Tax Percentage In Las Vegas

Welcome to Las Vegas, the vibrant city renowned for its dazzling lights, world-class entertainment, and, of course, its bustling casino scene. While the allure of winning big may be enticing, it's essential to understand the tax implications that come with gambling winnings in this vibrant city. In this comprehensive guide, we'll delve into the tax percentage in Las Vegas, shedding light on the financial considerations every visitor and resident should be aware of.

Taxation in Las Vegas: An Overview

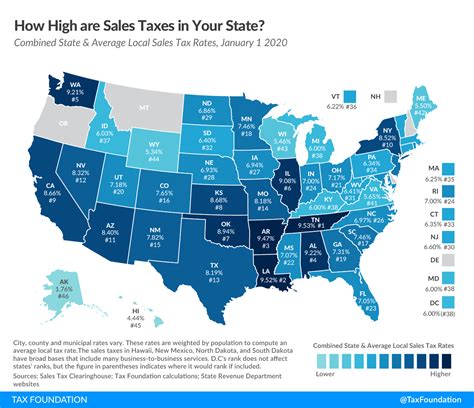

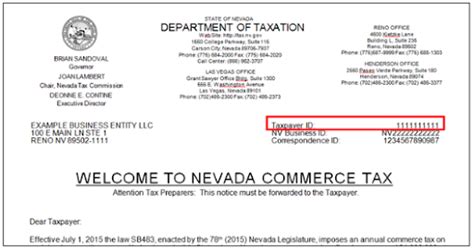

Las Vegas, nestled in the state of Nevada, boasts a unique tax landscape compared to many other parts of the United States. Nevada is known for its favorable tax environment, and this extends to the realm of gambling as well. The state has a distinct tax structure that differentiates it from other states, particularly when it comes to taxes on gambling winnings.

When you win big in Las Vegas, whether it's at the slot machines, blackjack tables, or during a thrilling poker tournament, you may be wondering how much of your winnings will be subject to taxation. The tax percentage applicable to your winnings depends on several factors, including the type of gambling activity, the amount won, and the residency status of the winner. Let's explore these factors in detail to provide a comprehensive understanding of the tax situation in Sin City.

Taxation for Visitors and Residents: A Comparative Analysis

One of the critical distinctions in the tax landscape of Las Vegas is the difference between taxation for visitors and residents. While both groups are subject to tax on their gambling winnings, the specifics vary, and understanding these nuances is essential for financial planning.

Taxation for Visitors

Visitors to Las Vegas, often referred to as non-residents, are generally subject to a flat tax rate on their gambling winnings. This flat tax rate is applied to all winnings, regardless of the amount or the type of game played. As of my last update, the flat tax rate for visitors in Las Vegas is 5% on all gambling winnings.

This means that if a visitor wins $10,000 at the roulette table, they would owe the state of Nevada a tax of $500 on those winnings. The tax is calculated as a straightforward percentage of the total winnings, making it a simple and predictable system for visitors to navigate.

It's important to note that the 5% tax rate is applied to the gross winnings, not the net winnings. This means that even if a visitor has significant losses during their gambling session, the tax is calculated based on the total amount won, not the profit made. This flat tax system ensures simplicity and consistency for visitors, allowing them to budget and plan their finances accordingly during their Las Vegas adventure.

| Gambling Winnings | Tax Amount |

|---|---|

| $1,000 | $50 |

| $5,000 | $250 |

| $10,000 | $500 |

| $50,000 | $2,500 |

Taxation for Residents

For residents of Las Vegas, the tax landscape is slightly more complex. While the state of Nevada does not impose a personal income tax on its residents, gambling winnings are treated as an exception to this tax-friendly environment.

Resident gamblers in Las Vegas are subject to a progressive tax system on their winnings. This means that the tax rate increases as the amount of winnings increases. The progressive tax structure is designed to ensure fairness and account for the varying financial situations of residents.

Here's a breakdown of the progressive tax rates for resident gamblers in Las Vegas:

| Gambling Winnings | Tax Rate |

|---|---|

| $1,000 or less | 0% |

| $1,001 - $5,000 | 1.5% |

| $5,001 - $10,000 | 3% |

| $10,001 - $25,000 | 4% |

| $25,001 - $100,000 | 6% |

| Over $100,000 | 8% |

For instance, if a Las Vegas resident wins $20,000 at the craps table, they would be subject to a tax rate of 4% on their winnings, resulting in a tax amount of $800. The progressive tax system ensures that residents with higher winnings contribute a larger portion to the state's revenue.

