Sd Property Tax

Welcome to a comprehensive exploration of the SD Property Tax system, an essential aspect of homeownership in San Diego County. This guide aims to provide an in-depth understanding of the property tax landscape, offering insights into how it works, what it entails, and how it impacts residents and businesses alike. We will delve into the specific rates, assessment processes, and payment schedules, as well as explore strategies for managing and potentially reducing these tax liabilities.

Understanding the SD Property Tax Landscape

In San Diego County, property taxes play a crucial role in funding essential public services and infrastructure projects. These taxes are levied on real estate properties, including residential homes, commercial buildings, and land, and are a primary source of revenue for local governments.

The SD Property Tax system is governed by a set of regulations and guidelines that ensure fairness and transparency. These regulations dictate how properties are assessed, how tax rates are determined, and how the collected funds are distributed among various governmental entities. Understanding these processes is key to navigating the property tax landscape effectively.

Property Assessment Process

The assessment process is a critical component of the SD Property Tax system. The County Assessor’s Office is responsible for evaluating each property’s value, taking into account factors such as location, size, improvements, and market conditions. This valuation determines the property’s assessed value, which serves as the basis for calculating the tax liability.

Properties in San Diego County are assessed annually, and the assessed value cannot increase by more than 2% per year unless there are significant improvements or changes to the property. This Proposition 13 provision aims to provide stability and predictability for property owners.

| Assessment Category | Description |

|---|---|

| Market Value Assessment | The Assessor determines the property's value based on current market conditions. |

| Base Year Value | This is the property's value at the time of purchase or when significant changes are made. |

| Annual Adjustment | The assessed value can increase by a maximum of 2% annually, as per Proposition 13. |

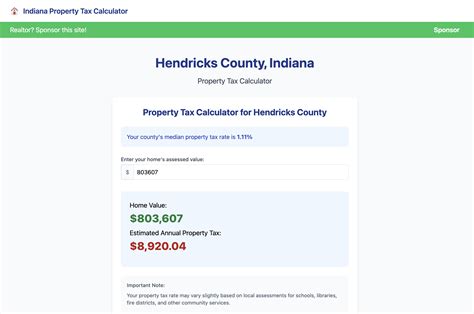

Tax Rates and Calculations

The tax rate in San Diego County is determined by the combined tax rates of various governmental entities, including the County, cities, and special districts. These entities rely on property taxes to fund services such as law enforcement, fire protection, education, and infrastructure development.

The tax rate is typically expressed as a percentage of the assessed value. For instance, if the tax rate is 1.2%, a property with an assessed value of $500,000 would have an annual tax liability of $6,000.

| Entity | Tax Rate (%) |

|---|---|

| San Diego County | 0.5215 |

| City of San Diego | 0.2279 |

| Special Districts (e.g., schools, fire protection) | Varies by district |

Payment Schedule and Options

Property taxes in San Diego County are typically due twice a year, with payment deadlines in February and November. However, property owners have the flexibility to pay their taxes in full or opt for a payment plan.

The payment plan allows property owners to divide their tax liability into installments, making it more manageable. Late payments may incur penalties and interest, so it's important to stay informed about the payment schedule and deadlines.

Strategies for Managing SD Property Taxes

Navigating the SD Property Tax system can be complex, but there are strategies that property owners can employ to manage their tax liabilities effectively.

Understanding Tax Exemptions and Credits

California offers various property tax exemptions and credits that can reduce the tax burden for eligible property owners. These include:

- Homeowner's Exemption: This exemption reduces the assessed value of a primary residence by up to $7,000, resulting in lower property taxes.

- Senior Citizen Exemption: Eligible seniors may qualify for a reduction in their assessed value, leading to significant tax savings.

- Veteran's Exemption: Veterans may be eligible for an exemption based on their military service, which can provide substantial tax benefits.

- Disabled Veteran's Exemption: Veterans with certain disabilities may qualify for a full exemption, removing their property from the tax rolls.

It's crucial to understand the eligibility criteria and application processes for these exemptions, as they can significantly impact property tax liabilities.

Appealing Property Assessments

If a property owner believes their assessed value is inaccurate or too high, they have the right to appeal the assessment. The appeal process involves presenting evidence and arguments to the Assessment Appeals Board, demonstrating why the assessed value should be adjusted.

Successful appeals can lead to a reduction in the assessed value, which directly impacts the property tax liability. It's important to gather supporting documentation, such as recent sales of similar properties or expert appraisals, to strengthen the appeal.

Utilizing Tax Abatement Programs

San Diego County offers tax abatement programs aimed at encouraging economic development and revitalizing certain areas. These programs provide tax incentives for property owners who invest in improvements or developments that align with the county’s strategic goals.

By participating in these programs, property owners can benefit from reduced tax liabilities, making their projects more financially feasible. It's worth exploring these opportunities, especially for those involved in commercial developments or renovations.

Conclusion: Navigating the SD Property Tax System

The SD Property Tax system is a vital component of San Diego County’s financial landscape, funding essential services and infrastructure. Understanding this system, from property assessments to tax calculations and payment options, is crucial for property owners and businesses.

By staying informed about tax rates, exemptions, and appeal processes, property owners can effectively manage their tax liabilities. Exploring strategies like tax abatement programs and staying up-to-date with the latest regulations can further optimize the tax-paying experience.

As San Diego continues to grow and evolve, the property tax system will play a pivotal role in shaping the county's future. Navigating this system with knowledge and strategy can ensure that property owners and businesses thrive while contributing to the community's prosperity.

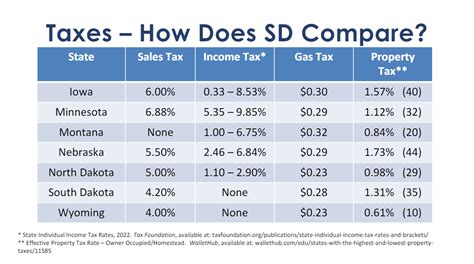

What is the average property tax rate in San Diego County?

+The average property tax rate in San Diego County is approximately 1.1%, which is slightly lower than the statewide average of around 1.2%.

How often are property taxes assessed in San Diego County?

+Property taxes are assessed annually in San Diego County. The assessed value of a property can increase by a maximum of 2% per year unless there are significant changes or improvements.

Are there any property tax exemptions available in San Diego County?

+Yes, San Diego County offers various property tax exemptions, including the Homeowner’s Exemption, Senior Citizen Exemption, Veteran’s Exemption, and Disabled Veteran’s Exemption. These exemptions can significantly reduce property tax liabilities for eligible individuals.