Taxes And Levies

Taxes and levies are integral components of any functioning economy, playing a crucial role in shaping the financial landscape and influencing the lives of individuals and businesses alike. These financial obligations are levied by governments to generate revenue, fund public services, and regulate economic activities. Understanding the intricacies of taxes and levies is essential for both taxpayers and policymakers, as it directly impacts financial planning, investment decisions, and the overall health of the economy.

The Evolution of Taxes and Levies: A Historical Perspective

The concept of taxation has evolved significantly over centuries, from ancient civilizations’ rudimentary tax systems to the sophisticated and multifaceted systems we see today. In the past, taxes were often imposed to finance wars, construct public works, or support religious institutions. For instance, the ancient Egyptians implemented a complex tax system that included levies on crops, livestock, and even the use of the Nile River for transportation.

The evolution of taxes and levies has been a dynamic process, adapting to societal changes, technological advancements, and shifting political ideologies. In modern times, taxes have become a vital tool for governments to redistribute wealth, promote social welfare, and achieve economic goals. The introduction of progressive tax systems, for example, aims to reduce income inequality by imposing higher tax rates on higher income brackets.

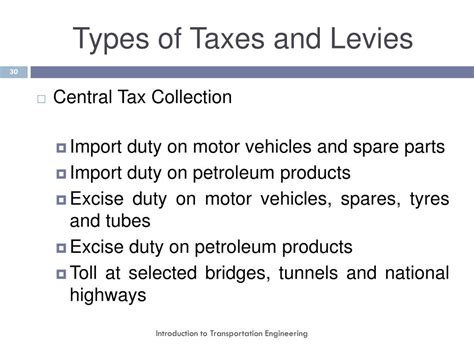

Types of Taxes and Levies: A Comprehensive Overview

Taxes and levies can be broadly categorized into several types, each serving a unique purpose and impacting different aspects of economic activity. Here’s an overview of some of the most common types:

Income Tax

Income tax is perhaps the most well-known and widely implemented type of tax. It is levied on an individual’s or entity’s earnings, typically calculated as a percentage of taxable income. Income tax is a crucial source of revenue for governments, allowing them to fund public services such as education, healthcare, and infrastructure development.

The income tax system often varies across jurisdictions, with different tax rates, brackets, and deductions. For instance, some countries employ a flat tax rate, while others opt for a progressive system where higher incomes are taxed at progressively higher rates. Understanding the nuances of income tax is essential for individuals and businesses to optimize their financial strategies and minimize tax liabilities.

Sales Tax and Value-Added Tax (VAT)

Sales tax and VAT are consumption-based taxes, imposed on the sale of goods and services. While sales tax is typically charged as a percentage of the sale price, VAT is a more complex system where tax is added at each stage of production and distribution, with credits given for taxes already paid. These taxes are designed to generate revenue from consumer spending and can significantly impact retail prices.

The implementation of sales tax and VAT varies widely across countries. For example, while some nations have a uniform sales tax rate, others employ multiple rates for different types of goods and services. In certain regions, essential items like groceries may be exempt from sales tax to alleviate the burden on low-income households.

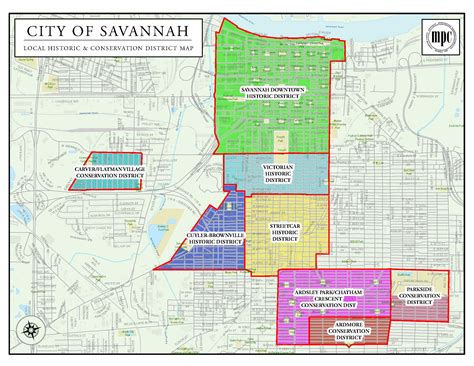

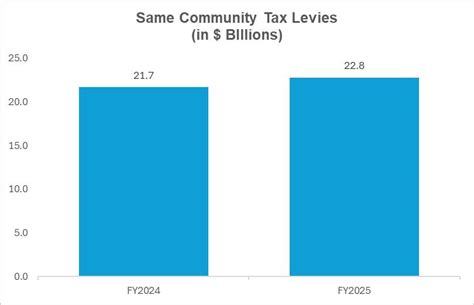

Property Tax

Property tax is levied on the ownership of real estate, such as land, buildings, and other improvements. It is a significant source of revenue for local governments, used to fund public amenities like schools, parks, and emergency services. Property tax rates are typically based on the assessed value of the property, with assessments conducted periodically.

