Delaware Refund Tax

Delaware, the Diamond State, is known for its business-friendly environment and tax advantages. While the state offers a range of incentives and a favorable corporate tax structure, it also provides options for individual taxpayers to claim refunds when eligible. This article aims to provide an in-depth guide to understanding the process of obtaining a Delaware refund tax, including eligibility criteria, the application process, and strategies to ensure a smooth and timely refund.

Understanding Delaware’s Tax System

Delaware’s tax system is designed to promote economic growth and attract businesses. The state boasts a competitive business tax environment, with no sales tax, personal income tax, or corporate income tax. However, this does not mean that Delaware residents are exempt from all taxes. The state levies other taxes, such as the Gross Receipts Tax, the Compensating Use Tax, and the Individual Income Tax, among others.

The Individual Income Tax is an important aspect of Delaware's tax system, as it provides a mechanism for individuals to contribute to the state's revenue while also allowing for refunds when applicable. Understanding this tax and the associated refund process is crucial for Delaware residents and businesses alike.

Eligibility for Delaware Refund Tax

Not all taxpayers are eligible for a refund from Delaware. The eligibility criteria are primarily based on the individual’s tax situation and the type of taxes paid. Here are some key points to consider when determining eligibility:

- Overpayment of Taxes: The most common reason for a refund is overpayment of taxes. If you have paid more taxes than you owe, you are entitled to a refund. This can occur due to various reasons, such as tax deductions, credits, or errors in tax calculation.

- Tax Withholding: Delaware residents who have multiple jobs or sources of income may experience tax withholding from each employer. If the total amount withheld exceeds your tax liability, you are eligible for a refund.

- Tax Credits: Delaware offers various tax credits to encourage certain behaviors or support specific industries. If you qualify for any of these credits and have overpaid your taxes, you can claim a refund.

- Special Circumstances: Certain life events or unique situations may make you eligible for a tax refund. For instance, if you moved out of Delaware during the tax year, you may be entitled to a partial refund based on the time you spent as a resident.

The Delaware Refund Tax Application Process

Applying for a Delaware refund tax is a straightforward process, but it requires attention to detail and accurate record-keeping. Here’s a step-by-step guide to help you through the application:

- Gather Your Documents: Before starting the application, ensure you have all the necessary documents. This includes your previous year's tax return, W-2 forms, 1099 forms, and any other relevant financial records. Having these documents organized will streamline the process.

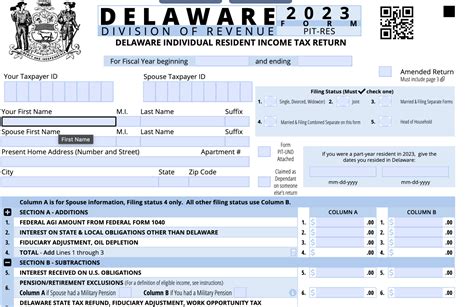

- Access the Online Portal: Delaware offers an online portal for taxpayers to file their returns and apply for refunds. Visit the official website of the Delaware Division of Revenue and log in or create an account if you haven't already.

- Select the Appropriate Form: Depending on your tax situation, you will need to choose the correct tax form. For individual income tax refunds, the form is typically Form 1040-X. Ensure you are using the most recent version of the form to avoid any discrepancies.

- Fill Out the Form: Carefully read through the instructions provided with the form. Enter the required information, including your personal details, tax year, and the amount you are claiming as a refund. Be sure to double-check your calculations to avoid errors.

- Submit Additional Documentation: If you are claiming specific tax credits or have unique circumstances, you may need to provide additional documentation to support your refund claim. Refer to the instructions on the form to understand what supporting documents are required.

- Review and Submit: Before submitting your application, thoroughly review all the information you have entered. Ensure that the details are accurate and that you have provided all the necessary documentation. Once you are satisfied, submit your application online.

- Track Your Refund: After submitting your application, you can track the status of your refund using the online portal. Delaware aims to process refunds within a reasonable timeframe, but delays may occur during peak tax seasons.

Tips for a Smooth Application Process

- Keep accurate records of all your financial transactions, tax documents, and any correspondence with the Delaware Division of Revenue.

- If you have complex tax situations or are unsure about your eligibility, consider seeking advice from a tax professional or consultant.

- Ensure that you meet all the deadlines for filing your tax returns and applying for refunds. Late submissions may result in penalties or delays.

