Arizona State Tax Refund

The state of Arizona, known for its vibrant cities, breathtaking deserts, and year-round sunshine, offers a unique tax landscape. One of the most anticipated aspects for taxpayers is the Arizona state tax refund. This refund process is a crucial component of Arizona's tax system, impacting both residents and businesses alike. In this comprehensive guide, we will delve into the intricacies of the Arizona state tax refund, exploring the factors that influence its issuance, the steps involved in claiming it, and the potential benefits it brings to taxpayers.

Understanding the Arizona State Tax Refund

The Arizona state tax refund is a financial return provided by the Arizona Department of Revenue to eligible taxpayers. It represents the difference between the total tax liability calculated based on the taxpayer’s income and the taxes already paid throughout the year through withholdings or estimated tax payments.

This refund serves as a critical mechanism for ensuring taxpayers receive a fair and accurate return on their tax contributions. It plays a significant role in Arizona's economy, as it provides a financial boost to individuals and families, allowing them to reinvest in their communities, pay off debts, or save for future expenses.

Eligibility Criteria

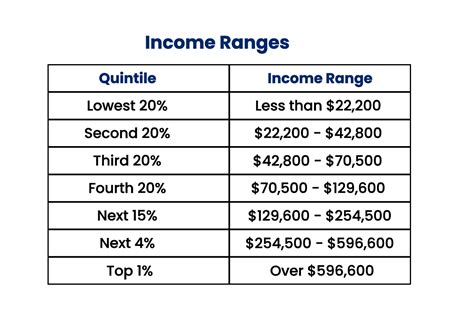

Determining eligibility for an Arizona state tax refund primarily depends on the taxpayer’s annual income, tax liabilities, and the specific deductions and credits they qualify for. Generally, individuals who have had taxes withheld from their paychecks or made estimated tax payments during the year are eligible for a refund if their total tax liability is lower than the amount withheld or paid.

Arizona's tax system offers a range of deductions and credits that can further impact the refund amount. These include deductions for dependent children, educational expenses, medical costs, and various other expenses. Additionally, taxpayers may qualify for credits such as the Low Income Tax Credit or the Property Tax Refund Credit, which can significantly reduce their tax liability and increase their refund.

| Deduction/Credit | Description |

|---|---|

| Dependent Child Deduction | Allows taxpayers to claim a deduction for each dependent child. |

| Educational Expense Deduction | Permits taxpayers to deduct eligible education-related expenses. |

| Low Income Tax Credit | Provides a credit for low-income individuals and families. |

| Property Tax Refund Credit | Offers a credit for taxpayers who have paid property taxes. |

The Process of Claiming an Arizona State Tax Refund

Claiming an Arizona state tax refund involves a systematic process that ensures accuracy and timely reimbursement. Here’s a step-by-step guide to navigate the refund claiming process:

Gathering Necessary Documentation

Before initiating the refund claim, taxpayers should ensure they have all the required documentation. This includes W-2 forms from employers, 1099 forms for any additional income sources, receipts for eligible deductions, and proof of estimated tax payments, if applicable. Having these documents readily available streamlines the process and reduces the chances of errors.

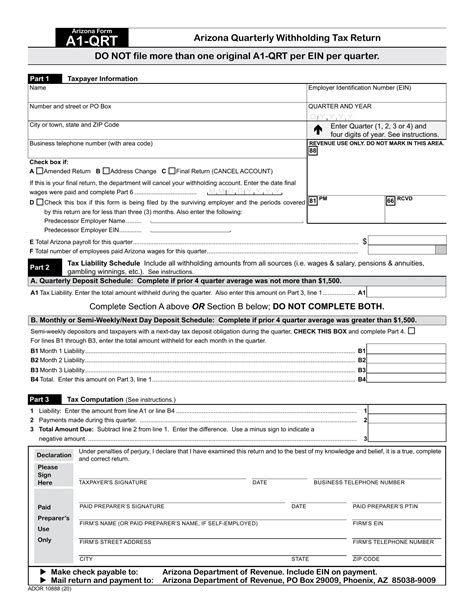

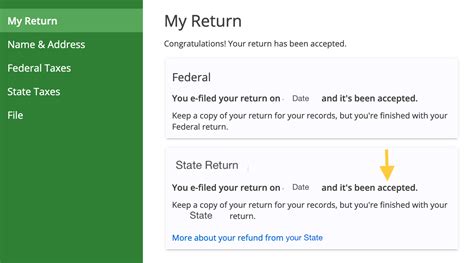

Filing Tax Returns

The first step in claiming a refund is to file an accurate and complete Arizona state tax return. Taxpayers can choose to file their returns electronically or through traditional paper forms. Electronic filing is generally faster and reduces the risk of errors, as it often includes built-in error-checking features.

When filing, taxpayers should ensure they select the appropriate filing status (single, married filing jointly, head of household, etc.) and claim all eligible deductions and credits. This step is crucial as it directly impacts the final refund amount.

Submitting the Refund Claim

Once the tax return is filed, taxpayers can initiate the refund claim process. This typically involves completing a specific section within the tax return indicating the desire to receive a refund. Taxpayers should provide accurate banking information if they prefer direct deposit, as this is the fastest way to receive the refund.