Property tax systems can vary significantly, with some jurisdictions employing a simple flat rate based on property value, while others use more complex formulas that take into account factors like location, property type, and even environmental considerations. Effective property tax management is crucial for both property owners and local governments to ensure fair assessments and sustainable revenue generation.

Corporate Tax

Corporate tax is levied on the profits of corporations and businesses. It is a significant source of revenue for governments, especially in developed economies where corporate activities contribute substantially to the GDP. Corporate tax rates can vary widely, with some countries offering incentives like tax holidays or reduced rates to attract investment.

Effective corporate tax management is essential for businesses to optimize their financial performance and maintain competitiveness. This involves understanding the intricacies of tax laws, utilizing available deductions and credits, and implementing strategies to minimize tax liabilities. Additionally, corporations often engage in tax planning to ensure compliance and optimize their financial position within the legal framework.

Excise Tax

Excise tax is imposed on the production, sale, or consumption of specific goods, often referred to as “sin taxes.” These taxes are commonly applied to items like alcohol, tobacco, and certain luxury goods. Excise taxes are designed to generate revenue and also serve as a tool for governments to influence consumer behavior and promote public health objectives.

The implementation of excise tax can have significant economic and social implications. For instance, higher excise taxes on tobacco products have been shown to reduce smoking rates, especially among younger populations. On the other hand, excise taxes on fuel can impact transportation costs and, subsequently, the prices of goods and services across the economy.

Customs Duties and Import Taxes

Customs duties and import taxes are levied on goods imported into a country. These taxes are a significant source of revenue for many governments and can also be used as a tool for trade policy, influencing the flow of goods and protecting domestic industries. Customs duties are often calculated as a percentage of the value of the imported goods, with specific rates set for different product categories.

The implementation of customs duties and import taxes can impact international trade relations and business strategies. For instance, higher import taxes on certain goods can make them less competitive in the domestic market, encouraging local production or the development of alternative supply chains. Effective management of import taxes is crucial for businesses involved in international trade to optimize their pricing strategies and maintain competitiveness.

The Impact of Taxes and Levies on Economic Activity

Taxes and levies have a profound impact on economic activity, influencing investment decisions, consumer behavior, and the overall health of the economy. The imposition of taxes can affect the supply and demand of goods and services, impact the distribution of wealth, and shape the competitive landscape for businesses.

For instance, higher income taxes can reduce disposable income for individuals, potentially leading to decreased consumer spending. On the other hand, lower corporate taxes can encourage investment and business growth, creating job opportunities and boosting economic output. The intricate relationship between taxes and economic activity is a key consideration for policymakers, as they strive to strike a balance between revenue generation and economic growth.

Tax Incentives and Economic Development

Tax incentives are a powerful tool used by governments to promote economic development and attract investment. These incentives can take various forms, such as tax credits, tax holidays, or reduced tax rates for specific industries or geographic areas. By offering tax benefits, governments can stimulate economic activity, encourage innovation, and create jobs.

For example, tax incentives for renewable energy projects can accelerate the transition to sustainable energy sources, creating new industries and reducing environmental impact. Similarly, offering tax breaks to encourage business expansion in underdeveloped regions can promote economic growth and reduce regional disparities. The strategic use of tax incentives is a delicate balancing act, requiring careful consideration of the potential benefits and costs to ensure effective economic development.

Tax Avoidance and Evasion: The Dark Side of Taxation

While taxes are a necessary component of a functioning economy, they can also be a source of contention and abuse. Tax avoidance and evasion are significant issues faced by governments worldwide, resulting in substantial revenue losses and creating an unfair playing field for compliant taxpayers.

