Seattle Washington Property Tax

Seattle, Washington, is a vibrant city known for its stunning natural beauty, thriving tech industry, and diverse neighborhoods. As with any urban area, understanding the property tax system is crucial for both homeowners and prospective buyers. In this comprehensive guide, we will delve into the intricacies of Seattle's property tax landscape, providing you with expert insights and valuable information to navigate this essential aspect of real estate ownership.

The Seattle Property Tax System: An Overview

Property taxes in Seattle, like in many other cities, serve as a primary source of revenue for local governments, funding essential services such as education, public safety, and infrastructure development. The system is designed to ensure that property owners contribute to the community’s well-being based on the value of their real estate holdings.

The property tax rate in Seattle is determined by a combination of factors, including the assessed value of the property, the type of property (residential, commercial, or industrial), and the applicable tax rate set by various taxing districts within the city.

The assessed value of a property is established through a comprehensive valuation process conducted by the King County Assessor's Office. This value, often referred to as the "assessed value" or "assessed tax value," is then used as the basis for calculating the property tax owed.

Assessed Value and Property Tax Calculation

The assessed value of a property in Seattle is typically 100% of its fair market value. This value is determined by considering factors such as the property’s size, location, age, and recent sales data of comparable properties. The assessor’s office aims to ensure that property assessments are fair and equitable across the city.

Once the assessed value is determined, it is multiplied by the applicable tax rate. The tax rate is established by various taxing districts, including the city of Seattle, King County, and local school districts. These districts use property taxes to fund their operations and services.

For instance, let's consider a residential property in Seattle with an assessed value of $500,000. If the combined tax rate for the relevant taxing districts is 1.7%, the annual property tax bill for this property would be calculated as follows:

| Assessed Value | $500,000 |

|---|---|

| Tax Rate | 1.7% |

| Annual Property Tax | $8,500 |

In this example, the property owner would be responsible for paying an annual property tax of $8,500.

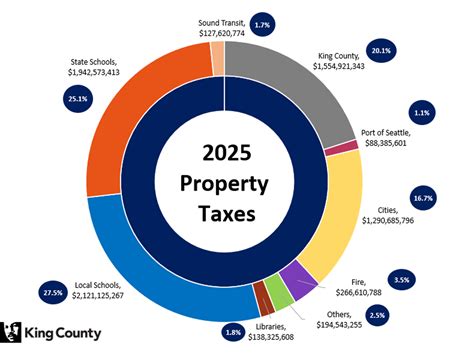

Property Tax Rates and Taxing Districts

It’s important to note that property tax rates can vary within Seattle due to the presence of multiple taxing districts. These districts include:

- City of Seattle: The city sets its own tax rate, which contributes to funding city services and initiatives.

- King County: As the county in which Seattle is located, King County also imposes a tax rate to support county-wide operations.

- Local School Districts: Seattle is served by several school districts, each with its own tax rate to finance public education.

- Special Districts: There may be additional special districts, such as fire protection or water districts, with their own tax rates.

The combined tax rate for a specific property is determined by adding up the rates set by all applicable taxing districts. This can result in varying tax rates across different neighborhoods within Seattle.

Exemptions and Tax Relief Programs

Seattle, like many other jurisdictions, offers various exemptions and tax relief programs to alleviate the property tax burden for certain property owners. These programs aim to provide financial assistance to eligible individuals and promote homeownership.

One notable exemption is the Senior Exemption, which allows qualifying senior citizens to reduce their property tax liability. To be eligible, seniors must meet specific age and income requirements and must have owned and occupied the property as their primary residence for a minimum period.

Additionally, Seattle offers the Low Income Senior/Disabled Exemption, which provides further tax relief for low-income seniors and individuals with disabilities. This exemption can significantly reduce the property tax burden for those who meet the income and residency criteria.

Other potential exemptions and relief programs may be available based on factors such as veteran status, homestead status, or participation in specific affordable housing initiatives. Property owners should consult with the King County Assessor's Office or a tax professional to explore their eligibility for these programs.

Property Tax Payment Options and Due Dates

Property owners in Seattle have several options for paying their property taxes. Understanding these options and the associated due dates is essential to ensure timely payments and avoid penalties.

Payment Options

Property taxes in Seattle can be paid through various methods, including:

- Online Payments: The most convenient option, allowing property owners to pay their taxes securely via the King County Treasury's website. This method offers real-time payment confirmation and is available 24/7.

- Mail-in Payments: Property owners can send their tax payments by mail to the King County Treasury. It's important to ensure timely postage to avoid late fees.