It's important to note that taxpayers have the option to receive their refund as a check in the mail if they prefer a more traditional method. However, direct deposit is generally recommended for its speed and convenience.

Processing and Receiving the Refund

After submitting the refund claim, the Arizona Department of Revenue processes the request. This process involves verifying the accuracy of the tax return and ensuring the taxpayer meets all eligibility criteria. The department aims to process refunds within a specified timeframe, typically within a few weeks of filing.

Taxpayers can track the status of their refund online or by contacting the Arizona Department of Revenue. Once the refund is processed and approved, it will be sent to the taxpayer's specified banking account or mailed as a check, depending on their chosen method.

Maximizing Your Arizona State Tax Refund

While the primary goal of claiming an Arizona state tax refund is to receive a financial return on taxes paid, taxpayers can take strategic steps to maximize the refund amount. Here are some strategies to consider:

Reviewing Deductions and Credits

As mentioned earlier, deductions and credits play a significant role in reducing tax liability and increasing refunds. Taxpayers should carefully review all eligible deductions and credits to ensure they are maximizing their benefits. This may involve consulting with a tax professional or using tax preparation software that identifies and applies relevant deductions and credits.

Optimizing Withholding and Estimated Tax Payments

Taxpayers can optimize their refund by ensuring their tax withholding or estimated tax payments are aligned with their actual tax liability. Overpaying taxes throughout the year may result in a larger refund, but it also means the taxpayer is essentially providing the government with an interest-free loan. On the other hand, underpaying taxes can lead to penalties and interest charges.

To strike a balance, taxpayers should review their withholding allowances or estimated tax payment schedules regularly, especially after significant life changes such as marriage, divorce, or a new job. Adjusting these payments can help ensure the refund amount is optimized without incurring penalties.

Exploring Tax Credits

Arizona offers a range of tax credits that can significantly impact refund amounts. These credits are designed to provide financial relief to specific groups of taxpayers. For instance, taxpayers with dependent children may qualify for the Child and Dependent Care Credit, which can reduce their tax liability. Similarly, taxpayers who have made energy-efficient home improvements may be eligible for the Residential Energy Efficient Property Credit.

By exploring and understanding the various tax credits available, taxpayers can strategically plan their expenses and investments to maximize their refund potential.

Potential Benefits of an Arizona State Tax Refund

Receiving an Arizona state tax refund can bring several benefits to taxpayers. Here are some key advantages to consider:

Financial Relief and Planning

An unexpected refund can provide a significant financial boost, allowing taxpayers to catch up on bills, pay off debts, or build an emergency fund. It can also serve as a financial cushion for future expenses, such as home repairs, medical costs, or educational expenses.

Investment Opportunities

For those with long-term financial goals, a tax refund can be a great opportunity to invest in stocks, bonds, or other financial instruments. Taxpayers can use this refund to grow their wealth over time, potentially leading to substantial returns in the future.

Community Reinvestment

Arizona’s tax refund system plays a vital role in stimulating the local economy. When taxpayers receive refunds, they often reinvest this money in their communities, supporting local businesses, restaurants, and services. This cycle of spending and reinvestment helps drive economic growth and development in Arizona.

Financial Stability and Security

For many taxpayers, especially those with limited financial resources, a state tax refund can provide a sense of financial stability and security. It can help bridge income gaps, cover unexpected expenses, and reduce financial stress. The refund can act as a safety net, offering peace of mind during challenging economic times.

Conclusion

The Arizona state tax refund is a valuable aspect of the state’s tax system, offering financial relief, planning opportunities, and economic stimulation. By understanding the eligibility criteria, navigating the claiming process, and maximizing refund potential, taxpayers can make the most of this financial return. With careful planning and strategic tax management, individuals and families can reap the benefits of a well-deserved Arizona state tax refund.

When will I receive my Arizona state tax refund?

+The timeframe for receiving an Arizona state tax refund varies, but it is typically processed within a few weeks of filing. The Arizona Department of Revenue aims to process refunds promptly, but factors like the volume of returns, complexity of the case, or any issues with the return can impact the processing time.

Can I check the status of my Arizona state tax refund online?

+Yes, taxpayers can check the status of their Arizona state tax refund online through the Arizona Department of Revenue’s website. This online tool provides real-time updates on the progress of the refund, allowing taxpayers to track its journey from processing to issuance.

What should I do if my Arizona state tax refund is delayed or incorrect?

+If taxpayers experience a delay or notice an error in their Arizona state tax refund, they should contact the Arizona Department of Revenue promptly. The department’s customer service representatives can assist in resolving issues, providing guidance, and ensuring taxpayers receive their rightful refund amount.

Are there any penalties for claiming an Arizona state tax refund if I am not eligible?

+Yes, claiming an Arizona state tax refund when not eligible can result in penalties and interest charges. It is crucial for taxpayers to carefully review their eligibility criteria and ensure they meet all requirements before claiming a refund. Deliberately claiming an ineligible refund may also lead to legal consequences.