Is No Tax On Overtime In Effect

The concept of a "No Tax on Overtime" initiative has gained attention and traction in recent years, aiming to address the financial burdens faced by employees who work extended hours. This article explores the intricacies of this policy, its potential benefits, and the implications it may have on various aspects of employment and the economy.

Unveiling the “No Tax on Overtime” Policy

The “No Tax on Overtime” policy is a proposed legislative measure designed to alleviate the tax burden on individuals who work beyond their regular working hours. Traditionally, overtime wages are subject to income tax, which can result in a significant portion of earnings being deducted for taxes. This policy seeks to exempt or reduce the tax liability associated with overtime pay, providing a financial incentive for employees to work additional hours.

Potential Advantages of the Policy

The implementation of a “No Tax on Overtime” policy could yield several advantages, both for employees and the economy as a whole. Firstly, it offers a direct financial benefit to employees, allowing them to retain a larger portion of their overtime earnings. This increased disposable income can stimulate consumer spending, boost the economy, and improve the standard of living for those working extended hours.

Furthermore, the policy may serve as an incentive for employers to offer more overtime opportunities. With reduced tax implications, employers might be more inclined to assign overtime work, leading to increased productivity and potentially addressing labor shortages in certain industries. This could be particularly beneficial during times of economic growth or industry-specific labor demands.

Case Studies and Real-World Impact

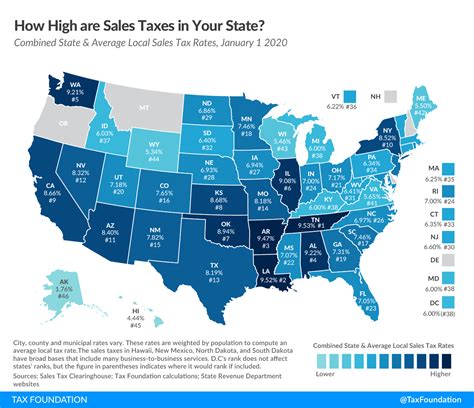

Several countries have explored or implemented variations of “No Tax on Overtime” policies, providing valuable insights into their effectiveness. For instance, Germany introduced a tax exemption for certain overtime payments in 2008, which resulted in increased overtime work and a boost in tax revenues from higher incomes. Similarly, Singapore offers a tax deduction for overtime wages, encouraging employees to work longer hours during peak periods.

In the United States, some states have proposed or implemented similar measures. Texas, for example, has considered legislation to exempt overtime pay from state income tax, aiming to attract businesses and boost the local economy. While the impact of such policies varies depending on the specific implementation and economic conditions, these case studies highlight the potential for positive outcomes.

| Country/State | Policy Details | Impact |

|---|---|---|

| Germany | Tax exemption for certain overtime payments | Increased overtime work, higher tax revenues |

| Singapore | Tax deduction for overtime wages | Encouraged overtime work during peak periods |

| Texas, USA | Proposed exemption from state income tax for overtime pay | Potential to attract businesses, boost local economy |

Implications and Considerations

While the “No Tax on Overtime” policy presents potential advantages, it also warrants careful consideration of various factors to ensure a balanced approach.

Work-Life Balance and Employee Well-Being

One of the critical aspects to consider is the impact on work-life balance and employee well-being. While the policy aims to incentivize overtime work, it should not encourage excessive or unsustainable working hours. Ensuring that employees have adequate rest and time off is essential for maintaining a healthy workforce and preventing burnout.

Equity and Fair Compensation

The policy should also strive for equity in compensation. Different industries and occupations may have varying overtime rates and practices. Ensuring that the tax exemption or reduction applies fairly across sectors is crucial to prevent potential disparities in earnings and benefits.

Revenue and Budgetary Implications

From a governmental perspective, the policy’s impact on revenue and budgetary planning must be carefully assessed. While the policy aims to stimulate economic growth, it could also lead to reduced tax revenues in the short term. Balancing the potential loss in tax income with the expected economic benefits is a key consideration for policymakers.

Industry-Specific Considerations

The success of the policy may vary across industries. Sectors with high labor demands or seasonal fluctuations might benefit significantly, while others may see limited impact. Understanding the unique needs and dynamics of different industries is essential for tailoring the policy effectively.

Conclusion: A Nuanced Approach to Overtime Tax Relief

The “No Tax on Overtime” policy presents an intriguing prospect for addressing financial challenges associated with extended work hours. However, its implementation requires a thoughtful and nuanced approach to balance the benefits for employees, the economy, and societal well-being.

By carefully considering the potential advantages, real-world examples, and various implications, policymakers can develop a policy that encourages overtime work while ensuring fairness, work-life balance, and sustainable economic growth. The future of this policy will undoubtedly shape the landscape of employment and tax systems, offering an opportunity for positive change and a more equitable work environment.

How does the “No Tax on Overtime” policy benefit employees financially?

+

The policy allows employees to retain a larger portion of their overtime earnings, increasing their disposable income and improving their financial situation.

What are the potential impacts of this policy on the economy?

+

It can stimulate economic growth by encouraging consumer spending and boosting productivity. However, the long-term economic impact depends on various factors, including industry dynamics and labor market conditions.

Are there any concerns about work-life balance with this policy?

+

Yes, there are concerns that the policy might encourage excessive working hours, leading to potential burnout. Balancing the incentive for overtime work with the importance of work-life balance is crucial for a healthy workforce.