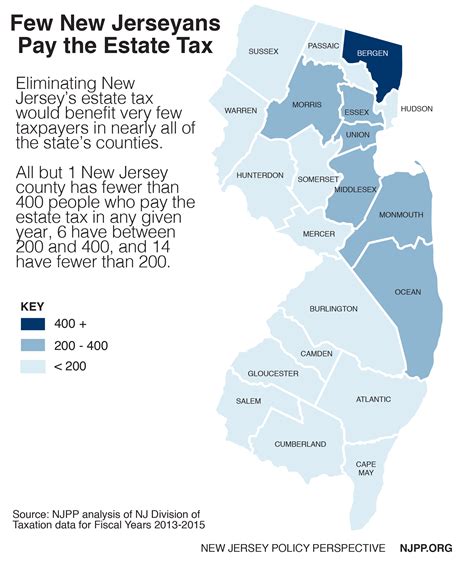

New Jersey Estate Tax

Estate planning is a critical aspect of financial management, especially for high-net-worth individuals and families. With a focus on the state of New Jersey, understanding the intricacies of its estate tax laws is essential for those seeking to protect their wealth and ensure a smooth transition of assets to their heirs. This comprehensive guide delves into the specifics of the New Jersey Estate Tax, offering a detailed analysis of its implications, calculation methods, and strategies for effective planning.

Unraveling the New Jersey Estate Tax

The New Jersey Estate Tax stands as a significant consideration for residents and non-residents alike, as it applies to the transfer of assets upon an individual’s death. Unlike the federal estate tax, which underwent reforms in 2018, New Jersey’s estate tax remains in effect, making it a key factor in estate planning for those with substantial assets.

Understanding the Tax Base

The estate tax in New Jersey is levied on the transfer of assets during an individual’s lifetime or at death. This includes a wide range of assets, such as real estate, personal property, cash, stocks, bonds, and business interests. The tax is calculated based on the gross estate, which is the total fair market value of these assets at the time of the decedent’s death.

For the tax year 2023, New Jersey has set a unified credit of $2,000,000, which effectively exempts estates with a value below this threshold from the state estate tax. This means that estates valued at $2,000,000 or less will not incur any state estate tax liability. However, it's important to note that this exemption amount is subject to change, and individuals should stay informed about any updates to the state's tax laws.

| Tax Year | Exemption Amount |

|---|---|

| 2023 | $2,000,000 |

| 2022 | $2,000,000 |

| 2021 | $2,000,000 |

It's worth mentioning that the exemption amount is adjusted periodically to account for inflation. This ensures that the tax remains relevant and that estates with modest values are not unduly burdened.

Calculating the Tax

The calculation of the New Jersey Estate Tax involves a straightforward process. The taxable estate, which is the value of the gross estate minus applicable deductions and the unified credit, is multiplied by the applicable tax rate.

The tax rates in New Jersey are graduated, meaning they increase as the value of the taxable estate rises. The current tax rates for 2023 are as follows:

| Taxable Estate Range | Tax Rate |

|---|---|

| $0 - $675,000 | 0% |

| $675,001 - $1,000,000 | 3% |

| $1,000,001 - $1,500,000 | 6% |

| $1,500,001 - $2,000,000 | 10% |

| Above $2,000,000 | 16% |

These tax rates apply to both residents and non-residents of New Jersey. It's important to note that the tax is calculated on a sliding scale, ensuring that larger estates bear a proportionally higher tax burden.

Strategies for Effective Planning

Given the complexity of estate planning and the potential tax implications, it’s crucial to employ effective strategies to minimize the impact of the New Jersey Estate Tax. Here are some key considerations:

-

Gift Giving: Making strategic gifts during one's lifetime can reduce the value of the taxable estate. Gifts to individuals, charities, or trusts can be an effective way to lower the estate's value and potentially avoid the estate tax altogether.

-

Life Insurance: Utilizing life insurance policies can be a powerful tool for estate planning. By structuring the policies appropriately, the proceeds can be directed to beneficiaries outside of the taxable estate, thereby reducing the overall tax burden.

