Broward County Property Tax Search

Welcome to this comprehensive guide on the Broward County Property Tax Search, a powerful tool that simplifies the process of accessing vital property-related information for residents and businesses in this vibrant Florida county. This article will delve into the intricacies of the Broward County Property Tax Search system, its features, and its impact on property owners and investors.

Unveiling the Broward County Property Tax Search

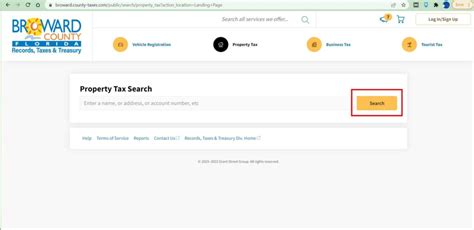

The Broward County Property Tax Search is an online portal developed by the Broward County Property Appraiser’s Office, serving as a centralized hub for property-related data and transactions. This user-friendly platform allows individuals to access a wealth of information about real estate properties within the county, making it an invaluable resource for property owners, prospective buyers, investors, and even curious neighbors.

With just a few clicks, users can explore detailed property records, understand tax assessments, and gain insights into the local real estate market. The platform's efficiency and transparency have made it an essential tool for anyone with an interest in Broward County's diverse and dynamic property landscape.

Key Features and Benefits

The Broward County Property Tax Search boasts an array of features designed to cater to a wide range of users:

- Property Search: Users can easily search for properties by address, owner name, or parcel ID, providing quick access to detailed property profiles.

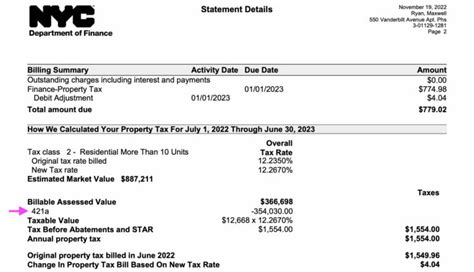

- Assessment Information: The platform offers transparent tax assessment data, including property values, tax rates, and historical assessment trends.

- Property Details: Comprehensive property details are available, including land and building characteristics, ownership history, and legal descriptions.

- Tax Payment History: Property owners can conveniently access their tax payment records, ensuring transparency and ease of reference.

- Interactive Maps: An integrated mapping tool allows users to visualize property locations, boundaries, and nearby amenities, enhancing the research experience.

- Comparative Analysis: The platform facilitates comparative property analysis, enabling users to evaluate similar properties and understand market trends.

- Notification Services: Property owners can subscribe to notification services, receiving updates on assessment changes, tax due dates, and other relevant information.

These features empower users to make informed decisions, whether it's for personal residence, investment purposes, or business ventures. The platform's user-centric design and rich data make it a go-to resource for anyone navigating the Broward County real estate landscape.

Enhancing Transparency and Efficiency

The Broward County Property Tax Search plays a pivotal role in enhancing transparency and efficiency in property-related transactions. By providing open access to detailed property information, the platform ensures that property owners, buyers, and investors have the knowledge they need to make well-informed decisions.

For property owners, the platform offers a convenient way to stay updated on their property's assessment value, tax obligations, and any changes or improvements needed to maintain or increase its value. It also simplifies the process of understanding and managing property taxes, ensuring that owners are well-prepared for tax payments and can plan their finances effectively.

Prospective buyers and investors benefit from the platform's comprehensive data, which allows them to research properties thoroughly before making any commitments. They can assess a property's value, compare it with others in the area, and understand its tax implications, all of which contribute to smarter investment decisions.

Furthermore, the platform's transparency fosters a sense of trust and fairness in the real estate market. By providing equal access to property information, it levels the playing field for all participants, ensuring that no one is at a disadvantage due to a lack of knowledge. This transparency also helps prevent potential disputes and misunderstandings, promoting a more harmonious real estate environment.

Streamlining Property Transactions

The Broward County Property Tax Search streamlines property transactions by providing a centralized repository of vital information. Real estate agents, brokers, and other professionals rely on this platform to access accurate and up-to-date property data, which is crucial for efficient and accurate listing and sales processes.

The platform's ability to provide detailed property profiles, including historical data and assessment information, allows professionals to create comprehensive listings and marketing materials. This level of detail not only attracts potential buyers but also speeds up the sales process by reducing the need for additional research and verification.

For buyers, the platform offers peace of mind, as they can verify the accuracy of property information presented to them. This verification process reduces the risk of surprises or hidden issues, making the buying experience more secure and reliable. Additionally, the platform's mapping tools and comparative analysis features assist buyers in understanding the property's context within the neighborhood and local market, enabling them to make offers with confidence.

In summary, the Broward County Property Tax Search is a powerful tool that enhances transparency, efficiency, and fairness in property transactions. Its comprehensive data, user-friendly interface, and range of features make it an indispensable resource for property owners, buyers, investors, and professionals alike. By leveraging this platform, users can navigate the Broward County real estate market with confidence and make well-informed decisions.

Navigating the Broward County Real Estate Market

The Broward County real estate market is a diverse and dynamic landscape, characterized by a mix of residential, commercial, and industrial properties. With its vibrant economy, attractive lifestyle offerings, and strategic location, Broward County has become a sought-after destination for both residents and investors.

Understanding the local market is crucial for anyone considering a property purchase or investment in Broward County. The Broward County Property Tax Search serves as an invaluable tool for market research, providing insights into property values, tax assessments, and market trends. By analyzing this data, users can make informed decisions about their real estate ventures.

