Colorado Tax Return Status

Filing taxes is a crucial process for individuals and businesses, and it's natural to want to know the status of your tax return. If you've filed your Colorado tax return and are eager to check its progress, this comprehensive guide will provide you with all the information you need. From understanding the various stages of the filing process to exploring online tools and resources, we'll cover everything to help you track your Colorado tax return status with ease.

Understanding the Colorado Tax Return Process

The Colorado Department of Revenue handles the processing of tax returns, and it's essential to familiarize yourself with the typical timeline and procedures involved.

Filing Deadlines

For Colorado state taxes, the filing deadline is typically aligned with the federal tax deadline, which is usually April 15th. However, it's crucial to stay updated on any changes or extensions announced by the state. The deadline may vary based on the specific circumstances, such as filing electronically or submitting a paper return.

Processing Timeframes

The processing time for tax returns can vary, and it's influenced by several factors. The Colorado Department of Revenue aims to process returns as efficiently as possible, but the volume of returns, complexity of cases, and the method of filing (electronic or paper) can impact the timeline.

Here's a general overview of the processing times:

| Filing Method | Typical Processing Time |

|---|---|

| Electronic Filing | 2-4 weeks |

| Paper Returns | 4-6 weeks |

It's important to note that these are approximate timelines, and individual circumstances may cause variations. For instance, if your return is selected for further review or audit, the processing time may extend beyond these estimates.

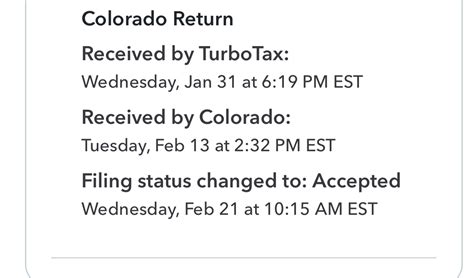

Return Statuses

During the processing of your Colorado tax return, it will go through several stages, each indicating a specific status. Understanding these statuses can provide valuable insights into the progress of your return.

Common return statuses include:

- Received: Your tax return has been successfully submitted and is now in the possession of the Colorado Department of Revenue.

- In Process: The return is currently being processed, and the authorities are reviewing and verifying the information provided.

- Review: This status indicates that your return requires further examination and may be subject to additional scrutiny or audit.

- Accepted: The tax return has been accepted, and no further action is required from your end. You can expect your refund or any applicable payments to be processed soon.

- Rejected: If your return is rejected, it means there was an error or discrepancy identified during the processing. You'll need to correct the issue and resubmit the return.

Checking Your Colorado Tax Return Status

Now that we've covered the fundamentals, let's delve into the practical steps to check the status of your Colorado tax return.

Online Tools and Resources

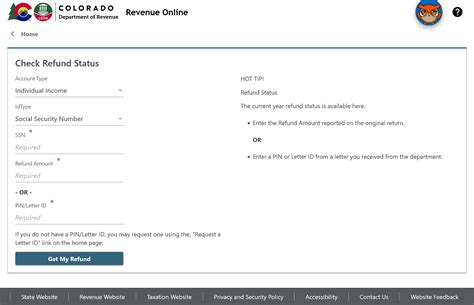

The Colorado Department of Revenue provides online tools and resources to help taxpayers track the status of their returns. These digital platforms offer a convenient and efficient way to stay informed about the progress of your tax return.

Colorado Department of Revenue Website

The official website of the Colorado Department of Revenue serves as a valuable resource for taxpayers. Here, you can find updates, announcements, and valuable information related to tax filing and return status.

To check your return status, navigate to the "Where's My Refund?" section on the website. You'll typically need to provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), as well as other identifying information to access your return status.

The website will display the current status of your return, along with any relevant updates or messages from the Department of Revenue.

Colorado Taxpayer Access Point (CTAP)

CTAP is a secure online portal provided by the Colorado Department of Revenue. This platform allows registered users to manage their tax accounts, view payment history, and, most importantly, check the status of their tax returns.

To access CTAP, you'll need to create an account using your SSN or ITIN. Once logged in, you can view detailed information about your tax return, including the current status, processing progress, and any corresponding messages.

CTAP provides a comprehensive overview of your tax situation and is an excellent resource for staying informed throughout the filing process.

Telephone Inquiries

If you prefer a more direct approach or encounter issues with online tools, you can reach out to the Colorado Department of Revenue via telephone.

The Department of Revenue operates a taxpayer assistance line, where trained representatives are available to answer your queries and provide information on return status.

To contact them, call (303) 238-7378 or (800) 385-8768 (toll-free for out-of-state callers). Be prepared to provide your SSN or ITIN, as well as other identifying details to access your return information.

Tips for a Smooth Tax Return Process

To ensure a seamless tax return experience, consider the following tips and best practices:

File Electronically

Electronic filing is generally faster and more efficient than submitting paper returns. It reduces the risk of errors and allows for quicker processing times.

Double-Check Your Information

Before submitting your tax return, thoroughly review all the information you've provided. Ensure that your personal details, income sources, deductions, and credits are accurate and up-to-date. Double-checking can help prevent errors and potential delays in processing.

