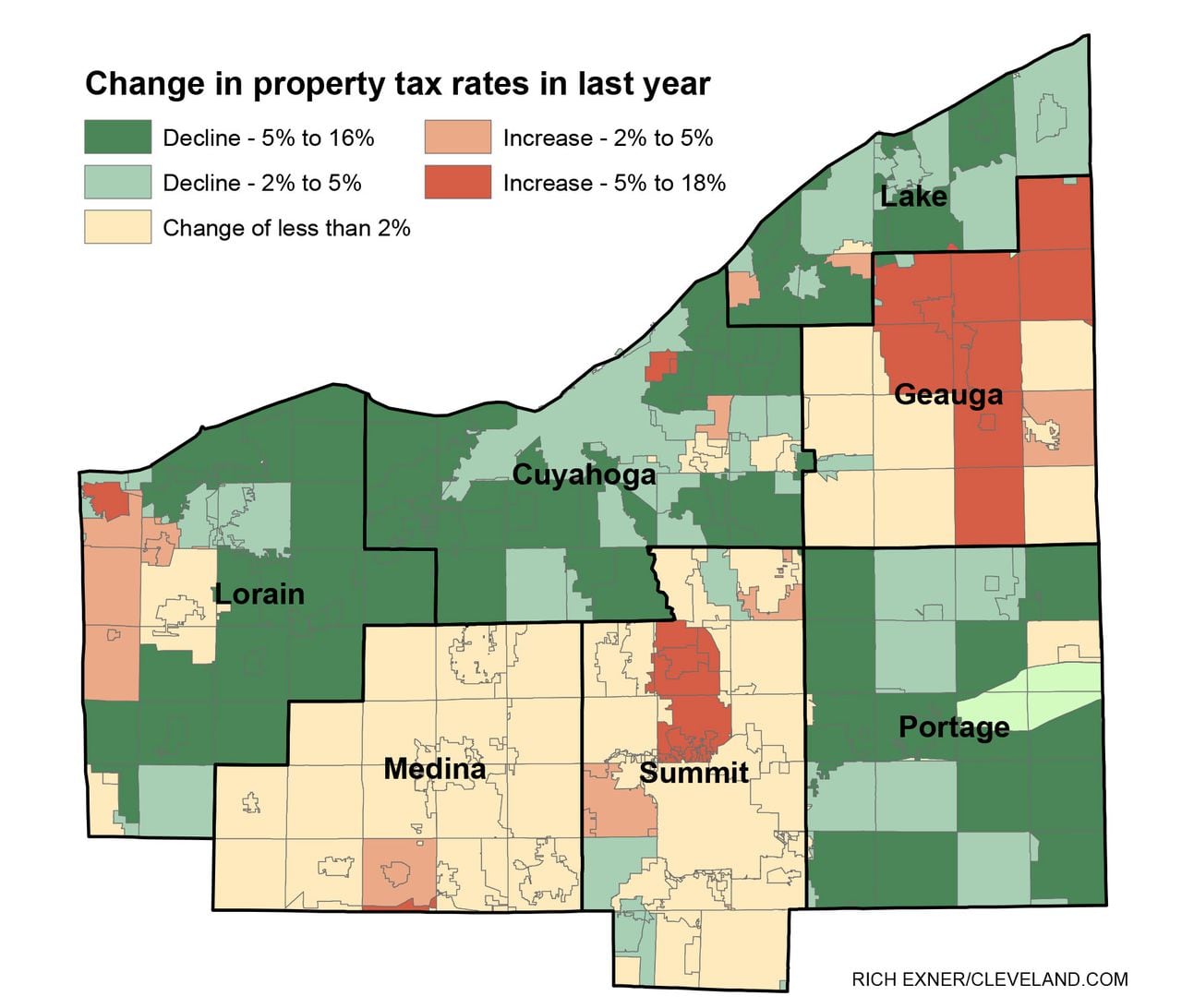

Changing Demographics and Property Values

Ohio's demographics are undergoing significant transformations, with an aging population and changing migration patterns. These demographic shifts can impact property values and, consequently, land tax revenue. As older residents downsize or move out of state, it can lead to a decrease in property values and tax revenue in certain areas. On the other hand, growing urban centers may experience increased property values and tax revenue as younger professionals and families move in.

To address these demographic shifts, Ohio's land tax system must be flexible and adaptable. This may involve adjusting tax rates and reassessing the distribution of tax revenue to ensure that all communities receive adequate funding for essential services, regardless of their demographic composition.