- In-Person Payments: Payments can be made in person at the King County Treasury's office during regular business hours. This option provides immediate confirmation of payment.

- Electronic Funds Transfer (EFT): Some property owners may opt for automatic payments through EFT, which allows for regular transfers from a designated bank account.

Payment Due Dates

Property tax payments in Seattle are due twice a year, with the first installment typically falling in February and the second in July. Failure to make timely payments can result in penalties and interest charges.

It's important to note that due dates may vary slightly based on the specific taxing district. Property owners should refer to their tax statements or consult the King County Treasury's website for accurate due date information.

Late Payment Penalties and Interest

Late payments of property taxes in Seattle are subject to penalties and interest charges. The specific rates and calculation methods can vary based on the taxing district.

For instance, if a property owner misses the first installment deadline, they may be charged a late fee of 10% of the unpaid amount, along with a 1% interest rate per month on the outstanding balance. These charges can accumulate quickly, so it's essential to stay informed about due dates and make timely payments.

Property owners should also be aware that failure to pay property taxes can lead to more severe consequences, including tax liens and potential foreclosure proceedings. It's crucial to prioritize property tax payments to avoid legal complications.

Understanding Property Tax Appeals

Property tax assessments are subject to errors and discrepancies, which can result in an unfair tax burden for property owners. Fortunately, Seattle provides a process for appealing property tax assessments to ensure fairness and accuracy.

Reasons for Appealing

Property owners may choose to appeal their assessments for various reasons, including:

- Overvaluation: If a property's assessed value is significantly higher than its fair market value, an appeal can be made to correct the assessment.

- Inequality: Property owners may appeal if they believe their property is assessed at a higher value compared to similar properties in the area.

- Exemption Denials: In cases where a property owner believes they qualify for an exemption but has been denied, an appeal can be filed to review the decision.

The Appeal Process

The property tax appeal process in Seattle typically involves the following steps:

- Notice of Value Review: Property owners receive a Notice of Value from the King County Assessor's Office, which includes the assessed value of their property. This notice serves as a starting point for the appeal process.

- Informal Review: Before filing a formal appeal, property owners can request an informal review with the assessor's office. This step allows for a discussion of the assessment and potential resolution without the need for a formal hearing.

- Formal Appeal: If the informal review does not resolve the issue, property owners can file a formal appeal with the King County Board of Equalization. This appeal must be submitted within a specified timeframe and include supporting documentation.

- Hearing: The Board of Equalization schedules a hearing to review the appeal. Property owners have the opportunity to present their case and provide evidence to support their appeal.

- Decision: After the hearing, the Board of Equalization issues a decision, which may result in a change to the property's assessed value or the denial of the appeal.

It's important to note that the appeal process can be complex and time-consuming. Property owners are encouraged to seek professional advice or representation to navigate the process effectively.

The Impact of Property Taxes on Real Estate Transactions

Property taxes play a significant role in real estate transactions, influencing both buyers and sellers. Understanding the impact of property taxes can help individuals make informed decisions when buying or selling property in Seattle.

Buyer Considerations

For buyers, property taxes are a crucial factor to consider when evaluating the affordability and long-term costs of a property. Here are some key considerations:

- Annual Property Tax Expense: Buyers should calculate the annual property tax liability based on the assessed value and tax rates. This expense should be factored into their overall budget and mortgage calculations.

- Tax Rate Stability: Buyers should research the stability of tax rates in the area. Rapidly increasing tax rates can impact the affordability of a property over time.

- Tax Relief Programs: Understanding available tax relief programs can help buyers assess their eligibility and potential savings. This information can be a deciding factor in their purchasing decision.

Seller Considerations

Sellers also need to consider the impact of property taxes on their transactions. Here are some key points:

- Tax Liability Disclosure: Sellers are often required to disclose property tax information, including the assessed value and recent tax bills, to potential buyers. This transparency is crucial for a smooth transaction.

- Appeals and Assessments: Sellers should be aware of their property's assessed value and any ongoing appeals. Accurate assessments can impact the property's market value and its appeal to buyers.

- Tax Incentives: Sellers may benefit from tax incentives or programs that can enhance the property's desirability, such as homestead exemptions or transfer tax exemptions.

Real estate professionals play a vital role in guiding buyers and sellers through these considerations, ensuring that property taxes are factored into the transaction process appropriately.

