City Of St Louis Real Estate Taxes

The City of St. Louis, often referred to as the Gateway to the West, boasts a vibrant real estate market with a diverse range of properties. One crucial aspect that prospective homeowners and investors should consider when navigating this market is the city's real estate tax system. Understanding how these taxes work and their implications is essential for making informed decisions. This article aims to delve into the intricacies of the City of St. Louis real estate taxes, offering a comprehensive guide for anyone interested in the local real estate scene.

Unraveling the City’s Real Estate Tax Landscape

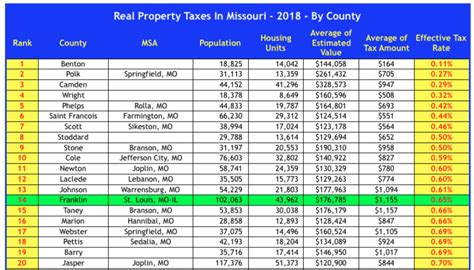

The taxation system for real estate in St. Louis is intricate, influenced by various factors such as property type, location, and assessed value. The city’s revenue department plays a pivotal role in assessing properties and determining the applicable tax rates. Here’s a detailed breakdown of the key elements to consider.

Assessment Process and Tax Rates

Each year, the city’s Assessor’s Office is tasked with evaluating residential, commercial, and industrial properties to establish their fair market value. This assessment forms the basis for calculating the real estate taxes. The assessed value is typically a percentage of the property’s full value, with different rates applicable to different property types. For instance, residential properties might be assessed at a rate of 19%, while commercial properties could be assessed at a higher rate of 32%.

Once the assessment is complete, the city's revenue department applies the appropriate tax rate to the assessed value. These rates are set by the City Council and can vary from year to year. The tax rate is expressed in cents per $100 of assessed value, making it easy to calculate the actual tax liability. For example, if the tax rate is set at 65 cents per $100, a property with an assessed value of $150,000 would have a tax liability of $975 (65 cents x $150,000 / 100).

| Property Type | Assessment Rate | Example Tax Rate |

|---|---|---|

| Residential | 19% | 65 cents per $100 |

| Commercial | 32% | 70 cents per $100 |

| Industrial | 32% | 60 cents per $100 |

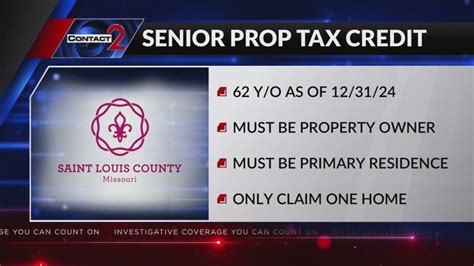

Tax Exemptions and Relief Programs

The City of St. Louis offers several tax relief programs and exemptions to support homeowners and promote economic development. These initiatives can significantly reduce the tax burden for eligible property owners.

One notable program is the Homestead Tax Credit, which provides a credit of up to $1500 for qualifying homeowners. To be eligible, homeowners must occupy the property as their primary residence and meet certain income requirements. This credit effectively reduces the tax liability, providing much-needed relief for homeowners.

Additionally, the city offers tax abatements for certain redevelopment projects. These abatements are granted to encourage investment in distressed areas and can result in a substantial reduction in taxes for a specified period. The city's Economic Development Partnership plays a crucial role in identifying and promoting these opportunities.

Payment Options and Deadlines

Real estate taxes in St. Louis are typically due in two installments. The first installment is due on February 1st, with a 3% discount for early payment. If the first installment is not paid by the due date, a penalty of 1% is applied for each month it remains unpaid. The second installment is due on July 1st, with the same penalty structure for late payments.

The city offers various payment methods, including online payments through their official website, in-person payments at designated locations, and payment by mail. Homeowners can also opt for escrow accounts, where the tax payments are managed by the mortgage lender, ensuring timely payments and avoiding penalties.

Impact on the Real Estate Market

The real estate tax system in St. Louis influences the local housing market in several ways. Firstly, it affects the affordability of properties, especially for first-time buyers and those on a budget. Higher tax rates can make it more challenging for buyers to afford their dream homes, potentially pushing them towards more affordable neighborhoods.

Secondly, the tax system can influence investment decisions. Investors often consider the tax implications when deciding on a property purchase. The availability of tax relief programs and abatements can make certain areas more attractive for investment, stimulating economic growth in those regions.

Lastly, the tax system's impact extends to property values. Properties with lower tax liabilities are often more desirable, leading to increased demand and potentially higher property values. Conversely, properties with higher taxes may face challenges in attracting buyers, impacting their overall market value.

Navigating the City’s Real Estate Tax Landscape

Understanding the intricacies of the City of St. Louis real estate tax system is crucial for both homeowners and investors. By being aware of the assessment process, tax rates, and available relief programs, individuals can make more informed decisions when purchasing or investing in property.

Prospective buyers should consider the tax implications alongside other factors such as location, property condition, and future development plans. For investors, the tax system can be a strategic tool to identify opportunities for growth and maximize returns.

Staying informed about the city's tax policies and keeping up with any changes is essential. The city's official website and the Assessor's Office are valuable resources for the latest information on tax rates, assessment schedules, and available relief programs.

How often are real estate taxes assessed in St. Louis?

+Real estate taxes in St. Louis are assessed annually. The Assessor’s Office evaluates properties each year to determine their fair market value, which forms the basis for calculating the taxes.

Can I appeal my property’s assessed value?

+Yes, if you believe your property’s assessed value is inaccurate, you have the right to appeal. The process involves submitting an appeal to the Board of Equalization within a specified timeframe. It’s advisable to gather supporting evidence, such as recent sales of similar properties, to strengthen your case.

Are there any penalties for late real estate tax payments?

+Yes, late payments of real estate taxes in St. Louis incur penalties. The penalty is 1% for each month the payment remains unpaid, starting from the due date. It’s essential to stay informed about the payment deadlines to avoid these penalties.

Can I deduct my real estate taxes on my federal tax return?

+Yes, real estate taxes paid in St. Louis are generally deductible on your federal tax return. However, it’s important to consult with a tax professional or refer to the IRS guidelines to understand the specific requirements and limitations for deducting real estate taxes.