Property Taxes Cook County

Property taxes are a crucial aspect of homeownership, and Cook County, Illinois, is known for its complex and often confusing tax system. Understanding the intricacies of property taxes in Cook County is essential for homeowners and prospective buyers alike. In this comprehensive guide, we will delve into the world of property taxes in Cook County, shedding light on the factors that influence tax assessments, the assessment process, and strategies to manage and reduce your tax burden.

Understanding Property Taxes in Cook County

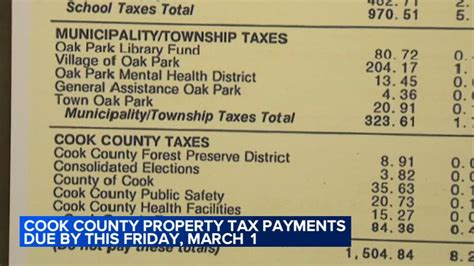

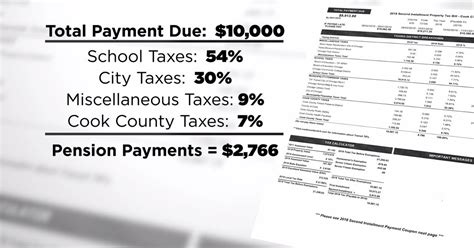

Property taxes in Cook County serve as a primary source of revenue for local governments, including municipalities, townships, and school districts. These taxes are used to fund essential services such as education, public safety, infrastructure maintenance, and more. The tax rate and assessment process vary across different areas within the county, making it a challenging task for homeowners to navigate.

Factors Influencing Property Tax Assessments

Several key factors contribute to the determination of property tax assessments in Cook County. These include:

- Property Value: The assessed value of your property is a significant determinant of your tax bill. Cook County employs a unique assessment methodology, which we will explore in detail later.

- Tax Rates: Each taxing district within the county sets its own tax rate, which is applied to the assessed value of properties within its jurisdiction. These rates can vary significantly, leading to discrepancies in tax bills for similar properties.

- Exemptions and Deductions: Cook County offers various exemptions and deductions that can reduce the taxable value of your property. These include homeowner exemptions, senior citizen exemptions, and deductions for improvements such as solar panels or energy-efficient upgrades.

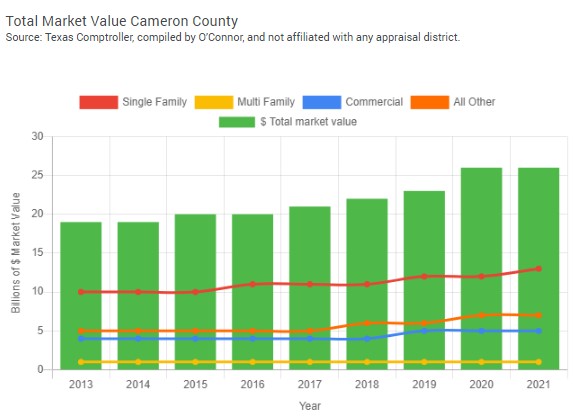

- Market Conditions: Property values are influenced by market trends, and these fluctuations can impact your tax assessment. Rapidly appreciating areas may see higher assessments, while struggling markets might experience declines.

The Cook County Assessment Process

The assessment process in Cook County is carried out by the Cook County Assessor’s Office. Here’s an overview of the key steps involved:

- Initial Assessment: Properties in Cook County are assessed based on their estimated market value as of January 1st of the previous year. The assessor’s office utilizes sales data, property characteristics, and other factors to determine this value.

- Notice of Proposed Assessment: Property owners receive a notice of their proposed assessment, typically in the mail. This notice provides an opportunity for homeowners to review and potentially appeal the assessment if they believe it is inaccurate.

- Appeal Process: If a property owner disagrees with the proposed assessment, they can initiate an appeal. The appeal process involves submitting documentation and evidence to support their case. The Cook County Board of Review handles these appeals, and a hearing may be scheduled if necessary.

- Final Assessment: After the appeal process, the Cook County Board of Review issues a final assessment, which becomes the basis for calculating property taxes.

It's important to note that the assessment process can vary slightly depending on the municipality or township. Some areas may have additional steps or requirements, so it's advisable to consult local resources or seek professional guidance.

