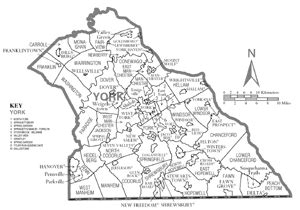

Understanding the York County Tax Map: A Beginner’s Guide

The intricate landscape of local taxation often presents a formidable barrier for residents, landowners, and prospective investors in understanding property assessments and associated liabilities. Among various jurisdictions, York County's tax map stands out as a pivotal tool that encapsulates property boundaries, valuation metrics, and taxation zones into a cohesive spatial format. Despite its critical role, many newcomers and even seasoned residents grapple with deciphering its nuances. This comprehensive analysis endeavors to elucidate the core functionalities, interpretative strategies, and practical applications of the York County Tax Map, situating it within the broader context of land administration and fiscal policy.

Fundamentals of the York County Tax Map: Components and Structure

The York County Tax Map operates at the intersection of geographic information systems (GIS) and property assessment methodologies. It serves as a visual repository that integrates cadastral data—detailing parcel boundaries, land use classifications, and valuation figures—with spatial accuracy. Each map is meticulously segmented into parcels, each assigned a unique identifier, often called a parcel number or PIN (Property Identification Number). These identifiers are crucial for cross-referencing with assessment records, tax bills, and zoning ordinances.

At its core, the tax map comprises several interrelated layers: boundary delineations, land-use overlays, valuation zones, and jurisdictional overlays. Boundary delineations demarcate the physical extents of individual properties, which may include residential, commercial, industrial, or agricultural parcels. Land-use overlays classify parcels based on current zoning codes or designated purpose classifications, offering insights into permissible uses and potential development constraints.

Valuation zones integrate property assessment data, indicating the appraised value of each parcel, often segmented into land and improvements. Jurisdictional overlays reveal the governing authorities, such as municipal boundaries, school districts, and special tax districts, which influence tax rates and service provision. The multifaceted nature of the tax map ensures that users can visualize how various elements factor into the local taxation schema.

Technical Architecture and Data Sources

Technologically, the York County Tax Map relies heavily on GIS platforms such as ArcGIS or QGIS, enabling dynamic and interactive visualization. Data sources integrate cadastral surveys, assessor records, zoning maps, and infrastructural datasets maintained by county agencies. Regular updates ensure that changes in land use, parcel subdivision, or boundary realignments are accurately reflected, maintaining the map’s reliability.

| Relevant Category | Substantive Data |

|---|---|

| Spatial Resolution | Typically 1:1,200 to 1:2,400 scale, allowing detailed parcel-level visualization |

| Update Frequency | Quarterly or annually, depending on land transactions and administrative practices |

| Primary Data Sources | Cadastral surveys, assessor records, municipal planning departments |

Deciphering the Tax Map: Keys, Symbols, and Layers

Interpreting the York County Tax Map necessitates understanding its symbology and data overlays. Common symbols include boundary lines with varying thicknesses, color-coded land use zones, and parcel labels. The legend — typically accessible via the GIS interface — translates these symbols into meaningful descriptors.

Color Coding and Land Use Classifications

Color schemes often assign green for agricultural lands, yellow for residential zones, purple or blue for commercial properties, and red for industrial parcels. These visual cues facilitate quick assessments of land use distribution across the county. For example, a densely populated urban area may exhibit extensive yellow and purple overlays, indicating a mix of residential and commercial zones.

Overlay Capabilities and Spatial Queries

Advanced GIS-enabled maps permit spatial queries, enabling users to select a parcel and retrieve associated data such as owner information, assessed value, and zoning restrictions. Overlay layers—such as flood zones, historic districts, or high-traffic areas—are essential for risk assessment and strategic planning.

| Relevant Category | Substantive Data |

|---|---|

| Map Scale | Varies from 1:600 to 1:2,400 depending on purpose |

| Legend Elements | Color codes for land use, line styles for boundary types, symbols for special districts |

| Data Linking | Parcel IDs linked to assessors' offices, tax systems, zoning databases |

Practical Applications and User Engagements with the York County Tax Map

The tax map is not merely a static visualization but a dynamic instrument pivotal for multiple stakeholder interactions. Property owners utilize it to confirm parcel boundaries, evaluate potential developments, or dispute assessment figures. County officials leverage the map for tax collection, land management, and urban planning. Investors consult the map to identify opportunities within zones offering incentives or particular protections.

Property Assessment and Taxation Process

In practice, the tax map underpins the entire assessment cycle—serving as the spatial foundation for property valuation, tax rate application, and billing. Accurate boundary delineation ensures equitable tax distribution aligned with landholding extents. Conversely, inaccuracies could lead to legal disputes or revenue shortfalls.

Urban Planning and Development

Urban planners rely on the tax map’s overlays to analyze land use trends, identify priority zones, or evaluate the impact of zoning amendments. Developers may cross-reference the parcel data with infrastructure layers to gauge suitability for projects, influence zoning changes, or apply for permits.

Community Engagement and Transparency

Public access portals for York County integrate the tax map, fostering transparency and accountability. Citizens can explore property boundaries, tax districts, and land use classifications online, supporting participatory planning and dispute resolution processes.

| Relevant Category | Substantive Data |

|---|---|

| Engagement Platforms | Online GIS portals, mobile apps for field inspection |

| Legal Validation | Parcel boundary accuracy essential for boundary disputes and title claims |

| Development Planning | Identification of zoned areas suitable for commercial or residential expansion |

Challenges, Limitations, and Future Directions

While the York County Tax Map offers an invaluable resource, it encounters several limitations. Data inaccuracies, especially in rapidly changing urban landscapes, can undermine trust and lead to misinformed decisions. Maintaining up-to-date datasets demands continuous investment and robust correction protocols.

Moreover, technical barriers—such as limited user technical proficiency or incompatible device interfaces—restrict full utilization of the map’s capabilities. Addressing these issues involves investing in user education, enhancing interface design, and expanding access channels.

Looking ahead, the integration of emerging technologies such as artificial intelligence, machine learning, and blockchain could revolutionize tax mapping. AI-driven data validation could streamline updates, while blockchain may augment transparency and immutability of property records. The incorporation of 3D mapping and augmented reality (AR) tools will further enhance spatial understanding and stakeholder interaction.

| Relevant Category | Substantive Data |

|---|---|

| Technological Innovation | AI and blockchain integration, 3D mapping, AR applications |

| Data Security | Encrypted data exchanges, access controls, audit trails |

| Implementation Barriers | Resource constraints, technological literacy gaps |

Conclusion: Unlocking the Potential of the York County Tax Map

Understanding the York County Tax Map extends beyond mere interpretation of lines and labels—it embodies a gateway to comprehensive land stewardship, equitable taxation, and strategic development. As technological advances reshape spatial data management, continual refinement and user-centered design will ensure that the map remains an accessible, reliable, and integral resource for all stakeholders. Embracing a future-oriented approach, grounded in data-driven insights and technological innovation, will unlock the full potential of this vital geographic-information system.

How can I access the York County Tax Map?

+The tax map is typically accessible through York County’s official GIS portal or land records office. Many counties provide online interactive maps that allow users to search by parcel ID, address, or owner name, often with tutorial guides for navigation.

What do the different colors on the tax map signify?

+Colors are used to represent land use categories—green for agricultural land, yellow for residential areas, purple for commercial zones, and red for industrial zones—facilitating quick visual identification of land types and zoning classifications.

How often is the tax map updated?

+Update frequency varies; many counties update their GIS layers quarterly or annually to reflect recent land transactions, subdivision, or boundary amendments, ensuring data remains current for assessments and planning.