Pay Taxes Wayne County

In the realm of financial obligations, one of the most important duties for residents of Wayne County is paying taxes. Understanding the process, deadlines, and potential benefits can ensure a smooth and stress-free experience for taxpayers. This comprehensive guide aims to provide an in-depth analysis of the tax payment process in Wayne County, covering everything from due dates to payment methods, with a focus on the 2023 tax season.

Navigating the Tax Landscape in Wayne County

Wayne County, a vibrant and diverse community, has a robust tax system that supports its infrastructure, services, and overall development. The county’s tax revenue plays a crucial role in maintaining public facilities, funding education, and ensuring the smooth functioning of local government operations.

For residents, understanding the tax landscape is essential. It involves knowing the types of taxes applicable, the due dates for payments, and the various methods available to settle these obligations. The information provided here aims to demystify the process and offer a clear, step-by-step guide to ensure compliance and peace of mind.

Types of Taxes in Wayne County

Wayne County residents typically encounter a range of taxes, each with its own purpose and calculation method. These include:

- Property Taxes: Based on the assessed value of real estate properties, these taxes fund local services like schools, roads, and emergency services. The due date for property tax payments is typically in two installments: one in July and the other in December.

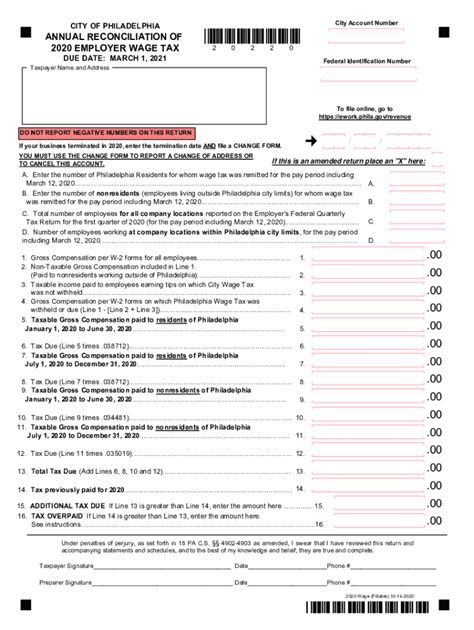

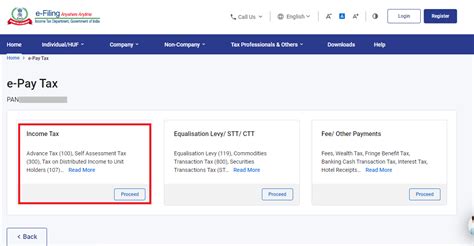

- Income Taxes: Individuals earning income within Wayne County are required to pay income taxes. The county’s income tax is separate from federal and state income taxes, and the rates can vary based on income brackets. The filing deadline for income taxes is usually in April.

- Sales and Use Taxes: These taxes are applied to the purchase of goods and services within the county. Sales tax is collected by businesses at the point of sale, while use tax is self-assessed for out-of-state purchases. The rate is subject to change, so it’s advisable to check the current rate before making any major purchases.

- Estate and Inheritance Taxes: These taxes are levied on the transfer of property upon an individual’s death. While the specifics can be complex, understanding the requirements and deadlines can help ensure a seamless transfer of assets.

Due Dates and Payment Methods

Staying on top of tax due dates is crucial to avoid penalties and interest. Here’s a breakdown of the key dates and the various payment methods available in Wayne County:

| Tax Type | Due Date | Payment Methods |

|---|---|---|

| Property Taxes | July and December (two installments) | Online payment portal, mail-in checks, direct debit, or in-person at the county treasurer’s office. |

| Income Taxes | Typically April (filing deadline) | Electronic filing and payment options, mail-in checks, or in-person at designated tax payment centers. |

| Sales and Use Taxes | Varies based on business type and frequency of sales | Online payment portals, direct bank transfers, or payment through authorized agents. |

| Estate and Inheritance Taxes | Six months from the date of death (for estate tax); Within 9 months from the date of death (for inheritance tax) | Online payment options, mail-in checks, or in-person at the county probate court. |

It's important to note that while these are the standard due dates, certain circumstances may warrant an extension. Consult with a tax professional or the Wayne County Treasurer's Office for more information on extension eligibility and procedures.

Benefits and Exemptions

Wayne County offers several benefits and exemptions to taxpayers, which can significantly reduce their tax burden. These include:

- Homestead Exemption: This exemption reduces the taxable value of a homeowner’s primary residence, providing a financial benefit especially for those on fixed incomes.

- Senior Citizen Exemption: Qualifying seniors may be eligible for a reduction in their property taxes, helping to ease the financial burden during retirement.

- Military Exemptions: Active-duty military personnel and veterans may be entitled to tax exemptions or reductions, as a way to honor their service.

- Tax Credits: Wayne County, in partnership with the state, offers various tax credits for things like energy-efficient home improvements, childcare expenses, and certain business investments.

Resources and Assistance

Navigating the tax system can be complex, but Wayne County provides several resources to assist taxpayers. The Wayne County Treasurer’s Office is a key point of contact, offering guidance on tax payments, due dates, and available exemptions. They also provide online tools and resources to help taxpayers calculate their obligations accurately.

For more complex tax situations, such as business taxes or estate planning, it's advisable to consult with a Certified Public Accountant (CPA) or a tax attorney. These professionals can provide personalized advice and ensure compliance with the law.

Conclusion: A Smooth Tax Payment Journey

Paying taxes in Wayne County is an essential civic duty that supports the community’s growth and development. By understanding the types of taxes, due dates, and available payment methods, residents can ensure a smooth and timely tax payment process. Additionally, being aware of the benefits and exemptions can help reduce the overall tax burden.

Remember, staying informed and prepared is key to a stress-free tax experience. With the right resources and a proactive approach, Wayne County residents can navigate the tax landscape with confidence and ease.

What is the penalty for late tax payments in Wayne County?

+

Late payments of taxes in Wayne County can incur penalties and interest. The specific amount varies based on the type of tax and the length of the delay. It’s advisable to contact the Wayne County Treasurer’s Office for accurate and up-to-date information on penalty rates.

Can I set up a payment plan for my property taxes?

+

Yes, Wayne County offers a deferred payment plan for property taxes, which allows taxpayers to pay their taxes in installments. This plan is particularly beneficial for those who may struggle to pay the full amount by the due date. To enroll, contact the Wayne County Treasurer’s Office and provide the necessary financial information.

Are there any tax incentives for energy-efficient home improvements in Wayne County?

+

Absolutely! Wayne County, in collaboration with the state, offers tax credits for energy-efficient home improvements. These credits can significantly reduce the cost of making environmentally friendly upgrades to your home. To learn more about eligibility and the application process, visit the Wayne County Treasurer’s Office website or consult with a tax professional.

How can I stay updated on tax-related news and changes in Wayne County?

+

The best way to stay informed is to regularly check the official website of the Wayne County Treasurer’s Office. They provide updates on tax rates, due dates, and any changes to the tax system. Additionally, signing up for their newsletter or following their social media accounts can ensure you receive timely notifications.