Az Sales Tax Car

When purchasing a vehicle, it's crucial to understand the intricacies of sales tax, as it can significantly impact the overall cost. In this comprehensive guide, we will delve into the world of sales tax for car purchases, specifically focusing on Arizona. By the end of this article, you'll have a clear understanding of how sales tax works, the rates applicable in Arizona, and the various factors that can influence the final amount you pay. So, let's embark on this journey to navigate the often complex world of car sales tax in Arizona.

Understanding Sales Tax for Cars in Arizona

Sales tax in Arizona is a percentage-based tax applied to the purchase price of a vehicle. It is collected by the seller and remitted to the state government. The primary purpose of sales tax is to generate revenue for the state, which is then allocated towards various public services and infrastructure development. In the context of car purchases, sales tax ensures that buyers contribute to the overall economic growth and sustainability of the state.

The sales tax rate for cars in Arizona is not a fixed percentage but rather a variable rate that depends on several factors. These factors include the location of the dealership or seller, the type of vehicle being purchased, and any applicable exemptions or credits. Understanding these variables is crucial to estimate the sales tax accurately and plan your car-buying budget effectively.

Location-Based Sales Tax Rates

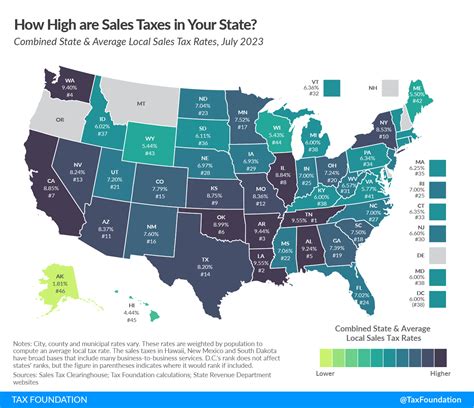

One of the primary determinants of sales tax rates in Arizona is the location of the dealership or seller. Arizona, like many other states, has a system where the sales tax rate varies based on the county or municipality where the purchase takes place. This means that the sales tax you pay can differ depending on which part of Arizona you choose to buy your car from.

| County | Sales Tax Rate (%) |

|---|---|

| Maricopa County | 2.8% |

| Pima County | 2.5% |

| Pinal County | 2.7% |

| Yavapai County | 2.5% |

| Coconino County | 2.4% |

These rates are just a glimpse into the varying sales tax structures across Arizona. Each county or municipality may have its own unique rate, and it's essential to research the specific location you plan to purchase from to get an accurate estimate.

Vehicle Type and Sales Tax

The type of vehicle you purchase can also influence the sales tax rate. Arizona, like many states, has different tax structures for new and used vehicles. Additionally, certain types of vehicles, such as electric or hybrid cars, may be eligible for tax credits or exemptions, further reducing the sales tax burden.

| Vehicle Type | Sales Tax Rate (%) |

|---|---|

| New Vehicles | 5.6% |

| Used Vehicles | 6.6% |

| Electric/Hybrid Vehicles (with rebate) | 2.5% |

It's important to note that these rates are subject to change, and there may be additional fees or surcharges applicable depending on the vehicle's specifications. Always consult with the dealership or tax authorities for the most up-to-date and accurate information.

Exemptions and Credits

Arizona offers certain exemptions and credits that can reduce the sales tax burden for car buyers. These exemptions are typically aimed at promoting specific initiatives or supporting specific groups of people. For example, veterans, active-duty military personnel, and individuals with disabilities may be eligible for tax exemptions or reduced rates.

Additionally, as mentioned earlier, electric and hybrid vehicles often come with tax credits or rebates. These incentives are designed to encourage the adoption of environmentally friendly vehicles and can significantly reduce the overall sales tax liability. It's worth exploring these options, as they can make a notable difference in your car-buying journey.

Calculating Sales Tax for Your Car Purchase

Now that we've covered the various factors influencing sales tax rates, let's delve into the process of calculating the sales tax for your car purchase. This involves a few simple steps that will help you estimate the tax accurately.

Step 1: Determine the Base Price

Start by finding the base price of the vehicle you intend to purchase. This is the manufacturer's suggested retail price (MSRP) or the negotiated price you've agreed upon with the seller. Ensure you have a clear understanding of any additional fees or charges that might be included in the base price, such as destination fees or dealer-installed accessories.

Step 2: Identify Applicable Tax Rates

Using the information provided earlier, identify the sales tax rate applicable to your purchase. This will depend on the location of the dealership, the type of vehicle, and any relevant exemptions or credits you may be eligible for. If you're purchasing a new vehicle in Maricopa County, for instance, the base tax rate would be 5.6%, but with an applicable exemption, it could be reduced.

Step 3: Calculate the Sales Tax

Once you have the base price and the applicable tax rate, calculating the sales tax is straightforward. Simply multiply the base price by the tax rate. For example, if the base price of your vehicle is $25,000 and the applicable tax rate is 5.6%, the sales tax would be calculated as follows:

$25,000 x 0.056 = $1,400

So, in this case, the sales tax for your car purchase would be $1,400.

Step 4: Consider Additional Fees and Taxes

It's important to note that sales tax is not the only fee or tax you may encounter during your car-buying process. There might be additional charges such as registration fees, title fees, or documentation fees. These fees are typically added to the total cost and are not included in the sales tax calculation.

The Impact of Sales Tax on Your Car-Buying Decision

Understanding sales tax and its implications is crucial when making a car-buying decision. It can significantly influence the overall cost of your purchase and, consequently, your budget. Here are a few key points to consider:

- Budgeting: Sales tax adds to the overall cost of your vehicle, so it's essential to factor it into your budget. When comparing car deals, ensure you're considering the total cost, including sales tax, to make an informed decision.

- Location Strategy: As we've discussed, sales tax rates can vary significantly across Arizona. If you have the flexibility, consider purchasing your car from a location with a lower tax rate. This strategy can save you a substantial amount, especially if you're buying a higher-priced vehicle.

- Research and Negotiation: Researching sales tax rates and applicable exemptions in advance can put you in a better negotiating position. Dealers are often open to discussing tax rates and may offer incentives or discounts to sweeten the deal.

- Tax Benefits: Keep an eye out for tax benefits or credits, especially if you're purchasing an electric or hybrid vehicle. These benefits can provide significant savings and make your car-buying experience more financially rewarding.

Frequently Asked Questions (FAQ)

Can I negotiate the sales tax on my car purchase?

+While the sales tax rate itself is set by the state and cannot be negotiated, you can negotiate other aspects of the purchase, such as the vehicle's price or additional fees, which can indirectly impact the total tax amount.

Are there any online resources to calculate sales tax for car purchases in Arizona?

+Yes, the Arizona Department of Revenue provides an online sales tax calculator that can help you estimate the sales tax for your purchase. You can find it on their official website.

Do I need to pay sales tax if I'm buying a car from a private seller?

+In Arizona, sales tax is typically paid to the seller, whether it's a dealership or a private seller. However, the process and requirements may vary, so it's best to consult with the Department of Revenue or a tax professional for specific guidance.

Are there any tax incentives for purchasing electric vehicles in Arizona?

+Yes, Arizona offers a state tax credit for the purchase of electric vehicles. The credit amount varies based on the vehicle's battery capacity. You can find detailed information about this incentive on the Arizona Department of Revenue's website.

Sales tax is an essential consideration when purchasing a car, and Arizona’s varying tax rates and incentives add an extra layer of complexity. By understanding the factors that influence sales tax and how to calculate it, you can make more informed decisions and potentially save money on your car purchase. Remember to research, compare, and take advantage of any applicable exemptions or credits to get the best deal.