Idaho State Tax Rate

In the state of Idaho, understanding the tax landscape is essential for both residents and businesses. The state's tax system, while relatively straightforward, can have a significant impact on financial planning and decision-making. This comprehensive guide aims to delve into the intricacies of Idaho's state tax rate, providing a detailed analysis of its structure, implications, and unique features.

The Foundation of Idaho’s Tax System

Idaho, like many other states, relies on a combination of taxes to generate revenue for various public services and infrastructure projects. The state’s tax system is primarily composed of the following key components:

- Income Tax: Idaho levies an income tax on both individuals and businesses. The state’s income tax system is progressive, meaning tax rates increase as income levels rise.

- Sales and Use Tax: Sales tax is a common form of taxation across the United States, and Idaho is no exception. The state imposes a sales tax on retail sales, leases, and rentals of tangible personal property.

- Property Tax: Property taxes are a significant source of revenue for local governments in Idaho. These taxes are levied on real estate, personal property, and certain business assets.

- Excise Taxes: Idaho also imposes excise taxes on specific goods and services, such as gasoline, tobacco products, and alcohol. These taxes are often used to fund specific programs or infrastructure projects.

Idaho’s State Tax Rate: A Closer Look

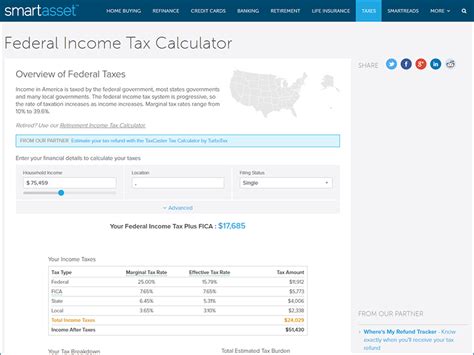

Now, let’s dive deeper into Idaho’s state tax rate, focusing on the income tax structure. As mentioned earlier, Idaho employs a progressive income tax system, which means that taxpayers with higher incomes are subject to higher tax rates. Here’s a breakdown of the state’s income tax brackets for the current tax year:

| Income Bracket | Tax Rate |

|---|---|

| 0 - 2,225</td> <td>1.6%</td> </tr> <tr> <td>2,226 - 4,450</td> <td>2.4%</td> </tr> <tr> <td>4,451 - 6,675</td> <td>4.4%</td> </tr> <tr> <td>6,676 - 9,300</td> <td>5.9%</td> </tr> <tr> <td>9,301 - 12,700</td> <td>6.9%</td> </tr> <tr> <td>12,701 and above | 7.8% |

It's important to note that these tax rates are applicable to Idaho residents and businesses operating within the state. Non-residents with income sourced from Idaho may also be subject to taxation, but the rates and regulations may vary.

Taxable Income and Deductions

When calculating taxable income, Idaho residents and businesses can take advantage of certain deductions and exemptions. These deductions can significantly reduce the overall tax liability. Some common deductions include:

- Standard Deduction: Idaho offers a standard deduction that reduces taxable income for individuals and families.

- Itemized Deductions: Taxpayers can opt for itemized deductions, which include expenses such as mortgage interest, charitable contributions, and medical expenses.

- Business Deductions: Businesses operating in Idaho can deduct a range of expenses, including salaries, rent, and supplies.

Tax Credits and Incentives

Idaho, like many states, offers various tax credits and incentives to encourage specific behaviors or support certain industries. Some notable tax credits available in Idaho include:

- Research and Development Tax Credit: This credit is designed to incentivize businesses to invest in research and development activities within the state.

- Historic Preservation Tax Credit: Property owners who undertake historic preservation projects may be eligible for this credit, promoting the preservation of Idaho’s historical assets.

- Energy Tax Credits: Idaho offers tax credits for various energy-related initiatives, such as the installation of renewable energy systems or energy-efficient upgrades.

The Impact of Idaho’s Tax System

The state tax system in Idaho has several implications for residents and businesses. Here are some key considerations:

- Financial Planning: Understanding Idaho’s tax rates and structures is crucial for effective financial planning. Residents and businesses can optimize their tax strategies by taking advantage of deductions and credits.

- Business Climate: Idaho’s tax system, particularly its income tax rates, can influence business decisions. Companies may consider the tax implications when choosing a location for their operations or expansions.

