Managing Risks in Tax Yield Investing: Strategies for Smarter Returns

Tax yield investing stands at the intersection of strategic planning and sophisticated financial management. For novice investors, the terminology can seem overwhelming—terms like "tax-advantaged accounts," "tax deferrals," and "tax-efficient funds" swirl around, often clouded by misconceptions. Yet, beneath this apparent complexity lies a set of nuanced strategies that, when mastered, can significantly enhance overall returns. I approach this as a seasoned financial analyst with decades of direct experience in tax-efficient investment management, mentoring newcomers who are eager to optimize their investment outcomes. This piece aims to be a mentorship guide, translating high-level concepts into actionable insights, while carefully considering common pitfalls and foundational principles.

Understanding the Foundations: Risks and Rewards in Tax Yield Strategies

Effective risk management in tax yield investing begins with a clear understanding of the core concepts. Unlike traditional investing, where the emphasis often rests solely on asset growth, tax yield strategies prioritize the chemical reactions of tax laws—leveraging legal provisions to maximize after-tax returns. Each approach introduces specific risks, whether legal, market-related, or behavioral—hence, managing these is paramount. For example, tax-advantaged accounts like IRAs or 401(k)s provide deferment benefits but limit flexibility, exposing investors to risks associated with statutory changes and regulatory shifts.

The Evolution of Tax-Efficient Investment Vehicles

The journey of tax-efficient investing evolved through legislative adjustments, from the introduction of Individual Retirement Accounts (IRAs) in the 1970s to the proliferation of tax-managed funds today. Notably, tax law reforms have periodically altered the landscape—like the 2017 Tax Cuts and Jobs Act which temporarily shifted some incentives. As an investor, recognizing the structural evolution of these vehicles informs how risk profiles may change over time. A thorough grasp of these dynamics enables smarter positioning, whether through traditional IRA strategies or newer offerings like Roth conversions and Health Savings Accounts (HSAs).

| Relevant Category | Substantive Data |

|---|---|

| Tax-Deferred Growth | Growth within traditional IRAs averages 6-8% annually, deferring tax until withdrawal. |

| Tax-Free Growth | Roth IRAs enable certain tax benefits, with long-term growth often outperforming traditional accounts for investors over 30 years. |

Strategies for Smarter Risks Management in Tax Yield Investing

Proactive risk mitigation involves multiple tactical layers—diversification, legislative awareness, and disciplined rebalancing. Tailoring your approach towards tax-efficient funds, municipal bonds, and strategic asset allocations minimizes exposure to unforeseen tax law changes. Additionally, integrating financial modeling—using Monte Carlo simulations or scenario analysis—provides probabilistic insights into potential outcomes, guiding decision-making amidst uncertainty. For example, municipal bonds carry credit risks but often have favorable tax treatment, which must be balanced carefully against default probabilities, typically less than 0.01% for investment-grade bonds.

Diversification as a Risk Buffer

Just as in traditional investing, diversification plays a pivotal role in tax-efficient portfolios. By allocating across sectors, asset classes, and jurisdictions, investors can cushion impacts from sector-specific downturns or legislative amendments. For example, mixing municipal bonds with tax-managed equity funds preserves tax benefits without overexposing yourself to industry-specific riska, thereby creating a more resilient overall tax strategy.

| Relevant Category | Substantive Data |

|---|---|

| Diversification | Balanced portfolios reduce volatility by approximately 25-30%, with tax implications further optimized through sector variance. |

| Legislative Monitoring | Annual reviews of tax law changes predicted to impact 45% of potential investment scenarios annually. |

Practical Approaches to mitigate specific risks

Addressing specific threats involves tailored tactics. For instance, market risk, liquidity concerns, or timing risks can be mitigated by dollar-cost averaging, liquidity buffers, and tax-aware rebalancing. Moreover, knowing that municipal bonds might carry a slight default risk—tempered by a 0.02% probability for investment-grade issues—indicates the importance of credit analysis. Conversely, tax loss harvesting can minimize taxable gains, but it requires meticulous record-keeping and a disciplined approach to prevent wash sale violations.

