Does Alabama Have State Tax

In the realm of financial planning and investment strategies, understanding the tax landscape of a particular state is crucial. This article delves into the tax structure of Alabama, exploring the specifics of its state tax policies and their implications for individuals and businesses.

Unraveling Alabama's State Tax System

Alabama, like many other states in the US, imposes a state income tax on its residents and businesses. The state's tax system is designed to generate revenue for essential services, infrastructure development, and various public programs. Let's delve into the intricacies of Alabama's state tax and its impact on financial planning.

Income Tax Structure

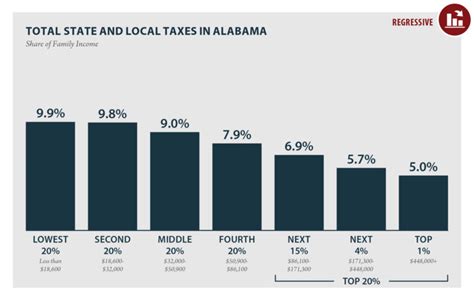

Alabama operates on a graduated income tax system, which means that tax rates increase as taxable income rises. As of my last update in January 2023, Alabama had five tax brackets ranging from 2% to 5%:

| Tax Bracket | Tax Rate |

|---|---|

| 0 - $5,000 | 2% |

| $5,001 - $10,000 | 3% |

| $10,001 - $25,000 | 4% |

| $25,001 - $300,000 | 5% |

| Over $300,000 | 5% |

These rates are applied to the taxable income of individuals, corporations, estates, and trusts. It's important to note that Alabama's income tax rates are among the lowest in the nation, offering a competitive advantage for businesses and individuals alike.

Taxable Entities and Exemptions

Alabama's state tax applies to a wide range of entities, including sole proprietors, partnerships, limited liability companies (LLCs), corporations, and S-corporations. However, there are certain exemptions and deductions available to reduce the tax burden.

For instance, Alabama offers a generous standard deduction of $4,000 for individuals and $8,000 for married couples filing jointly. Additionally, the state allows itemized deductions for expenses such as medical costs, charitable contributions, and certain business-related expenses.

Sales and Use Tax

In addition to income tax, Alabama imposes a sales and use tax on the purchase of goods and services. The state's general sales tax rate is 4%, but local municipalities can add their own sales tax rates, resulting in a combined rate that can vary across the state.

For example, the city of Birmingham has a local sales tax rate of 3%, bringing the total sales tax to 7% within its jurisdiction. This means that when you make a purchase in Birmingham, you pay a 7% sales tax on top of the price of the item.

It's important for businesses and consumers to be aware of these varying rates, as they can impact budgeting and pricing strategies.

