Putnam County Wv Tax

In the heart of West Virginia, Putnam County stands as a thriving community with a rich history and a robust economic landscape. One crucial aspect of its functioning is the Putnam County Tax system, which plays a significant role in the county's development and maintenance. This article aims to delve deep into the intricacies of Putnam County's tax structure, its implications, and its impact on the local community.

Understanding the Putnam County Tax Landscape

Putnam County, much like other counties across the United States, relies on a comprehensive tax system to fund various public services and initiatives. This system encompasses a range of taxes, each serving a specific purpose and contributing to the overall fiscal health of the county.

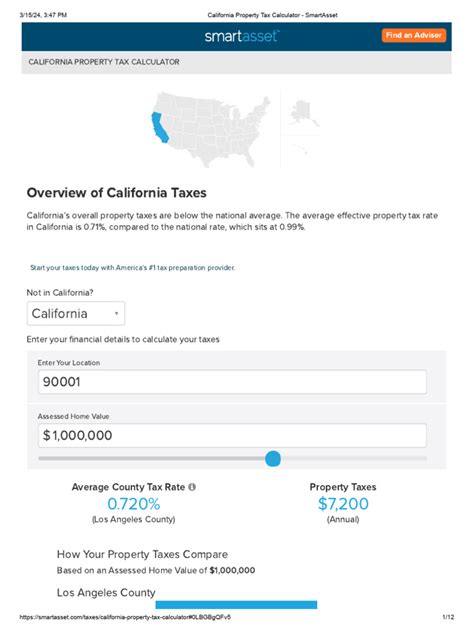

Property Taxes: A Key Revenue Stream

Property taxes are a fundamental component of Putnam County’s tax landscape. These taxes are levied on both real estate and personal property owned by individuals and businesses within the county. The revenue generated from property taxes forms a significant portion of the county’s budget, funding essential services such as education, infrastructure development, and public safety.

The Putnam County Assessor’s Office plays a pivotal role in this process. It is responsible for assessing the value of properties, ensuring that tax liabilities are accurately determined, and maintaining transparency in the tax assessment process. Property owners in Putnam County can access detailed information about their tax obligations through the Assessor’s Office website, promoting transparency and accountability.

| Property Tax Type | Tax Rate (per $100 of Assessed Value) |

|---|---|

| Residential Property Tax | 0.62 |

| Commercial Property Tax | 0.68 |

| Agricultural Property Tax | 0.46 |

These rates, while subject to change, provide a glimpse into the county's tax structure. It's important to note that property tax rates can vary based on the specific municipality within Putnam County.

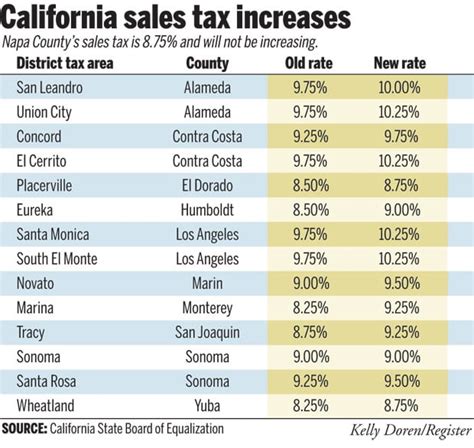

Sales and Use Taxes: Supporting Local Businesses

Putnam County also imposes sales and use taxes, which are applied to the sale of goods and services within the county. These taxes contribute to the development of local infrastructure, support small businesses, and enhance the overall economic vitality of the region. The county’s commitment to a fair and transparent tax system ensures that businesses thrive while also contributing to the community’s growth.

The Putnam County Commission, in collaboration with the West Virginia State Tax Department, plays a vital role in setting and administering these taxes. They work diligently to strike a balance between generating revenue and fostering a business-friendly environment, understanding the delicate equilibrium required for sustainable economic growth.

| Tax Type | Rate |

|---|---|

| General Sales Tax | 6% |

| Use Tax | 6% |

| Hotel/Motel Tax | 5% |

Personal Income Taxes: Individual Contributions

Putnam County residents also contribute to the local economy through personal income taxes. These taxes are based on an individual’s earnings and are a critical component of the county’s revenue stream. The county ensures a fair and progressive tax system, with rates varying based on income brackets, to ensure that everyone contributes proportionally to the community’s well-being.

The Putnam County Clerk's Office is responsible for collecting and managing personal income tax payments. They provide a user-friendly online portal, making it convenient for residents to fulfill their tax obligations. Additionally, the office offers assistance and guidance to ensure that individuals understand their tax responsibilities and can navigate the process seamlessly.

| Income Bracket | Tax Rate |

|---|---|

| Up to $10,000 | 2% |

| $10,001 - $25,000 | 3% |

| $25,001 and above | 4% |

The Impact of Putnam County Taxes on the Community

The tax revenue generated in Putnam County has a profound impact on the community’s overall development and quality of life. It funds critical services and initiatives, shaping the county into a vibrant and thriving region.

