Tarrant County Property Tax Records

Welcome to this in-depth exploration of Tarrant County Property Tax Records, a vital component of the local real estate landscape. As a knowledgeable expert, I will guide you through the intricacies of this topic, offering insights, analysis, and practical information to help you navigate the world of property taxes in Tarrant County. This comprehensive guide is designed to provide an engaging and informative read, ensuring you leave with a deeper understanding of this essential aspect of property ownership.

Understanding Tarrant County Property Tax Records

In Tarrant County, Texas, property taxes are an integral part of the community’s financial framework, contributing significantly to the county’s budget and services. The property tax system in Tarrant County is a complex yet crucial mechanism that determines the financial obligations of property owners. This system ensures that each property owner contributes their fair share towards the county’s operations and development.

The process of calculating property taxes in Tarrant County involves a meticulous assessment of each property's value. This value, known as the appraised value, is determined by the Tarrant Appraisal District (TAD), an independent body tasked with this critical responsibility. The TAD employs a team of professionals who assess properties based on various factors, including location, size, improvements, and market trends.

The Role of Appraised Value

The appraised value of a property serves as the foundation for calculating property taxes. It is this value that determines the tax liability for each property owner. The TAD conducts an annual appraisal process, ensuring that property values remain accurate and up-to-date. This appraisal process is essential to ensure fairness and equity in the tax system.

To illustrate, consider a residential property in Tarrant County. Let's say the TAD assesses this property with an appraised value of $250,000. This value is then used as the basis for calculating the property taxes owed. The specific tax rate, which is set by the local taxing units, is applied to this appraised value to determine the final tax amount.

| Property Type | Appraised Value | Tax Rate | Estimated Taxes |

|---|---|---|---|

| Residential | $250,000 | 2.4% | $6,000 |

| Commercial | $500,000 | 2.8% | $14,000 |

| Agricultural | $150,000 | 1.8% | $2,700 |

As shown in the table, the tax rate can vary depending on the property type and the taxing unit. These rates are set annually and can influence the final tax amount significantly.

Taxing Authorities in Tarrant County

Tarrant County is unique in that it is served by a diverse array of taxing authorities, each with its own role and responsibility. These authorities include the county itself, various cities and towns within the county, school districts, and special districts such as water districts and community colleges.

Each of these taxing authorities sets its own tax rate, which is then applied to the appraised value of properties within its jurisdiction. This system ensures that the tax burden is distributed fairly among different types of properties and across the various services provided by these authorities.

| Taxing Authority | Tax Rate (2023) |

|---|---|

| Tarrant County | 0.38% |

| City of Fort Worth | 0.56% |

| Arlington ISD | 1.45% |

| North East ISD | 1.62% |

| Tarrant County College District | 0.24% |

The table above provides an example of the tax rates set by some of the major taxing authorities in Tarrant County for the year 2023. These rates can vary from year to year and may also differ based on the specific location of the property within the county.

Property Tax Records: A Comprehensive Overview

Property tax records in Tarrant County provide a wealth of information for property owners, investors, and anyone interested in the local real estate market. These records offer a transparent view of the tax system, ensuring accountability and providing valuable insights into the financial obligations associated with property ownership.

What Do Property Tax Records Include?

Property tax records in Tarrant County typically contain a range of important details, including:

- Property Details: Comprehensive information about the property, such as its address, legal description, square footage, and improvements.

- Appraised Value: The assessed value of the property, determined by the TAD, which serves as the basis for tax calculations.

- Tax Rate: The tax rate applied to the appraised value, set by the relevant taxing authorities.

- Tax Amount: The total amount of property taxes owed for the current year.

- Payment History: A record of past tax payments, including any penalties or late fees.

- Exemptions and Discounts: Information about any exemptions or discounts applied to the property, such as homestead exemptions or senior citizen discounts.

- Assessment Notices: Copies of assessment notices sent to property owners, outlining the appraised value and tax rate for the current year.

- Tax Bills: Detailed tax bills showing the calculation of taxes, including any applicable credits or deductions.

These records are an invaluable resource for property owners, offering a clear understanding of their tax obligations and providing a historical perspective on the property's tax history.

Accessing Property Tax Records in Tarrant County

Tarrant County offers convenient access to property tax records through its online portal, Tarrant Appraisal District (TAD). This portal allows users to search for property tax information by address, account number, or property ID. The search results provide a wealth of information, including the property’s details, appraised value, tax rate, and tax amount.

For those who prefer a more traditional approach, property tax records can also be accessed in person at the TAD's offices. Here, staff members are available to assist with any queries and provide hard copies of the required documents.