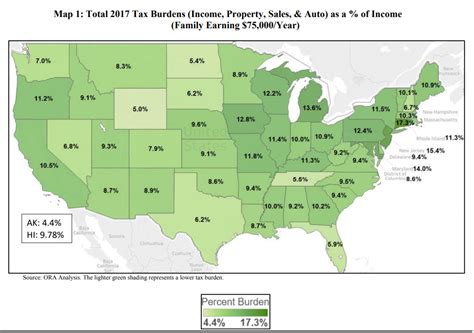

Future Outlook and Trends in Seattle’s Property Tax Landscape

The property tax landscape in Seattle is subject to ongoing changes and trends that can impact property owners and the real estate market as a whole. Staying informed about these developments is essential for making informed decisions.

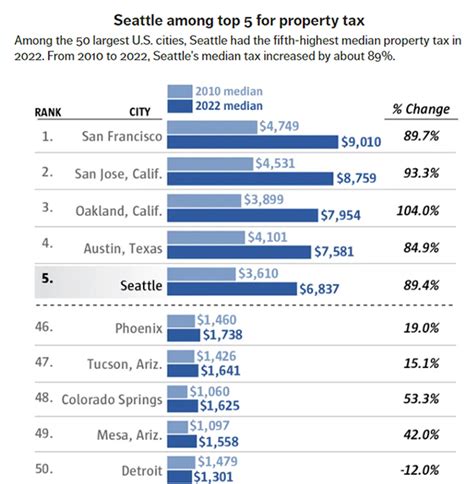

Rising Property Values

Seattle’s real estate market has experienced significant growth in recent years, leading to rising property values. As property values increase, so do the assessed values, resulting in higher property tax bills for homeowners.

While this trend can be beneficial for homeowners in terms of equity growth, it also means higher tax liabilities. Property owners should be prepared for potential increases in their property tax obligations as the market continues to evolve.

Tax Rate Stability

Maintaining stable tax rates is a priority for local governments, including Seattle. While tax rates may fluctuate slightly from year to year, the city aims to provide a predictable and sustainable tax environment for property owners.

However, it's important to note that tax rates can be influenced by various factors, including changes in government budgets, economic conditions, and voter-approved initiatives. Property owners should stay informed about local politics and budgetary decisions to anticipate potential tax rate adjustments.

Tax Relief Initiatives

Seattle and King County recognize the importance of providing tax relief to certain segments of the population. As a result, they continue to explore and implement initiatives to support homeowners, particularly those facing financial challenges.

For instance, the city has expanded its Senior Exemption program to include more eligible seniors and provide greater tax relief. Additionally, programs like the Low Income Senior/Disabled Exemption are being promoted to ensure that vulnerable populations can afford to remain in their homes.

These initiatives aim to strike a balance between funding essential services and supporting the financial well-being of Seattle's residents.

Technology and Innovation

Advancements in technology are also shaping the property tax landscape in Seattle. The King County Assessor’s Office and Treasury are adopting digital tools and platforms to enhance the efficiency and accuracy of assessments and tax collection processes.

For example, online portals and mobile apps are being developed to provide property owners with easy access to their assessment information, tax bills, and payment options. These innovations aim to improve transparency and convenience for taxpayers.

Conclusion: Navigating Seattle’s Property Tax System

Understanding Seattle’s property tax system is crucial for homeowners, prospective buyers, and real estate professionals alike. By familiarizing themselves with the assessment process, tax rates, payment options, and available exemptions, individuals can make informed decisions and effectively manage their property tax obligations.

Staying informed about local developments, tax relief programs, and market trends is essential for navigating the dynamic property tax landscape. Whether it's appealing an assessment, exploring tax savings opportunities, or making a real estate purchase, knowledge is power when it comes to property taxes in Seattle.

Remember, the information provided in this guide is a comprehensive overview, and specific details may vary based on individual circumstances and the ever-changing nature of the tax system. Consulting with tax professionals, real estate experts, and local authorities is always recommended to ensure accuracy and compliance.

How can I estimate my property tax liability before purchasing a home in Seattle?

+

To estimate your property tax liability, you can use the assessed value of the property and the current tax rate. Multiply the assessed value by the tax rate to get an approximate annual tax amount. Keep in mind that tax rates can change, so it’s a good idea to confirm the latest rates with the King County Assessor’s Office.

What happens if I miss a property tax payment deadline in Seattle?

+

Missing a property tax payment deadline can result in late fees and interest charges. It’s important to make timely payments to avoid penalties. If you encounter financial difficulties, consider contacting the King County Treasury to discuss potential payment plans or relief options.

Are there any online tools to help me understand my property tax bill in Seattle?

+

Yes, the King County Treasury provides an online Property Tax Lookup tool. This tool allows you to view your property tax information, including assessed value, tax rates, and payment history. It’s a convenient way to stay informed about your tax obligations.