Sales Tax Rate In Ma

In the state of Massachusetts, sales tax is a crucial component of the state's revenue generation system, contributing significantly to the funding of various public services and infrastructure projects. Understanding the sales tax rate in MA is essential for both businesses and consumers, as it directly impacts the final cost of goods and services purchased within the state. This article delves into the intricacies of the sales tax system in Massachusetts, providing an in-depth analysis of the rates, exemptions, and implications for different industries and individuals.

Sales Tax Rates in Massachusetts

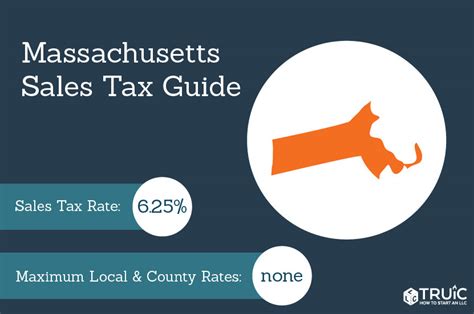

Massachusetts imposes a state-wide sales and use tax on most tangible personal property, as well as certain services. As of my last update in January 2023, the general sales tax rate in Massachusetts is 6.25%, which is applied to most retail sales, rentals, and leases of tangible personal property. This rate is set by the Massachusetts Department of Revenue and is subject to change with legislative amendments.

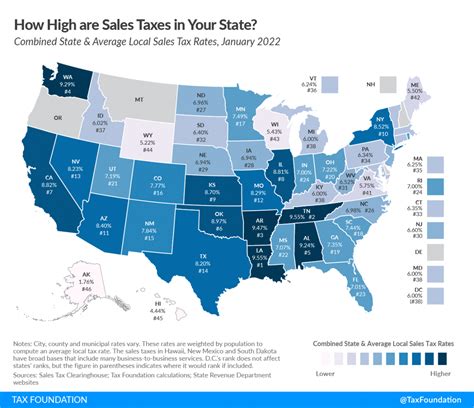

However, it is important to note that in addition to the state sales tax, some municipalities in Massachusetts also impose local option taxes. These local taxes can range from 0% to 2.75%, bringing the total sales tax rate in some areas to as high as 9%. For instance, the city of Boston levies an additional local tax of 1.75%, resulting in a combined rate of 8% for businesses and consumers in that jurisdiction.

To provide a clearer picture, let's consider a hypothetical example. If you purchase a television in Boston, you would pay a sales tax of 8% on the retail price of the TV. This tax is comprised of the state sales tax of 6.25% and the local option tax of 1.75% specific to Boston. Thus, a TV priced at $1000 would incur a sales tax of $80, resulting in a total cost of $1080 for the consumer.

| Location | State Sales Tax Rate | Local Option Tax Rate | Combined Rate |

|---|---|---|---|

| Boston | 6.25% | 1.75% | 8% |

| Cambridge | 6.25% | 1.5% | 7.75% |

| Worcester | 6.25% | 0% | 6.25% |

| Springfield | 6.25% | 0.75% | 7% |

How Sales Tax is Calculated in MA

The sales tax in Massachusetts is calculated as a percentage of the purchase price of taxable goods and services. The base tax is the state sales tax rate of 6.25%, and this can be increased by the addition of local option taxes, which vary depending on the municipality. For instance, if you buy a laptop in Boston, you would pay a sales tax of 8% (6.25% state tax + 1.75% local tax), whereas the same laptop purchased in Worcester would only attract a sales tax of 6.25% (state tax only, as Worcester has no additional local tax).

Exemptions and Special Rates

Not all goods and services are subject to the full sales tax rate in Massachusetts. Certain items are exempt from sales tax, while others have reduced tax rates. For example, most food items, clothing, and footwear are exempt from sales tax, providing some relief to consumers' budgets. On the other hand, items like tobacco products, marijuana, and certain short-term rentals are subject to higher tax rates.

Additionally, Massachusetts offers a reduced sales tax rate of 0.75% for specific business-to-business transactions. This rate applies to sales of tangible personal property and certain services that are intended for further processing, resale, or rental. For instance, if a manufacturer purchases raw materials for use in its production process, the sales tax on those materials would be 0.75%, rather than the standard 6.25% rate.

| Item Category | Sales Tax Rate |

|---|---|

| Most Food Items | 0% |

| Clothing and Footwear | 0% |

| Tobacco Products | 6.25% |

| Marijuana | 20% |

| Short-Term Rentals (31 days or less) | 12.45% |

Impact of Sales Tax on Businesses and Consumers

The sales tax rate in Massachusetts has a significant impact on both businesses and consumers. For businesses, particularly those in the retail sector, the sales tax can represent a substantial portion of their revenue. It also influences pricing strategies, as businesses must factor in the sales tax when setting their retail prices. This can be particularly challenging for small businesses with narrow profit margins.

For consumers, the sales tax can significantly impact their purchasing power. Higher sales tax rates can discourage spending, especially on big-ticket items, as the added tax can significantly increase the final cost. On the other hand, sales tax holidays or reduced tax rates on specific items can encourage consumer spending and provide much-needed relief for households with tight budgets.

Sales Tax and Economic Development

The sales tax rate can also influence economic development and business investment within Massachusetts. Higher sales tax rates can potentially deter businesses from setting up operations in the state, as they may face increased costs and reduced profitability. On the other hand, a competitive sales tax rate can attract businesses, particularly in sectors where sales tax is a significant factor, such as retail and hospitality.

Furthermore, the sales tax revenue generated in Massachusetts is a vital source of funding for public services and infrastructure projects. This revenue is used to support various sectors, including education, healthcare, transportation, and public safety. As such, the sales tax rate has a direct impact on the quality and accessibility of these services for residents and businesses alike.

Conclusion

In conclusion, the sales tax rate in Massachusetts is a critical component of the state's fiscal policy, influencing economic activity, consumer behavior, and the provision of public services. While the state sales tax rate is consistent across Massachusetts, the addition of local option taxes can create significant variations in the total sales tax rate across different municipalities. Understanding these rates and their implications is essential for both businesses and consumers operating within the state.

Frequently Asked Questions

What is the current sales tax rate in Massachusetts?

+

As of my last update, the general sales tax rate in Massachusetts is 6.25%. However, some municipalities impose additional local option taxes, which can increase the total sales tax rate to as high as 9%.

Are there any sales tax holidays in Massachusetts?

+

Yes, Massachusetts has sales tax holidays for specific items. For example, there is a sales tax holiday for clothing and footwear, typically held over a weekend in August. During this time, these items are exempt from sales tax.

Are there any sales tax exemptions for specific industries or goods in MA?

+

Yes, Massachusetts offers a reduced sales tax rate of 0.75% for certain business-to-business transactions. Additionally, items like food, clothing, and footwear are generally exempt from sales tax.