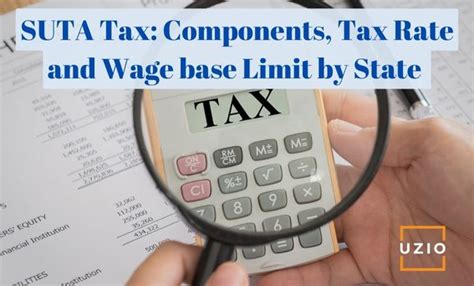

What Is Suta Tax

In the realm of taxation, various systems and mechanisms are employed to ensure efficient revenue collection and equitable distribution of resources. Among these, the Suta Tax, also known as the State Unemployment Tax Act, plays a significant role in the United States, particularly in the context of employment and unemployment benefits.

This article aims to delve into the intricacies of the Suta Tax, exploring its definition, purpose, and implications for both employers and employees. By understanding this tax system, we can gain insights into its role in supporting unemployment programs and its impact on the broader economy.

Unveiling the Suta Tax: A Comprehensive Overview

The Suta Tax, or State Unemployment Tax Act, is a vital component of the United States' unemployment insurance system. It is a state-level tax imposed on employers to fund unemployment benefits for workers who become unemployed through no fault of their own. This tax is a critical element of the social safety net, providing financial support to individuals during periods of job loss.

The Suta Tax is a compulsory levy, meaning that all employers operating within a state must contribute to the unemployment insurance fund. The tax is calculated based on a percentage of an employer's payroll, with rates varying across states. This variability is influenced by factors such as an employer's industry, their history of employee turnover, and the overall unemployment rate in the state.

For instance, let's consider the state of California. Here, the Suta Tax rate for the year 2023 is set at 1.5% of an employer's taxable wages, up to a maximum taxable wage amount of $7,000 per employee. This means that for an employee earning $50,000 annually, an employer would pay a Suta Tax of $105 (1.5% of $7,000), assuming the employee's entire income is taxable. However, it's important to note that not all states follow the same tax structure, and some may have different rate structures or wage bases.

Key Components of the Suta Tax

The Suta Tax system is designed with several key components to ensure its effectiveness and fairness:

- Taxable Wages: Only a portion of an employee's wages is considered taxable for Suta Tax purposes. This taxable wage base varies by state, as mentioned earlier. Wages above this base are typically not subject to the tax.

- Experience Rating: The Suta Tax rate an employer pays is often influenced by their history of unemployment claims. Employers with a higher number of claims may face higher tax rates, creating an incentive to maintain a stable workforce.

- Rate Schedules: Each state publishes a rate schedule that outlines the tax rates applicable to employers based on their experience rating. These schedules provide transparency and ensure that employers understand their obligations.

- Wage Credits: Some states offer wage credits to employers who provide job training or who employ certain types of workers, such as veterans or individuals with disabilities. These credits can reduce an employer's Suta Tax liability.

By combining these components, the Suta Tax system aims to strike a balance between providing adequate unemployment benefits to workers and incentivizing employers to maintain stable employment.

| State | Taxable Wage Base | 2023 Tax Rate |

|---|---|---|

| California | $7,000 | 1.5% |

| New York | $12,000 | 0.25% - 6.3% |

| Texas | $9,000 | 0.8% |

Impact and Implications of the Suta Tax

The Suta Tax has wide-ranging implications for both employers and employees. For employers, it represents a cost of doing business, impacting their financial planning and payroll management. The tax rate and associated regulations can influence an employer's hiring practices and workforce retention strategies.

From an employee's perspective, the Suta Tax is an essential component of the unemployment insurance system. It ensures that individuals who become unemployed due to economic conditions or other qualifying reasons can receive financial support to help cover their living expenses. This support is particularly crucial during periods of economic downturn, when job opportunities may be limited.

Benefits of the Suta Tax for Employers

While the Suta Tax may seem like an additional burden for employers, it offers several benefits that contribute to a stable and efficient labor market:

- Stability and Continuity: By funding unemployment benefits, the Suta Tax helps maintain a stable workforce. Employees know they have a safety net if they lose their jobs, encouraging them to stay with their current employer.

- Reduced Turnover: The tax system incentivizes employers to invest in their workforce, reducing turnover rates. This can lead to improved productivity and reduced recruitment costs for businesses.

- Economic Stimulus: Unemployment benefits provided through the Suta Tax system can stimulate the economy during downturns. When unemployed individuals receive benefits, they can continue to spend and contribute to economic activity.

Challenges and Considerations

Despite its benefits, the Suta Tax system also presents challenges and considerations:

- Complexity: The varying tax rates and regulations across states can make compliance complex for businesses operating in multiple jurisdictions. This complexity can lead to administrative burdens and potential non-compliance.

- Funding Shortfalls: In times of high unemployment, the demand for benefits may exceed the available funds. This can lead to temporary increases in tax rates or the need for state governments to borrow funds to cover benefit payments.

- Equity Concerns: The Suta Tax system may not be equitable for all employers. Those with a history of low turnover may face higher tax rates, while those with higher turnover rates may pay less, despite potentially contributing to a more unstable labor market.

Future Prospects and Innovations

As the labor market continues to evolve, the Suta Tax system is also undergoing changes and innovations to address emerging challenges and opportunities:

Technology Integration

Many states are embracing technology to streamline Suta Tax administration. Online portals and digital platforms are being introduced to simplify tax filing, payment, and reporting processes. These innovations aim to reduce administrative burdens for employers and improve the efficiency of tax collection.

Flexible Rate Structures

Some states are experimenting with more flexible rate structures to provide greater stability and predictability for employers. Instead of traditional experience rating systems, these states are considering alternative approaches, such as wage-based or industry-specific rates, to ensure fairness and reduce volatility.

Enhanced Data Analytics

Advancements in data analytics are enabling states to better understand unemployment trends and patterns. This data-driven approach can help states adjust tax rates and benefit levels more effectively, ensuring that the Suta Tax system remains responsive to economic conditions.

Expanding Eligibility

In response to changing labor market dynamics, some states are expanding the eligibility criteria for unemployment benefits. This includes considering factors such as gig work, part-time employment, and self-employment. By broadening eligibility, states aim to provide support to a wider range of workers who may face unique challenges in the modern economy.

How often do Suta Tax rates change?

+Suta Tax rates are typically reviewed and adjusted annually by state governments. The exact timing and frequency of rate changes can vary, but most states publish new rates for the upcoming year in late fall or early winter.

Are there any tax credits or incentives for employers under the Suta Tax system?

+Yes, some states offer tax credits or incentives to employers who meet certain criteria. These may include credits for providing job training, employing veterans, or creating jobs in underserved communities. The availability and specifics of these incentives vary by state.

How can employers calculate their Suta Tax liability?

+Employers can calculate their Suta Tax liability by multiplying their taxable wages (up to the state’s taxable wage base) by the applicable tax rate. This rate is determined based on the employer’s experience rating and the state’s rate schedule. It’s essential to consult the specific regulations and guidelines provided by the state’s tax agency for accurate calculations.