Managing Your Property Tax Burden

While property taxes are an unavoidable expense for homeowners, there are strategies to manage and potentially reduce your tax burden. Here are some effective approaches:

- Stay Informed: Understanding the assessment process and factors that influence your tax bill is crucial. Stay updated on local tax policies, exemptions, and market trends to make informed decisions.

- Take Advantage of Exemptions: Cook County offers various exemptions that can reduce your taxable value. Research and apply for relevant exemptions, such as the homeowner exemption, which provides a $6,000 deduction for primary residences.

- Appeal Your Assessment: If you believe your property’s assessed value is inaccurate, consider appealing. Gather evidence, such as recent sales data or appraisals, to support your case. Seek guidance from tax professionals or legal experts if needed.

- Make Improvements: Certain improvements to your property can lead to tax deductions. Energy-efficient upgrades, solar panel installations, or renovations that increase your property’s value may qualify for deductions. Consult with a tax advisor to understand the potential benefits.

- Explore Tax Relief Programs: Cook County and other local governments may offer tax relief programs for eligible homeowners. These programs can provide temporary or permanent reductions in property taxes, especially for seniors or those with limited incomes.

Case Study: A Cook County Homeowner’s Experience

Let’s consider the story of John, a homeowner in Cook County. John purchased his home in 2018, and he has been diligently paying his property taxes ever since. However, he recently received a notice of a significant increase in his assessed value, leading to a higher tax bill.

After reviewing the notice, John decided to appeal the assessment. He gathered recent sales data of similar properties in his neighborhood, showing that his home's value had not increased as much as the assessor's office suggested. He also obtained an independent appraisal to support his case.

John submitted his appeal to the Cook County Board of Review, providing detailed evidence and arguments. After a hearing, the Board of Review agreed with John's assessment and reduced his property's taxable value, resulting in a substantial decrease in his tax bill. This experience highlights the importance of staying informed, gathering evidence, and exercising your right to appeal.

Future Implications and Tax Planning

As Cook County continues to evolve, property taxes will remain a critical consideration for homeowners. Here are some future implications and tax planning strategies to keep in mind:

- Market Volatility: Cook County’s real estate market is subject to fluctuations. Stay vigilant about market trends and how they might impact your property’s value and, consequently, your tax assessment.

- Tax Rate Changes: Keep an eye on local tax rates. While they are typically set annually, unexpected changes can occur, affecting your tax burden. Stay informed through local news and government updates.

- Long-Term Planning: Consider your long-term financial goals and how property taxes fit into your overall strategy. If you plan to sell your property in the future, understanding the potential tax implications can help you make informed decisions.

- Professional Guidance: Engaging the services of a tax professional or financial advisor can provide valuable insights and strategies tailored to your specific situation. They can help you navigate the complexities of Cook County’s tax system and maximize your savings.

By staying proactive, informed, and engaged in the assessment and appeal process, homeowners in Cook County can effectively manage their property tax obligations. Remember, understanding the system and leveraging available resources are key to minimizing your tax burden and maximizing your financial well-being.

Frequently Asked Questions

What is the typical property tax rate in Cook County?

+The property tax rate in Cook County can vary significantly depending on the specific taxing district. On average, the rate ranges from approximately 2% to 3% of the assessed value of the property. However, it’s important to note that individual districts may have different rates, so it’s advisable to check with the local government or tax assessor’s office for precise information.

How often are property taxes assessed in Cook County?

+Property taxes in Cook County are assessed annually. The assessment process typically begins with the determination of the property’s estimated market value as of January 1st of the previous year. Homeowners then receive a notice of their proposed assessment, which they can appeal if they believe it is inaccurate.

Can I appeal my property tax assessment in Cook County?

+Absolutely! Cook County provides property owners with the right to appeal their assessments. If you believe your property’s assessed value is incorrect or too high, you can initiate an appeal. The appeal process involves submitting evidence and supporting documentation to the Cook County Board of Review. It’s essential to gather relevant data, such as recent sales of comparable properties, to strengthen your case.

What are some common exemptions and deductions available in Cook County?

+Cook County offers a range of exemptions and deductions to reduce the taxable value of properties. Some common ones include the homeowner exemption, which provides a $6,000 deduction for primary residences, and the senior citizen exemption, which can offer significant tax relief to eligible homeowners aged 65 and older. Additionally, deductions are available for improvements like solar panels and energy-efficient upgrades.