Gambling Tax Implications: What to Consider

Understanding the tax implications of gambling winnings is crucial for both visitors and residents of Las Vegas. Here are some key considerations to keep in mind:

- Reporting Requirements: Whether you're a visitor or a resident, it's essential to report your gambling winnings accurately. Casinos are required to report winnings exceeding specific thresholds to the Internal Revenue Service (IRS). For visitors, this threshold is often $600 or more, while for residents, it can vary depending on the type of game and the amount won.

- Tax Forms and Documentation: When claiming gambling winnings, you may need to complete specific tax forms, such as Form W-2G for certain types of winnings. Keeping records of your winnings, including casino receipts or statements, is crucial for accurate reporting.

- Deducting Losses: While gambling winnings are taxable, you may be able to deduct gambling losses to offset your taxable income. However, it's important to keep detailed records of your losses and consult with a tax professional to ensure compliance with IRS regulations.

- Professional Guidance: The tax landscape can be complex, especially when it comes to gambling winnings. Consulting with a qualified tax advisor or accountant who specializes in gambling taxation can provide valuable insights and ensure you're optimizing your tax situation.

The Future of Gambling Taxation in Las Vegas

As the gambling industry continues to evolve, so too does the tax landscape in Las Vegas. While the current tax structure provides a relatively straightforward framework for visitors and residents, there are ongoing discussions and potential changes on the horizon.

One key consideration is the potential introduction of a personal income tax in Nevada. While this idea has been debated for years, there is a growing movement to explore alternative revenue sources to support public services and infrastructure. If a personal income tax were to be implemented, it could significantly impact the taxation of gambling winnings for residents.

Additionally, as the digital gaming landscape expands, with online casinos and sports betting gaining popularity, the tax treatment of these activities may require further clarification and regulation. The Nevada Tax Commission and state legislators are actively engaged in discussions to ensure that the tax system remains fair and adaptable to the evolving nature of the gambling industry.

As an informed gambler or financial planner, staying abreast of these potential changes is crucial. Keeping an eye on legislative developments and engaging with industry experts can provide valuable insights into how the tax landscape may evolve, ensuring you're prepared for any adjustments that may impact your financial planning.

Conclusion: Navigating the Tax Landscape in Las Vegas

Las Vegas, with its vibrant casinos and world-class entertainment, offers an unforgettable experience for visitors and residents alike. Understanding the tax implications of gambling winnings is an essential aspect of financial planning in this unique city. Whether you’re a visitor enjoying a fleeting adventure or a resident navigating the local tax system, knowledge is power when it comes to optimizing your financial situation.

By familiarizing yourself with the tax percentages applicable to your winnings, you can make informed decisions and plan your finances accordingly. Whether it's budgeting for tax payments or exploring strategies to optimize your tax situation, being well-informed is the first step toward financial success in the vibrant world of Las Vegas gambling.

As you embark on your gambling journey in Las Vegas, remember that while the thrill of winning is exhilarating, staying mindful of the tax implications ensures a responsible and well-rounded approach to your financial well-being. Enjoy the excitement of the city, but always keep an eye on the tax landscape to make the most of your gaming adventures.

What happens if I win a large jackpot in Las Vegas? Do I need to pay tax immediately?

+If you’re fortunate enough to win a large jackpot in Las Vegas, you may be required to pay tax on those winnings immediately. Casinos typically withhold a certain percentage of your winnings for tax purposes, especially for jackpots exceeding specific thresholds. The amount withheld will depend on your residency status and the type of game you won on. It’s important to consult with a tax professional to understand the specific tax implications of your winnings and ensure compliance with tax regulations.

Are there any tax benefits for frequent gamblers in Las Vegas?

+Frequent gamblers in Las Vegas may be able to take advantage of certain tax benefits. One potential benefit is the ability to deduct gambling losses from their taxable income. However, it’s crucial to keep detailed records of your winnings and losses to substantiate any deductions claimed. Consulting with a tax professional can provide personalized advice based on your specific gambling activities and tax situation.

How can I report my gambling winnings to the IRS if I’m a non-resident of the United States?

+As a non-resident of the United States, you may still be required to report your gambling winnings to the IRS if they exceed specific thresholds. In such cases, you’ll need to file a US tax return using Form 1040NR, which is specifically designed for non-residents. It’s essential to seek professional tax advice to ensure you’re complying with the correct tax reporting requirements for your situation.