Challenges and Controversies in Property Taxation

While the property tax system in Tarrant County is designed to be fair and equitable, it is not without its challenges and controversies. One of the primary concerns is the potential for tax inequities to arise, particularly in areas where property values may be rapidly increasing or decreasing.

Addressing Tax Inequities

To address tax inequities, the TAD employs a system of value protests, allowing property owners to challenge their appraised values if they believe they are inaccurate or unfair. This process ensures that property owners have a voice in the appraisal process and can seek adjustments if necessary.

Value protests are an important mechanism for maintaining fairness in the tax system. Property owners who successfully protest their appraised values may see a reduction in their tax liability, ensuring that they are not overburdened by their property taxes.

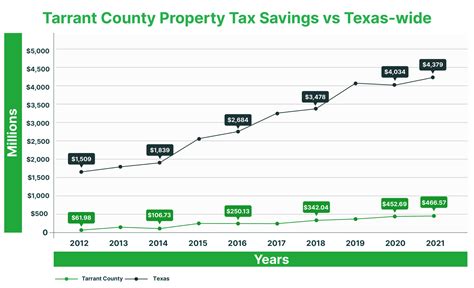

The Impact of Market Fluctuations

Market fluctuations can significantly impact property values and, consequently, property taxes. In times of economic prosperity, property values may increase rapidly, leading to higher tax obligations for property owners. Conversely, during economic downturns, property values may decline, resulting in lower tax bills.

The TAD's annual appraisal process aims to capture these market fluctuations, ensuring that property values remain current. However, this process can be complex and may not always perfectly reflect the dynamic nature of the real estate market.

The Future of Property Taxation in Tarrant County

As Tarrant County continues to grow and evolve, the property tax system will play a crucial role in shaping the future of the community. With a focus on fairness, transparency, and efficiency, the TAD and local taxing authorities are committed to ensuring that the property tax system remains sustainable and equitable.

Innovations in Property Taxation

To enhance the property tax system, Tarrant County is exploring various innovations and technologies. These include the use of advanced data analytics to improve the accuracy of property appraisals and the implementation of digital platforms to streamline the tax payment process.

By embracing these innovations, Tarrant County aims to reduce administrative burdens, improve efficiency, and provide a better experience for property owners. These efforts are part of a broader strategy to ensure that the property tax system remains adaptable and responsive to the changing needs of the community.

Community Engagement and Education

A key aspect of ensuring a fair and transparent property tax system is community engagement and education. The TAD and local authorities recognize the importance of keeping property owners informed about their rights and responsibilities.

Through educational initiatives and outreach programs, Tarrant County aims to empower property owners with the knowledge they need to navigate the property tax system effectively. This includes providing resources and guidance on topics such as value protests, tax exemptions, and payment options.

Conclusion

In conclusion, Tarrant County Property Tax Records provide a comprehensive and transparent view of the county’s tax system. They offer a wealth of information for property owners, investors, and community members, ensuring accountability and promoting a deeper understanding of the local real estate landscape.

As Tarrant County continues to thrive, the property tax system will remain a vital component of the community's financial framework. With a commitment to fairness, innovation, and community engagement, Tarrant County is well-positioned to meet the challenges and opportunities that lie ahead.

FAQ

How often are property taxes assessed in Tarrant County?

+

Property taxes in Tarrant County are assessed annually. The Tarrant Appraisal District (TAD) conducts an annual appraisal process to determine the appraised value of each property, which forms the basis for calculating property taxes.

Can I appeal my property’s appraised value?

+

Yes, property owners in Tarrant County have the right to appeal their property’s appraised value if they believe it is inaccurate or unfair. This process, known as a value protest, allows property owners to present their case to the Appraisal Review Board (ARB) for review and potential adjustment.

What happens if I don’t pay my property taxes on time?

+

Unpaid property taxes in Tarrant County can result in penalties and interest charges. If taxes remain unpaid, the property may be subject to a tax lien, which could lead to foreclosure proceedings. It’s important to stay current with property tax payments to avoid these consequences.

Are there any tax exemptions available in Tarrant County?

+

Yes, Tarrant County offers several tax exemptions to eligible property owners. These include the homestead exemption for primary residences, the over-65 exemption for senior citizens, and exemptions for disabled veterans. It’s important to research and understand the eligibility criteria for these exemptions.

How can I access my property’s tax records in Tarrant County?

+

You can access your property’s tax records in Tarrant County through the Tarrant Appraisal District (TAD) website. Simply search for your property by address, account number, or property ID to view detailed information, including appraised value, tax rate, and tax amount. Hard copies of tax records can also be obtained at the TAD’s offices.