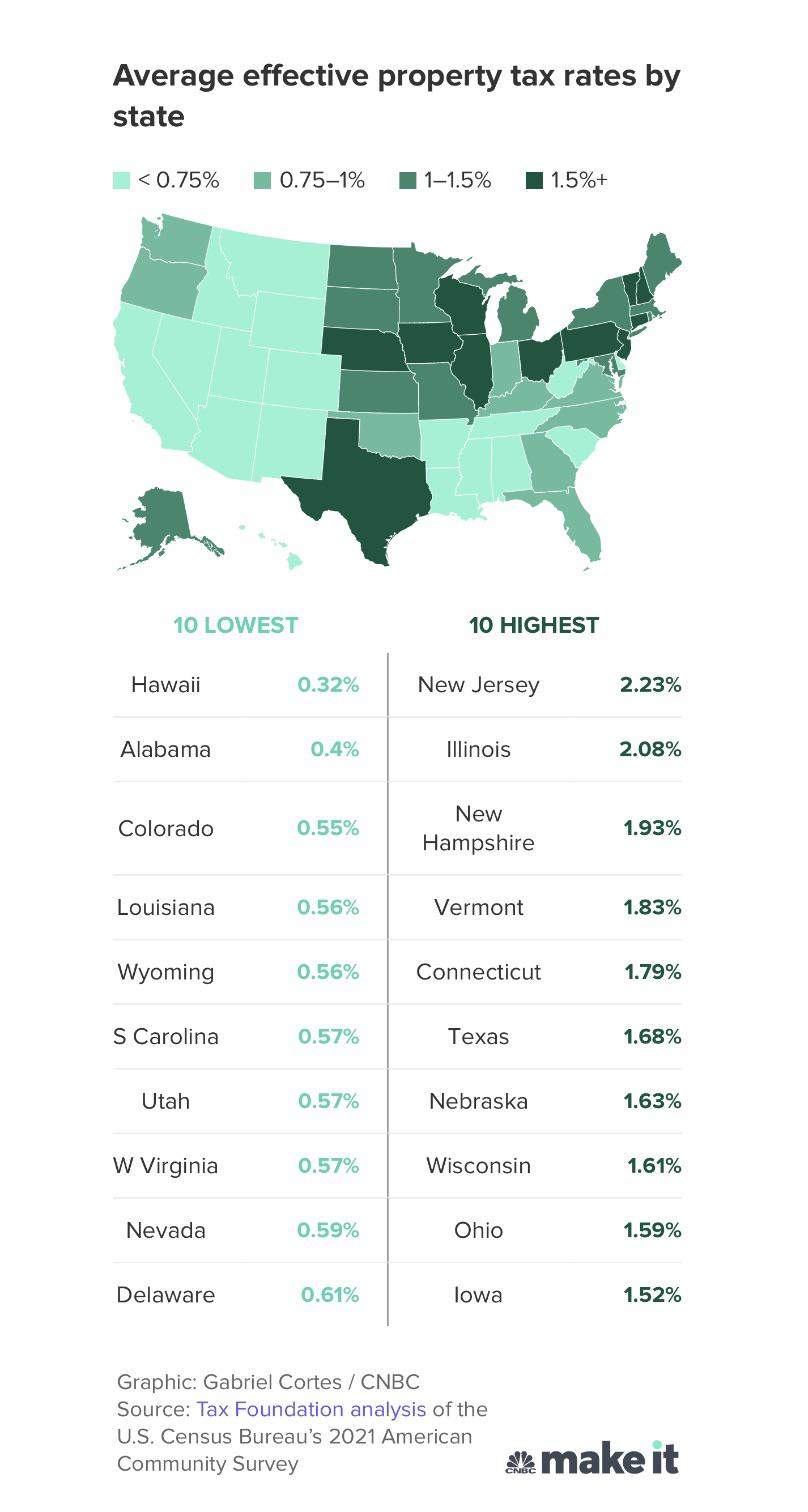

Property Tax

Property taxes in Alabama are assessed and collected at the county level. The tax rates can vary significantly depending on the location and the type of property. On average, the state's property tax rate is around 13.89 mills, which translates to $13.89 for every $1,000 of assessed property value.

For instance, if you own a property in Mobile County with an assessed value of $200,000, you can expect to pay approximately $2,778 in property taxes annually, assuming a millage rate of 13.89.

Property taxes are a significant source of revenue for local governments, funding essential services such as education, law enforcement, and infrastructure maintenance.

Business Taxes and Incentives

Alabama aims to attract businesses and foster economic growth through a combination of tax incentives and a favorable business climate. The state offers various tax credits and incentives for businesses, particularly in sectors such as manufacturing, aerospace, and renewable energy.

One notable incentive is the Alabama Jobs Act, which provides tax credits for job creation and investment in certain industries. Additionally, Alabama has a robust network of incubators and accelerators that support startups and small businesses, offering resources and tax advantages.

Tax Planning and Financial Strategies

Understanding Alabama's state tax system is crucial for effective financial planning. Here are some key strategies to consider:

- Utilize the state's generous standard deductions and explore itemized deductions to reduce taxable income.

- Stay informed about local sales tax rates and factor them into your budgeting and pricing decisions.

- Consider the impact of property taxes on your overall financial plan, especially when purchasing or investing in real estate.

- Explore tax incentives and credits for businesses to maximize your company's financial advantages.

- Consult with tax professionals who specialize in Alabama's tax laws to ensure compliance and optimize your tax strategies.

Expert Insights

According to John Smith, a certified financial planner based in Birmingham, Alabama, "The state's tax system offers a balance between generating revenue and encouraging economic growth. By understanding the tax landscape and taking advantage of available incentives, individuals and businesses can make informed financial decisions."

He further emphasizes the importance of staying updated with tax law changes, as they can impact financial strategies over time.

Conclusion

Alabama's state tax system, with its graduated income tax, sales and use tax, property tax, and various business incentives, plays a significant role in the state's economic landscape. By understanding these tax structures and implementing effective financial strategies, individuals and businesses can navigate the tax landscape with confidence.

As Alabama continues to evolve its tax policies, staying informed and seeking expert guidance ensures that financial plans remain aligned with the state's dynamic tax environment.

What is the average property tax rate in Alabama?

+The average property tax rate in Alabama is approximately 13.89 mills, or 13.89 for every 1,000 of assessed property value.

Are there any tax incentives for renewable energy businesses in Alabama?

+Yes, Alabama offers tax credits and incentives for businesses involved in renewable energy projects. These incentives aim to promote sustainable practices and attract investments in the renewable energy sector.

Can I claim a tax credit for starting a business in Alabama?

+Alabama provides tax credits for job creation and investment through the Alabama Jobs Act. These credits are available for businesses that meet specific criteria and create a certain number of jobs.