Keep Records and Documentation

Maintain organized records of your income, expenses, and other relevant tax-related documents. This practice ensures that you have the necessary support for any claims or deductions you've made on your return. It also simplifies the process if your return is selected for further review.

Stay Informed

Keep yourself updated on the latest tax regulations, announcements, and changes. The Colorado Department of Revenue's website and social media channels are excellent sources of information. By staying informed, you can ensure compliance and avoid potential issues.

Seek Professional Assistance

If you have complex tax situations, substantial income, or are unsure about certain aspects of your return, consider seeking professional assistance from a tax advisor or accountant. They can provide valuable guidance and ensure that your return is accurate and optimized.

Future Implications and Considerations

Understanding the status of your Colorado tax return is just the beginning. Here are some additional considerations and implications to keep in mind:

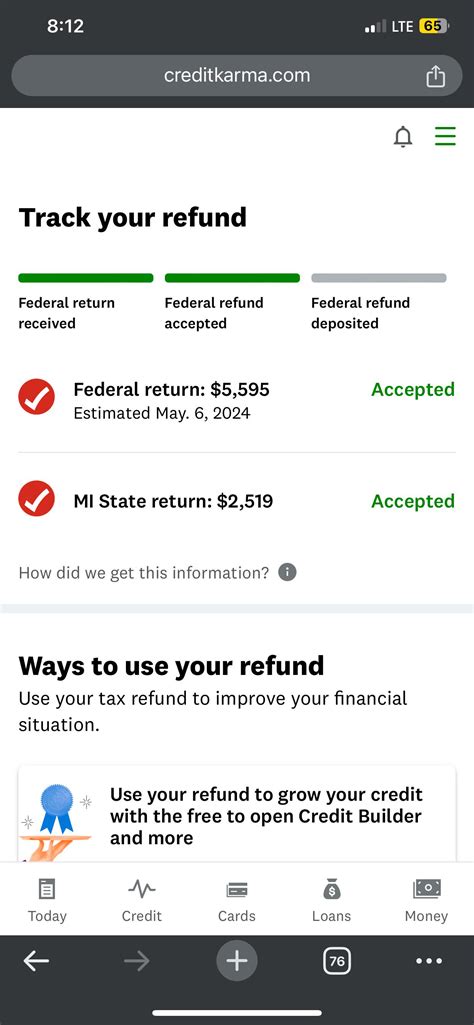

Refund Timelines

If you're expecting a refund, the processing time for your return will determine when you receive it. Electronic refunds are typically faster, with funds being deposited directly into your bank account within a few weeks. Paper refunds may take slightly longer due to the additional processing time required.

Payment Due Dates

If you owe taxes, the status of your return will indicate when your payment is due. It's crucial to stay on top of these deadlines to avoid penalties and interest charges. The Colorado Department of Revenue provides payment options and resources to help taxpayers meet their obligations.

Audit and Review Procedures

In some cases, the Colorado Department of Revenue may select returns for further review or audit. This process is standard and ensures the accuracy and integrity of the tax system. If your return is chosen, cooperate fully with the authorities and provide any requested documentation.

Amending Returns

If you discover an error or need to make changes to your tax return after filing, you can amend it using Form 1040X. This form allows you to correct any discrepancies and ensure that your return is accurate. Keep in mind that amending a return may impact your refund or payment timeline.

Frequently Asked Questions (FAQ)

How long does it take to receive a refund after my Colorado tax return is accepted?

+Typically, it takes around 2-4 weeks to receive a refund after your Colorado tax return is accepted. However, factors like the volume of returns and any potential issues can affect the timeline. It's best to stay patient and use the online tools provided to track the progress of your refund.

What should I do if my tax return is rejected due to an error?

+If your tax return is rejected, carefully review the error message provided by the Colorado Department of Revenue. Identify and correct the issue, and then resubmit your return. Ensure that you address all errors to avoid further delays.

Can I check the status of my tax return if I don't have access to the internet?

+Yes, you can still check the status of your tax return even without internet access. Simply call the Colorado Department of Revenue's taxpayer assistance line at (303) 238-7378 or (800) 385-8768, and a representative will provide you with the current status of your return.

How often should I check the status of my Colorado tax return?

+You don't need to check the status of your tax return frequently. It's recommended to check once a week or every two weeks, especially if you're expecting a refund or have a complex tax situation. Frequent checks may not provide additional information and can be unnecessary.

What happens if my tax return is selected for an audit?

+If your tax return is selected for an audit, it's important to remain calm and cooperate with the Colorado Department of Revenue. They will guide you through the process and provide instructions on what documentation to submit. Respond promptly to any requests and provide accurate information to resolve the audit efficiently.

Staying informed about the status of your Colorado tax return is essential for a stress-free tax filing experience. By understanding the process, utilizing online tools, and following best practices, you can navigate the tax landscape with confidence. Remember to stay updated, seek assistance when needed, and maintain organized records for a smooth and successful tax season.