Tax avoidance refers to the use of legal strategies to minimize tax liabilities, often through complex financial arrangements or the exploitation of loopholes in tax laws. On the other hand, tax evasion involves the illegal non-payment or underpayment of taxes, often through deliberate concealment of income or assets. These practices undermine the integrity of the tax system and can have far-reaching consequences for the economy and society.

Combating tax avoidance and evasion requires robust tax administration systems, international cooperation, and innovative approaches. Governments are increasingly utilizing data analytics and artificial intelligence to identify potential tax avoidance schemes and evasion activities. Additionally, enhanced information sharing between tax authorities and increased transparency in financial transactions are critical components of the fight against tax abuse.

The Future of Taxes and Levies: Trends and Innovations

The landscape of taxes and levies is continually evolving, driven by technological advancements, changing societal needs, and shifting political priorities. Here are some key trends and innovations shaping the future of taxation:

Digital Taxation

The rise of the digital economy has presented unique challenges for tax authorities. Many digital businesses, particularly those in the technology sector, have complex international operations, making it difficult to determine their tax liabilities in different jurisdictions. To address this, governments are exploring new approaches, such as digital service taxes and value-added taxes on digital transactions.

Digital taxation aims to ensure that digital businesses contribute fairly to the economies in which they operate. This involves developing new tax rules and frameworks that consider the unique characteristics of digital services and platforms. As the digital economy continues to expand, effective digital taxation will be crucial for maintaining a level playing field and generating revenue for public services.

Green Taxation

As the world grapples with the challenges of climate change, green taxation is gaining prominence as a tool to promote sustainable practices and reduce environmental harm. Green taxes are designed to discourage activities that harm the environment, such as carbon emissions or the use of non-renewable resources. These taxes can provide an incentive for businesses and individuals to adopt more sustainable practices.

For instance, carbon taxes are being implemented in various countries to reduce greenhouse gas emissions. These taxes are levied on the carbon content of fuels, encouraging the transition to cleaner energy sources and promoting investment in renewable technologies. Green taxation is a powerful tool for governments to shape economic behavior and accelerate the transition to a more sustainable future.

Tax Simplification and Automation

Tax systems can be complex and burdensome for taxpayers, particularly small businesses and individuals. To address this, governments are exploring ways to simplify tax laws and procedures, making them more accessible and user-friendly. This includes initiatives like tax reform, streamlining tax filing processes, and implementing digital tax platforms.

Additionally, tax automation is gaining traction, leveraging technology to streamline tax administration. This involves the use of advanced data analytics, artificial intelligence, and machine learning to automate tax calculations, improve compliance, and reduce the burden on taxpayers and tax authorities. As technology continues to advance, tax automation will play an increasingly significant role in the future of taxation.

Conclusion: The Role of Taxes and Levies in a Changing World

Taxes and levies are fundamental to the functioning of modern societies, serving as a crucial source of revenue for governments and a tool for economic regulation and social welfare. As the world continues to evolve, the role of taxes and levies will adapt to meet new challenges and opportunities.

From the historical perspective of ancient civilizations to the innovative approaches of the digital age, the evolution of taxes and levies reflects the dynamic nature of economic systems. As we navigate the complexities of the modern world, understanding the intricacies of taxes and levies is essential for individuals, businesses, and policymakers to make informed decisions and shape a sustainable and prosperous future.

What is the primary purpose of taxes and levies?

+The primary purpose of taxes and levies is to generate revenue for governments to fund public services, promote social welfare, and achieve economic goals. Taxes play a crucial role in redistributing wealth, regulating economic activities, and shaping the overall health of the economy.

How do taxes impact economic activity?

+Taxes can significantly influence economic activity by impacting investment decisions, consumer behavior, and the competitive landscape for businesses. For instance, higher income taxes can reduce disposable income, potentially leading to decreased consumer spending. Conversely, lower corporate taxes can encourage investment and business growth.

What are some emerging trends in taxation?

+Some emerging trends in taxation include digital taxation, which aims to address the challenges posed by the digital economy, and green taxation, which utilizes taxes to promote sustainable practices and reduce environmental harm. Additionally, tax simplification and automation are gaining traction to make tax systems more accessible and efficient.