Strategies for Maximizing Your Delaware Refund

Maximizing your Delaware refund tax involves more than just overpaying your taxes. It requires a strategic approach to tax planning and an understanding of the various deductions, credits, and incentives offered by the state. Here are some strategies to consider:

Tax Deductions

Delaware offers several tax deductions that can reduce your taxable income and, consequently, increase your refund. Some common deductions include:

- Medical Expenses: If you have incurred significant medical expenses, you may be eligible for a deduction. Keep records of your medical bills, insurance payments, and any other related expenses.

- Charitable Contributions: Donations to qualified charitable organizations are deductible. Remember to keep receipts and records of your contributions.

- Education Costs: Educational expenses, such as tuition fees and books, can be deductible. If you or your dependents are pursuing higher education, ensure you claim these deductions.

Tax Credits

Delaware provides various tax credits to encourage specific behaviors or support certain industries. Some notable credits include:

- Low-Income Tax Credit: Delaware offers a credit for low-income taxpayers to help reduce their tax liability. If your income falls within the eligible range, you can claim this credit to boost your refund.

- Research and Development Credit: Businesses engaged in research and development activities may be eligible for this credit. It can significantly reduce your tax liability and increase your refund.

- Energy Efficiency Credit: Delaware promotes energy efficiency by offering a credit for individuals and businesses that invest in energy-efficient improvements. If you have made such improvements, be sure to claim this credit.

Other Strategies

In addition to deductions and credits, there are other strategies to maximize your Delaware refund tax:

- Review Your Withholding: Ensure that your tax withholding is appropriate for your income and tax situation. If you are consistently overpaying, consider adjusting your withholding to receive a larger paycheck and reduce the likelihood of a large refund.

- Invest in Tax-Advantaged Accounts: Delaware offers various tax-advantaged accounts, such as 529 plans for education savings and health savings accounts. Contributing to these accounts can provide tax benefits and potentially increase your refund.

- Plan for Major Purchases: If you are considering making a significant purchase, such as a new home or vehicle, plan it strategically. Certain purchases may qualify for tax deductions or credits, so timing your purchase correctly can impact your refund.

Delaware Refund Tax: A Comprehensive Guide to Future Implications

The Delaware refund tax process is an essential aspect of the state’s tax system, offering individuals and businesses the opportunity to claim refunds when eligible. By understanding the eligibility criteria, following the application process diligently, and implementing strategic tax planning, taxpayers can maximize their refunds and contribute to their financial well-being.

As Delaware continues to evolve its tax policies and incentives, staying informed about changes and updates is crucial. Tax laws and regulations can impact your eligibility for refunds and the strategies you employ to maximize your tax benefits. Regularly reviewing and updating your tax knowledge can ensure you stay ahead of any changes and make the most of your tax situation.

In conclusion, the Delaware refund tax process is a valuable tool for taxpayers to reclaim overpaid taxes and take advantage of various deductions and credits. By being proactive, keeping accurate records, and seeking professional advice when needed, individuals and businesses can navigate the tax system effectively and optimize their financial outcomes.

What is the Delaware refund tax process like for businesses?

+The Delaware refund tax process for businesses is similar to that for individuals. Businesses can claim refunds for overpaid taxes, tax credits, or special circumstances. They should follow the same steps as individuals, including gathering necessary documents, accessing the online portal, and submitting the appropriate forms. However, businesses may have more complex tax situations and should consult with tax professionals for guidance.

How long does it typically take to receive a Delaware refund tax?

+The timeframe for receiving a Delaware refund tax can vary. During peak tax seasons, such as the end of the tax year, it may take longer for the state to process refunds. Typically, Delaware aims to process refunds within 6 to 8 weeks after receiving a complete and accurate application. However, delays can occur, so it’s advisable to track the status of your refund regularly.

Are there any penalties for filing late for a Delaware refund tax?

+Yes, Delaware imposes penalties for late filing of tax returns and refund applications. The penalties can vary depending on the amount of tax owed and the extent of the delay. It’s important to file your tax returns and apply for refunds within the designated deadlines to avoid penalties and ensure a timely refund process.

Can I check the status of my Delaware refund tax online?

+Yes, you can check the status of your Delaware refund tax online through the Delaware Division of Revenue’s official website. By logging into your account, you can track the progress of your refund application and receive updates on its status. This feature provides transparency and allows you to stay informed throughout the process.

What should I do if my Delaware refund tax is delayed or I have issues with the application process?

+If you experience delays or encounter issues with your Delaware refund tax application, it’s recommended to contact the Delaware Division of Revenue directly. You can reach out to their customer support or tax specialists for assistance. They can provide guidance, address any concerns, and help resolve any problems you may be facing.