Economic Fluctuations and Tax Revenue

Economic fluctuations, such as recessions and economic downturns, can significantly impact land tax revenue. During economic downturns, property values may decline, leading to a decrease in tax revenue. This can put strain on local governments' budgets, affecting their ability to provide essential services and maintain infrastructure.

To mitigate the impact of economic fluctuations, Ohio's land tax system should consider implementing measures such as reserve funds or revenue stabilization plans. These strategies can help local governments weather economic downturns and maintain a stable source of revenue for critical services.

Technology and Tax Administration

Advancements in technology are transforming the way land taxes are administered and collected. Ohio's tax authorities are increasingly leveraging technology to improve efficiency, accuracy, and transparency in the tax assessment and collection process. This includes the use of geographic information systems (GIS) for property mapping and valuation, online tax payment portals, and digital record-keeping systems.

However, with the increasing reliance on technology, there are also challenges to address. Ensuring data security and privacy, as well as providing access to technology for all taxpayers, regardless of their digital literacy or access to resources, are crucial considerations. Ohio's tax authorities must strike a balance between embracing technological advancements and ensuring that the tax system remains accessible and equitable for all taxpayers.

Policy Reforms and Tax Equity

The ongoing discussion around tax equity and fairness is a critical aspect of Ohio's land tax system. As the state's economy and society evolve, there is a need to continuously evaluate and reform tax policies to ensure they remain fair and equitable for all taxpayers.

Policy reforms may involve reevaluating tax rates, reassessing the distribution of tax revenue, and exploring new tax incentives or exemptions. For example, Ohio could consider implementing a land value tax, which taxes the value of the land itself rather than the improvements made on it. This approach has the potential to promote economic efficiency and discourage land speculation, while also providing a more stable and equitable tax base.

Frequently Asked Questions (FAQ)

How often are property values reassessed in Ohio for tax purposes?

+Property values in Ohio are typically reassessed every three years. However, some counties may conduct reassessments more frequently, especially in areas with rapidly changing property values. It's important for property owners to stay informed about their county's reassessment schedule to ensure they are aware of any changes in their property's taxable value.

Can I appeal my property's assessed value if I believe it is inaccurate?

+Yes, Ohio law provides property owners with the right to appeal their assessed value. The appeals process involves submitting an appeal to the county Board of Revision, presenting evidence and documentation to support your claim, and attending a hearing if necessary. It's important to gather supporting evidence, such as recent sales of similar properties or appraisals, to strengthen your case.

What happens if I miss the deadline to pay my land taxes in Ohio?

+If you miss the deadline to pay your land taxes in Ohio, you may be subject to late payment penalties and interest charges. The specific penalties and interest rates can vary depending on the county and the length of the delay. It's important to contact your county treasurer's office to discuss your options and explore potential payment plans to avoid further penalties.

Are there any tax relief programs available for low-income homeowners in Ohio?

+Yes, Ohio offers several tax relief programs to assist low-income homeowners. One notable program is the Property Tax Reduction program, which provides a credit on the homeowner's property tax bill based on their income and property value. Additionally, the Homestead Exemption can provide significant tax savings for eligible low-income homeowners. It's recommended to consult with your local tax authority or a tax professional to determine your eligibility for these programs.

How can I stay updated on changes to land tax rates and policies in Ohio?

+To stay informed about changes to land tax rates and policies in Ohio, you can regularly check the websites of your local tax authorities, such as your county auditor's office and county treasurer's office. These websites often provide updates on tax rate changes, reassessment schedules, and any new policies or programs. Additionally, you can subscribe to their newsletters or follow their social media accounts for timely updates.

Ohio's land tax system is a dynamic and integral part of the state's financial landscape, impacting property owners, local governments, and the overall economy. By understanding the assessment process, tax rates, exemptions, and payment options, property owners can navigate the land tax system with confidence. Additionally, recognizing the broader implications of land taxes on public services, economic development, and social justice highlights the critical role these taxes play in shaping Ohio's communities.

As Ohio continues to evolve, the land tax system must adapt to meet the changing needs of its residents and businesses. By staying informed about demographic shifts, economic fluctuations, technological advancements, and policy reforms, taxpayers and stakeholders can actively participate in shaping a fair and sustainable tax system that supports the growth and well-being of Ohio’s communities.