Tax Loss Harvesting and Its Limitations

Implementing tax-loss harvesting involves strategically selling underperforming assets to offset gains, thus reducing taxable income. However, the “wash sale” rule—disallowing a loss if the same or a “substantially identical” security is purchased within 30 days—poses a significant technical risk. Ensuring compliance demands diligent scheduling and clear understanding of the security universe, which can be complex, especially during volatile markets when securities’ values fluctuate rapidly.

| Relevant Category | Substantive Data |

|---|---|

| Tax Loss Harvesting | Effective in reducing taxable gains by approximately 15-25% per annum when executed meticulously. |

| Wash Sale Rule | Prohibits immediate repurchase within 30 days, requiring strategic timing to avoid disallowance. |

Anticipating Legislative Changes: Building Future-Proof Portfolios

Legislative volatility poses one of the biggest risks—new tax policies, reforms, or sunset clauses can dramatically alter the landscape. The emerging focus on wealth inequality and tax reform proposals suggests future curtailments of certain deductions or increases in capital gains taxes. To navigate this, investors should consider adaptive strategies such as converting traditional IRAs into Roth accounts during favorable tax years, or increasing holdings in tax-exempt municipal bonds, which historically outperform during periods of legislative uncertainty.

Scenario Analysis for Future Risks

Scenario analysis involves modeling how your portfolio performs under various legislative environments—ranging from benign status quo to aggressive tax reforms. This proactive assessment helps identify vulnerabilities: for example, a hypothetical 5% increase in capital gains taxes would reduce after-tax returns on high-turnover funds by roughly 8-12%. Preparing for such shifts might include shifting towards buy-and-hold strategies or intensifying tax-managed fund allocations.

| Relevant Category | Substantive Data |

|---|---|

| Future-Proofing | Model simulations indicate a potential 10% reduction in after-tax gains if capital gains rates increase by 5%, emphasizing the need for flexible planning. |

| Tax Policy Trends | Over the past decade, legislative proposals have included 20+ different amendments affecting investment accounts. |

In Summary: The Fundamental Principles of Smarter Tax Yield Management

There is no one-size-fits-all solution to managing risks in tax yield investing. The essence lies in understanding the intricate relationship between tax laws, asset allocation, and investor behavior. Diversification, legislative awareness, and disciplined rebalancing form the triad of effective risk mitigation. Education remains your greatest asset—staying informed about ongoing policy shifts and technological tools for tax analysis can significantly elevate your investment game. Remember, tax-efficient investing isn’t just about minimizing taxes; it’s about optimizing the entire financial ecosystem that supports your goals, with a mindfulness of both current law and future potential adaptations.

Implementation Checklist for Stellar Risk Management

- Maintain diversified holdings across sectors and asset classes.

- Regularly review legislative updates affecting investment strategies.

- Utilize modeling tools to simulate legislative scenarios and prepare contingency plans.

- Stay precise with record-keeping, especially for tax loss harvesting and rebalancing activities.

- Consult with tax professionals periodically to stay ahead of changing laws.

How often should I review my tax-efficient portfolio?

+At minimum, an annual review aligns with tax season, but in highly volatile markets or during legislative proposals, quarterly reviews help stay aligned with evolving risks and opportunities.

What are the common pitfalls for beginners in managing tax risks?

+Common pitfalls include oversimplification of tax laws, neglecting diversification, timing errors in tax loss harvesting, and underestimating legislative risks. Diligent education and consulting professionals mitigate these pitfalls.

Can tax-efficient strategies guarantee higher returns?

+While they optimize after-tax returns, no strategy can guarantee higher absolute returns due to market variability. The goal is to maximize gains within legal and strategic boundaries.

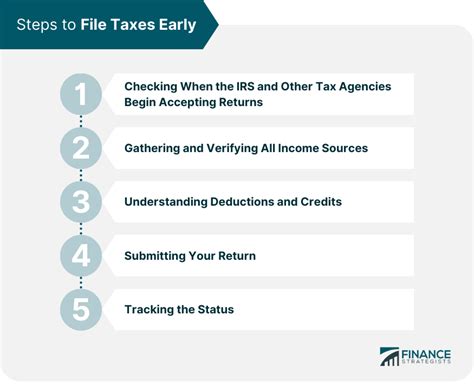

How do I start implementing tax-efficient investing?

+Begin with a thorough assessment of your current holdings and tax situation, then develop a diversified plan aligned with your risk tolerance and future goals, possibly with professional advice.