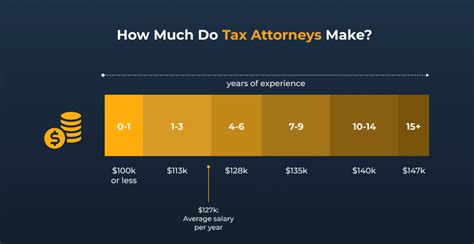

Uncovering the Impact of Experience on Tax Attorney Salary Growth

In the complex labyrinth of tax law, the role of experience is often quantified not just by years, but by the nuanced depth of knowledge, client trust, and strategic problem-solving skills imbued over time. While initial salary figures for tax attorneys may seem modest, a closer look reveals that accumulated experience significantly influences salary growth trajectories, shaping career excellence and financial reward in ways that are both predictable and multifaceted. This behind-the-scenes exploration uncovers how experience molds the earning potential of tax attorneys, charting the evolution of professional value within this specialized legal domain.

Decoding the Relationship Between Experience and Tax Attorney Salary Growth

Understanding how experience impacts salary growth in the tax law sector requires a deep dive into industry standards, skill development patterns, and market demand dynamics. At its core, the correlation between experience and remuneration is rooted in mastery of complex regulatory frameworks—like the Internal Revenue Code (IRC), state tax statutes, and international tax treaties—that demand years of focused study and practice. Moreover, seasoned tax attorneys tend to develop a robust network of professional relationships, enabling them to access higher-profile cases or lucrative consulting engagements.

The Evolution of Compensation: From Entry-Level to Senior Partner

At the entry level, tax attorneys typically attract salaries ranging between 60,000 and 100,000, depending on geographic region, firm size, and prior academic background. As they accrue experience—three to five years—they often see salary increments driven by increased proficiency, client portfolios, and strategic advisory abilities. Mid-career professionals, with seven to ten years in the field, can command between 120,000 and 200,000, especially when their expertise extends into niche areas like transfer pricing or international taxation.

Further along the career path, senior attorneys and partners often reach compensation levels exceeding 300,000 annually, with some elite practitioners surpassing 1 million annually, driven by their ability to secure high-stakes, high-value cases or advisory roles for multinational corporations. The trajectory of salary growth is thus nonlinear; early experience catalyzes foundational skills, while subsequent deepening of expertise and expanded industry influence accelerate earning potential.

The Underlying Mechanics: Why Experience Matters so Much

Several interdependent factors underpin the significant impact of experience on tax attorney salaries. Firstly, technical mastery developed through years of dealing with evolving tax laws ensures attorneys can provide nuanced advice that minimizes liability while optimizing financial outcomes. This depth of expertise becomes increasingly valuable to clients seeking trusted counsel capable of navigating complex legal landscapes.

Secondly, experience breeds industry recognition, which translates into higher client retention and referrals. Experienced attorneys often assume leadership roles within firms, oversee junior staff, and play pivotal parts in firm management—responsibilities that justify salary premiums. Thirdly, seasoned practitioners tend to cultivate relationships with influential policymakers, regulators, and corporate executives, fostering opportunities for high-profile engagements that further amplify their earning capacity.

Finally, the evolution of an attorney’s professional reputation—from being an eager novice to a recognized authority—serves as a multiplier effect, enhancing bargaining power and enabling the pursuit of specialized, and often more remunerative, niches within tax law.

| Relevant Category | Substantive Data |

|---|---|

| Average Salary for Entry-Level Tax Attorneys | $60,000–$100,000; increases with geographic and institutional factors |

| Mid-Career Salary Range | $120,000–$200,000; driven by expertise development and specialization |

| Senior Partner Compensation | $300,000–$1,000,000+; influenced by reputation, client base, and leadership roles |

How Niche Specializations Amplify Salary Progression

The impact of experience is further magnified when tax attorneys develop expertise in certain high-demand niches. Transfer pricing, international tax planning, and estate tax—areas requiring intensive knowledge and strategic foresight—are areas where experience directly correlates with compensational escalations. Mastery in such domains not only elevates an attorney’s marketability but also enables their involvement in multi-million dollar deals or policy advisories.

Practitioners who diversify their experience by gaining certifications or cross-disciplinary knowledge—such as international business, economics, or finance—stand to command even higher premiums. This phenomenon underscores the importance of continual learning and specialization as accelerants of salary growth over the lifespan of a legal career.

The Role of Volatility and Market Dynamics

While experience generally correlates with higher income, external market forces can modify this relationship. Fluctuations in economic cycles, regulatory reforms, and technological advancements (like AI-driven tax analysis tools) influence demand for seasoned professionals. For example, during tax reform periods or economic downturns, experienced practitioners often retain their value better due to their strategic advisory capabilities.

Further, the expansion of global commerce and cross-border transactions has increased the need for international tax expertise, benefitting those with extensive experience in multijurisdictional tax planning, thereby impacting salary structures favorably.

| Relevant Category | Substantive Data |

|---|---|

| Market Influence on Salary Growth | Economy-driven fluctuations impact demand; experienced attorneys are more resilient during downturns |

| Impact of Technological Advancements | AI tools reduce routine workload, placing premium on strategic experience and nuanced judgment |

Potential Limitations and Future Outlook

Despite the strong correlation between experience and salary growth, there are limitations. The plateau effect can occur when attorneys fail to adapt to regulatory changes or technological innovations, underscoring that experience alone does not guarantee continued growth. Additionally, market saturation in certain jurisdictions or practice areas can suppress salary progression despite years of service.

Looking ahead, the trajectory of salary growth for tax attorneys will hinge on their adaptability, ongoing education, and strategic positioning within niche markets. The most successful professionals will be those who leverage their accumulated experience to innovate and anticipate industry shifts, maintaining their value in an ever-evolving landscape.

How many years of experience are typically needed to reach top-tier salaries?

+Generally, reaching top-tier salaries in tax law requires approximately 10-15 years of focused practice, with additional value gained through specialization, leadership roles, and reputation building.

What certifications enhance salary growth for experienced tax attorneys?

+Certifications such as Certified Public Accountant (CPA), LL.M. in Taxation, or Enrolled Agent (EA) status significantly enhance an attorney’s credibility and earning potential, especially as experience grows.

Does technological change diminish the value of experience in tax law?

+While technology automates routine tasks, strategic and interpretive skills rooted in experience become more valuable, shifting the emphasis from rote calculations to complex analysis and advisory expertise.