-

Trusts: Establishing various types of trusts, such as revocable living trusts or irrevocable trusts, can provide flexibility and control over the distribution of assets. Trusts can also offer potential tax benefits and protect assets from creditors.

-

Charitable Giving: Donating to qualified charitable organizations can provide tax benefits and reduce the taxable estate. This strategy not only supports charitable causes but also minimizes the impact of estate taxes.

Case Study: A Real-Life Example

To illustrate the impact of the New Jersey Estate Tax and the effectiveness of planning strategies, let’s consider a hypothetical case study.

Imagine a New Jersey resident, John, who has accumulated a substantial estate valued at $3 million. Without any estate planning, John's estate would be subject to the New Jersey Estate Tax, potentially resulting in a significant tax liability.

However, John, with the guidance of his financial advisor, decides to implement a comprehensive estate plan. He establishes a revocable living trust, naming his children as beneficiaries. He also purchases a life insurance policy, with the proceeds directed to a charitable remainder trust. This strategy not only provides a steady income stream for his beneficiaries but also offers potential tax benefits.

Additionally, John makes annual gifts to his children and grandchildren, taking advantage of the annual gift tax exclusion. By strategically gifting a portion of his assets, John effectively reduces the value of his taxable estate.

Through these planning strategies, John is able to minimize the impact of the New Jersey Estate Tax. By combining the use of trusts, life insurance, and strategic gifting, he ensures that his heirs receive a larger portion of his estate, while also supporting his charitable goals.

Future Implications and Considerations

As with any aspect of tax law, the New Jersey Estate Tax is subject to potential changes and updates. It’s essential for individuals and families to stay informed about any legislative developments that may impact their estate planning strategies.

Furthermore, the interplay between state and federal estate taxes adds another layer of complexity. While the federal estate tax exemption is significantly higher than New Jersey's, it's important to consider the potential for future changes at both the state and federal levels. This underscores the importance of regular reviews and updates to one's estate plan to ensure alignment with the latest tax laws.

Conclusion

The New Jersey Estate Tax is a critical consideration for those with substantial assets, and effective planning is essential to minimize its impact. By understanding the tax base, calculation methods, and implementing strategic planning strategies, individuals can ensure that their wealth is protected and transferred to their heirs in the most tax-efficient manner.

Staying informed about tax laws and seeking professional guidance are key components of successful estate planning. With the right strategies in place, individuals can navigate the complexities of the New Jersey Estate Tax and secure a bright financial future for their loved ones.

How does the New Jersey Estate Tax differ from the federal estate tax?

+The New Jersey Estate Tax and the federal estate tax are separate taxes with different exemption amounts and tax rates. While the federal estate tax exemption is currently set at 12.06 million for 2023, New Jersey has a much lower exemption amount of 2,000,000. Additionally, the tax rates differ, with New Jersey’s rates being graduated and starting at 0% for estates valued at 675,000 or less.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Are there any exemptions or deductions available for the New Jersey Estate Tax?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, there are certain exemptions and deductions available to reduce the taxable estate in New Jersey. These include the unified credit, which effectively exempts estates valued at 2,000,000 or less from the state estate tax. Additionally, various deductions, such as funeral expenses, administration costs, and certain charitable contributions, can further reduce the taxable estate.

How often are the New Jersey Estate Tax exemption amounts and tax rates updated?

+The New Jersey Estate Tax exemption amounts and tax rates are typically updated periodically to account for inflation and economic changes. However, the frequency of these updates can vary, and it’s important for individuals to stay informed about any changes to the state’s tax laws. It’s recommended to consult with a tax professional or monitor official sources for the most up-to-date information.

Can non-residents of New Jersey be subject to the state’s estate tax?

+Yes, non-residents of New Jersey can be subject to the state’s estate tax if they own real or tangible personal property located within the state. This includes assets such as real estate, vehicles, or other tangible assets. It’s important for non-residents with significant assets in New Jersey to consider the potential impact of the state’s estate tax and plan accordingly.