Market Trends and Insights

The platform offers historical data and assessment trends, allowing users to track the performance of the real estate market over time. This information is especially beneficial for investors looking to identify emerging trends, such as rising property values in certain neighborhoods or fluctuations in tax rates.

By analyzing market trends, investors can make strategic decisions about when to buy, sell, or hold onto properties. For instance, they can identify areas with high appreciation potential or stable tax environments, which can significantly impact the profitability of their investments. The platform's data-driven approach empowers users to make decisions backed by hard facts and market insights.

Additionally, the platform's interactive maps and comparative analysis tools provide a geographic perspective on the market. Users can visualize property locations, assess proximity to amenities, and compare properties within specific neighborhoods or regions. This geographic analysis is crucial for understanding local market dynamics and identifying areas with strong potential for growth or investment.

Property Research and Due Diligence

For property buyers and investors, conducting thorough research and due diligence is essential to mitigate risks and ensure a successful transaction. The Broward County Property Tax Search simplifies this process by providing comprehensive property profiles and historical data.

Buyers can access detailed property records, including ownership history, building characteristics, and legal descriptions. This information helps them understand the property's history, potential issues, and future prospects. By researching past transactions and assessing the property's value over time, buyers can negotiate more effectively and make offers that reflect the property's true worth.

Investors, on the other hand, can leverage the platform's data to evaluate potential investment opportunities. They can analyze property values, rental yields, and tax implications to determine the profitability of a particular investment. The platform's comparative analysis tools allow investors to compare multiple properties, helping them identify the most promising opportunities and make informed investment decisions.

In conclusion, the Broward County Property Tax Search is an essential tool for navigating the local real estate market. Its comprehensive data, user-friendly interface, and market analysis features empower users to make informed decisions, whether they are buying a home, investing in real estate, or simply exploring the market. By leveraging this platform, users can stay ahead of the curve and make the most of the dynamic Broward County real estate landscape.

Future Outlook and Technological Innovations

As technology continues to advance and the real estate industry evolves, the Broward County Property Tax Search is poised to embrace new innovations and enhancements. The platform’s future outlook is focused on leveraging cutting-edge technologies to further improve the user experience and enhance the efficiency of property-related transactions.

Integrating AI and Machine Learning

One of the key areas of focus for future development is the integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies. By harnessing the power of AI, the platform can offer even more intelligent and personalized user experiences. AI-powered search algorithms can enhance the accuracy and speed of property searches, providing users with highly relevant results based on their specific needs and preferences.

Furthermore, AI can be utilized to analyze vast amounts of property data, identifying patterns and trends that may not be immediately apparent to human analysts. This advanced data analysis can provide valuable insights into market dynamics, property values, and potential investment opportunities. By leveraging AI and ML, the platform can become a powerful tool for predictive analytics, helping users make even more informed decisions.

Blockchain and Smart Contracts

The integration of blockchain technology and smart contracts is another exciting development on the horizon for the Broward County Property Tax Search. Blockchain technology offers enhanced security, transparency, and efficiency for property transactions. By utilizing blockchain, the platform can provide an immutable record of property ownership, transfers, and transactions, reducing the risk of fraud and ensuring a more secure environment for buyers, sellers, and investors.

Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, can further streamline property transactions. These contracts can automatically trigger actions based on predefined conditions, such as releasing funds upon successful property transfer or automatically updating ownership records. By leveraging smart contracts, the platform can simplify the complex process of property transactions, reducing the need for intermediaries and potential delays.

User Experience Enhancements

In addition to technological advancements, the future of the Broward County Property Tax Search will also focus on enhancing the overall user experience. This includes improvements to the platform’s usability, design, and accessibility. By conducting user research and gathering feedback, the platform developers can identify areas for improvement and implement design changes that make the platform more intuitive and user-friendly.

The integration of interactive features, such as virtual tours and 3D property visualizations, can enhance the user experience by providing a more immersive and engaging way to explore properties. Additionally, the platform can leverage user-generated content, such as reviews and ratings, to provide valuable insights and recommendations to other users. These enhancements will make the platform more accessible and appealing to a wider range of users, including those who are new to the real estate market.

In conclusion, the future of the Broward County Property Tax Search is bright, with a focus on leveraging technology to enhance the user experience and streamline property transactions. By integrating AI, machine learning, blockchain, and smart contracts, the platform will become an even more powerful tool for property owners, buyers, investors, and professionals. As technology continues to evolve, the platform will remain at the forefront, providing innovative solutions to meet the evolving needs of the real estate industry.

How often is the Broward County Property Tax Search data updated?

+The platform strives to provide the most up-to-date information. Property assessment data is typically updated annually, while other information, such as ownership changes and tax payment records, is updated regularly as new data becomes available.

Can I access historical property tax records using the platform?

+Yes, the Broward County Property Tax Search allows users to access historical property tax records dating back several years. This feature is particularly useful for conducting market research and understanding long-term property value trends.

Is the platform accessible to the general public, or is it restricted to certain users?

+The platform is designed to be accessible to the general public. Anyone with an interest in Broward County properties can access the platform and utilize its features, making it a valuable resource for a wide range of users.

How can I receive notifications about changes to my property’s assessment or tax due dates?

+You can subscribe to notification services within the platform. By providing your contact information, you’ll receive updates on assessment changes, tax due dates, and other relevant information directly to your preferred communication channel.

Are there any fees associated with using the Broward County Property Tax Search platform?

+No, accessing the Broward County Property Tax Search platform is completely free. The platform is a public service provided by the Broward County Property Appraiser’s Office to enhance transparency and accessibility for property-related information.