- Local Government Funding: Property taxes play a significant role in funding local governments and public services. This revenue stream ensures the maintenance of schools, roads, and other essential infrastructure.

- Economic Development: The state’s tax incentives and credits can attract businesses and promote economic growth. By incentivizing specific industries or activities, Idaho can foster a thriving business environment.

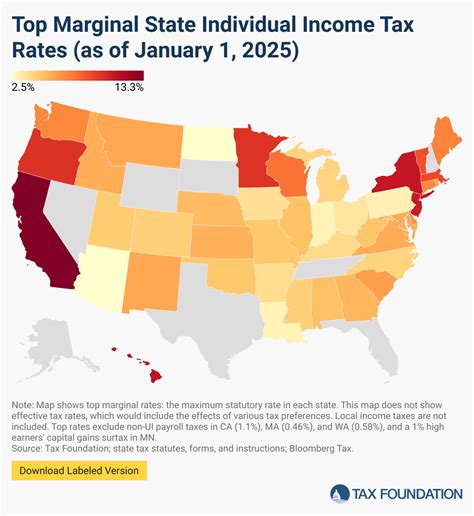

Comparative Analysis: Idaho’s Tax System vs. Other States

When comparing Idaho’s tax system to those of other states, several key differences emerge. Here’s a brief overview:

| State | Income Tax Structure | Sales Tax Rate | Notable Tax Features |

|---|---|---|---|

| Idaho | Progressive income tax with 6 brackets | 6% | Research & Development credit, Historic Preservation credit |

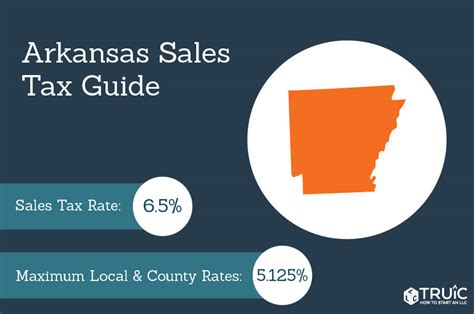

| Washington | No income tax | 6.5% | Business & Occupation tax, No sales tax on services |

| Oregon | Progressive income tax with 9 brackets | 0% (no state sales tax) | Individual income tax, Corporate excise tax |

| Nevada | No personal income tax | 6.85% | Gaming tax, Commerce tax |

This comparative analysis highlights the variations in tax structures across different states. While Idaho has a progressive income tax system, some neighboring states, like Washington and Nevada, have unique approaches, such as no personal income tax or specific industry-focused taxes.

Future Outlook and Potential Changes

The tax landscape in Idaho, like any other state, is subject to potential changes and reforms. Here are some factors to consider when looking ahead:

- Legislative Changes: The Idaho State Legislature has the authority to propose and enact tax law changes. Future legislative sessions may bring about modifications to tax rates, brackets, or deductions.

- Economic Conditions: Economic factors, such as inflation or recession, can influence tax policy. In times of economic hardship, tax rates or deductions may be adjusted to provide relief to residents and businesses.

- Tax Reform Initiatives: There may be ongoing discussions or proposals for comprehensive tax reform in Idaho. These initiatives could aim to simplify the tax system, reduce rates, or introduce new incentives.

Frequently Asked Questions

What is the current sales tax rate in Idaho?

+The current sales tax rate in Idaho is 6%. This rate applies to most retail sales, leases, and rentals of tangible personal property.

Are there any local sales tax variations in Idaho?

+Yes, Idaho allows for local option sales taxes. Certain cities or counties may impose additional sales taxes on top of the state rate. It’s important to check with local authorities for specific rates.

When are Idaho state tax returns due?

+Idaho state tax returns are typically due on April 15th of each year, aligned with the federal tax deadline. However, it’s advisable to check for any changes or extensions announced by the Idaho State Tax Commission.

Can non-residents with Idaho-sourced income file a state tax return?

+Yes, non-residents with income sourced from Idaho activities or investments may be required to file a state tax return. The specific regulations and requirements depend on the nature of the income and the individual’s residency status.

Are there any tax incentives for renewable energy projects in Idaho?

+Yes, Idaho offers tax incentives for renewable energy projects. These incentives include tax credits for the installation of renewable energy systems, such as solar panels or wind turbines. The Idaho State Tax Commission provides detailed guidelines for these credits.