Education: Investing in the Future

A significant portion of Putnam County’s tax revenue is allocated to education. This investment ensures that the county’s youth have access to quality educational resources and opportunities. From state-of-the-art schools to extracurricular programs, the county’s commitment to education is evident in its dedication to creating a skilled and knowledgeable workforce for the future.

The Putnam County Board of Education works closely with the county's tax authorities to allocate funds effectively. Their strategic approach ensures that every dollar contributes to enhancing the educational experience, from improving teacher-student ratios to investing in cutting-edge technology for classrooms.

Infrastructure Development: Building a Stronger Community

Tax revenue also plays a crucial role in Putnam County’s infrastructure development. It funds projects ranging from road construction and maintenance to the development of recreational facilities. These initiatives not only enhance the county’s aesthetic appeal but also contribute to the overall quality of life for its residents.

The Putnam County Public Works Department is at the forefront of these endeavors, overseeing projects that improve connectivity, enhance safety, and create spaces for community gatherings. From constructing new bridges to revitalizing parks, their work is a testament to the county's commitment to creating a modern and sustainable living environment.

Community Initiatives: Strengthening the Social Fabric

Putnam County’s tax revenue extends beyond physical infrastructure. It also supports various community initiatives aimed at fostering social cohesion and addressing social issues. These initiatives include programs for at-risk youth, senior citizen support services, and initiatives focused on mental health and well-being.

Organizations like the Putnam County Community Foundation and the United Way of Putnam County play pivotal roles in identifying and addressing community needs. With the support of tax revenue, they are able to implement programs that make a tangible difference in the lives of Putnam County residents, building a stronger and more resilient community.

Future Implications and Outlook

As Putnam County continues to grow and evolve, its tax system will play a pivotal role in shaping its future. The county’s proactive approach to tax policy and revenue allocation ensures that it remains fiscally responsible while also investing in initiatives that drive long-term growth and development.

Sustainable Development: Balancing Growth and Preservation

Putnam County recognizes the importance of sustainable development. As such, a significant portion of its tax revenue is directed towards environmental initiatives and the preservation of natural resources. From investing in renewable energy projects to implementing waste management strategies, the county is committed to creating a greener and more sustainable future.

The Putnam County Planning Commission, in collaboration with local environmental organizations, is at the forefront of these efforts. They work tirelessly to strike a balance between development and preservation, ensuring that the county's natural beauty and ecological integrity are maintained for future generations.

Economic Diversification: Strengthening the Local Economy

Putnam County understands the importance of a diversified economy. While the county already boasts a robust business landscape, efforts are being made to attract new industries and businesses. The tax system plays a crucial role in this strategy, offering incentives and a business-friendly environment to encourage economic diversification.

The Putnam County Economic Development Authority works closely with local businesses and entrepreneurs to facilitate growth and expansion. Through tax incentives, business support programs, and targeted marketing initiatives, they aim to create a vibrant and resilient local economy, ensuring that Putnam County remains a desirable destination for businesses and investors alike.

Community Engagement: Empowering Residents

Putnam County believes in the power of community engagement. As such, a portion of tax revenue is dedicated to initiatives that empower residents and foster a sense of ownership and involvement. From citizen engagement programs to community development grants, the county aims to create an environment where every resident has a voice and an opportunity to contribute to the community’s growth.

Organizations like the Putnam County Community Action Association and the Putnam County Chamber of Commerce play crucial roles in facilitating these initiatives. They work tirelessly to connect residents with resources, support local businesses, and create platforms for community dialogue, ensuring that Putnam County remains a vibrant and engaged community.

How often are property taxes assessed in Putnam County, WV?

+

Property taxes in Putnam County are typically assessed annually. The county’s Assessor’s Office evaluates property values to determine the tax liability for each property owner. This process ensures that tax obligations are fair and up-to-date.

Are there any tax incentives for businesses in Putnam County, WV?

+

Yes, Putnam County offers various tax incentives to attract and support businesses. These incentives can include tax credits, reduced tax rates, and grants for business development. The Putnam County Economic Development Authority provides detailed information on these incentives and can guide businesses through the process.

How can Putnam County residents stay informed about tax changes and updates?

+

Putnam County provides a wealth of resources to keep residents informed about tax matters. The official Putnam County website offers detailed tax information, including rates, due dates, and payment options. Additionally, the county’s social media platforms and local news outlets often provide updates and announcements regarding tax-related matters.

What support is available for Putnam County residents facing tax-related challenges?

+

Putnam County understands that tax matters can be complex and challenging for some residents. The county offers various support services, including tax assistance programs and resources. The Putnam County Clerk’s Office provides guidance and assistance, and residents can also seek help from tax professionals or community organizations that specialize in tax-related matters.